Valid Loan Agreement Document

Loan Agreement Document Subtypes

Fill out Popular Documents

Wedding Venue Contract - Reserve your special day in an enchanting space.

In addition to its essential role in the vehicle transaction process, the Texas Vehicle Purchase Agreement form can be easily accessed and downloaded from resources such as OnlineLawDocs.com, ensuring that both buyers and sellers have the tools they need to formalize their agreement effectively.

Profits or Loss From Business - Common deductions include advertising expenses, travel costs, and office supplies on Schedule C.

Misconceptions

Understanding loan agreements can be challenging. There are several misconceptions that people often have about these forms. Below is a list of common misunderstandings.

- All loan agreements are the same. Many believe that every loan agreement follows a standard template. In reality, each agreement can vary based on the lender's requirements and the borrower's needs.

- Loan agreements are only for large amounts. Some think that loan agreements are only necessary for substantial loans, like mortgages or car loans. However, even small personal loans often require a formal agreement to protect both parties.

- You can ignore the terms once signed. A common misconception is that once a loan agreement is signed, the borrower can disregard the terms. In truth, the agreement is a binding contract, and both parties must adhere to its terms.

- Loan agreements are only for the lender's benefit. Many assume that these agreements are solely designed to protect the lender. However, they also provide important protections for the borrower, outlining rights and responsibilities clearly.

By clarifying these misconceptions, individuals can approach loan agreements with a better understanding and make informed decisions.

Documents used along the form

When entering into a loan agreement, several other forms and documents may be needed to ensure everything is clear and properly documented. These documents help both parties understand their rights and responsibilities, making the loan process smoother. Below is a list of commonly used forms that accompany a loan agreement.

- Promissory Note: This is a written promise from the borrower to repay the loan. It outlines the amount borrowed, the interest rate, and the repayment schedule.

- Loan Application: This document is completed by the borrower to provide information about their financial situation. It helps the lender assess the borrower's creditworthiness.

- Credit Report: A detailed report of the borrower's credit history. Lenders use this to evaluate the risk of lending money to the borrower.

- Trailer Bill of Sale: For those buying or selling a trailer, filling out a Trailer Bill of Sale form is essential to legally document the transaction in Florida.

- Collateral Agreement: If the loan is secured, this document outlines the assets that will back the loan. It specifies what the lender can claim if the borrower defaults.

- Disclosure Statement: This document provides important information about the loan terms, including fees, interest rates, and total repayment amounts.

- Personal Guarantee: Sometimes required from business owners, this document holds them personally responsible for the loan if the business cannot repay it.

- Loan Closing Statement: This summarizes the final terms of the loan, including any closing costs. It is typically reviewed and signed at the loan closing.

- Payment Schedule: A detailed outline of when payments are due, how much is owed, and the total number of payments over the life of the loan.

- Amortization Schedule: This document breaks down each payment into principal and interest, showing how the loan balance decreases over time.

Understanding these documents can help borrowers and lenders navigate the loan process with confidence. Having everything in order promotes transparency and helps avoid misunderstandings down the road.

Steps to Filling Out Loan Agreement

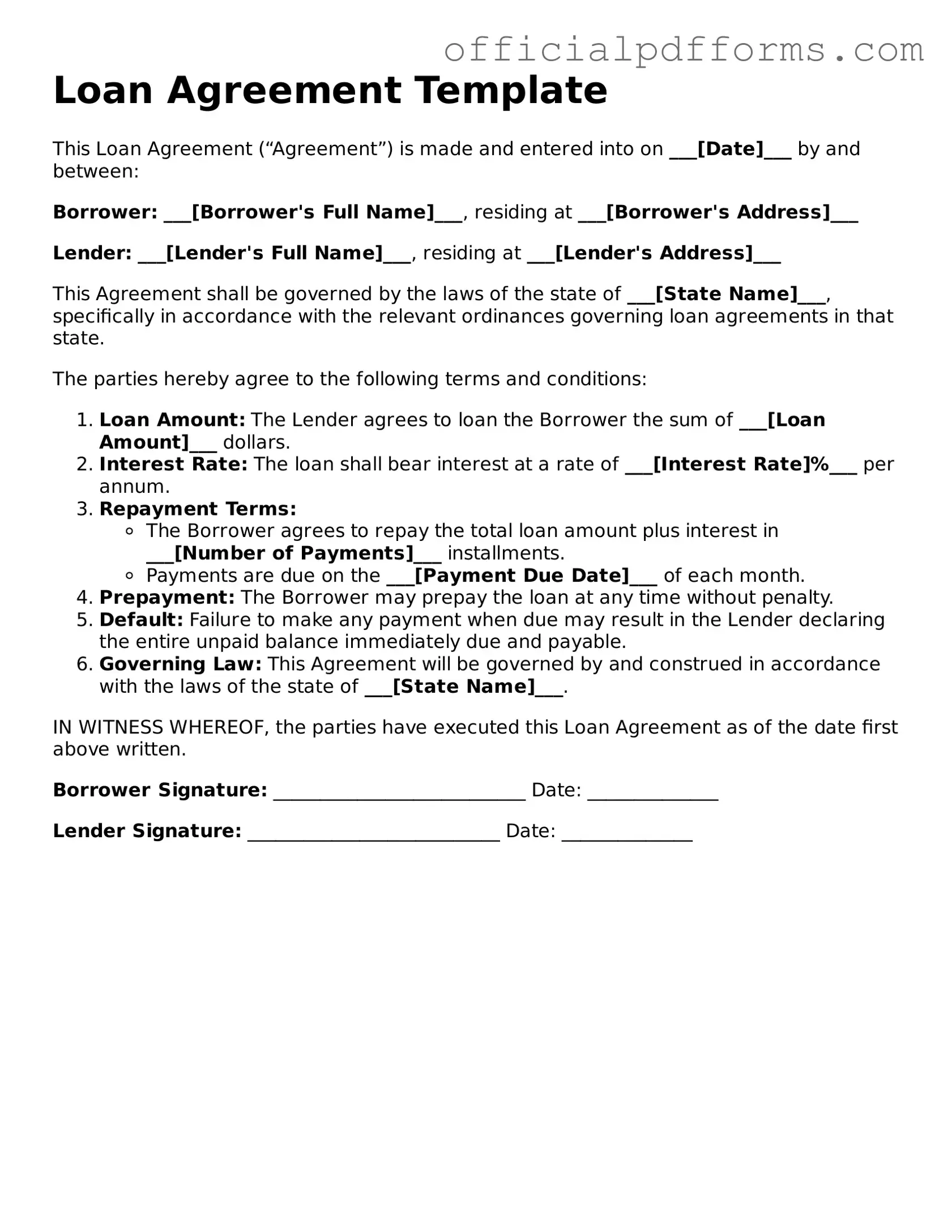

Filling out a Loan Agreement form requires attention to detail. Each section must be completed accurately to ensure that all parties understand the terms of the loan. Follow these steps to complete the form properly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Fill in the names and addresses of both the borrower and the lender. Make sure to include full names and current addresses.

- Specify the loan amount. Clearly state the total amount being borrowed.

- Indicate the interest rate. This should be a percentage and should be clearly defined.

- Set the repayment terms. Include the duration of the loan and the frequency of payments (e.g., monthly, quarterly).

- Include any fees associated with the loan. This could be origination fees or late payment fees.

- Review any additional terms or conditions. This may include collateral or guarantees, if applicable.

- Both parties should sign and date the form. Ensure that the signatures are dated correctly.

After completing the form, keep a copy for your records. Ensure that all parties have a signed copy for their reference.

Common mistakes

-

Incomplete Information: One of the most common mistakes is leaving sections blank. Every part of the form is important, so make sure to fill out all required fields.

-

Incorrect Personal Details: Double-check your name, address, and contact information. Typos can lead to delays or issues in processing your loan.

-

Not Reading the Terms: Many people skim through the terms and conditions. Take your time to understand what you are agreeing to, including interest rates and repayment terms.

-

Forgetting to Sign: It sounds simple, but forgetting to sign the form can hold up your application. Always ensure that your signature is included where necessary.

-

Providing Inaccurate Financial Information: Your income, expenses, and credit history should be accurate. Misrepresenting your financial situation can lead to serious consequences.

-

Ignoring Additional Documentation: Sometimes, lenders require extra documents, such as proof of income or identification. Failing to include these can result in delays or denial of your loan.

Get Clarifications on Loan Agreement

What is a Loan Agreement form?

A Loan Agreement form is a legal document that outlines the terms and conditions under which a borrower agrees to receive funds from a lender. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral required. It serves to protect both parties by clearly defining their rights and obligations throughout the loan period.

What information do I need to provide when filling out the Loan Agreement form?

When completing the Loan Agreement form, you will need to provide several key pieces of information, including:

- Your full name and contact information.

- The lender's name and contact details.

- The total amount of the loan being requested.

- The interest rate and any applicable fees.

- The repayment schedule, including due dates and payment amounts.

- Any collateral offered to secure the loan.

Providing accurate and complete information is crucial, as it helps ensure that the agreement is valid and enforceable.

What happens if I cannot repay the loan on time?

If you find yourself unable to repay the loan on time, it is important to communicate with your lender as soon as possible. Many lenders are willing to work with borrowers who face financial difficulties. Possible options may include:

- Requesting a loan extension or modification.

- Negotiating a new repayment plan that is more manageable.

- Exploring the possibility of partial payments until your situation improves.

Ignoring the issue can lead to additional fees, damage to your credit score, or even legal action. Open communication is key to finding a solution that works for both parties.

Can I make changes to the Loan Agreement after it has been signed?

Once a Loan Agreement has been signed, making changes can be challenging. However, amendments are possible if both the borrower and lender agree to the changes. To formally amend the agreement:

- Both parties should discuss the desired changes.

- Draft a written amendment that clearly outlines the modifications.

- Ensure both parties sign the amendment to make it legally binding.

It is advisable to keep a copy of the original agreement along with any amendments for your records. This helps maintain clarity about the terms of the loan.