Valid Vehicle Repayment Agreement Document

Fill out Popular Documents

Simple Shared Well Agreement Form - The Agreement allows for the installation of separate energy meters to track water usage costs for each parcel.

What Do I Write in an Immigration Support Letter - It is important to include personal anecdotes that highlight the couple's bond and commitment.

For anyone looking to buy or sell property, understanding the importance of a basic General Bill of Sale can be crucial. This form provides a clear record of the transaction, helping to safeguard the interests of both buyers and sellers.

How to Make Payroll Checks - This form is used to request a payroll check.

Misconceptions

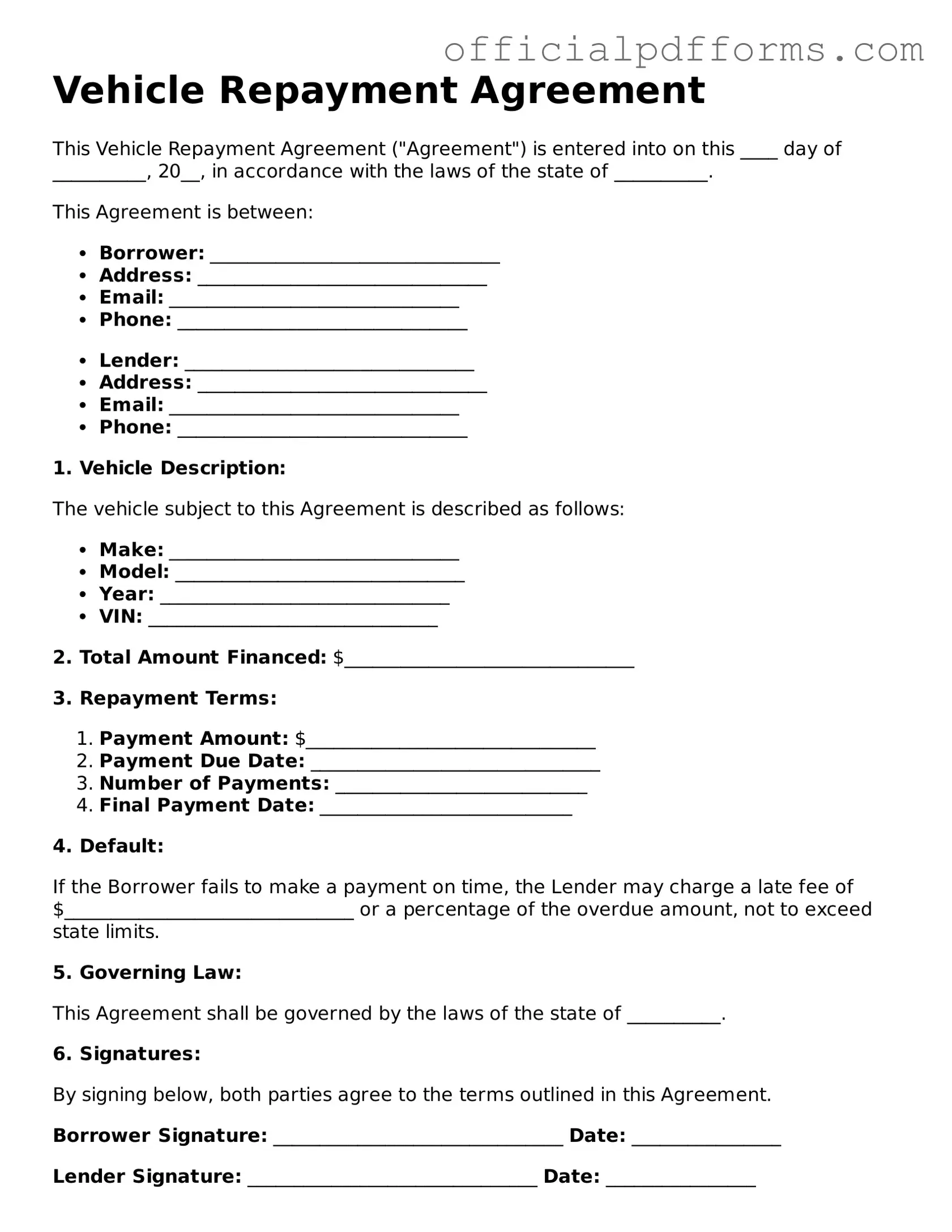

Understanding the Vehicle Repayment Agreement form is essential for anyone involved in a vehicle financing situation. However, several misconceptions can lead to confusion. Below are nine common misunderstandings about this form.

-

The form is only for buyers with poor credit.

This is not true. The Vehicle Repayment Agreement can be used by anyone financing a vehicle, regardless of their credit history.

-

Signing the form means you own the vehicle outright.

In reality, signing this agreement indicates that you are entering into a financing arrangement. Ownership is typically retained by the lender until the loan is fully paid.

-

The terms are set in stone and cannot be changed.

While the agreement outlines specific terms, many lenders are open to negotiation. It’s always worth discussing any concerns with your lender.

-

Late payments are not a big deal.

Late payments can have serious consequences, including penalties and negative impacts on your credit score. Timely payments are crucial.

-

All Vehicle Repayment Agreements are the same.

Each agreement can vary significantly based on the lender and the specific terms of the loan. Always read the details carefully.

-

You can ignore the agreement if you change your mind.

This is a misconception. Once signed, the agreement is a binding contract, and failing to comply can lead to legal repercussions.

-

The form is only necessary for new vehicles.

Both new and used vehicles can require a Vehicle Repayment Agreement. The form is relevant regardless of the vehicle's age.

-

You don’t need to keep a copy of the agreement.

It’s important to retain a copy for your records. Having the agreement on hand can help resolve any disputes that may arise.

-

All lenders provide the same protections in their agreements.

This is false. Different lenders may offer varying levels of consumer protection. Always review the specifics before signing.

Being informed about these misconceptions can help you navigate your vehicle financing more confidently. If you have further questions, consider reaching out to a financial advisor or legal expert for personalized guidance.

Documents used along the form

The Vehicle Repayment Agreement form is a critical document used in the process of financing a vehicle. It outlines the terms and conditions under which a borrower agrees to repay the loan. Alongside this form, several other documents may be required to complete the transaction. Below is a list of commonly used forms and documents that often accompany the Vehicle Repayment Agreement.

- Loan Application Form: This document collects essential information about the borrower, including personal details, financial history, and the specifics of the vehicle being financed.

- Credit Report Authorization: Borrowers may need to authorize lenders to access their credit reports, which help assess their creditworthiness and ability to repay the loan.

- Promissory Note: This legal document serves as a written promise from the borrower to repay the loan amount, detailing the repayment schedule and interest rate.

- Vehicle Release of Liability: This form releases the seller from future claims of damage or liability related to the vehicle after the sale, serving as a vital record for both parties. For more information, visit TopTemplates.info.

- Title Application: This form is necessary to transfer the vehicle's title to the lender until the loan is paid off, ensuring that the lender has a legal claim to the vehicle.

- Insurance Verification: Lenders often require proof of insurance to ensure that the vehicle is protected against damage or loss during the loan period.

These documents work together to create a clear understanding between the borrower and the lender. Having all necessary paperwork in order can facilitate a smoother financing process and help avoid potential disputes in the future.

Steps to Filling Out Vehicle Repayment Agreement

Filling out the Vehicle Repayment Agreement form is an important step in managing your vehicle financing. Once the form is completed, it will be submitted for processing, which will help ensure that all parties are clear about the repayment terms.

- Begin by entering your full name in the designated section at the top of the form.

- Provide your current address, including street, city, state, and ZIP code.

- Fill in your contact information, including your phone number and email address.

- Enter the details of the vehicle, such as the make, model, year, and Vehicle Identification Number (VIN).

- Specify the total amount owed on the vehicle and the repayment amount you propose.

- Indicate the payment frequency (weekly, bi-weekly, or monthly) and the date you plan to make your first payment.

- Review the terms and conditions section, ensuring you understand your obligations.

- Sign and date the form at the bottom, confirming that all information provided is accurate.

Common mistakes

-

Not reading the entire form before filling it out. This can lead to misunderstandings about the terms and conditions.

-

Failing to provide accurate personal information. Double-check names, addresses, and contact details to avoid delays.

-

Leaving sections blank. Every part of the form is important. Omitting information can cause processing issues.

-

Using incorrect vehicle information. Ensure the make, model, and VIN are correct to avoid complications.

-

Not signing the agreement. A signature is essential to validate the document.

-

Overlooking the repayment terms. Make sure to understand the payment schedule and interest rates.

-

Ignoring the consequences of default. Be aware of what happens if payments are missed.

-

Not keeping a copy of the completed form. Retaining a copy is crucial for your records.

-

Failing to ask questions. If something is unclear, reach out for clarification before submitting.

-

Submitting the form without reviewing it. A final check can catch errors that may have been overlooked.

Get Clarifications on Vehicle Repayment Agreement

What is a Vehicle Repayment Agreement?

A Vehicle Repayment Agreement is a legal document that outlines the terms under which a borrower agrees to repay a loan taken out to purchase a vehicle. This agreement details the repayment schedule, interest rates, and any penalties for late payments. It serves to protect both the lender and the borrower by clearly defining the expectations and responsibilities of each party.

Who needs to sign the Vehicle Repayment Agreement?

Typically, both the borrower and the lender must sign the Vehicle Repayment Agreement. The borrower is usually the individual or entity purchasing the vehicle, while the lender is often a financial institution or dealership providing the loan. In some cases, a co-signer may also be required, particularly if the borrower has a limited credit history.

What information is included in the Vehicle Repayment Agreement?

The Vehicle Repayment Agreement generally includes:

- The names and contact information of the borrower and lender.

- A description of the vehicle, including its make, model, year, and Vehicle Identification Number (VIN).

- The total loan amount and the interest rate.

- The repayment schedule, including the number of payments and due dates.

- Any fees associated with the loan, such as late payment penalties.

- Terms regarding default and repossession of the vehicle.

How is the repayment schedule structured?

The repayment schedule is typically structured based on the loan amount and interest rate. Borrowers may choose between different repayment plans, such as monthly or bi-weekly payments. Each payment will generally include both principal and interest, allowing borrowers to gradually pay down the loan over time. The specific terms will be outlined in the agreement.

What happens if I miss a payment?

If a borrower misses a payment, the lender may impose penalties as specified in the Vehicle Repayment Agreement. These penalties can include late fees and an increase in the interest rate. Continued missed payments can lead to default, which may result in the lender repossessing the vehicle. It is crucial for borrowers to communicate with their lender if they anticipate difficulty in making payments.

Can the terms of the Vehicle Repayment Agreement be modified?

Yes, the terms of a Vehicle Repayment Agreement can be modified, but this usually requires the consent of both the borrower and the lender. Modifications may include changes to the repayment schedule or interest rate. It is essential to document any changes in writing to ensure clarity and legal enforceability.

What should I do if I cannot repay the loan?

If you find yourself unable to repay the loan, it is important to act quickly. Contact your lender as soon as possible to discuss your situation. They may offer options such as restructuring the loan or providing a temporary forbearance. Ignoring the problem can lead to more severe consequences, including repossession of the vehicle.