Valid Transfer-on-Death Deed Document

Transfer-on-Death Deed Forms for Individual US States

Consider More Types of Transfer-on-Death Deed Documents

Correction Deed California - It acts as a remedy for unintentional omissions in past property documents.

Completing the Trader Joe's application form is crucial for aspiring employees to effectively present their qualifications and interest in joining this vibrant grocery chain. For those ready to embark on this journey, detailed guidance and examples can be found at https://toptemplates.info, ensuring that candidates are well-prepared to make a strong impression.

Free Lady Bird Deed Form - This deed serves as a valuable tool for individuals wishing to preserve their home while planning for its future.

Deed in Lieu of Foreclosure Template - A straightforward way to clear home ownership and debt simultaneously.

Misconceptions

Transfer-on-Death Deeds (TOD Deeds) can be a useful estate planning tool, but several misconceptions surround them. Here are four common misunderstandings:

- Misconception 1: A TOD Deed avoids probate completely.

- Misconception 2: You can change the beneficiaries at any time without any formal process.

- Misconception 3: A TOD Deed is only for real estate.

- Misconception 4: The property automatically transfers upon the owner's death without any action from the beneficiaries.

While a TOD Deed allows property to pass directly to beneficiaries without going through probate, it does not eliminate the need for probate for other assets. If the deceased had other assets that do not have designated beneficiaries, those will still go through the probate process.

Although you can revoke or change a TOD Deed, it must be done in writing and properly recorded. Simply telling someone you’ve changed your mind does not alter the legal standing of the deed.

Many people think that TOD Deeds apply only to real property. However, they can also be used for certain types of financial accounts, depending on state laws. Always check local regulations to understand what can be included.

While the property does transfer outside of probate, beneficiaries must still take steps to claim the property. This usually involves providing a death certificate and possibly other documentation to the relevant authorities or financial institutions.

Documents used along the form

A Transfer-on-Death Deed (TOD Deed) allows individuals to designate beneficiaries who will inherit their property upon their death, bypassing the probate process. While the TOD Deed is a crucial document, several other forms and documents often accompany it to ensure a smooth transfer of assets and to clarify intentions. Here’s a list of commonly used documents related to the Transfer-on-Death Deed:

- Last Will and Testament: This document outlines an individual's wishes regarding the distribution of their assets after death. It can complement a TOD Deed by addressing assets not covered by the deed.

- Living Trust: A living trust is an arrangement where a trustee holds assets on behalf of beneficiaries. It can work alongside a TOD Deed to manage property during the individual’s lifetime and facilitate a smoother transfer upon death.

- Beneficiary Designation Forms: These forms are used for financial accounts, insurance policies, and retirement plans. They specify who will receive these assets upon the account holder's death, ensuring that they are passed directly to the beneficiaries.

- Power of Attorney: This document grants someone the authority to act on behalf of another person in legal or financial matters. A power of attorney can be crucial for managing assets before death, especially if the individual becomes incapacitated.

- Affidavit of Heirship: This sworn statement identifies the heirs of a deceased person. It can be used to establish ownership of property when there is no will or deed in place, providing clarity in the absence of formal documentation.

- Motor Vehicle Bill of Sale: This form officially records the sale of a vehicle in Florida, serving as a critical document that proves the transaction took place. For more information, visit smarttemplates.net/fillable-florida-motor-vehicle-bill-of-sale/.

- Property Deeds: These documents establish ownership of real estate. They may need to be reviewed or updated to reflect the intentions expressed in the TOD Deed.

- Death Certificate: This official document certifies the occurrence of a person's death. It is often required to finalize the transfer of assets, including those designated in a TOD Deed.

- Notice of Death: This is a formal notification to relevant parties, such as creditors and beneficiaries, that an individual has passed away. It can help in managing the estate and ensuring that all parties are informed.

- Estate Inventory: This document lists all assets and liabilities of the deceased. It provides a comprehensive overview of the estate, which is essential for both beneficiaries and the probate process.

Understanding these documents and their roles in the estate planning process can greatly enhance clarity and efficiency in asset transfer. Properly preparing and organizing these forms alongside a Transfer-on-Death Deed can help ensure that your wishes are honored and that your beneficiaries receive their inheritance with minimal complications.

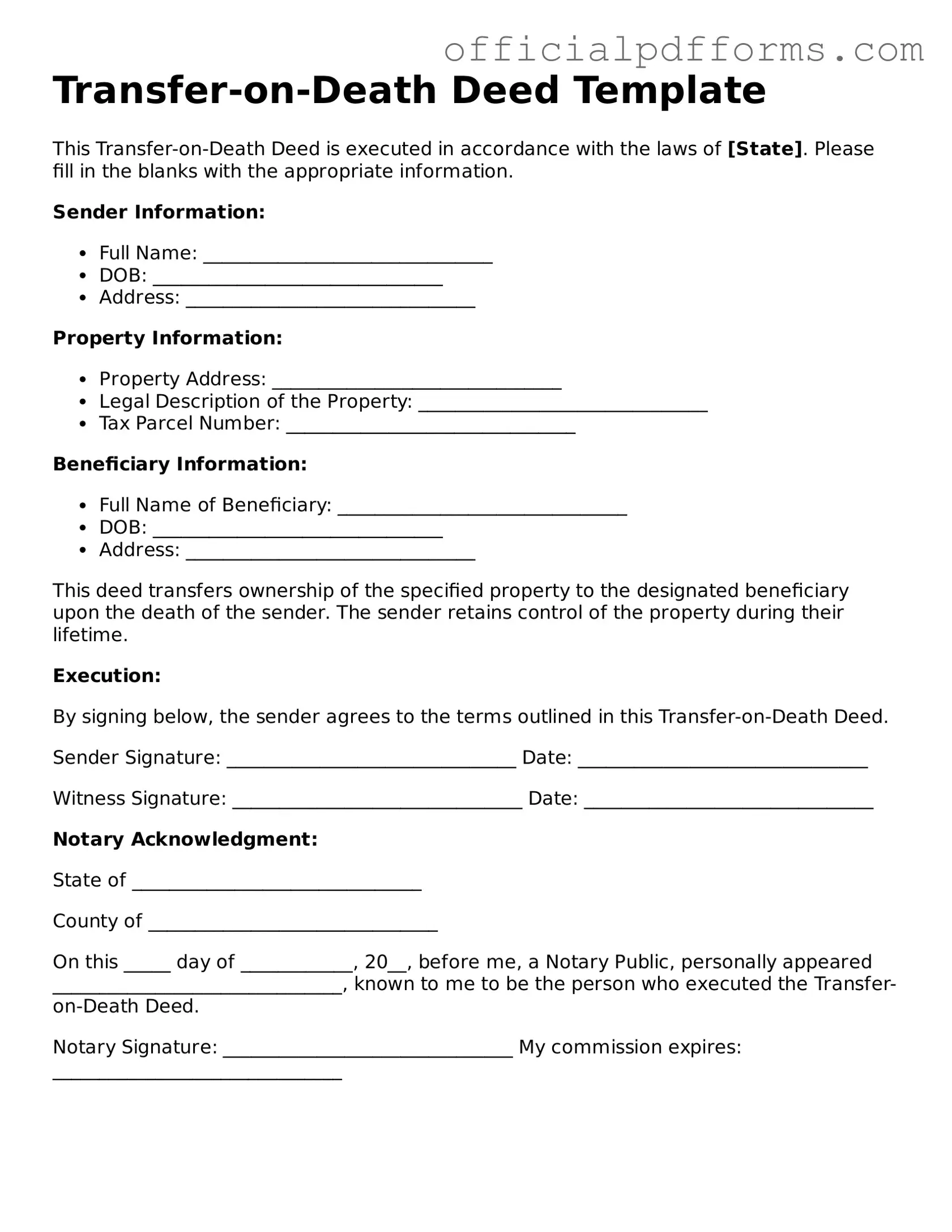

Steps to Filling Out Transfer-on-Death Deed

Filling out a Transfer-on-Death Deed form is a straightforward process. Once completed, the form must be signed and filed with the appropriate local authority to ensure that your wishes are legally recognized. Below are the steps to guide you through the process of filling out the form.

- Obtain the Transfer-on-Death Deed form from your local government office or download it from a reliable online source.

- Fill in your name and address in the designated section. Ensure that your information is accurate and up to date.

- Identify the property you wish to transfer. Include the full legal description of the property, which can often be found on your property deed.

- Provide the name and address of the beneficiary or beneficiaries. This is the person or people who will receive the property upon your death.

- Include any additional instructions or conditions for the transfer, if applicable. Be clear and concise in this section.

- Sign and date the form in the presence of a notary public. This step is crucial for the validity of the deed.

- File the completed and notarized form with your local recorder’s office or land registry. Check for any filing fees that may apply.

Common mistakes

-

Failing to include the full legal name of the property owner. This can lead to confusion or disputes over ownership.

-

Not identifying the property accurately. It’s crucial to provide a complete description, including the address and legal description.

-

Neglecting to name the beneficiary clearly. The beneficiary’s name must be precise to avoid complications after the owner’s death.

-

Forgetting to sign the deed. A signature is essential for the deed to be valid.

-

Not having the deed notarized. Many states require notarization for the deed to be legally binding.

-

Failing to record the deed with the appropriate county office. Without recording, the deed may not be enforceable.

-

Using outdated forms. Always ensure that the most current version of the Transfer-on-Death Deed form is being used.

-

Overlooking state-specific requirements. Each state may have different laws regarding Transfer-on-Death Deeds, so it’s important to be aware of local regulations.

Get Clarifications on Transfer-on-Death Deed

- Obtain the appropriate form for your state.

- Fill out the form, including your name, property details, and the beneficiary's information.

- Sign the deed in the presence of a notary public.

- Record the signed deed with the county recorder's office where the property is located.

- Bypasses probate, saving time and costs.

- Allows for easy transfer of property to heirs.

- Retains control of the property during the owner's lifetime.

- Can be revoked or changed at any time before death.

- Not all states recognize Transfer-on-Death Deeds.

- Only real property can be transferred using a TOD deed; personal property cannot.

- Beneficiaries must survive the owner for the transfer to take effect.

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD deed) is a legal document that allows an individual to transfer real estate to a beneficiary upon their death. This type of deed bypasses the probate process, making the transfer of property more straightforward and efficient.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property can use a Transfer-on-Death Deed. This includes homeowners, landowners, and property investors. However, the laws governing TOD deeds may vary by state, so it is essential to check local regulations.

How do I create a Transfer-on-Death Deed?

To create a TOD deed, follow these general steps:

What are the benefits of using a Transfer-on-Death Deed?

There are several advantages to using a Transfer-on-Death Deed:

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time before the death of the property owner. To do this, a new deed must be created, or the original deed must be formally revoked and recorded with the county recorder's office.

Are there any limitations to a Transfer-on-Death Deed?

Yes, there are some limitations to consider:

What happens if the beneficiary dies before the property owner?

If the beneficiary named in the Transfer-on-Death Deed dies before the property owner, the property will not transfer to that beneficiary. Instead, the property will become part of the owner's estate and will be distributed according to the owner's will or state intestacy laws.

Is a Transfer-on-Death Deed taxable?

The property transferred via a Transfer-on-Death Deed may be subject to estate taxes, depending on the total value of the estate. However, since the transfer occurs after the owner's death, the beneficiary typically does not incur income tax at the time of transfer. It is advisable to consult a tax professional for specific guidance.

Can a Transfer-on-Death Deed be used for multiple beneficiaries?

Yes, a Transfer-on-Death Deed can designate multiple beneficiaries. The property will be divided among the beneficiaries according to the terms specified in the deed. If no specific percentages are mentioned, the property will be divided equally among them.