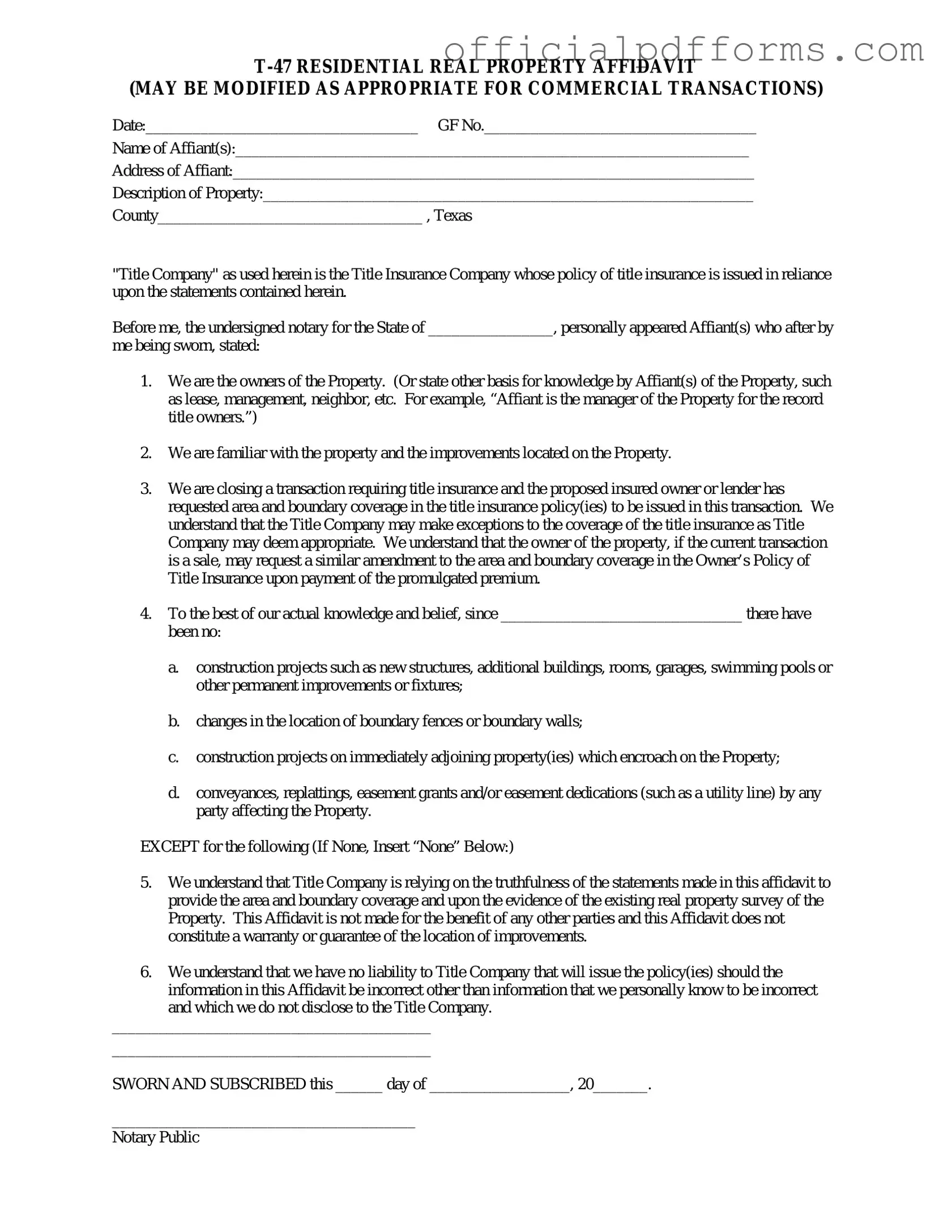

Fill in a Valid Texas residential property affidavit T-47 Form

Common PDF Forms

96 Well Plate Size - The form’s layout supports easy data entry and result tracking.

When buying or selling a trailer in New York, it's crucial to complete the New York Trailer Bill of Sale form to ensure the ownership transfer is documented correctly. This legal document guarantees that the buyer can register the trailer without issues, and to assist with this process, resources like OnlineLawDocs.com provide helpful templates and guidance for completing the form.

Aircraft Bill of Sale - The Aircraft Bill of Sale contributes to transparency in the aviation marketplace.

Misconceptions

The Texas residential property affidavit T-47 form is often misunderstood. Below are ten common misconceptions about this important document, along with clarifications to help you navigate its use.

-

The T-47 form is optional.

This form is typically required by lenders during the closing process. It provides necessary information about the property, making it essential for securing financing.

-

The T-47 form only applies to new constructions.

In reality, the T-47 form is relevant for both new and existing properties. It serves to affirm the current state of the property regardless of its age.

-

Completing the T-47 form is straightforward and requires no legal knowledge.

While the form may seem simple, inaccuracies can lead to significant issues. It is advisable to consult a professional to ensure it is filled out correctly.

-

The T-47 form is the same as a title policy.

This is a misconception. The T-47 is an affidavit that provides specific details about the property, while a title policy offers insurance against defects in the title.

-

Once submitted, the T-47 form cannot be changed.

In fact, if errors are discovered, it is possible to amend the form. However, prompt action is necessary to avoid complications.

-

The T-47 form is only for residential properties.

This form is primarily used for residential transactions, but it can also be applicable in certain commercial real estate situations.

-

All lenders require the T-47 form.

While many lenders do require it, some may not. It's essential to verify with your lender whether this form is necessary for your transaction.

-

The T-47 form guarantees clear title.

Submitting the T-47 does not guarantee that the title is clear. It simply provides a sworn statement about the property's condition at the time of signing.

-

Filing the T-47 form is the buyer's responsibility.

Typically, the seller or their agent is responsible for completing and filing the T-47 form, although buyers should ensure it is done correctly.

-

The T-47 form is valid indefinitely.

This is incorrect. The T-47 form is generally valid only for a limited time. Changes to the property or ownership may require a new affidavit.

Understanding these misconceptions can help streamline the home-buying process and ensure that all parties are informed. Always seek professional advice when dealing with legal documents to avoid pitfalls.

Documents used along the form

The Texas residential property affidavit T-47 form is a vital document in real estate transactions, particularly in the context of title insurance. Alongside this form, several other documents are commonly utilized to ensure a smooth process. Below is a list of some of these essential forms and documents.

- Title Commitment: This document outlines the terms under which a title insurance policy will be issued. It provides details about the property, including any liens or encumbrances that may affect ownership.

- Deed: A deed is a legal document that transfers ownership of real property from one party to another. It includes the names of the parties involved and a description of the property.

- FedEx Bill of Lading: Essential for shipping, this document serves as a contract between the shipper and FedEx, outlining shipment details and responsibilities. For more information, visit smarttemplates.net/fillable-fedex-bill-of-lading/.

- Property Survey: A property survey shows the boundaries and dimensions of a property. It can help identify any encroachments or easements that may impact the property’s use.

- Closing Disclosure: This document provides a detailed account of the final terms of a mortgage loan, including loan terms, monthly payments, and closing costs. It ensures that all parties are aware of the financial aspects of the transaction.

- Affidavit of Heirship: Used when property is inherited, this affidavit establishes the heirs of a deceased property owner. It is essential for transferring property rights without a formal probate process.

Understanding these documents can significantly aid in navigating the complexities of real estate transactions in Texas. Each serves a specific purpose and contributes to the overall clarity and legality of property dealings.

Steps to Filling Out Texas residential property affidavit T-47

Filling out the Texas residential property affidavit T-47 form is a straightforward process that requires careful attention to detail. Once completed, this form will play a crucial role in the real estate transaction process, ensuring that all parties have the necessary documentation for the property in question.

- Obtain the T-47 form from a reliable source, such as the Texas Land Title Association or your real estate agent.

- Begin by entering the property address in the designated field. Ensure that the address is accurate and complete.

- Fill in the name of the affiant, which is the person making the affidavit. This should be the individual who has firsthand knowledge of the property.

- Provide the affiant's contact information, including their phone number and email address, if applicable.

- In the section regarding the property description, include details such as the lot number, block number, and any relevant subdivision name.

- Indicate the date of the affidavit in the specified area. This should be the date when you are completing the form.

- Sign the affidavit in the presence of a notary public. The notary will then complete their section, verifying your identity and the authenticity of your signature.

- Make copies of the completed and notarized form for your records and for any parties involved in the transaction.

After filling out the T-47 form, it is essential to submit it to the appropriate parties involved in the transaction, such as the title company or your real estate attorney. This step ensures that the affidavit is properly recorded and utilized in the closing process.

Common mistakes

-

Failing to provide accurate property descriptions. It's essential to ensure that the legal description of the property is correct and matches public records.

-

Not signing the affidavit. All parties involved must sign the form for it to be valid. Omitting a signature can render the document ineffective.

-

Incorrectly identifying the parties involved. The names of all owners must be listed accurately. Mistakes in names can lead to legal complications.

-

Leaving out the date of execution. The affidavit should include the date it was signed. This information is crucial for establishing the timeline of the property transaction.

-

Using outdated or incorrect versions of the form. Always ensure that the most current version of the T-47 form is being used to avoid potential issues.

-

Neglecting to provide supporting documentation. If applicable, include any necessary documents that support the claims made in the affidavit.

-

Failing to notarize the affidavit. Most affidavits require notarization to be considered valid. Skipping this step can lead to problems down the line.

-

Not reviewing the completed form for errors. It's important to double-check all information for accuracy before submission. Mistakes can cause delays and additional work.

Get Clarifications on Texas residential property affidavit T-47

What is the Texas residential property affidavit T-47 form?

The T-47 form is a legal document used in Texas during real estate transactions. It serves as an affidavit that provides a sworn statement regarding the property’s current state and any existing liens or encumbrances. This form is often required by title companies to ensure a clear title transfer.

Who needs to complete the T-47 form?

The T-47 form must be completed by the property owner or seller. If the property is owned by multiple individuals, all owners must sign the affidavit. This ensures that all parties are aware of the property’s status and any potential issues that may affect the sale.

When should the T-47 form be submitted?

The T-47 form should be submitted during the closing process of a real estate transaction. It is typically required before the final closing documents are signed. Timely submission is crucial to avoid delays in the closing process.

What information is required on the T-47 form?

The T-47 form requires several key pieces of information, including:

- The property address.

- The names of all property owners.

- A description of any existing liens or encumbrances.

- A statement confirming that the information provided is accurate.

Completing this information accurately is essential to ensure a smooth transaction.

What happens if the information on the T-47 form is inaccurate?

If the information on the T-47 form is found to be inaccurate, it can lead to serious consequences. Potential issues include delays in closing, legal disputes, or even financial liability for the seller. It is critical to review all information carefully before submission.

Is the T-47 form notarized?

Yes, the T-47 form must be notarized. This adds a layer of verification to the information provided, ensuring that the signatures are legitimate and that the document is legally binding. Notarization helps protect all parties involved in the transaction.

Where can I obtain a copy of the T-47 form?

The T-47 form can be obtained from various sources, including:

- Title companies.

- Real estate attorneys.

- Online legal form providers.

Ensure that you are using the most current version of the form to comply with Texas regulations.