Fill in a Valid Tax POA dr 835 Form

Common PDF Forms

Simple Job Application Form - Standardized format for job application submissions.

When engaging in a rental agreement, it is crucial to understand the nuances of the document, which can be found at OnlineLawDocs.com, as it serves as a comprehensive guide to navigating the obligations and rights outlined in the New York Residential Lease Agreement form.

1099 Nonemployee Compensation - Employers use the 1099-NEC to report payments that do not involve withholding taxes.

Misconceptions

The Tax Power of Attorney (POA) Form DR 835 is an important document, but there are several misconceptions surrounding it. Here’s a list of common misunderstandings:

-

Only tax professionals can use the form.

This is not true. While tax professionals often file this form, individuals can also designate someone else to represent them, such as a family member or friend.

-

The form is only for federal tax matters.

Many believe that the DR 835 is limited to federal tax issues. In fact, it can be used for state tax matters as well, depending on the jurisdiction.

-

Once filed, the POA is permanent.

Some think that filing this form creates a lifelong arrangement. However, a Power of Attorney can be revoked or modified at any time by the person who created it.

-

All tax issues are covered by the form.

This form does not cover every tax issue. It is important to specify the types of tax matters the representative is authorized to handle.

-

Signing the form is enough; no further action is needed.

Simply signing the form does not guarantee its acceptance. It must be properly submitted to the appropriate tax authority for it to be effective.

-

Only one person can be appointed.

Many believe that only one representative can be designated. However, multiple individuals can be appointed to act jointly or separately.

-

There is no need to inform the tax authority about changes.

Failing to inform the tax authority about any changes to the Power of Attorney can lead to complications. It’s essential to keep them updated.

-

The form is only for individuals.

This misconception overlooks that businesses can also use the DR 835 form to designate a representative for tax matters.

-

Filing the form guarantees representation.

Filing the form does not guarantee that the representative will be accepted by the tax authority. Acceptance can depend on various factors, including the representative's qualifications.

-

There is a standard fee for filing the form.

Some assume there is a universal fee for filing the DR 835. Fees can vary based on the tax authority and the specific circumstances surrounding the filing.

Documents used along the form

The Tax Power of Attorney (POA) DR 835 form is a crucial document that allows individuals to appoint a representative to act on their behalf regarding tax matters. Alongside this form, several other documents may be required or beneficial in managing tax-related issues. Below is a list of commonly used forms and documents that complement the Tax POA DR 835.

- Form 2848: This is the IRS Power of Attorney and Declaration of Representative form. It allows taxpayers to appoint individuals to represent them before the IRS and grants them the authority to receive and inspect confidential tax information.

- Form 8821: This form is the Tax Information Authorization. It permits individuals to authorize someone else to receive and inspect their tax information without granting them the authority to represent them.

- California Dog Bill of Sale: This form serves as a vital record in the sale of dogs, ensuring a clear transfer of ownership. For comprehensive resources, refer to All California Forms.

- Form 4506: This form is used to request a copy of a tax return from the IRS. Taxpayers may need this document to provide proof of income or to resolve discrepancies.

- Form 1040: This is the standard individual income tax return form. Taxpayers file this annually to report their income and calculate their tax liability.

- Form 9465: This is the Installment Agreement Request form. Taxpayers use this to request a payment plan for any taxes owed to the IRS.

- Form 1040-X: This is the Amended U.S. Individual Income Tax Return form. It is used to correct errors on a previously filed Form 1040.

- Form W-2: This form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It is essential for accurate tax filing.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. It includes income from self-employment, interest, and dividends.

- Form 4868: This is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. It allows taxpayers to extend their filing deadline for an additional six months.

These documents play significant roles in the tax process, ensuring that individuals can effectively manage their tax obligations and maintain compliance with IRS regulations. Each form serves a specific purpose and can facilitate smoother interactions with tax authorities.

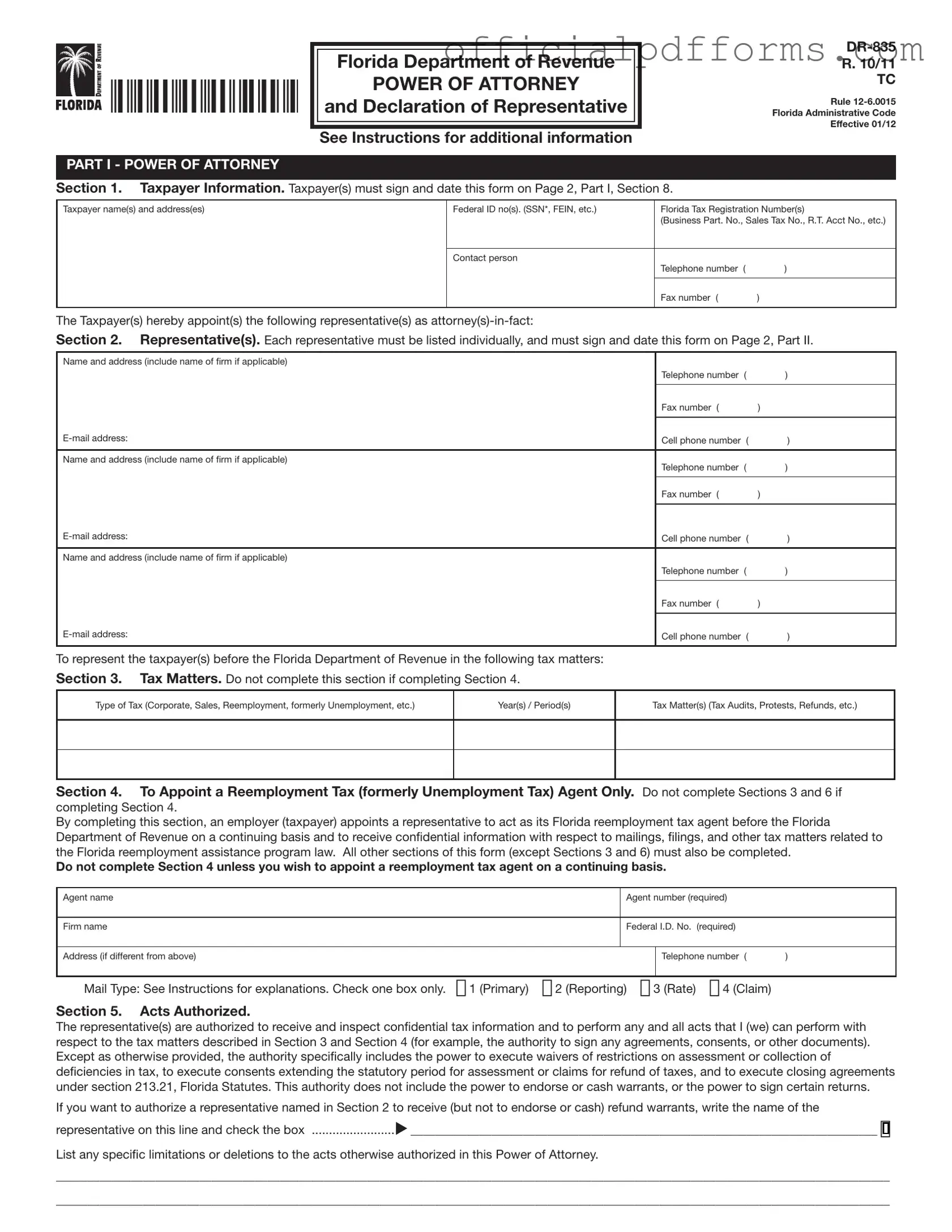

Steps to Filling Out Tax POA dr 835

Once you have the Tax POA DR 835 form in hand, it's time to fill it out carefully. This form allows you to authorize someone to represent you before the tax authority. Follow the steps below to ensure that you complete the form accurately.

- Begin by entering your personal information in the designated fields. This includes your full name, address, and Social Security number or taxpayer identification number.

- Next, provide the name and address of the person you are authorizing. This could be a tax professional or anyone you trust to handle your tax matters.

- Specify the type of tax for which you are granting power of attorney. This might include income tax, sales tax, or other specific taxes.

- Indicate the tax years or periods for which this authorization applies. Be clear and specific to avoid any confusion.

- Sign and date the form. Your signature confirms that you are granting power of attorney to the designated individual.

- Finally, make a copy of the completed form for your records before submitting it to the appropriate tax authority.

After filling out the form, you will need to submit it to the tax authority. Ensure that you follow any additional instructions provided by the authority regarding submission methods and deadlines.

Common mistakes

-

Incorrect Personal Information: One of the most common mistakes is failing to provide accurate personal details. This includes the taxpayer's name, address, and Social Security number. Any discrepancies can lead to delays or rejections.

-

Missing Signatures: Often, individuals forget to sign the form. A signature is crucial, as it validates the authorization. Without it, the form may not be processed, leaving the taxpayer without representation.

-

Not Specifying the Scope of Authority: When filling out the form, clarity is key. Failing to specify what the representative is authorized to do can lead to confusion. It’s essential to indicate whether the authority covers all tax matters or is limited to specific issues.

-

Using Outdated Forms: The tax landscape can change, and so can the forms. Using an outdated version of the Tax POA dr 835 can result in complications. Always ensure you have the most current form from the IRS or state tax authority.

-

Neglecting to Include Additional Representatives: If there are multiple representatives, failing to list them all can be a significant oversight. Each representative must be identified clearly to avoid any issues during the authorization process.

-

Overlooking Submission Instructions: Each tax authority may have specific submission guidelines. Ignoring these instructions can lead to unnecessary delays. It’s important to follow the guidelines closely to ensure timely processing.

Get Clarifications on Tax POA dr 835

What is the Tax POA DR 835 form?

The Tax POA DR 835 form is a Power of Attorney document specifically designed for tax matters. It allows an individual or entity to authorize another person to act on their behalf in dealings with tax authorities. This can include filing returns, representing the taxpayer during audits, and handling other tax-related responsibilities.

Who needs to fill out the Tax POA DR 835 form?

Any taxpayer who wants to grant authority to someone else to manage their tax affairs should consider filling out this form. This could be useful for individuals, business owners, or anyone who may need assistance navigating tax issues. It’s especially helpful when you are unable to handle your tax matters personally due to time constraints or lack of expertise.

What information is required on the form?

The Tax POA DR 835 form typically requires the following information:

- Your name and contact information.

- The name and contact information of the person you are authorizing.

- A description of the specific tax matters for which the authority is granted.

- Signatures of both parties, indicating consent and understanding.

How do I submit the Tax POA DR 835 form?

Once you have completed the form, you can submit it to the relevant tax authority. This could be done by mailing it directly to the appropriate office or, in some cases, submitting it electronically. Always check the submission guidelines for the specific tax agency to ensure your form is processed correctly.

Is there a fee associated with filing the Tax POA DR 835 form?

Generally, there is no fee for submitting the Tax POA DR 835 form. However, it’s wise to confirm with the tax authority you are dealing with, as policies can vary. Keep in mind that while the form itself may not incur costs, other tax-related services provided by the authorized representative may have associated fees.

Can I revoke the Power of Attorney after submitting the form?

Yes, you can revoke the Power of Attorney at any time. To do so, you must submit a written notice to the tax authority indicating your intent to revoke the authorization. It’s a good practice to also inform the person you previously authorized, ensuring everyone is on the same page.

How long is the Tax POA DR 835 form valid?

The validity of the Tax POA DR 835 form typically lasts until you revoke it or until the specific tax matters for which it was granted are resolved. If you need the authority to last for an extended period, be sure to check the specific guidelines provided by the tax authority.

Can I authorize multiple individuals using one form?

What should I do if I have more questions about the form?

If you have additional questions or need clarification about the Tax POA DR 835 form, consider reaching out directly to the tax authority or consulting a tax professional. They can provide guidance tailored to your specific situation, ensuring you understand the process and requirements fully.