Valid Single-Member Operating Agreement Document

Consider More Types of Single-Member Operating Agreement Documents

What Does an Operating Agreement Look Like for an Llc - It can specify performance metrics for members to follow.

The Texas Operating Agreement form is essential for LLC members, serving to clearly define operational procedures and ownership structures, thus protecting the interests of all involved. To formalize the structure of your business and safeguard member agreements, fill out the Texas Operating Agreement form by clicking the button below or access it directly through the Operating Agreement form.

Misconceptions

Understanding the Single-Member Operating Agreement can be challenging due to various misconceptions. Here’s a list of common misunderstandings surrounding this important document.

- It is not necessary for single-member LLCs. Many believe that a Single-Member Operating Agreement is optional for single-member LLCs. In reality, having this agreement helps clarify the business structure and protects the owner’s personal assets.

- It must be filed with the state. Some think that the operating agreement needs to be submitted to the state. However, this document is typically kept internal and does not require filing.

- It is a one-size-fits-all document. A common misconception is that a Single-Member Operating Agreement is generic. Each agreement should be tailored to fit the specific needs and goals of the business.

- It is only for legal protection. While legal protection is a significant benefit, the agreement also serves to outline operational procedures and decision-making processes, providing clarity for the owner.

- It cannot be amended. Some individuals believe that once an operating agreement is created, it cannot be changed. In fact, amendments can be made as the business evolves or as needs change.

- It is only necessary for tax purposes. This document is often seen as a tax tool. However, its purpose extends beyond taxes, encompassing management and operational guidelines as well.

- It is not enforceable in court. There is a belief that operating agreements hold no legal weight. On the contrary, these agreements can be enforced in court, provided they are properly drafted and executed.

- It is only relevant during the formation of the LLC. Some think the agreement is only needed at the start. In reality, it remains relevant throughout the life of the business and should be reviewed regularly.

- It is only for businesses with multiple members. Many assume that operating agreements are only necessary for multi-member LLCs. However, single-member LLCs benefit significantly from having one as well.

By debunking these misconceptions, business owners can better understand the value of a Single-Member Operating Agreement and ensure their LLC operates smoothly and legally.

Documents used along the form

A Single-Member Operating Agreement is an essential document for individuals who own a limited liability company (LLC) on their own. While this agreement outlines the management structure and operational guidelines for the LLC, several other documents complement it and are often necessary for effective business management. Below is a list of related forms and documents that you may find useful.

- Articles of Organization: This document is filed with the state to officially create your LLC. It includes basic information such as the business name, address, and the registered agent.

- Employer Identification Number (EIN) Application: An EIN is required for tax purposes and is necessary if you plan to hire employees or open a business bank account.

- Operating Agreement: For LLC owners seeking clarity in management, the detailed operating agreement form guidelines provide essential insights into establishing business structure and operational processes.

- Membership Certificate: This certificate serves as proof of ownership in the LLC. It may be issued to signify the member’s interest in the company.

- Bylaws: Although not always required for single-member LLCs, bylaws can outline the operational procedures and rules governing the business, providing clarity on decision-making processes.

- Bank Resolution: This document authorizes a specific individual to open and manage bank accounts on behalf of the LLC, ensuring proper financial management.

- Annual Report: Many states require LLCs to file an annual report, which provides updated information about the business and maintains good standing with the state.

These documents work together to support the structure and function of your LLC. It is important to keep them organized and updated to ensure compliance and smooth operations. Proper documentation can help safeguard your interests and facilitate the growth of your business.

Steps to Filling Out Single-Member Operating Agreement

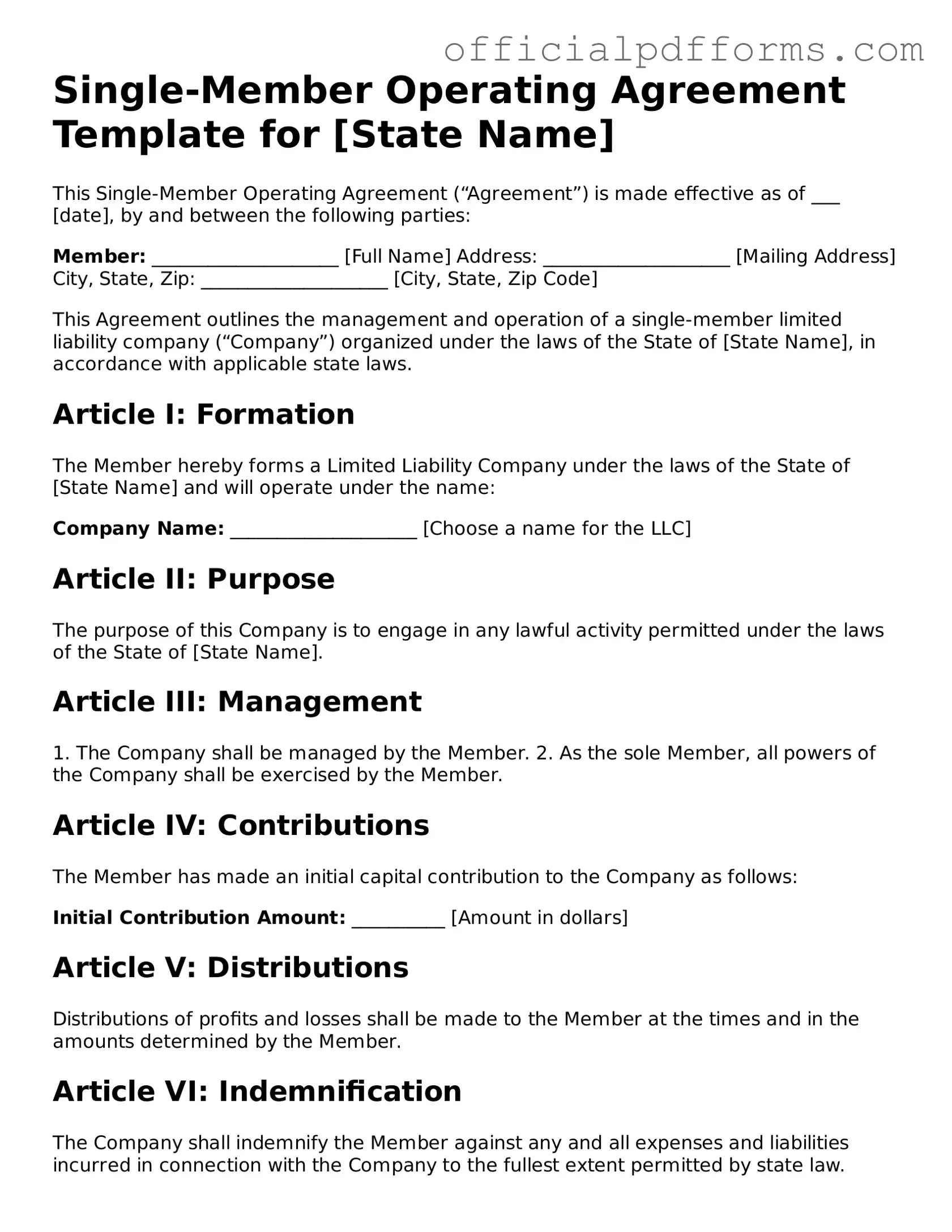

After obtaining the Single-Member Operating Agreement form, you are ready to begin filling it out. This document is essential for outlining the management structure and operational guidelines of your single-member business entity. Follow these steps carefully to ensure that all necessary information is accurately provided.

- Begin with the title of the document. Clearly label it as "Single-Member Operating Agreement."

- Provide the name of your business entity. This should match the name registered with the state.

- Enter the principal address of the business. This is where official correspondence will be sent.

- State the name of the single member. This person is the sole owner of the business.

- Include the date of formation. This is the date when the business was officially established.

- Outline the purpose of the business. Briefly describe the nature of the business activities.

- Specify the management structure. Indicate whether the member will manage the business or if an outside manager will be appointed.

- Detail the financial arrangements. Include how profits and losses will be allocated.

- Provide information about the member's capital contributions. List any initial investments made by the member.

- Include provisions for amendments. Describe how changes to the agreement can be made in the future.

- Sign and date the document. The member must sign to validate the agreement.

Common mistakes

-

Neglecting to Include Basic Information: One common mistake is failing to provide essential details such as the name of the business, the owner's name, and the principal address. This information is crucial for identifying the entity and ensuring compliance with state regulations.

-

Inaccurate Member Designation: Some individuals mistakenly indicate that there are multiple members when the agreement is intended for a single-member LLC. This can lead to confusion and potential legal issues down the line.

-

Omitting Purpose of the LLC: Another frequent error is not specifying the business purpose. Clearly stating the purpose helps clarify the intent of the LLC and can be beneficial for legal and tax matters.

-

Ignoring the Capital Contributions: Failing to outline the initial capital contributions made by the owner can lead to misunderstandings about ownership and financial expectations. This section is vital for establishing the financial foundation of the business.

-

Forgetting to Address Profit Distribution: Some individuals overlook detailing how profits will be distributed. It is important to clarify whether profits will be reinvested or distributed to the owner, as this affects financial planning.

-

Not Including an Amendment Clause: Many overlook the importance of including a clause that outlines how the agreement can be amended in the future. This flexibility is essential as business needs may change over time.

-

Failing to Sign and Date the Agreement: Lastly, individuals sometimes forget to sign and date the operating agreement. Without a signature, the document may not be considered valid, undermining its purpose.

Get Clarifications on Single-Member Operating Agreement

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the ownership and operational procedures of a single-member limited liability company (LLC). This agreement serves as an internal guide, detailing how the business will be managed and how decisions will be made. It is particularly important for maintaining the limited liability status of the LLC.

Why do I need a Single-Member Operating Agreement?

Having a Single-Member Operating Agreement is essential for several reasons:

- It establishes the legitimacy of your LLC, helping to protect your personal assets from business liabilities.

- The agreement clarifies the management structure and operational procedures, reducing potential conflicts in the future.

- It can be beneficial for opening business bank accounts and securing financing.

What should be included in a Single-Member Operating Agreement?

A comprehensive Single-Member Operating Agreement should include the following key elements:

- The name of the LLC and its principal address.

- The purpose of the business.

- The name of the single member and their ownership percentage, which is typically 100%.

- Management structure and decision-making processes.

- Procedures for adding new members, if applicable.

- Distribution of profits and losses.

- Amendment procedures for the agreement.

Is a Single-Member Operating Agreement legally required?

While many states do not legally require a Single-Member Operating Agreement, it is highly recommended. Having this document can help establish the separation between personal and business assets, which is crucial for maintaining limited liability protection. Additionally, some banks and lenders may require it to open business accounts or secure loans.

Can I create my own Single-Member Operating Agreement?

Yes, you can create your own Single-Member Operating Agreement. Many templates are available online, which can serve as a helpful starting point. However, it’s important to ensure that the agreement complies with your state’s laws and accurately reflects your business needs. Consulting with a legal professional may provide additional peace of mind.

How do I modify my Single-Member Operating Agreement?

To modify your Single-Member Operating Agreement, you should follow these steps:

- Review the existing agreement to determine the specific sections that need changes.

- Draft the amendments clearly, specifying what changes are being made.

- Sign and date the amended agreement to indicate your approval.

- Keep a copy of the amended agreement with your business records.

What happens if I don’t have a Single-Member Operating Agreement?

If you do not have a Single-Member Operating Agreement, you may face several risks. Without this document, it may be harder to prove that your LLC is a separate entity, which could expose your personal assets to business liabilities. Additionally, disputes may arise regarding the management and operations of your business without clear guidelines in place.