Fill in a Valid Sample Tax Return Transcript Form

Common PDF Forms

I-983 - The I-983 form outlines the training plan for the student's work experience.

By utilizing a detailed California ATV Bill of Sale, both parties can ensure a proper record is maintained throughout the transaction. This form is designed to facilitate the legal transfer of ownership and provide peace of mind for buyers and sellers alike.

Horse Training Agreement Template - Trainer commits to delivering the best care possible under the contract conditions.

Misconceptions

- Misconception 1: The Sample Tax Return Transcript shows all transactions related to the taxpayer's account.

- Misconception 2: The transcript can be used to file a new tax return.

- Misconception 3: The information on the transcript is not secure.

- Misconception 4: The transcript provides a complete picture of taxable income.

- Misconception 5: The Sample Tax Return Transcript is only useful for individuals.

- Misconception 6: The transcript is the same as a tax return.

Many people believe that this transcript includes every transaction or activity associated with their tax account. However, it only reflects the amounts as shown on the return and any adjustments made. It does not provide details on subsequent activities or changes to the account.

Some individuals think that they can use the Sample Tax Return Transcript to prepare and file a new tax return. This is incorrect. The transcript is a record of past tax filings and cannot be used as a substitute for a current tax return.

There is a common belief that the Sample Tax Return Transcript contains sensitive information that is easily accessible. In reality, the IRS takes the security of taxpayer data very seriously. The transcript is designed to protect personal information, and access is limited to authorized individuals.

Some may think that the Sample Tax Return Transcript includes all sources of income and deductions. However, it only summarizes specific income categories and adjustments. Other income or deductions not reported on the return will not appear on the transcript.

Many assume that this transcript is relevant only for individual taxpayers. In fact, businesses and self-employed individuals can also benefit from the information contained in the transcript for their tax records and financial planning.

Some people confuse the Sample Tax Return Transcript with the actual tax return. While the transcript summarizes the tax return data, it does not include all the detailed information found in the original return. It serves a different purpose and should not be viewed as a replacement for the complete tax return.

Documents used along the form

The Sample Tax Return Transcript form is an important document that provides a summary of a taxpayer's income, deductions, and tax liabilities for a specific tax year. However, several other forms and documents are often used in conjunction with this transcript to provide a more comprehensive view of a taxpayer's financial situation. Below is a list of related forms and documents that may be required or helpful in various tax scenarios.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers to report their annual income. It includes details about income, deductions, and credits.

- Schedule C: Used to report income or loss from a business operated as a sole proprietorship. It provides insights into gross receipts, expenses, and net profit or loss.

- Form W-2: Issued by employers, this form reports an employee's annual wages and the taxes withheld from their paycheck. It is essential for accurately filing income tax returns.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Different versions exist for different types of income, such as freelance work or interest income.

- Asurion F-017-08 MEN: This form is utilized for various administrative and service-related processes within Asurion's framework. Understanding its purpose can enhance your experience with Asurion services. For more details, visit Free Business Forms.

- Form 8862: This form is used to claim the Earned Income Credit after it has been disallowed in a prior year. It helps taxpayers demonstrate eligibility for this valuable credit.

- Form 8888: This form allows taxpayers to split their tax refund into multiple accounts, making it easier to manage finances and savings.

- Form 8863: This form is used to claim education credits, such as the American Opportunity Credit and the Lifetime Learning Credit, which can significantly reduce tax liability for eligible students.

- Form 4506-T: This form is a request for a transcript of tax return information. It is often used when applying for loans or financial aid, as it provides a summary of a taxpayer's income and tax history.

Understanding these forms and documents is crucial for taxpayers who want to ensure compliance with tax laws and maximize their financial benefits. Each document serves a specific purpose, and together they create a comprehensive picture of an individual's financial standing for tax purposes.

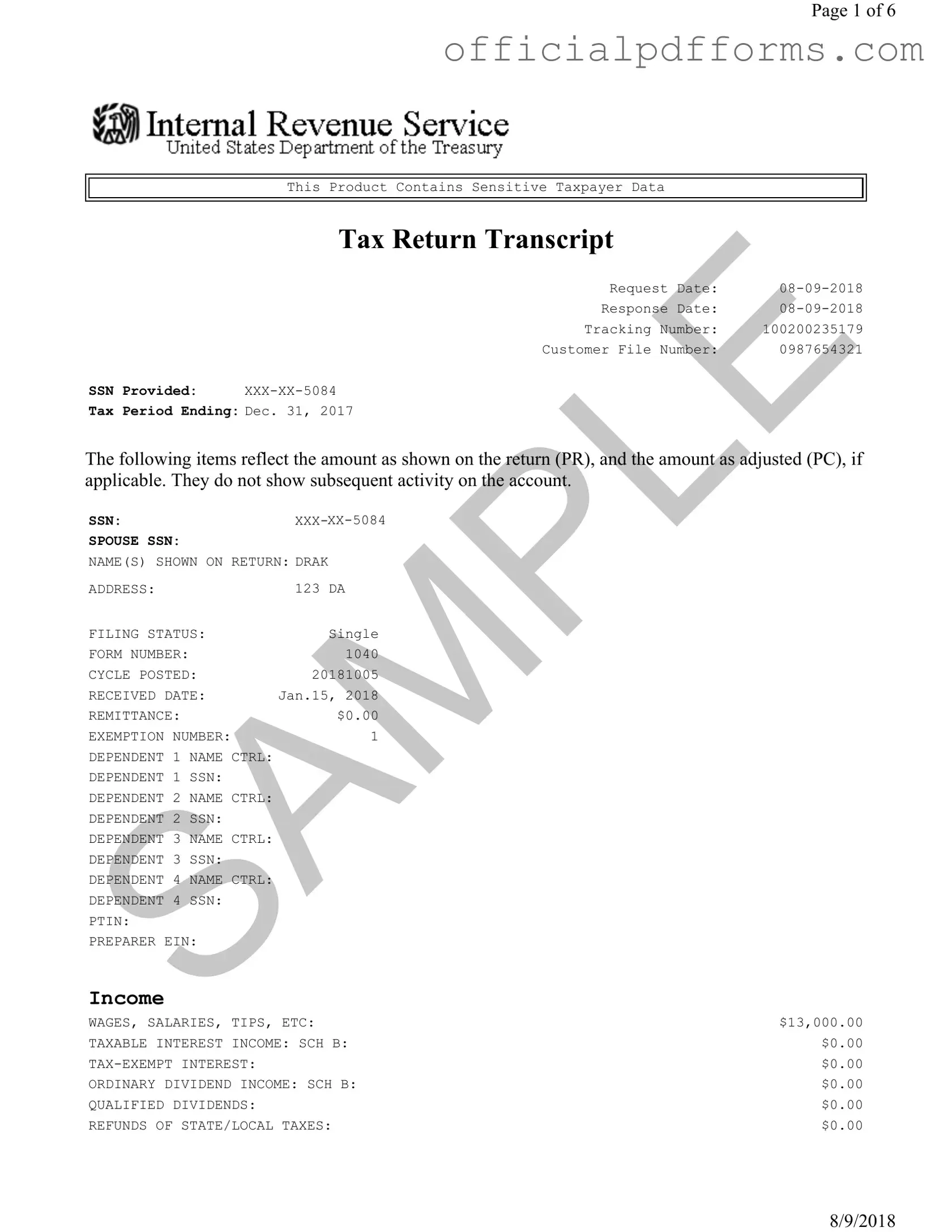

Steps to Filling Out Sample Tax Return Transcript

Completing the Sample Tax Return Transcript form is essential for accurately documenting your tax information. Follow these steps to ensure all necessary details are filled out correctly.

- Locate the form and ensure you have the correct version for your tax year.

- Fill in the Request Date and Response Date at the top of the form.

- Enter the Tracking Number and Customer File Number in their respective fields.

- Provide your Social Security Number (SSN) in the designated area.

- If applicable, include your spouse's SSN and your names as shown on the return.

- Complete your Address information accurately.

- Indicate your Filing Status (e.g., Single, Married Filing Jointly).

- Fill in the Form Number (typically 1040) and the Cycle Posted date.

- Record the Received Date of your tax return.

- Document the Remittance amount if applicable.

- List your Exemption Number and any dependents, including their names and SSNs.

- Provide your PTIN (Preparer Tax Identification Number) if you have one.

- Enter the Income details, including wages, salaries, and any other income sources.

- Fill out the section for Adjustments to Income, including any deductions you qualify for.

- Calculate your Adjusted Gross Income based on the information provided.

- Complete the Tax and Credits section, entering any applicable credits and deductions.

- Fill in the Other Taxes section, detailing any additional taxes owed.

- Document your Payments, including federal income tax withheld and any estimated payments made.

- Finally, calculate the Refund or Amount Owed and enter that information in the designated fields.

- Complete the Third Party Designee section if you wish to authorize someone to discuss your return.

Common mistakes

-

Incomplete Personal Information: Failing to provide complete names, Social Security Numbers (SSNs), or addresses can lead to processing delays. Ensure all fields are filled accurately.

-

Incorrect Tax Period: Using the wrong tax period can result in confusion. Verify that the tax period matches the year for which you are filing.

-

Missing Signatures: Not signing the form can cause it to be rejected. Always sign and date the form before submission.

-

Errors in Income Reporting: Misreporting income figures, such as wages or business income, can lead to incorrect tax calculations. Double-check all income entries for accuracy.

-

Omitting Deductions and Credits: Forgetting to claim eligible deductions or credits can result in overpayment. Review all potential deductions carefully before submitting.

-

Failure to Review for Errors: Not reviewing the entire form for mistakes before submission can lead to issues. Take time to proofread the form to catch any errors.

Get Clarifications on Sample Tax Return Transcript

What is a Sample Tax Return Transcript?

A Sample Tax Return Transcript is a document provided by the IRS that summarizes key information from your tax return. It includes details such as your income, filing status, and tax credits. This transcript does not show any subsequent changes made to your account after the return was filed. It is often used for verification purposes, such as when applying for loans or financial aid.

How can I obtain a Sample Tax Return Transcript?

You can request a Sample Tax Return Transcript through several methods:

- Online: Use the IRS website to access the Get Transcript tool. You will need to verify your identity using personal information.

- By Mail: Complete Form 4506-T, Request for Transcript of Tax Return, and send it to the IRS. Be sure to specify that you want a tax return transcript.

- By Phone: Call the IRS at 1-800-908-9946 and follow the prompts to request your transcript.

Keep in mind that it may take a few days to process your request, especially if you choose to receive it by mail.

What information is included in a Sample Tax Return Transcript?

A Sample Tax Return Transcript includes the following key details:

- Your name and Social Security Number (SSN)

- Filing status and exemption information

- Income details, including wages, salaries, and other sources

- Adjustments to income and deductions

- Tax credits and liabilities

- Payments made and any refund or amount owed

This information provides a comprehensive overview of your tax situation for the specified tax year.

Why might I need a Sample Tax Return Transcript?

There are several reasons you might need a Sample Tax Return Transcript:

- Loan Applications: Lenders often require this document to verify your income and tax status.

- Financial Aid: Colleges may ask for a transcript to assess your financial need.

- Tax Preparation: It can help you ensure accuracy when preparing your current year's tax return.

- Dispute Resolution: If you have discrepancies with the IRS, a transcript can serve as a reference.

Having this document on hand can simplify many financial processes.