Valid Release of Promissory Note Document

Consider More Types of Release of Promissory Note Documents

Car Loan Promissory Note - Important for safeguarding the rights of both borrower and lender.

When entering into a financial agreement, it is crucial to use a well-structured document like the New Jersey Promissory Note form, which can be found at https://newjerseyformspdf.com/editable-promissory-note. This form clearly outlines the terms of repayment and protects both the lender and borrower by specifying the obligations involved in the agreement.

Misconceptions

Misconceptions about the Release of Promissory Note form can lead to confusion. Here are four common misunderstandings:

-

It is only necessary for large loans.

This is not true. The Release of Promissory Note form is important for any loan, regardless of size. It serves as proof that the debt has been satisfied.

-

It eliminates all obligations.

Many believe that signing this form completely wipes out any remaining obligations. In reality, it only releases the borrower from the specific debt outlined in the note.

-

It must be notarized.

Some think that notarization is mandatory for the form to be valid. However, while notarization can add a layer of authenticity, it is not always required.

-

It is the same as a cancellation notice.

This is a common mix-up. The Release of Promissory Note form is not the same as a cancellation notice. It formally acknowledges that the debt has been paid, whereas a cancellation notice may simply state that the agreement is no longer in effect.

Documents used along the form

When dealing with financial agreements, several documents often accompany the Release of Promissory Note form. These documents help clarify terms, outline obligations, and protect the interests of all parties involved. Below is a list of common forms and documents that are frequently used in conjunction with the release of a promissory note.

- Promissory Note: This is the original document that outlines the borrower's promise to repay a loan under specified terms. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payment.

- Loan Agreement: This comprehensive document details the terms of the loan, including the responsibilities of both the lender and borrower. It often includes clauses about default, collateral, and dispute resolution.

- Payment Schedule: This document outlines the timeline for payments, including due dates and amounts. It helps both parties track payments and ensures clarity on when obligations must be met.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets being used as security. It protects the lender's interest by outlining what happens if the borrower defaults.

- Promissory Note Template: For those looking to create a compliant and effective promissory note, useful resources like NY PDF Forms offer printable templates that can help streamline the process and ensure all necessary information is included.

- Release of Lien: This document is used when a lender releases their claim on the collateral once the loan is paid off. It serves as proof that the borrower has fulfilled their obligations.

- Settlement Agreement: In cases where a dispute arises, this document outlines the terms of any settlement reached between the parties. It can prevent further legal action by formalizing the agreement.

- Affidavit of Debt: This sworn statement confirms the amount owed by the borrower. It can be used in legal proceedings to establish the borrower's debt and the lender's claim.

- Notice of Default: If a borrower fails to make payments, this document serves as a formal notification of default. It outlines the consequences and the lender's rights moving forward.

Understanding these documents can provide clarity and security in financial transactions. Each plays a vital role in ensuring that all parties are aware of their rights and responsibilities, ultimately fostering trust and transparency in lending relationships.

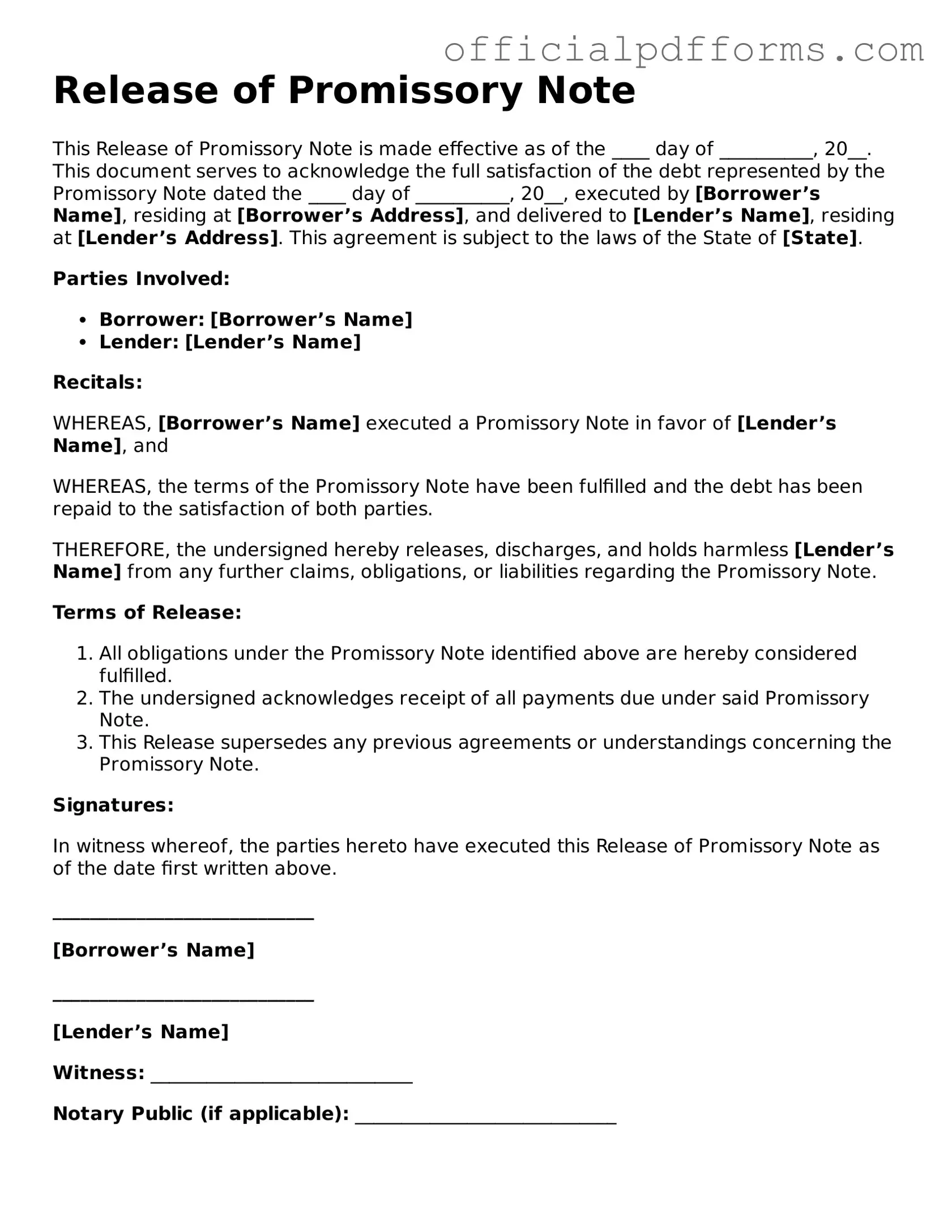

Steps to Filling Out Release of Promissory Note

After completing the Release of Promissory Note form, it is important to ensure that all parties involved receive a copy for their records. This document serves to formally acknowledge the release of the promissory note, which can provide clarity and closure for both the borrower and the lender. Following the steps outlined below will help ensure that the form is filled out correctly.

- Begin by entering the date at the top of the form. This should reflect the date when the release is being executed.

- Clearly print the name of the borrower in the designated space. Ensure that the name matches the one used in the original promissory note.

- In the next section, provide the name of the lender. Again, this should match the original document.

- Fill in the details of the promissory note being released. This typically includes the original amount, date of issuance, and any relevant identification numbers.

- Indicate the reason for the release, if applicable. This could be due to full payment, settlement, or other reasons as agreed upon by both parties.

- Sign the form in the designated area. The borrower must sign to acknowledge the release.

- Have the lender sign the form as well, confirming their agreement to the release.

- Include the printed names of both the borrower and the lender below their signatures for clarity.

- Make copies of the completed form for both parties to retain for their records.

Common mistakes

-

Inaccurate Information: Individuals often enter incorrect details such as names, addresses, or dates. This can lead to confusion and potential disputes in the future.

-

Missing Signatures: A common oversight is failing to sign the document. Without the necessary signatures, the release may not be legally binding.

-

Not Including Relevant Terms: Some people neglect to specify the terms of the release, such as the amount paid or the conditions under which the note is released. This omission can create ambiguity.

-

Improper Notarization: Failing to have the document properly notarized can invalidate the release. Notarization serves as a verification of identity and intent.

Get Clarifications on Release of Promissory Note

What is a Release of Promissory Note form?

The Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note. When the borrower pays off their debt, this form is used to officially release them from the obligation of the note. It acts as proof that the debt has been satisfied and the lender no longer has any claim to the amount specified in the note.

When should I use this form?

You should use the Release of Promissory Note form after the borrower has fully repaid the loan outlined in the promissory note. It is important to document this release to avoid any future disputes regarding the debt. This form should be completed and signed by the lender, acknowledging that the borrower has fulfilled their obligations.

Who needs to sign the form?

The form must be signed by the lender, who is the party that originally provided the loan. If there are multiple lenders or co-signers, they may also need to sign the form to ensure all parties agree to the release. The borrower should also receive a copy for their records.

What information is required on the form?

The Release of Promissory Note form typically requires the following information:

- The names and addresses of both the lender and borrower.

- The date the promissory note was signed.

- The amount of the original loan.

- The date the loan was paid in full.

- A statement confirming that the debt has been satisfied.

Do I need to notarize the form?

While notarization is not always required, it is often recommended. Having the form notarized adds an extra layer of authenticity and can help prevent any disputes in the future. Check your state’s requirements, as they may vary.

What happens if I don’t use this form?

If you do not use the Release of Promissory Note form after the debt is paid, the lender may still appear to have a claim on the borrower’s obligation. This could lead to misunderstandings or disputes down the line. It is always best to document the release to protect both parties.

Can I use this form for any type of loan?

The Release of Promissory Note form is specifically designed for promissory notes. If the loan is secured by collateral or is a different type of agreement, other forms may be necessary. Always ensure that you are using the correct documentation for your specific situation.