Valid Quitclaim Deed Document

Quitclaim Deed Forms for Individual US States

Consider More Types of Quitclaim Deed Documents

Problems With Transfer on Death Deeds California - The recipient of the property must accept the terms laid out in the deed before transfer occurs.

To simplify the rental process, many landlords utilize a Rental Application form, which can be conveniently accessed through OnlineLawDocs.com. This document is essential for screening potential tenants, as it collects vital information regarding their background, employment status, and rental history, thus aiding landlords in selecting the most reliable candidates for their properties.

Misconceptions

When dealing with real estate transactions, the quitclaim deed often comes up. However, several misconceptions surround this form. Here are four common misunderstandings:

- A quitclaim deed transfers ownership of a property completely. This is not entirely accurate. A quitclaim deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor actually owns the property or has clear title. If the grantor has no interest, the recipient receives nothing.

- A quitclaim deed is only used between family members. While it is common for family members to use quitclaim deeds, they are not limited to familial transactions. Anyone can use a quitclaim deed to transfer property interests, whether between friends, business partners, or even strangers.

- A quitclaim deed removes all liabilities associated with the property. This is a misconception. The quitclaim deed does not absolve the grantor of any debts or obligations tied to the property. If there are existing liens or mortgages, those responsibilities may still remain with the grantor.

- A quitclaim deed is the same as a warranty deed. This is incorrect. A warranty deed provides a guarantee that the title is clear and free from encumbrances, while a quitclaim deed offers no such assurances. The recipient of a quitclaim deed takes on the risk of any title issues.

Understanding these misconceptions can help individuals make more informed decisions when it comes to property transfers.

Documents used along the form

A Quitclaim Deed is a straightforward document used to transfer ownership of property from one party to another. However, several other forms and documents often accompany it to ensure a smooth transaction. Here’s a list of commonly used documents that you might encounter when dealing with a Quitclaim Deed.

- Warranty Deed: This document guarantees that the seller has clear title to the property and will defend against any claims. It offers more protection than a Quitclaim Deed.

- Power of Attorney: For those managing property transactions, our essential Power of Attorney form resources ensure legal representation in your absence.

- Title Search Report: This report reveals the history of ownership and any liens or encumbrances on the property. It helps buyers understand what they are getting.

- Property Transfer Tax Declaration: This form is often required by state or local authorities to assess taxes on the transfer of property. It provides information about the sale price and property details.

- Affidavit of Title: This sworn statement confirms that the seller is the rightful owner and that there are no undisclosed claims against the property.

- Closing Statement: Also known as a HUD-1, this document outlines all financial transactions related to the sale, including fees and taxes. It ensures transparency for both parties.

- Power of Attorney: If the seller cannot be present for the transaction, this document allows someone else to act on their behalf, ensuring the process can proceed smoothly.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community.

- Title Insurance Policy: This policy protects the buyer and lender against any future claims to the title that may arise after the purchase.

- Notice of Transfer: This document informs local authorities about the change in ownership, which is often necessary for tax records and public records updates.

- Deed of Trust: This document secures a loan by placing a lien on the property. It outlines the terms under which the lender can claim the property if the borrower defaults.

Understanding these documents can help you navigate the property transfer process with greater ease. Each one plays a crucial role in protecting your interests and ensuring that the transaction is completed legally and efficiently.

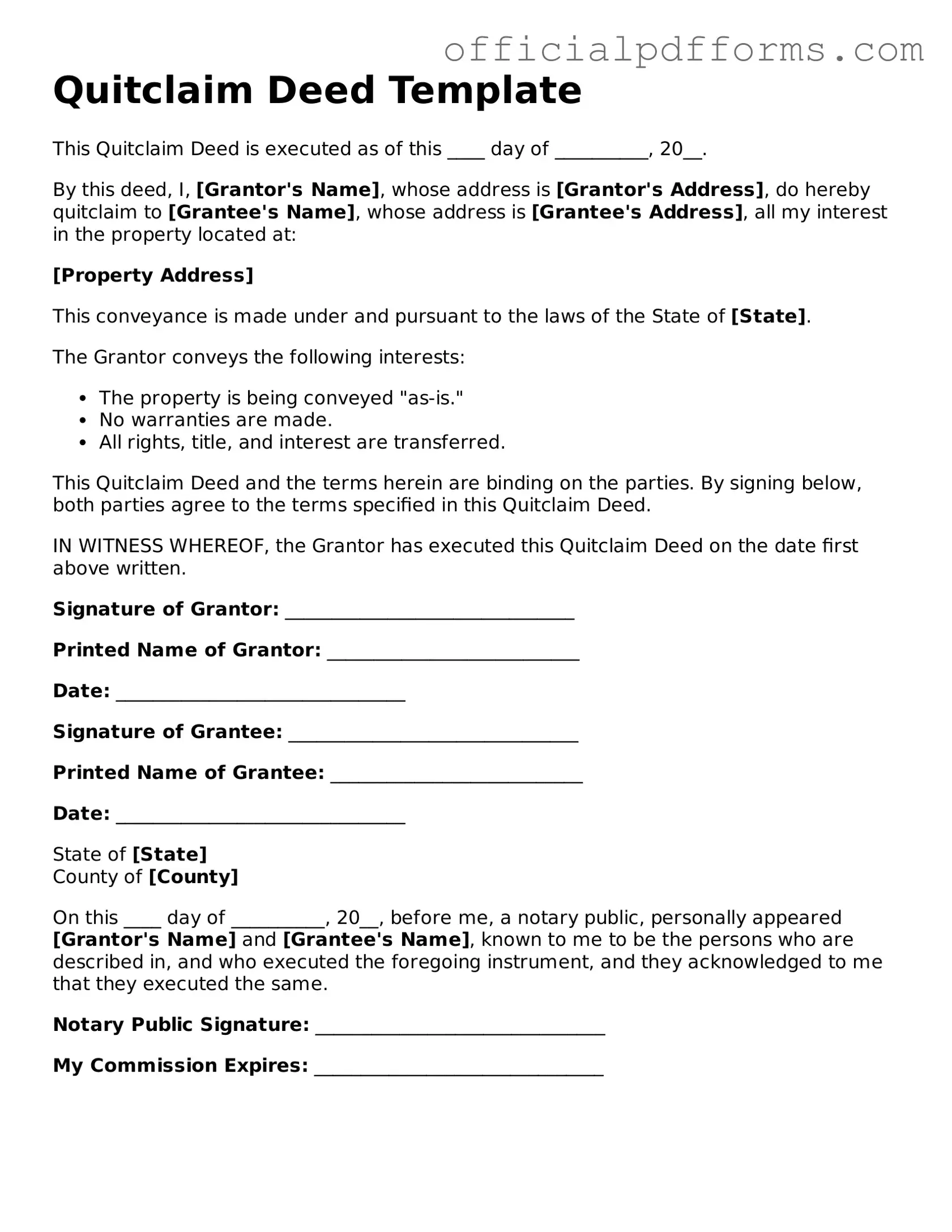

Steps to Filling Out Quitclaim Deed

After you have gathered the necessary information and documents, you are ready to begin filling out the Quitclaim Deed form. This process is important for ensuring that the transfer of property rights is clear and legally recognized. Follow these steps carefully to complete the form accurately.

- Identify the Grantor: Write the full name and address of the person transferring the property rights. This is the individual who currently holds the title.

- Identify the Grantee: Enter the full name and address of the person receiving the property rights. This is the individual who will hold the title after the transfer.

- Describe the Property: Provide a detailed description of the property being transferred. Include the address and any relevant legal descriptions, such as lot numbers or parcel numbers.

- State the Consideration: Indicate the amount of money or value exchanged for the property, if any. If the transfer is a gift, you can state "for love and affection" instead of a monetary value.

- Sign the Form: The grantor must sign the Quitclaim Deed in the presence of a notary public. This step is crucial for the document to be valid.

- Notarization: The notary public will sign and stamp the document, verifying the identity of the grantor and the authenticity of the signature.

- Record the Deed: Submit the completed Quitclaim Deed to the appropriate local government office, such as the county recorder's office, to officially record the transfer.

Completing these steps ensures that the Quitclaim Deed is filled out correctly and can be processed without delays. It is advisable to keep a copy of the recorded deed for your records once it has been filed.

Common mistakes

-

Not Including All Required Information: One common mistake is failing to provide all necessary details. This includes the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Missing this information can lead to confusion or even legal disputes down the line.

-

Incorrect Property Description: The property must be accurately described in the deed. Many people make the error of using vague or incomplete descriptions. It's essential to include the full legal description, which can typically be found on the original property deed or tax records.

-

Failure to Sign and Date: A quitclaim deed must be signed and dated by the grantor. Some individuals forget this crucial step. Without a signature and date, the deed is not valid, and the transfer of property does not take place.

-

Not Notarizing the Document: While some states do not require notarization, it is generally a good practice to have the deed notarized. Failing to do so can create complications, especially if the deed is challenged later.

-

Neglecting to Record the Deed: After filling out the quitclaim deed, it’s important to record it with the appropriate local government office. Some people overlook this step, thinking that filling out the form is enough. Without recording, the transfer may not be legally recognized by third parties.

Get Clarifications on Quitclaim Deed

-

What is a Quitclaim Deed?

-

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike other types of deeds, a quitclaim deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the grantor may have in the property, if any.

-

When should I use a Quitclaim Deed?

-

Quitclaim Deeds are often used in specific situations, including:

- Transferring property between family members, such as in a divorce or inheritance.

- Clearing up title issues when a property owner wants to relinquish their claim.

- Transferring property into or out of a trust.

-

What are the advantages of a Quitclaim Deed?

-

There are several advantages to using a Quitclaim Deed:

- It is typically a straightforward and quick process.

- It requires less documentation than other types of deeds.

- It can be a cost-effective way to transfer property without the need for a title search.

-

Are there any disadvantages to using a Quitclaim Deed?

-

While Quitclaim Deeds can be useful, they do have disadvantages:

- They do not provide any warranty or guarantee regarding the title.

- They may lead to disputes if the grantor does not actually own the property.

- They may not be suitable for transferring property in a sale or purchase situation.

-

Do I need a lawyer to prepare a Quitclaim Deed?

-

While it is not legally required to have a lawyer prepare a Quitclaim Deed, it is often advisable. A lawyer can help ensure that the deed is properly executed and recorded, reducing the risk of future disputes. Additionally, they can provide guidance on the implications of the transfer.

-

How do I complete a Quitclaim Deed?

-

Completing a Quitclaim Deed involves several steps:

- Identify the parties involved: the grantor (the person giving up their interest) and the grantee (the person receiving the interest).

- Provide a description of the property being transferred, including its legal description.

- Sign the deed in the presence of a notary public.

- Record the deed with the appropriate local government office, usually the county recorder's office.

-

Is a Quitclaim Deed the same as a Warranty Deed?

-

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed offers guarantees about the title, assuring the grantee that the grantor holds clear title and has the right to sell the property. In contrast, a Quitclaim Deed makes no such promises and simply transfers whatever interest the grantor may have.

-

Can I revoke a Quitclaim Deed once it is executed?

-

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked. The transfer of ownership is considered final. If you need to regain ownership, you may have to pursue legal action or negotiate a new agreement with the current owner.

-

What should I do if I have more questions about Quitclaim Deeds?

-

If you have additional questions about Quitclaim Deeds, consider consulting with a qualified attorney. They can provide personalized advice based on your specific situation and help you navigate the complexities of property transfers.