Valid Promissory Note for a Car Document

Consider More Types of Promissory Note for a Car Documents

How to Get Out of a Promissory Note - The Release of Promissory Note form represents a critical step in financial accountability.

Using a New Jersey Promissory Note form is crucial for establishing clear expectations and responsibilities in lending agreements. It ensures that both the borrower and lender understand the specific terms of the loan, including the amount borrowed, interest rates, and repayment timelines. For those looking to customize their agreements, resources like newjerseyformspdf.com/editable-promissory-note provide valuable templates and examples to help guide the process.

Misconceptions

Understanding the Promissory Note for a Car form is essential for both buyers and sellers. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- It's just a receipt for payment. Many believe that a promissory note is merely a receipt. In reality, it is a legally binding document that outlines the borrower's promise to repay a loan.

- It only benefits the lender. Some think that the note is only advantageous for the lender. However, it also protects the borrower by clearly stating the terms of the loan.

- All promissory notes are the same. Not all promissory notes are identical. The terms can vary widely based on the agreement between the parties involved.

- It doesn't need to be in writing. Some people assume a verbal agreement is sufficient. A written promissory note is crucial for legal enforceability.

- Once signed, it can't be changed. Many believe that a signed note is set in stone. Modifications can be made, but they must be documented and agreed upon by both parties.

- It guarantees loan approval. A promissory note does not guarantee that a loan will be approved. It simply outlines the terms if the loan is granted.

By clarifying these misconceptions, individuals can navigate the process of creating and signing a promissory note with greater confidence.

Documents used along the form

When entering into a financing agreement for a car, several important documents often accompany the Promissory Note. Each of these documents serves a specific purpose in the transaction, ensuring that both parties understand their rights and responsibilities. Below is a list of commonly used forms and documents that may be required.

- Purchase Agreement: This document outlines the terms of the sale between the buyer and seller, including the vehicle's price, condition, and any warranties or guarantees.

- Title Transfer Document: This form is essential for transferring ownership of the vehicle from the seller to the buyer. It includes details about the vehicle and must be signed by both parties.

- Bill of Sale: A bill of sale serves as a receipt for the transaction, confirming that the buyer has purchased the vehicle. It typically includes the sale date, purchase price, and vehicle information.

- Loan Application: If financing is involved, a loan application is necessary. This form collects personal and financial information to help the lender assess the buyer's creditworthiness.

- Credit Report Authorization: This document allows the lender to check the buyer's credit history. It is crucial for determining the terms of the loan, including interest rates and repayment options.

- Promissory Note: This critical document outlines the borrower's commitment to repay the car loan and lays out the terms of repayment, including interest rates and deadlines. For a proper template, you can refer to NY PDF Forms.

- Insurance Verification: Most lenders require proof of insurance before finalizing the loan. This document confirms that the buyer has adequate coverage for the vehicle.

- Payment Schedule: A payment schedule outlines the repayment terms, including the amount due, frequency of payments, and total duration of the loan. This helps the buyer understand their financial obligations.

- Security Agreement: This document grants the lender a security interest in the vehicle, meaning they can repossess it if the borrower fails to make payments as agreed.

Understanding these documents is crucial for anyone involved in buying or financing a vehicle. Each form plays a vital role in ensuring a smooth transaction and protecting the interests of both the buyer and the lender.

Steps to Filling Out Promissory Note for a Car

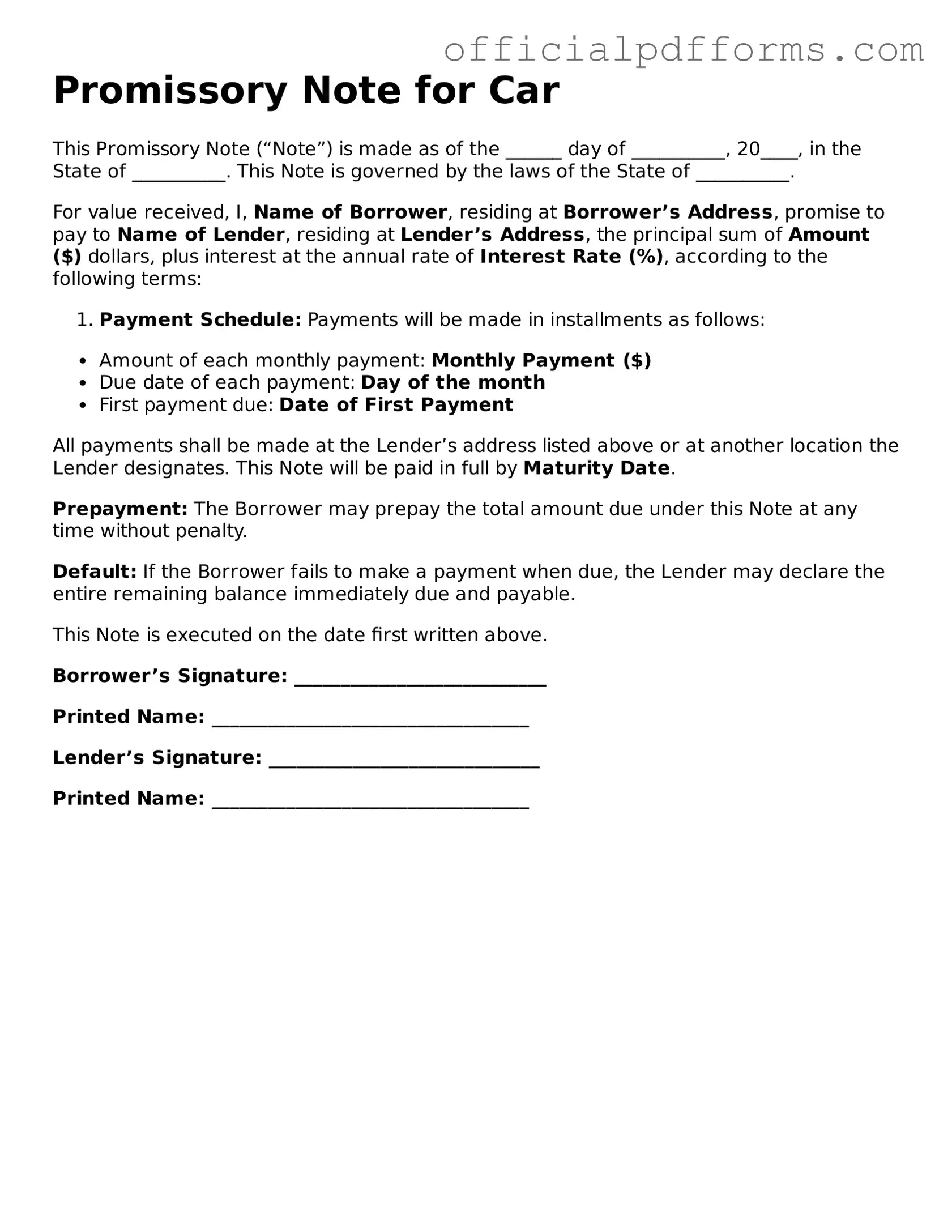

Once you have gathered all necessary information, you are ready to fill out the Promissory Note for a Car form. This form is essential for documenting the loan agreement between the borrower and the lender. It outlines the terms of repayment and ensures both parties understand their obligations.

- Obtain the form: Download the Promissory Note for a Car form from a reliable source or request a physical copy from your lender.

- Fill in the date: Write the date when the agreement is being made at the top of the form.

- Enter borrower information: Provide the full name, address, and contact information of the borrower. Ensure that all details are accurate.

- Enter lender information: Fill in the lender's full name, address, and contact information. This could be an individual or a financial institution.

- Specify the loan amount: Clearly state the total amount being borrowed for the car purchase.

- Detail repayment terms: Indicate the repayment schedule, including the frequency of payments (e.g., monthly) and the due date for each payment.

- Include interest rate: If applicable, specify the interest rate for the loan. Be clear whether it is fixed or variable.

- State any late fees: Mention any fees that will be charged if a payment is made after the due date.

- Sign the document: Both the borrower and the lender should sign and date the form to indicate their agreement to the terms outlined.

- Make copies: After signing, make copies of the completed form for both parties’ records.

With the form completed and signed, both parties should keep their copies in a safe place. This document will serve as a reference throughout the duration of the loan, ensuring clarity and accountability.

Common mistakes

-

Inaccurate Personal Information: Many individuals fail to provide correct details such as their full name, address, or contact number. This can lead to confusion or issues in communication.

-

Missing Loan Amount: Some people neglect to specify the exact amount being borrowed. This omission can create disputes later on regarding the terms of repayment.

-

Incorrect Interest Rate: It is common for individuals to either miscalculate or misunderstand the interest rate. An inaccurate rate can lead to unexpected financial burdens.

-

Failure to Include Payment Schedule: Not outlining a clear payment schedule is a frequent mistake. Without this, both parties may have different expectations about when payments are due.

-

Neglecting Signatures: Some individuals forget to sign the document, or they may not have all necessary parties sign it. This can render the note unenforceable.

-

Not Keeping a Copy: After filling out the form, failing to keep a copy for personal records is a common oversight. This can make it difficult to reference the agreement in the future.

Get Clarifications on Promissory Note for a Car

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document in which one party promises to pay a specific amount of money to another party. This note outlines the terms of the loan for purchasing a vehicle. It includes details such as the loan amount, interest rate, payment schedule, and consequences for failing to repay the loan.

Who needs a Promissory Note for a Car?

If you are borrowing money to buy a car or if you are lending money for someone to buy a car, you should use a Promissory Note. This document protects both the borrower and the lender by clearly stating the terms of the agreement.

What information is included in a Promissory Note for a Car?

A typical Promissory Note for a Car includes:

- The names and addresses of the borrower and lender

- The amount of the loan

- The interest rate

- The repayment schedule (monthly, bi-weekly, etc.)

- The due date for each payment

- Consequences of late payments or default

- Signatures of both parties

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document. Once signed, both parties are obligated to follow the terms outlined in the note. If either party fails to comply, the other party may take legal action to enforce the agreement.

Can I modify a Promissory Note after it has been signed?

Yes, modifications can be made, but both parties must agree to the changes. It’s best to document any modifications in writing and have both parties sign the updated note to avoid confusion in the future.

What happens if I default on my Promissory Note?

If you default on your Promissory Note, the lender may take several actions. They could charge late fees, report the default to credit agencies, or pursue legal action to recover the owed amount. It’s important to communicate with the lender if you are having trouble making payments.

Do I need a lawyer to create a Promissory Note for a Car?

No, you do not need a lawyer to create a Promissory Note. However, it is wise to consult with one if you have specific concerns or complex terms. Many templates are available online that can help you draft a simple note without legal assistance.

Can I use a Promissory Note for other types of loans?

Absolutely! A Promissory Note can be used for various types of loans, not just for cars. Whether it’s for personal loans, student loans, or business loans, the structure remains similar. Just ensure that all relevant terms are included.

Where can I find a template for a Promissory Note for a Car?

Templates for Promissory Notes can be found online through legal websites, document preparation services, or even local office supply stores. Make sure to choose a template that complies with your state’s laws and meets your specific needs.