Valid Promissory Note Document

Promissory Note Forms for Individual US States

Promissory Note Document Subtypes

Fill out Popular Documents

Dd Form 2870 Army Pubs - DD 2870 supports transparency in the handling of medical information.

4 Point Inspection Form - Hazards or deficiencies identified during the inspection must be noted in the report.

The importance of a Rental Application form cannot be overstated, as it serves as a vital tool for landlords to assess the suitability of potential tenants. This document not only collects essential information about an applicant's background, employment, and rental history, but it also assists in minimizing risks associated with leasing properties. For those looking to streamline the rental process, resources such as OnlineLawDocs.com can provide valuable information and assistance in creating these forms effectively.

Florida Association of Realtors Lease Agreement - Obligations under this lease must be adhered to by all parties.

Misconceptions

Misconceptions about the Promissory Note form can lead to misunderstandings about its purpose and use. Here are six common misconceptions:

-

All promissory notes must be notarized.

While notarization can add an extra layer of authenticity, it is not a legal requirement for a promissory note to be valid. The key elements are the agreement between parties and the clear terms outlined in the document.

-

Promissory notes are only used for loans.

Although they are commonly associated with loans, promissory notes can also be used in various transactions, including the sale of goods or services where payment is deferred.

-

Promissory notes are the same as contracts.

While both are legal documents, a promissory note specifically focuses on the promise to pay a certain amount, whereas a contract can encompass a broader range of obligations and agreements between parties.

-

Only financial institutions can issue promissory notes.

Individuals and businesses can create and issue promissory notes. Any party wishing to formalize a promise to pay can utilize this document.

-

Promissory notes do not require interest.

While some promissory notes may be interest-free, many include an interest rate. The terms of the note dictate whether interest is applicable and at what rate.

-

Once signed, a promissory note cannot be modified.

Promissory notes can be modified if both parties agree to the changes. It is advisable to document any modifications in writing to avoid disputes in the future.

Documents used along the form

When entering into a financial agreement, a Promissory Note serves as a fundamental document outlining the terms of a loan. However, it often works in conjunction with other important forms and documents that help clarify the relationship between the parties involved and provide additional legal protections. Below are four common documents that are frequently used alongside a Promissory Note.

- Loan Agreement: This document provides a comprehensive outline of the loan terms, including interest rates, repayment schedules, and any collateral involved. It serves as a detailed contract that goes beyond the basic terms of the Promissory Note.

- Security Agreement: When a loan is secured by collateral, a Security Agreement is essential. This document specifies the assets being used as security for the loan, detailing the lender’s rights in case of default.

- Guaranty Agreement: In situations where a third party agrees to take responsibility for the loan if the borrower defaults, a Guaranty Agreement is utilized. This document outlines the obligations of the guarantor and provides additional assurance to the lender.

- Vehicle Purchase Agreement: Essential for any vehicle transaction in California, this document can be found at https://toptemplates.info/ and outlines the terms agreed upon by both parties, ensuring clarity in the purchase process.

- Disclosure Statement: This document is often required by law and includes important information about the loan, such as total costs, fees, and the annual percentage rate (APR). It ensures that borrowers are fully informed before signing the Promissory Note.

Understanding these related documents can enhance your grasp of the financial agreement process. Each plays a crucial role in protecting both lenders and borrowers, ensuring clarity and security in financial transactions.

Steps to Filling Out Promissory Note

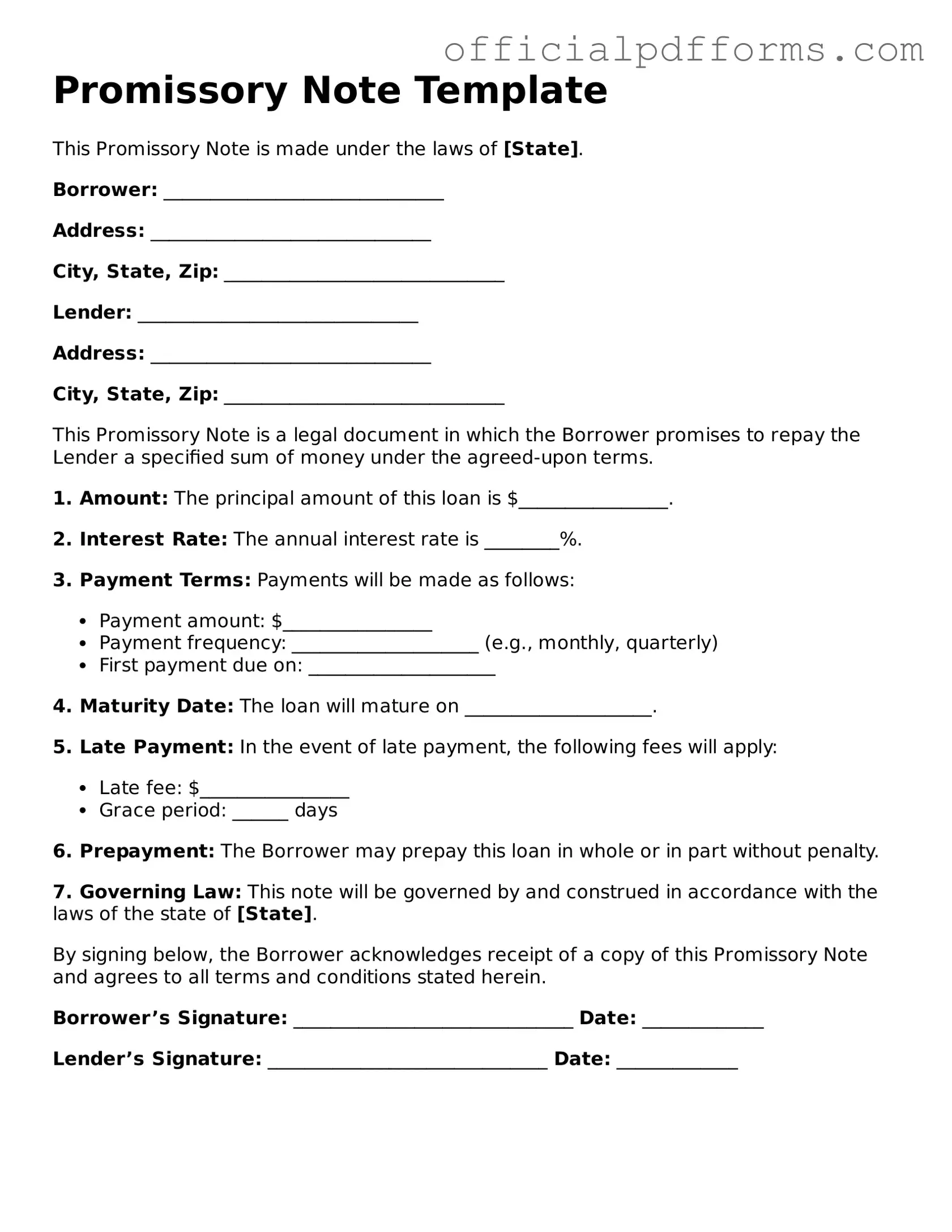

Once you have the Promissory Note form in front of you, it’s time to fill it out carefully. Each section requires accurate information to ensure clarity and enforceability. Follow these steps to complete the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- In the first blank, write the name of the borrower. This should be the full legal name.

- Next, enter the address of the borrower. Include the street address, city, state, and ZIP code.

- In the following section, write the name of the lender. Again, use the full legal name.

- Enter the lender’s address, including street, city, state, and ZIP code.

- Specify the principal amount of the loan in the designated space. This is the total amount borrowed.

- Indicate the interest rate, if applicable. This should be expressed as a percentage.

- Fill in the repayment terms. Clearly state the duration of the loan and the payment schedule (e.g., monthly, quarterly).

- In the next section, outline any late fees or penalties for missed payments.

- Finally, both the borrower and lender should sign and date the form at the bottom.

After completing the form, ensure that both parties retain a copy for their records. This will provide a reference for the terms agreed upon and help prevent any misunderstandings in the future.

Common mistakes

-

Failing to include the correct date. It's essential to write the date clearly to avoid confusion about when the agreement takes effect.

-

Not specifying the loan amount. Make sure to write the exact amount being borrowed in both numbers and words for clarity.

-

Omitting the interest rate. Clearly state the interest rate, if applicable. This prevents misunderstandings later on.

-

Ignoring payment terms. Specify how and when payments should be made. This includes due dates and acceptable payment methods.

-

Neglecting to sign the document. Both the borrower and lender must sign the note. Without signatures, the agreement is not enforceable.

-

Not providing borrower information. Include the full name and address of the borrower. This ensures proper identification.

-

Using vague language. Be clear and specific about the terms of the loan. Ambiguities can lead to disputes down the line.

-

Forgetting to include a default clause. Outline what happens if payments are missed. This protects both parties in case of non-payment.

Get Clarifications on Promissory Note

What is a Promissory Note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document that outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payment. This document is crucial for both lenders and borrowers, as it provides clarity and protects the rights of both parties involved in the transaction.

Who can use a Promissory Note?

Anyone can use a promissory note, whether they are individuals, businesses, or organizations. Common scenarios include:

- Personal loans between friends or family members.

- Business loans for startup funding or operational expenses.

- Real estate transactions where buyers need financing.

Regardless of the situation, it’s important for both parties to understand the terms laid out in the note to avoid any misunderstandings later on.

What should be included in a Promissory Note?

A well-drafted promissory note should include several key components to ensure its effectiveness:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the borrowed amount.

- Repayment Schedule: Specific dates or intervals when payments are due.

- Borrower and Lender Information: Names and contact details of both parties.

- Default Terms: Consequences if the borrower fails to make payments on time.

Including these elements helps to prevent disputes and ensures that both parties are on the same page regarding their financial obligations.

Is a Promissory Note legally binding?

Yes, a promissory note is legally binding as long as it meets certain criteria. For it to be enforceable, it must be signed by the borrower, clearly state the terms of the loan, and be executed voluntarily by both parties. While it is not necessary to have the document notarized, doing so can provide additional legal protection. If a borrower fails to repay the loan as agreed, the lender can use the promissory note as evidence in court to seek repayment.