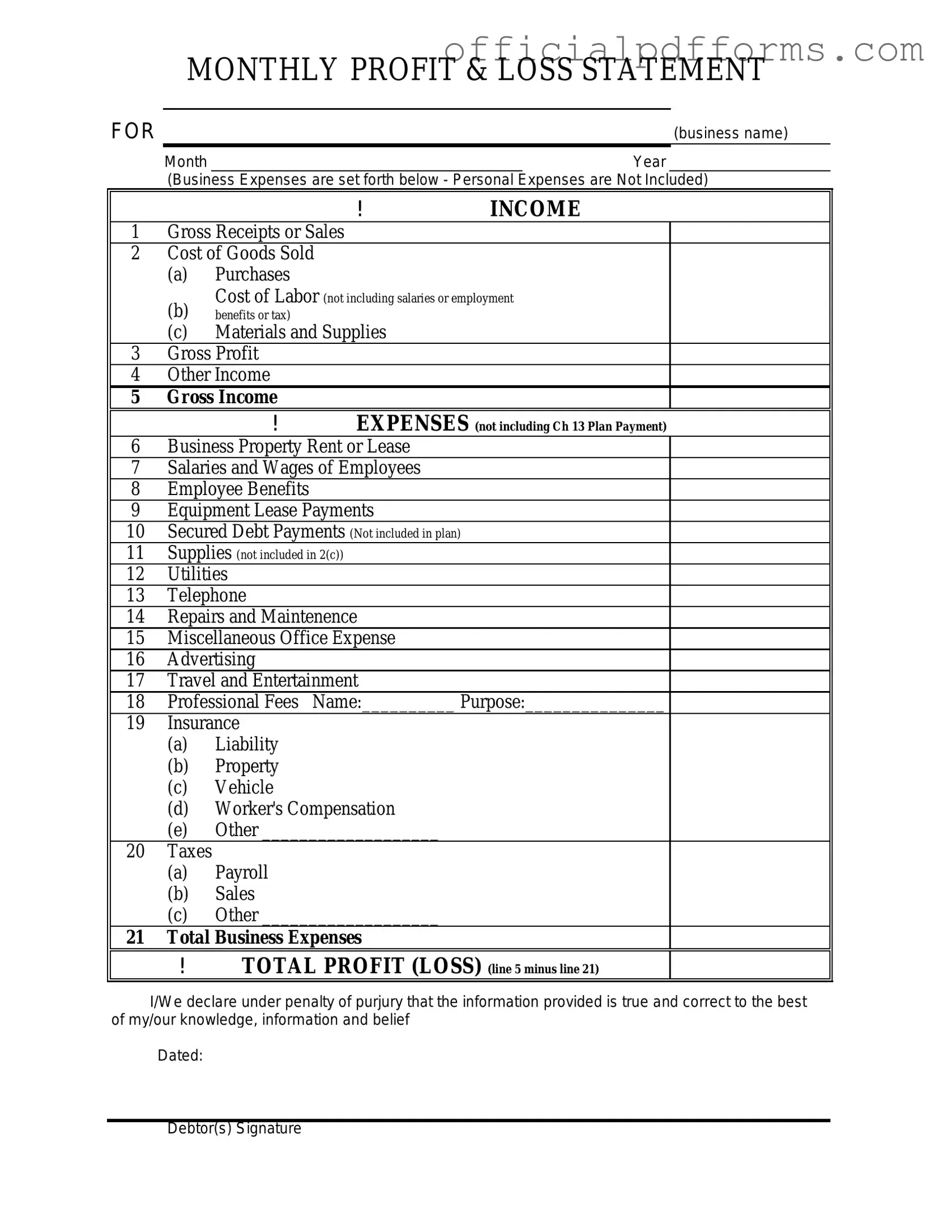

Fill in a Valid Profit And Loss Form

Common PDF Forms

Share Transfer Form Companies House - Ensure proper completion of the form to avoid future regulatory issues.

Da - It is vital to get signatures to confirm receipt and responsibility for items.

The Arizona ATV Bill of Sale form is an essential tool for anyone looking to buy or sell an all-terrain vehicle in the state. By officially documenting the transaction, this form helps safeguard the rights of both parties and aids in the registration process with local authorities. For those seeking to create or obtain this vital document, Legal PDF Documents offers a reliable template that ensures all necessary information is accurately recorded, making the process efficient and straightforward.

4 Point Inspection Form - No applications should include properties with non-functional electrical, heating, or plumbing systems.

Misconceptions

The Profit and Loss form, often referred to as the P&L statement, is a vital tool for businesses. However, several misconceptions can lead to misunderstandings about its purpose and function. Here are six common misconceptions:

- The P&L only shows profits. Many people think that the Profit and Loss form solely focuses on profits. In reality, it details both revenues and expenses, providing a comprehensive view of a company's financial performance over a specific period.

- It is only for large companies. Some believe that only large corporations need a P&L statement. However, all businesses, regardless of size, can benefit from this document. Small businesses, freelancers, and startups also use P&L statements to track their financial health.

- It is the same as a balance sheet. A common misunderstanding is that the P&L statement and balance sheet are interchangeable. While both are essential financial documents, the P&L focuses on income and expenses over time, while the balance sheet provides a snapshot of assets, liabilities, and equity at a specific moment.

- Only accountants can create a P&L statement. Some people think that only trained accountants can prepare a Profit and Loss form. In truth, anyone with a basic understanding of their business's finances can create one. Various software tools simplify this process.

- The P&L statement is not important for decision-making. Many underestimate the value of a P&L statement in decision-making. This form is crucial for evaluating profitability, identifying trends, and making informed business decisions.

- It reflects cash flow. Some assume that the P&L statement provides a clear picture of cash flow. However, it records revenues and expenses on an accrual basis, meaning it does not account for cash transactions that may occur outside the reporting period.

Understanding these misconceptions can help individuals and businesses utilize the Profit and Loss form more effectively, leading to better financial management and decision-making.

Documents used along the form

The Profit and Loss form is a vital tool for assessing a business's financial performance over a specific period. However, it often works in conjunction with several other important documents that provide a more comprehensive view of a company's financial health. Here are four commonly used forms and documents that complement the Profit and Loss form.

- Balance Sheet: This document provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It helps stakeholders understand what the business owns and owes, giving insight into its financial stability.

- Motor Vehicle Bill of Sale: Essential for documenting the sale of a vehicle in Arizona, you can access the Motor Vehicle Bill of Sale form to ensure all legal details are properly recorded.

- Cash Flow Statement: This statement tracks the flow of cash in and out of a business over a period. It highlights how well a company generates cash to fund its operations and pay its debts, making it essential for assessing liquidity.

- Statement of Retained Earnings: This document outlines the changes in retained earnings over a specific period. It shows how much profit is reinvested in the business rather than distributed to shareholders, reflecting the company's growth strategy.

- Budget: A budget is a financial plan that estimates future income and expenses. It serves as a benchmark for measuring actual performance against projected figures, helping businesses manage their finances effectively.

Understanding these documents alongside the Profit and Loss form can provide a clearer picture of a company's overall financial status. Together, they help business owners, investors, and stakeholders make informed decisions.

Steps to Filling Out Profit And Loss

Filling out the Profit and Loss form is an essential step in tracking your business’s financial performance. By accurately completing this form, you can gain insights into your income, expenses, and overall profitability. Here’s how to fill it out step by step.

- Gather Financial Records: Collect all relevant financial documents, including sales records, receipts, and invoices for the period you are reporting.

- Enter Revenue: Start by listing all sources of income. Include sales revenue, service income, and any other earnings.

- Calculate Total Revenue: Add up all income sources to find your total revenue. This figure will be used in further calculations.

- List Expenses: Write down all business expenses. This includes costs such as rent, utilities, salaries, and supplies.

- Calculate Total Expenses: Sum all the expenses to determine your total expenses for the period.

- Determine Net Profit or Loss: Subtract the total expenses from the total revenue. This will show whether you made a profit or incurred a loss.

- Review and Double-Check: Go through all entries to ensure accuracy. Verify that all figures are correct and that nothing is missing.

- Submit the Form: Once everything is complete and verified, submit the form to the appropriate parties, whether that’s for tax purposes or internal review.

Common mistakes

-

Failing to include all income sources. Many individuals overlook additional income streams, which can lead to an inaccurate representation of financial performance.

-

Neglecting to categorize expenses correctly. Misclassifying expenses can distort profit margins and mislead financial analysis.

-

Not updating the form regularly. Financial situations change, and failing to keep the Profit and Loss form current can result in outdated information.

-

Using estimates instead of actual figures. Relying on approximations can lead to significant discrepancies in financial reporting.

-

Ignoring non-operating income and expenses. These items can impact overall profitability and should be included for a complete picture.

-

Overlooking the importance of supporting documentation. Without receipts or invoices, it becomes challenging to verify the accuracy of reported figures.

-

Failing to review the form for errors. Simple mistakes in calculations or data entry can lead to incorrect conclusions about financial health.

Get Clarifications on Profit And Loss

What is a Profit and Loss form?

A Profit and Loss form, often referred to as a P&L statement, is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. It helps businesses understand their financial performance by showing whether they made a profit or incurred a loss. This form is essential for assessing the overall health of a business and is commonly used by owners, investors, and accountants.

Why is the Profit and Loss form important?

The Profit and Loss form is crucial for several reasons:

- It provides a clear overview of income and expenses.

- It helps in tracking financial performance over time.

- It aids in budgeting and forecasting future financial performance.

- It is often required by lenders and investors when seeking funding.

How often should a Profit and Loss form be completed?

The frequency of completing a Profit and Loss form can vary based on the needs of the business. Many businesses prepare this statement monthly, quarterly, or annually. Monthly reports can provide a more detailed view of trends and allow for timely adjustments. Quarterly and annual reports, on the other hand, are often used for broader assessments and tax purposes.

What are the main components of a Profit and Loss form?

A typical Profit and Loss form includes the following key components:

- Revenue: This is the total income generated from sales or services.

- Cost of Goods Sold (COGS): These are the direct costs associated with producing goods or services sold.

- Gross Profit: This is calculated by subtracting COGS from revenue.

- Operating Expenses: These include costs not directly tied to production, such as rent, utilities, and salaries.

- Net Profit or Loss: This is the final figure, calculated by subtracting total expenses from gross profit.

How can I use the Profit and Loss form to improve my business?

Using the Profit and Loss form effectively can lead to better business decisions. Here are a few ways to leverage this document:

- Identify trends in revenue and expenses to make informed adjustments.

- Pinpoint areas where costs can be reduced without sacrificing quality.

- Set realistic financial goals based on historical performance.

- Communicate financial health to stakeholders, including investors and lenders.