Valid Prenuptial Agreement Document

Prenuptial Agreement Forms for Individual US States

Fill out Popular Documents

Employee Handbook Templates - Policies regarding remote work and flexible scheduling options.

Affidavit of Identity - It is important to provide accurate information in the Affidavit to avoid legal issues.

Utilizing a Free And Invoice PDF form can significantly streamline your business operations; for more information on how to create these essential documents, visit https://smarttemplates.net/fillable-free-and-invoice-pdf/, where you can access user-friendly templates that will help you maintain meticulous records of your transactions.

Cash Reciept - Reliable documentation for cash income verification.

Misconceptions

Prenuptial agreements, often referred to as "prenups," are legal contracts made by couples before marriage. Despite their growing popularity, several misconceptions surround these agreements. Here are seven common misunderstandings:

- Prenups are only for the wealthy. Many believe that only rich individuals need a prenup. In reality, anyone can benefit from a prenup, regardless of their financial status. It can help clarify financial responsibilities and protect personal assets.

- Prenups are unromantic. Some people think discussing a prenup is a sign of distrust. However, having a prenup can foster open communication about finances, which is essential for a healthy relationship.

- Prenups are only about money. While financial matters are a significant aspect, prenups can also address other issues, such as debt management and property division. They can cover a wide range of topics relevant to the couple's future.

- Prenups are not enforceable. Many assume that prenups hold no legal weight. In fact, when properly drafted and executed, these agreements are enforceable in court, provided they meet certain legal requirements.

- Prenups can prevent a fair divorce settlement. Some worry that a prenup will lead to unfair outcomes in a divorce. However, a well-crafted prenup can ensure that both parties feel secure and that the terms are fair and reasonable.

- Prenups are only for first marriages. This misconception suggests that only first-time couples need prenups. In truth, individuals entering second or subsequent marriages may want to protect their assets and ensure their children from previous relationships are considered.

- Prenups are permanent. Many believe that once a prenup is signed, it cannot be changed. However, couples can modify or revoke a prenup at any time, as long as both parties agree and follow the proper legal procedures.

Understanding these misconceptions can help individuals make informed decisions about prenuptial agreements and approach the topic with clarity and confidence.

Documents used along the form

A prenuptial agreement is an important legal document that outlines the financial and property arrangements between two individuals before they marry. While the prenuptial agreement itself is crucial, there are other forms and documents that often accompany it to ensure a comprehensive understanding of the couple's financial situation and legal obligations. Below is a list of related documents that may be used in conjunction with a prenuptial agreement.

- Financial Disclosure Statement: This document details the assets, debts, income, and expenses of each party. It provides transparency and helps both individuals make informed decisions regarding their financial arrangements.

- Release of Liability: This legal document ensures that one party agrees not to hold another party responsible for any risks, injuries, or losses that may occur during an event. It is important for those involved in activities with inherent risks to acknowledge and accept potential dangers, as outlined by OnlineLawDocs.com.

- Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement is created after marriage. It can address changes in circumstances or clarify financial arrangements that were not covered in the prenuptial agreement.

- Separation Agreement: This document outlines the terms of separation between spouses, including asset division, child custody, and support arrangements. It is often used when a couple decides to live apart but is not yet divorced.

- Will: A will specifies how an individual's assets will be distributed upon their death. Having a will can complement a prenuptial agreement by ensuring that both parties' wishes regarding property distribution are clearly articulated.

These documents, when used alongside a prenuptial agreement, help clarify the financial and legal landscape for both parties. They can provide peace of mind and foster open communication, ensuring that both individuals are on the same page as they embark on their marital journey.

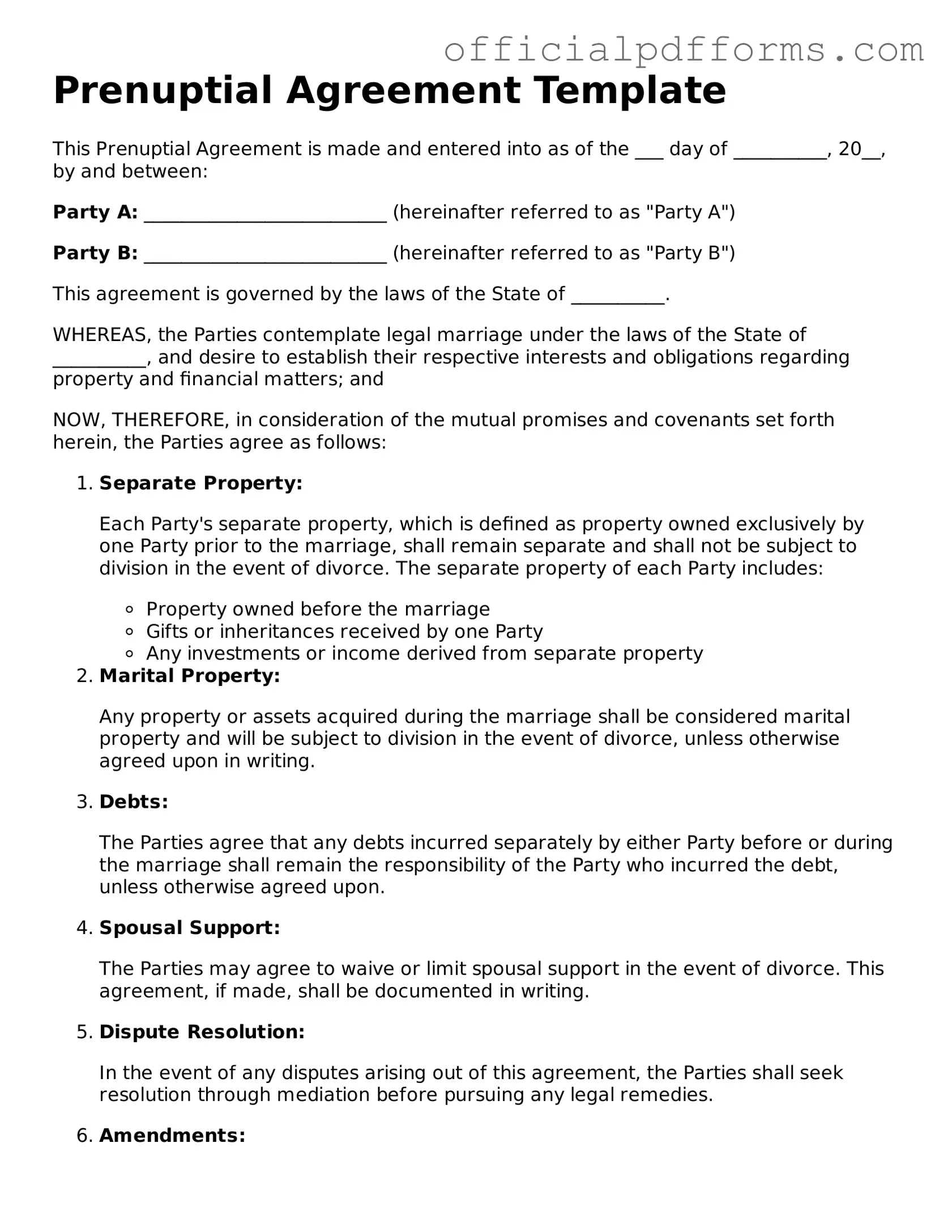

Steps to Filling Out Prenuptial Agreement

Completing a Prenuptial Agreement form requires careful attention to detail. This document will guide you through the necessary steps to ensure that all required information is accurately captured. Follow these instructions closely to avoid any potential issues.

- Begin by entering the full legal names of both parties at the top of the form.

- Provide the current addresses for both individuals. Ensure that the addresses are complete and up-to-date.

- Specify the date of the intended marriage. This should be the date when the couple plans to wed.

- Outline the assets and debts of each party. List all property, bank accounts, investments, and any liabilities.

- Detail how the assets and debts will be managed during the marriage. Clearly state any agreements on ownership and division.

- Include any provisions for spousal support or alimony in case of divorce. Specify the terms clearly to avoid misunderstandings.

- Both parties should review the completed form thoroughly. Make sure all information is accurate and reflects both parties' intentions.

- Sign and date the document in the presence of a notary public. This step is crucial for the agreement to be legally binding.

After completing the form, it is advisable to keep copies for both parties. Consulting with a legal professional can provide additional guidance and ensure that the agreement meets all legal requirements.

Common mistakes

-

Not Disclosing All Assets: One of the most critical mistakes is failing to fully disclose all assets. Transparency is essential in a prenuptial agreement. If one party hides assets, it can lead to legal disputes in the future.

-

Using Ambiguous Language: Vague terms can create confusion. It's important to use clear and precise language to avoid misunderstandings. Each clause should be straightforward and easily understood.

-

Failing to Consider Future Changes: Life circumstances change. Not accounting for potential future events, such as children or changes in income, can render the agreement ineffective over time.

-

Not Seeking Legal Advice: Many individuals attempt to draft a prenuptial agreement without professional help. This can lead to significant oversights. Consulting with a lawyer ensures that the agreement is legally sound and fair.

-

Ignoring State Laws: Each state has different laws regarding prenuptial agreements. Failing to adhere to these regulations can invalidate the agreement. It's crucial to understand the legal requirements in your state.

-

Not Reviewing the Agreement Together: Both parties should review the agreement together. This promotes understanding and agreement on all terms. Lack of communication can lead to resentment and disputes later on.

-

Signing Under Pressure: Signing a prenuptial agreement under duress can lead to challenges in its enforceability. Each party should feel comfortable and confident in the terms before signing.

Get Clarifications on Prenuptial Agreement

What is a prenuptial agreement?

A prenuptial agreement, often referred to as a "prenup," is a legal document created by two individuals before they get married. This agreement outlines how assets and debts will be divided in the event of a divorce or separation. It can also address other financial matters, such as spousal support. By establishing these terms upfront, couples can protect their individual interests and clarify expectations regarding finances during the marriage.

Who should consider a prenuptial agreement?

While any couple can benefit from a prenuptial agreement, certain situations make it particularly advisable. Consider a prenup if:

- One or both partners have significant assets or debts prior to marriage.

- One partner is a business owner or has a professional practice.

- There are children from previous relationships, and you want to ensure their inheritance is protected.

- There is a substantial difference in income or earning potential between partners.

- You want to establish financial responsibilities during the marriage.

How do we create a prenuptial agreement?

Creating a prenuptial agreement typically involves several key steps:

- Openly discuss your financial situation and goals with your partner.

- Draft the agreement, detailing how assets and debts will be handled.

- Consult with legal professionals to ensure that the agreement complies with state laws.

- Both parties should review the agreement independently with their own legal counsel.

- Sign the agreement in the presence of witnesses or a notary, as required by your state.

It's crucial to approach this process with transparency and honesty to foster trust between partners.

Are prenuptial agreements enforceable in court?

Yes, prenuptial agreements can be enforceable in court, provided they meet certain legal requirements. To increase the likelihood of enforcement, the agreement should be:

- In writing and signed by both parties.

- Entered into voluntarily, without coercion or undue pressure.

- Fair and reasonable at the time of signing.

- Disclosed fully regarding assets and debts.

If these conditions are met, courts are generally inclined to uphold the terms of the agreement during divorce proceedings.

Can a prenuptial agreement be changed after marriage?

Yes, a prenuptial agreement can be modified after marriage, but both parties must agree to the changes. This is often done through a postnuptial agreement, which serves a similar purpose as a prenup but is created after the marriage has taken place. Just like a prenup, a postnuptial agreement should be in writing, signed by both spouses, and ideally reviewed by legal counsel to ensure its enforceability.