Valid Power of Attorney Document

Power of Attorney Forms for Individual US States

Power of Attorney Document Subtypes

Fill out Popular Documents

California Boat Bill of Sale - The form is crucial whether selling a new or used boat.

In addition to understanding the significance of a Bill of Sale, it is also beneficial to have access to resources that can help streamline the process, such as Free Business Forms, which provides various templates and guides for creating these essential documents efficiently.

How to Draft an Mou - Can strengthen partnerships and improve outcomes.

Player Evaluation Form Basketball - Assess penetration ability to score effectively at the rim.

Misconceptions

Understanding the Power of Attorney (POA) form is crucial for effective legal and financial planning. However, several misconceptions can lead to confusion. Here are six common misconceptions about the Power of Attorney form:

- It only applies to financial matters. Many people believe that a POA is solely for financial decisions. In reality, a POA can also cover medical decisions, allowing someone to make healthcare choices on behalf of another person.

- It is permanent and cannot be revoked. Some individuals think that once a POA is established, it cannot be changed or revoked. In fact, a principal can revoke a POA at any time, as long as they are mentally competent to do so.

- Only lawyers can create a Power of Attorney. There is a misconception that only legal professionals can draft a POA. However, individuals can create a POA using templates or forms available online, as long as they comply with state laws.

- A Power of Attorney gives unlimited power. Many assume that a POA grants the agent unlimited authority. In reality, the principal can specify the powers granted, limiting the agent's authority to specific actions or decisions.

- Once signed, a Power of Attorney is effective immediately. It is often believed that a POA takes effect as soon as it is signed. However, a principal can choose to make it effective only upon a certain event, such as incapacitation.

- A Power of Attorney is the same as a living will. Some people confuse a POA with a living will. While both documents address healthcare decisions, a POA appoints someone to make decisions, whereas a living will outlines specific wishes regarding medical treatment.

By clarifying these misconceptions, individuals can better understand the Power of Attorney form and its implications for their personal and financial affairs.

Documents used along the form

A Power of Attorney (POA) is a significant legal document that allows one person to act on behalf of another in legal or financial matters. However, several other forms and documents may complement the POA to ensure comprehensive management of affairs. Below is a list of commonly used documents that often accompany a Power of Attorney.

- Advance Healthcare Directive: This document outlines a person's preferences for medical treatment in the event they become unable to communicate their wishes. It can include specific instructions regarding life-sustaining treatments and appoints a healthcare proxy to make decisions on the individual's behalf.

- Bill of Sale for ATVs: Essential for documenting the transfer of ownership, the Bill of Sale for ATVs serves as proof of purchase, protecting both buyers and sellers during the transaction process.

- Living Will: A living will is a type of advance directive that specifically addresses end-of-life care. It details the types of medical interventions a person desires or does not desire, providing guidance to healthcare providers and loved ones during critical moments.

- Durable Power of Attorney: Unlike a standard Power of Attorney, a durable POA remains effective even if the principal becomes incapacitated. This ensures that the designated agent can continue to make decisions on behalf of the principal when they are unable to do so themselves.

- Financial Power of Attorney: This document grants authority specifically for financial matters. It allows the designated agent to manage bank accounts, pay bills, and handle investments, ensuring that financial affairs are taken care of during the principal's absence or incapacity.

- Trust Document: A trust document establishes a legal entity that holds assets for the benefit of a designated beneficiary. It can help manage and distribute assets according to the principal's wishes, often avoiding probate and providing privacy regarding financial matters.

- Will: A will is a legal document that outlines how a person's assets should be distributed after their death. It appoints an executor to carry out the wishes of the deceased and can also designate guardians for minor children.

Each of these documents serves a unique purpose and can work in conjunction with a Power of Attorney to provide a comprehensive plan for managing health care and financial decisions. It is essential to consider these documents carefully to ensure that personal wishes are respected and that appropriate measures are in place for various circumstances.

Steps to Filling Out Power of Attorney

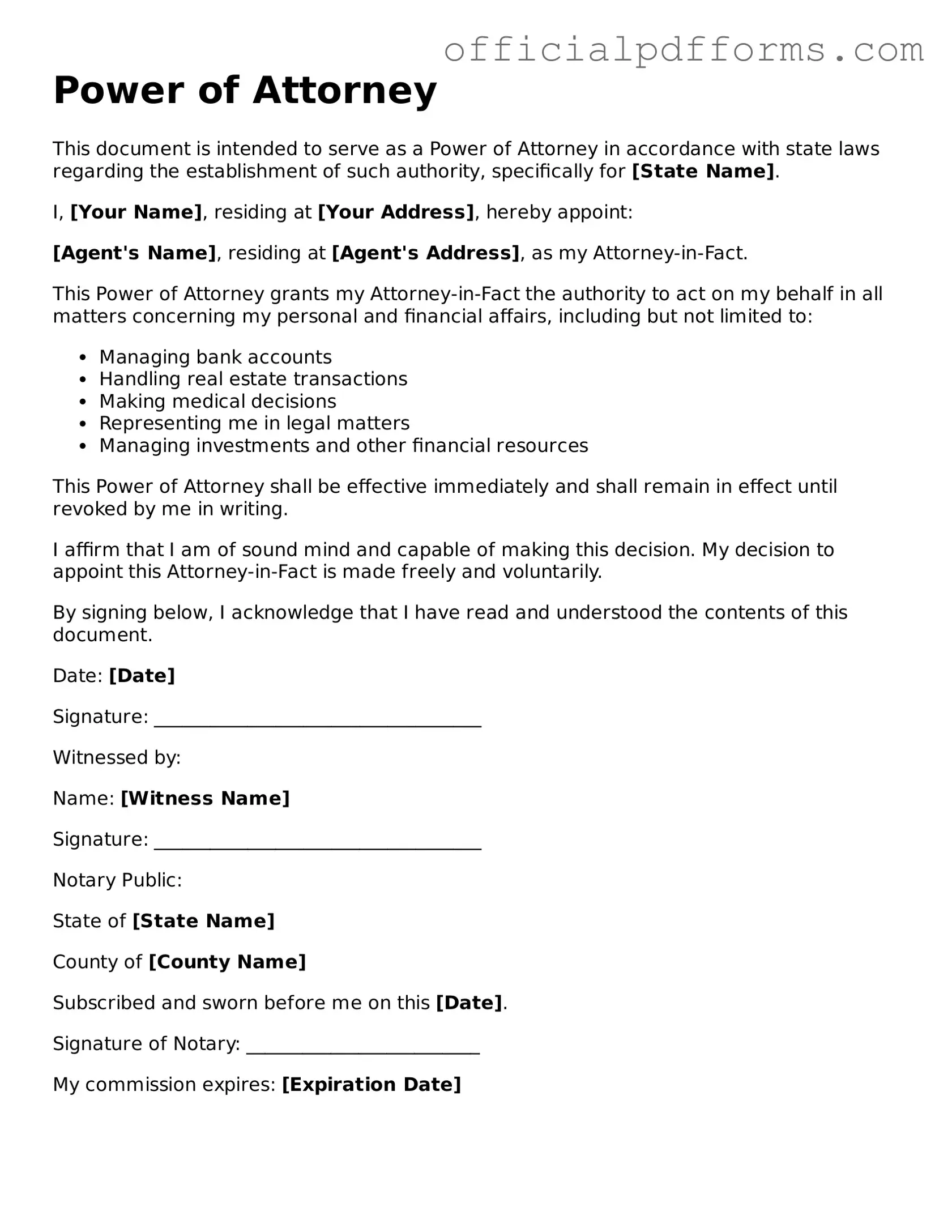

Filling out a Power of Attorney form is an important step in designating someone to make decisions on your behalf. This process requires careful attention to detail to ensure that your wishes are accurately reflected. Once you have completed the form, you will need to sign it in the presence of a notary or witnesses, depending on your state's requirements.

- Obtain the Power of Attorney form. You can find it online or request a copy from a legal professional.

- Read through the entire form to understand the sections and requirements. Familiarize yourself with the terminology used.

- Fill in your personal information in the designated sections. This usually includes your full name, address, and contact information.

- Identify the person you are appointing as your agent. Provide their full name, address, and contact information.

- Specify the powers you are granting to your agent. You may choose to give them broad authority or limit their powers to specific tasks.

- Include any special instructions or limitations you want to impose on the agent's authority.

- Indicate the effective date of the Power of Attorney. You can choose for it to be effective immediately or upon a specific event, such as your incapacitation.

- Review the form for accuracy. Ensure all information is correct and complete.

- Sign the form in the appropriate section. Depending on your state's laws, you may need to do this in front of a notary public or witnesses.

- Make copies of the signed form for your records and provide copies to your agent and any relevant parties.

Common mistakes

-

Not Specifying the Powers Granted: One common mistake is failing to clearly outline the specific powers the agent will have. Vague language can lead to confusion or disputes later on.

-

Choosing the Wrong Agent: Selecting someone who may not act in your best interest can have serious consequences. It’s crucial to choose a trustworthy and reliable individual.

-

Not Signing the Document Properly: The Power of Attorney must be signed according to state requirements. Neglecting to follow these rules can invalidate the document.

-

Failing to Have Witnesses or Notarization: Depending on your state, a Power of Attorney may need to be witnessed or notarized. Omitting this step can render the document ineffective.

-

Overlooking State-Specific Requirements: Each state has its own rules regarding Power of Attorney forms. Ignoring these can lead to complications in the future.

-

Not Updating the Document: Life circumstances change. Failing to update your Power of Attorney when necessary can leave your wishes unfulfilled.

-

Assuming All Agents Have Equal Authority: It’s important to clarify whether multiple agents share authority equally or if one has priority. Misunderstandings can arise without clear instructions.

-

Neglecting to Discuss the Document with the Agent: It’s vital to communicate your wishes and expectations with your chosen agent. A lack of discussion can lead to unintended actions.

Get Clarifications on Power of Attorney

What is a Power of Attorney (POA)?

A Power of Attorney is a legal document that allows one person, known as the principal, to grant another person, called the agent or attorney-in-fact, the authority to make decisions on their behalf. This authority can cover a wide range of matters, including financial transactions, healthcare decisions, and legal affairs. The specific powers granted can be broad or limited, depending on the principal's wishes.

What are the different types of Power of Attorney?

There are several types of Power of Attorney, each serving different purposes:

- General Power of Attorney: This grants the agent broad powers to act on behalf of the principal in various matters, such as financial and legal decisions.

- Durable Power of Attorney: This remains effective even if the principal becomes incapacitated, allowing the agent to continue making decisions.

- Medical Power of Attorney: This specifically authorizes the agent to make healthcare decisions for the principal if they are unable to do so themselves.

- Limited Power of Attorney: This gives the agent authority to act in specific situations or for a limited time, such as handling a real estate transaction.

How do I create a Power of Attorney?

Creating a Power of Attorney involves several steps:

- Determine the type of Power of Attorney you need based on your specific situation.

- Choose a trustworthy agent who understands your wishes and can act in your best interest.

- Complete the Power of Attorney form, ensuring that it clearly outlines the powers granted and any limitations.

- Sign the document in accordance with your state’s requirements, which may include having it notarized or witnessed.

It is advisable to consult with a legal professional to ensure that the document meets all necessary legal standards.

Can I revoke a Power of Attorney?

Yes, a Power of Attorney can be revoked at any time, as long as the principal is mentally competent. To revoke the document, the principal should create a written revocation notice and inform the agent and any relevant third parties, such as banks or healthcare providers. It’s essential to destroy any copies of the original Power of Attorney to prevent confusion.

What happens if I don’t have a Power of Attorney?

If you do not have a Power of Attorney and become unable to make decisions due to incapacity, a court may need to appoint a guardian or conservator to manage your affairs. This process can be lengthy, costly, and may not align with your personal wishes. Having a Power of Attorney in place allows you to choose someone you trust to handle your affairs without court intervention.