Printable Pennsylvania Transfer-on-Death Deed Template

Find Other Popular Transfer-on-Death Deed Templates for Specific States

Does a Beneficiary Deed Avoid Probate - The Transfer-on-Death Deed is an alternative to a living trust for simple property transfers.

The New York Trailer Bill of Sale form is a crucial document that facilitates the transfer of ownership of a trailer from the seller to the buyer. Not only does it serve as proof of purchase, but it is also essential for the registration process in New York. To help you with this process, you can visit OnlineLawDocs.com, which provides valuable resources and guidance to ensure a clear and legal transfer of ownership.

Transfer on Death Deed Form Ohio - Consultation with an estate planning attorney is recommended for best practices.

Transfer on Death Deed Illinois Cost - Allows property owners to maintain control over their property during their lifetime.

How to Gift a House to a Family Member - A simple way to ensure that real estate passes to chosen individuals without complications.

Misconceptions

Understanding the Pennsylvania Transfer-on-Death Deed (TODD) can be challenging, and many misconceptions exist surrounding its use. Here are nine common misunderstandings:

- It requires probate. Many believe that a TODD must go through the probate process. In reality, the property transferred via a TODD bypasses probate, allowing for a smoother transition to beneficiaries.

- It can only be used for residential property. Some think that the TODD is limited to residential real estate. However, this deed can be used for various types of property, including commercial real estate and vacant land.

- All heirs must agree to the deed. There is a misconception that all heirs must consent to a TODD. In fact, the property owner can unilaterally create a TODD without needing approval from other family members.

- It automatically takes effect upon signing. Many assume that signing a TODD immediately transfers ownership. The transfer actually occurs only upon the death of the property owner.

- It can be revoked only through a formal process. Some believe that revoking a TODD requires a complicated legal process. In truth, the property owner can revoke it at any time simply by executing a new deed.

- It is only beneficial for wealthy individuals. There is a notion that only affluent people can benefit from a TODD. In fact, this deed can be advantageous for anyone looking to simplify the transfer of their property after death.

- It is a substitute for a will. Some people think that a TODD can replace a will entirely. While it can simplify property transfer, it does not address other estate planning needs, such as guardianship or distribution of personal belongings.

- Beneficiaries cannot be changed. A common misconception is that once a beneficiary is named on a TODD, they cannot be altered. In reality, the property owner can change beneficiaries at any time before their death.

- It is only available to Pennsylvania residents. Some believe that the TODD is exclusive to Pennsylvania residents. However, individuals can use this deed for property located in Pennsylvania, regardless of their residency status.

By clarifying these misconceptions, individuals can make more informed decisions about their estate planning options in Pennsylvania.

Documents used along the form

When dealing with property transfer in Pennsylvania, the Transfer-on-Death Deed (TOD) serves as a useful tool for individuals wishing to pass their real estate directly to beneficiaries without the need for probate. However, several other documents often accompany the TOD deed to ensure a smooth transfer process. Below is a list of these forms and documents, each serving a specific purpose in the context of property transfer.

- Last Will and Testament: This document outlines how an individual's assets, including real estate, should be distributed after their death. It can provide additional clarity regarding the individual's wishes.

- Beneficiary Designation Forms: These forms allow individuals to specify who will receive certain assets, such as bank accounts or retirement plans, upon their death. They are important for ensuring that all assets are aligned with the individual's intentions.

- Power of Attorney: This legal document grants someone the authority to act on behalf of another person in financial or legal matters. It can be crucial if the individual becomes incapacitated before transferring property.

- Property Deed: The original deed to the property provides proof of ownership. It is essential for establishing the transfer of property rights to the designated beneficiary.

- Affidavit of Death: This document serves as a sworn statement confirming the death of the property owner. It may be necessary to validate the transfer of property upon the owner's passing.

- Title Search Report: A title search identifies any liens or claims against the property. This report is vital for ensuring that the property can be transferred free of encumbrances.

- Real Estate Transfer Tax Form: This form is required to report the transfer of property for tax purposes. It ensures compliance with local tax regulations during the transfer process.

- Motor Vehicle Bill of Sale: This form is essential for officially recording the sale of a vehicle in Florida, serving as a receipt and crucial documentary evidence for the transfer of the vehicle's title. For more details, visit https://smarttemplates.net/fillable-florida-motor-vehicle-bill-of-sale/.

- Notice of Transfer: This document informs relevant parties, such as mortgage lenders or local authorities, about the change in ownership of the property, ensuring that all records are updated accordingly.

Utilizing these documents in conjunction with the Pennsylvania Transfer-on-Death Deed can help streamline the transfer process and ensure that all legal requirements are met. Each form plays a vital role in protecting the interests of both the property owner and the beneficiaries, ultimately facilitating a smoother transition of property ownership.

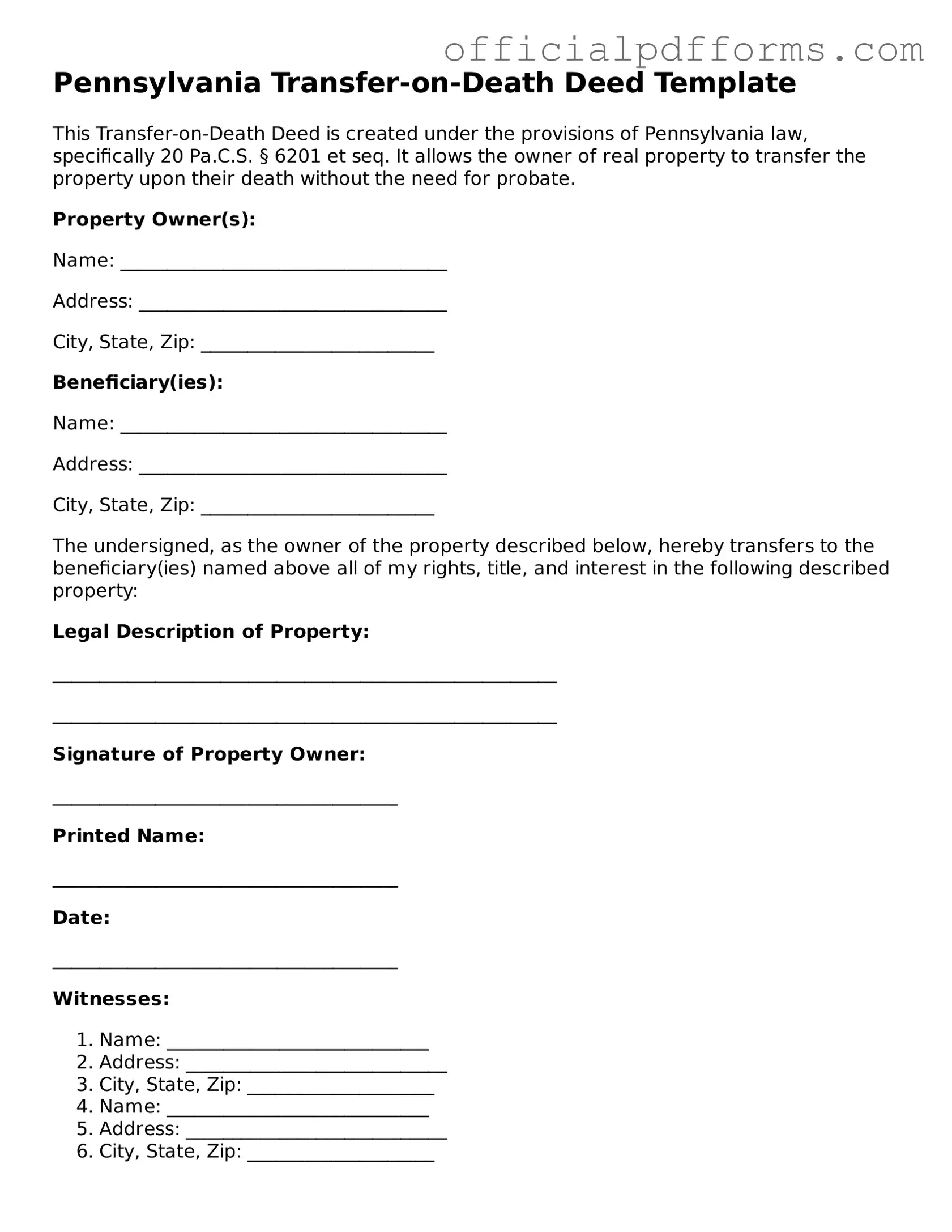

Steps to Filling Out Pennsylvania Transfer-on-Death Deed

After obtaining the Pennsylvania Transfer-on-Death Deed form, it is essential to complete it accurately to ensure proper transfer of property upon death. Follow these steps to fill out the form correctly.

- Begin by entering the name of the property owner at the top of the form.

- Provide the owner's current address, including city, state, and zip code.

- Identify the beneficiary by writing their full name in the designated area.

- Include the beneficiary's address, ensuring it is complete and accurate.

- Describe the property being transferred. This should include the property's street address and any additional identifying information, such as parcel number.

- Sign the form in the presence of a notary public. The signature must match the name of the property owner.

- Have the notary public complete their section, confirming the identity of the signer.

- Make copies of the completed deed for personal records.

- File the original deed with the appropriate county office where the property is located.

Once the form is filled out and filed, it will be processed by the county office. It is advisable to keep a copy for personal records and to inform the beneficiary about the deed.

Common mistakes

-

Not including all required information: Many individuals forget to fill in all necessary fields. This can lead to delays or rejection of the deed. Ensure that names, addresses, and property descriptions are complete and accurate.

-

Incorrect property description: A vague or incorrect description of the property can cause confusion. It is crucial to use the legal description as found in the property deed to avoid any issues.

-

Failure to sign and date: Some people overlook the importance of signing and dating the form. Without a signature and date, the document is not valid. Always double-check that these elements are included.

-

Not having witnesses: In Pennsylvania, the Transfer-on-Death Deed requires the presence of two witnesses. Failing to have witnesses present during the signing can invalidate the deed.

-

Neglecting to record the deed: After completing the form, individuals often forget to file it with the county recorder's office. Recording the deed is essential for it to take effect.

-

Not consulting a professional: Some people assume they can complete the form without guidance. Consulting a legal professional can help avoid mistakes and ensure that the deed meets all legal requirements.

Get Clarifications on Pennsylvania Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Pennsylvania?

A Transfer-on-Death Deed (TODD) is a legal document that allows you to transfer real estate to a designated beneficiary upon your death. This deed bypasses the probate process, meaning your property can go directly to the beneficiary without court involvement. It provides a simple and efficient way to ensure your property is passed on according to your wishes.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed in Pennsylvania, follow these steps:

- Obtain the official form for the Transfer-on-Death Deed.

- Fill out the form with accurate information, including your name, the property details, and the beneficiary’s information.

- Sign the deed in front of a notary public.

- Record the deed at the county recorder of deeds where the property is located.

Make sure to keep a copy of the recorded deed for your records. Always consider consulting a legal professional for guidance during this process.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must create a new deed that either designates a different beneficiary or explicitly revokes the previous deed. The new deed must also be signed, notarized, and recorded to be effective. Keep in mind that any changes should be documented properly to avoid confusion later on.

What happens if I don’t name a beneficiary?

If you do not name a beneficiary on your Transfer-on-Death Deed, the property will not transfer as intended. Instead, it will become part of your estate and will go through the probate process. This could lead to delays and additional costs for your heirs. To ensure your wishes are honored, it’s crucial to designate a beneficiary when you create the deed.