Printable Pennsylvania Real Estate Purchase Agreement Template

Find Other Popular Real Estate Purchase Agreement Templates for Specific States

Purchase Agreement Real Estate - It can outline what happens if either party backs out of the agreement.

How to Make a Purchase Agreement - Facilitates communication regarding any changes in terms.

Georgia Real Estate Contract - Legal descriptions ensure all parties are clear on which property is being bought or sold.

For those looking to ensure a smooth transaction, it's important to use a properly formatted document, like the Florida Motor Vehicle Bill of Sale form, which can be found at smarttemplates.net/fillable-florida-motor-vehicle-bill-of-sale/, as this ensures all necessary details are included and helps avoid any potential legal issues down the line.

Midland Title Toledo - It often outlines the terms for the transfer of title to the property.

Misconceptions

Understanding the Pennsylvania Real Estate Purchase Agreement is essential for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- It is a standard form used in all states. The Pennsylvania Real Estate Purchase Agreement is specific to Pennsylvania. Other states have their own forms and regulations, which may differ significantly.

- It only benefits the seller. This form is designed to protect the interests of both the buyer and the seller. It outlines the terms of the sale, ensuring that both parties understand their rights and obligations.

- Once signed, it cannot be changed. While the agreement is binding once signed, both parties can negotiate changes before closing. Amendments can be made if both parties agree.

- It does not require legal review. Although it is a standardized form, having a legal professional review the agreement can provide valuable insights and ensure that all terms are clear and enforceable.

- It guarantees the sale will go through. Signing the agreement does not guarantee that the sale will be completed. Various factors, such as financing or inspections, can affect the final outcome.

- All terms are negotiable. While many terms can be negotiated, some aspects, such as state laws and certain contingencies, may be non-negotiable and must be adhered to.

Being aware of these misconceptions can help buyers and sellers navigate the real estate process more effectively.

Documents used along the form

When entering into a real estate transaction in Pennsylvania, several key documents accompany the Pennsylvania Real Estate Purchase Agreement. Each of these forms plays a vital role in ensuring that the transaction proceeds smoothly and protects the interests of all parties involved. Below is a list of commonly used documents that you may encounter.

- Seller's Disclosure Statement: This document provides potential buyers with important information about the property's condition. Sellers are required to disclose any known issues, such as structural problems or past repairs, allowing buyers to make informed decisions.

- Agreement of Sale: Often used interchangeably with the purchase agreement, this document outlines the terms of the sale, including the purchase price, contingencies, and closing date. It serves as a formal contract between the buyer and seller.

- Trailer Bill of Sale: For the transfer of trailer ownership, it's crucial to have this document as it serves as proof of purchase and is necessary for registration. For more details, you can refer to OnlineLawDocs.com.

- Title Insurance Policy: This policy protects buyers and lenders from any potential claims against the property’s title. It ensures that the buyer has clear ownership of the property, free from disputes or liens.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document details all the financial aspects of the transaction. It includes costs such as closing fees, taxes, and any adjustments, ensuring transparency in the final settlement process.

Understanding these documents is crucial for anyone involved in a real estate transaction. By familiarizing yourself with these forms, you can navigate the process more confidently and ensure that your rights are protected throughout the transaction.

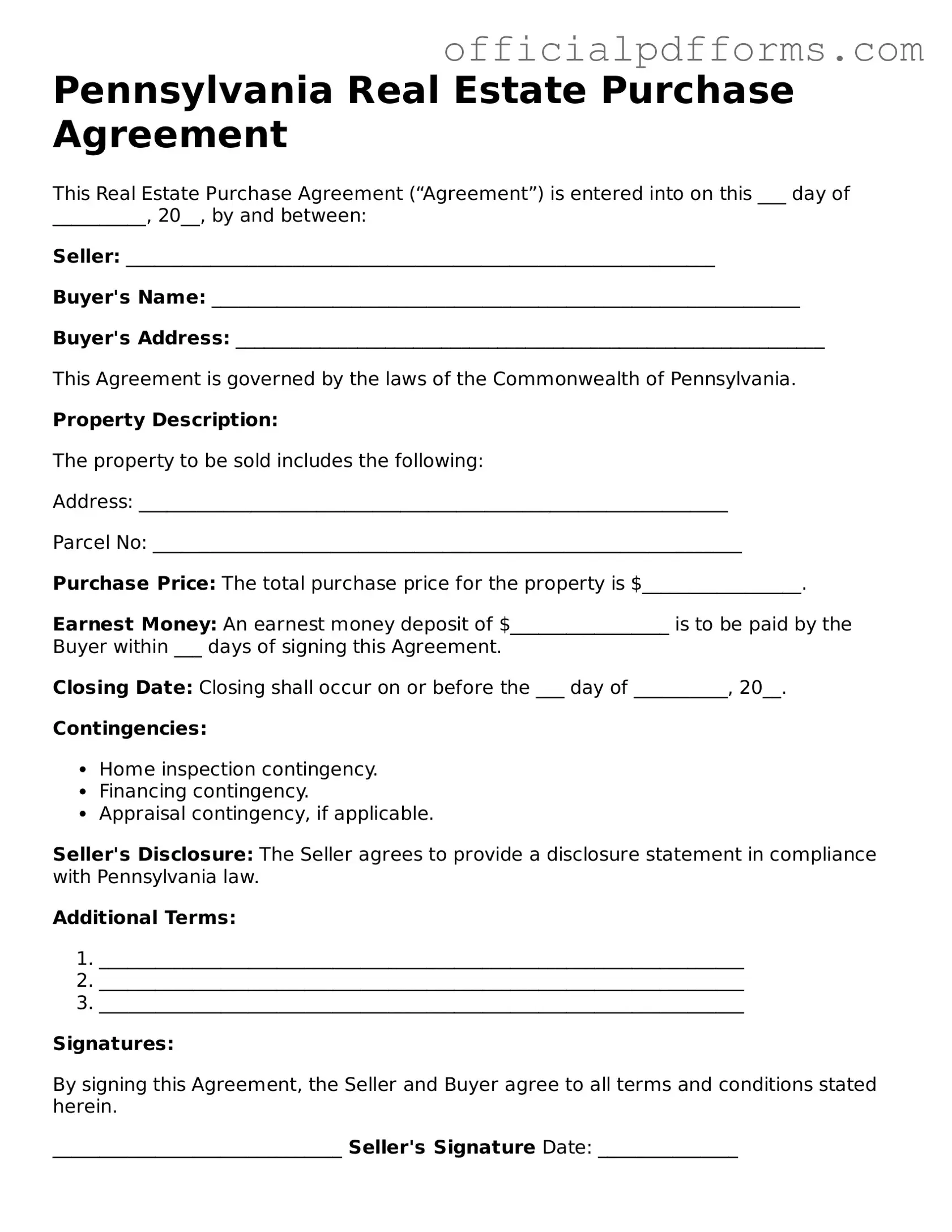

Steps to Filling Out Pennsylvania Real Estate Purchase Agreement

Filling out the Pennsylvania Real Estate Purchase Agreement form is an important step in the process of buying or selling property. Once you have completed the form, it will serve as a binding contract between the buyer and seller. Make sure to review the information carefully to ensure accuracy before submitting it.

- Obtain the form: You can find the Pennsylvania Real Estate Purchase Agreement form online or through a real estate professional.

- Fill in the date: At the top of the form, write the date when you are completing the agreement.

- Identify the parties: Clearly state the names and addresses of both the buyer and the seller. This ensures that all parties are accurately represented.

- Describe the property: Provide a detailed description of the property being sold, including the address and any relevant identifying information.

- Purchase price: Write down the agreed-upon purchase price for the property. Be clear and precise to avoid any misunderstandings.

- Deposit amount: Specify the amount of the deposit that the buyer will provide. This shows the seller that the buyer is serious about the purchase.

- Financing details: If applicable, indicate how the buyer plans to finance the purchase, whether through a mortgage or other means.

- Closing date: Agree on a closing date when the sale will be finalized. This is crucial for both parties to plan accordingly.

- Contingencies: Include any contingencies that must be met before the sale can proceed, such as inspections or financing approval.

- Signatures: Ensure that both the buyer and seller sign and date the agreement. This makes the contract legally binding.

After completing the form, both parties should keep a copy for their records. It's also wise to consult with a real estate professional or attorney to confirm that everything is in order before moving forward with the transaction.

Common mistakes

-

Incomplete Information: Buyers and sellers often forget to fill in all required fields. This can include names, addresses, or property details. Leaving sections blank can lead to confusion and delays in the transaction process.

-

Incorrect Property Description: It's crucial to accurately describe the property being sold. Mistakes in the address, lot number, or property type can create legal issues down the line. Double-checking this information is essential.

-

Ignoring Contingencies: Many people overlook the importance of contingencies. These are conditions that must be met for the sale to proceed. Not including contingencies related to financing, inspections, or appraisals can expose buyers to unnecessary risks.

-

Failure to Sign and Date: A common oversight is forgetting to sign or date the agreement. Without signatures, the document is not legally binding. Ensure that all parties involved sign and date the agreement to validate it.

Get Clarifications on Pennsylvania Real Estate Purchase Agreement

What is a Pennsylvania Real Estate Purchase Agreement?

The Pennsylvania Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a property is sold. It serves as a binding contract between the buyer and the seller, detailing the rights and obligations of each party. This agreement typically includes information such as the purchase price, property description, closing date, and any contingencies that may apply.

What are the key components of this agreement?

Several essential elements make up a Pennsylvania Real Estate Purchase Agreement. These include:

- Parties Involved: Names and addresses of both the buyer and the seller.

- Property Description: A detailed description of the property being sold, including its address and any relevant parcel numbers.

- Purchase Price: The agreed-upon price for the property.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or home inspections.

- Closing Date: The date when the property transfer will take place.

- Signatures: Both parties must sign the agreement to make it legally binding.

How does the agreement protect both buyers and sellers?

The Pennsylvania Real Estate Purchase Agreement is designed to protect the interests of both parties. For buyers, it ensures that they have a clear understanding of what they are purchasing and establishes conditions under which they can withdraw if certain criteria are not met. Sellers benefit from having a formal agreement that outlines the terms of the sale, providing them with legal recourse if the buyer fails to fulfill their obligations.

What happens if either party wants to back out of the agreement?

If either party wishes to back out of the agreement, the consequences depend on the specific terms outlined in the contract. Generally, if a buyer backs out without a valid reason, they may forfeit their earnest money deposit. Conversely, if a seller withdraws without cause, they may face legal action or be required to return the buyer's deposit. It's crucial to review the contingencies included in the agreement, as they can provide a way for either party to exit the contract without penalties.

Can the agreement be modified after it is signed?

Yes, the Pennsylvania Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to any changes. This typically involves drafting an amendment to the original agreement, which should be signed by both the buyer and the seller. It's important to document any modifications clearly to avoid confusion or disputes later on.

Is it advisable to use a lawyer when drafting or reviewing the agreement?

While it's not legally required to have a lawyer when drafting or reviewing a Pennsylvania Real Estate Purchase Agreement, it is highly advisable. A legal professional can provide valuable insights, ensure that the agreement complies with state laws, and help protect your interests. Their expertise can be especially beneficial if any complex issues arise during the transaction.