Printable Pennsylvania Quitclaim Deed Template

Find Other Popular Quitclaim Deed Templates for Specific States

Quit Claim Deed North Carolina - Many property owners overlook the impacts of transferring their interests via this form.

Georgia Quit Claim Deed - A quitclaim deed does not affect any existing liens on the property.

Quitclaim Deed Forms - They serve as a means of informal property gift without monetary exchange.

The completion of an RV Bill of Sale is a critical step for those engaged in transactions involving recreational vehicles. By documenting the sale clearly, both buyers and sellers can ensure that the transfer of ownership is recognized. For detailed guidelines, consider reviewing our resource on the proper RV Bill of Sale procedures.

Ohio Quit Claim Deed - A Quitclaim Deed does not warrant the property's title, making it ideal for certain transactions.

Misconceptions

Many people have misunderstandings about the Pennsylvania Quitclaim Deed form. Here are six common misconceptions:

- It transfers ownership without any warranties. A quitclaim deed does not guarantee that the person transferring the property has clear title. If there are any issues with the title, the new owner may face problems.

- It is only used between family members. While quitclaim deeds are often used in family transactions, they can be used in any situation where property is being transferred, including sales between strangers.

- It is the same as a warranty deed. A warranty deed provides guarantees about the title, while a quitclaim deed offers no such protections. Understanding this difference is crucial when transferring property.

- It requires a notary to be valid. While having a notary can help validate the deed, it is not a strict requirement for the deed to be legally binding in Pennsylvania.

- Quitclaim deeds are only for real estate. Although commonly associated with real estate, quitclaim deeds can also transfer other types of property, such as vehicles or personal belongings.

- Once signed, it cannot be revoked. A quitclaim deed can be revoked or canceled, but this typically requires additional legal steps. It is important to understand the implications of the deed before signing.

Being aware of these misconceptions can help you make informed decisions when dealing with property transfers in Pennsylvania.

Documents used along the form

When transferring property in Pennsylvania, the Quitclaim Deed is a common document used. However, several other forms and documents are often needed to ensure a smooth transaction. Below is a list of important documents that complement the Quitclaim Deed.

- Property Title Search: This document verifies the ownership history of the property. It identifies any liens, encumbrances, or claims against the property, ensuring the seller has the right to transfer ownership.

- Affidavit of Residence: This sworn statement confirms the residency of the seller. It may be necessary for tax purposes or to clarify the seller’s relationship to the property.

- Transfer Tax Form: This form is used to report the transfer of property to the local tax authority. It helps calculate any transfer taxes that may be due upon the sale.

- Motor Vehicle Power of Attorney: This form allows a vehicle owner to designate someone else to manage matters related to their motor vehicle. For more details, visit OnlineLawDocs.com.

- Settlement Statement: Also known as a HUD-1, this document outlines all the financial aspects of the transaction. It details the sale price, closing costs, and any adjustments made during the settlement.

- Title Insurance Policy: This policy protects the buyer against any future claims or disputes regarding the property’s title. It ensures that the buyer has clear ownership after the transaction is complete.

Using these documents alongside the Quitclaim Deed can help ensure a clear and legally sound transfer of property. Always consider consulting with a legal professional to address specific needs related to your situation.

Steps to Filling Out Pennsylvania Quitclaim Deed

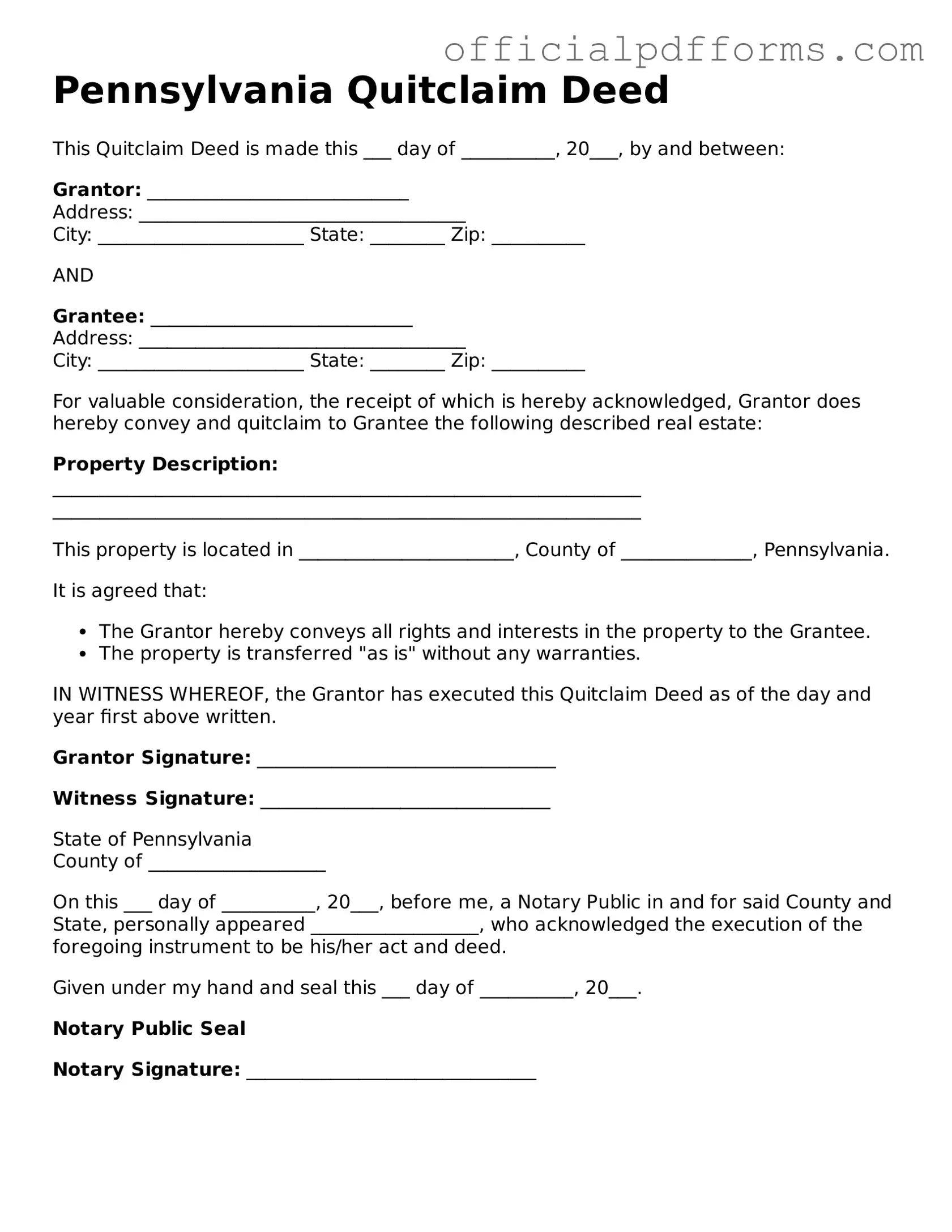

After obtaining the Pennsylvania Quitclaim Deed form, you will need to fill it out accurately to ensure a smooth transfer of property. Follow these steps carefully to complete the form correctly.

- Begin by entering the date at the top of the form.

- In the section labeled "Grantor," write the full name of the person transferring the property.

- Provide the address of the Grantor in the designated space.

- In the "Grantee" section, enter the full name of the person receiving the property.

- List the Grantee's address following the same format as the Grantor's address.

- Describe the property being transferred. Include the street address and any relevant details such as lot number or parcel number.

- Sign the form in the space provided for the Grantor. Ensure the signature matches the name listed.

- Have the signature notarized. The notary will complete their section, verifying the identity of the Grantor.

- Finally, review the completed form for any errors or missing information before submitting it for recording.

Once the form is filled out and notarized, it can be submitted to the appropriate county office for recording. This step is essential for making the transfer official and ensuring public notice of the change in property ownership.

Common mistakes

-

Incorrect Names: One common mistake is failing to list the names of the grantor and grantee accurately. Ensure that full legal names are used, and check for any spelling errors.

-

Missing Signatures: All parties involved must sign the document. Omitting a signature can render the deed invalid. Double-check that every required signature is present.

-

Inaccurate Property Description: The property must be described clearly and completely. Mistakes in the property description can lead to disputes or issues with ownership. Use the legal description found in the property’s title or previous deed.

-

Improper Notarization: A quitclaim deed must be notarized to be legally binding. If the notarization is missing or done incorrectly, the deed may not hold up in court.

-

Failure to Record the Deed: After completing the form, it’s essential to file the deed with the appropriate county office. Not recording the deed can lead to complications in proving ownership later on.

Get Clarifications on Pennsylvania Quitclaim Deed

What is a Quitclaim Deed in Pennsylvania?

A Quitclaim Deed is a legal document used to transfer ownership of real estate in Pennsylvania. It allows the grantor, or current owner, to convey any interest they may have in the property to the grantee, or new owner. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property. It simply transfers whatever interest the grantor has, if any.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in specific situations, including:

- Transferring property between family members.

- Divorces, where one spouse relinquishes their interest in a property to the other.

- Clearing up title issues, such as adding or removing a name from the title.

- Transferring property into or out of a trust.

How do I complete a Quitclaim Deed in Pennsylvania?

To complete a Quitclaim Deed, follow these steps:

- Obtain a Quitclaim Deed form. These can be found online or at legal supply stores.

- Fill in the names of the grantor and grantee.

- Provide a legal description of the property. This information is typically found on the property’s tax records.

- Sign the document in front of a notary public.

- File the completed deed with the county recorder of deeds office.

Do I need to notarize a Quitclaim Deed?

Yes, a Quitclaim Deed must be notarized in Pennsylvania. The grantor must sign the deed in the presence of a notary public, who will then affix their seal to the document. This step is crucial for the deed to be legally binding and enforceable.

Is there a fee to file a Quitclaim Deed in Pennsylvania?

Yes, there is typically a fee associated with filing a Quitclaim Deed. The fee varies by county. It is advisable to check with the local county recorder of deeds for the exact amount. Additionally, there may be other costs, such as notary fees or costs for obtaining certified copies.

Will a Quitclaim Deed affect my property taxes?

Generally, a Quitclaim Deed does not directly affect property taxes. However, transferring ownership may trigger a reassessment of the property’s value, which could lead to changes in tax obligations. It is important to check with the local tax authority for specific implications related to property tax after a transfer.

Can I revoke a Quitclaim Deed after it has been filed?

Once a Quitclaim Deed has been executed and filed, it cannot be revoked unilaterally. To reverse the transfer, the original grantor would need to execute a new deed, transferring the property back to themselves or to another party. This new deed must also be notarized and filed with the county recorder of deeds.

What are the risks of using a Quitclaim Deed?

Using a Quitclaim Deed carries certain risks. The primary concern is that the grantor does not guarantee clear title. If there are existing liens or encumbrances on the property, the grantee may inherit those issues. It is advisable for both parties to conduct due diligence, including title searches, before proceeding with a Quitclaim Deed.