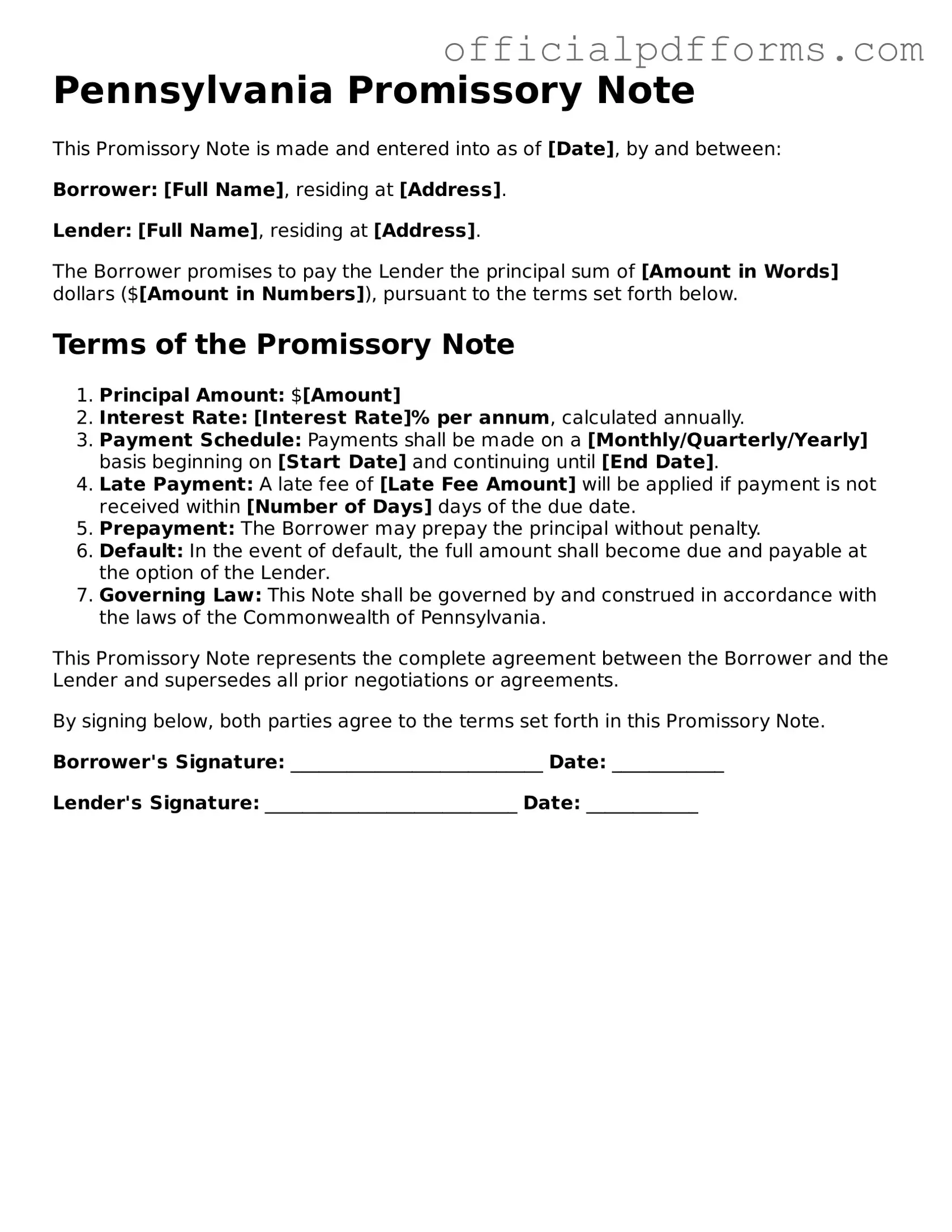

Printable Pennsylvania Promissory Note Template

Find Other Popular Promissory Note Templates for Specific States

North Carolina Promissory Note - Payments can be structured as lump-sum or installment-based depending on mutual agreement.

Completing the essential RV Bill of Sale document is crucial for anyone involved in the transaction of a recreational vehicle. This formal agreement verifies the sale and transfer of ownership, ensuring that both the buyer and seller have a clear understanding of the transaction. For more information, refer to this detailed RV Bill of Sale guideline to streamline your documentation process.

Ohio Promissory Note Requirements - Standard terms in a promissory note help set industry expectations for loans.

Misconceptions

Here are some common misconceptions about the Pennsylvania Promissory Note form:

- All promissory notes must be notarized. Many people believe that notarization is required for a promissory note to be valid. However, while notarization can add an extra layer of security, it is not a legal requirement in Pennsylvania.

- Promissory notes are only for large loans. Some think these notes are only used for significant amounts of money. In reality, they can be used for any loan amount, big or small.

- Verbal agreements are sufficient. Many assume that a verbal agreement is enough to enforce a loan. However, having a written promissory note provides clear evidence of the terms and conditions.

- Promissory notes are the same as contracts. While both are legal documents, a promissory note specifically focuses on the promise to pay a sum of money, whereas contracts cover a broader range of agreements.

- Interest rates must be included. Some believe that all promissory notes must include an interest rate. In fact, it is possible to create a note without interest, depending on the agreement between the parties.

- They can only be used between individuals. A common misconception is that promissory notes are only for personal loans. Businesses can also use them for transactions and loans.

- Once signed, they cannot be changed. Many think that after signing a promissory note, the terms are set in stone. However, parties can agree to modify the terms, provided both sides consent.

- They expire after a certain period. Some people believe promissory notes have an automatic expiration date. While the statute of limitations applies to enforcing the note, the note itself does not have a built-in expiration.

- Only banks can issue promissory notes. There is a misconception that only financial institutions can create promissory notes. In reality, anyone can issue one, as long as they follow the proper format.

Documents used along the form

When engaging in lending and borrowing transactions in Pennsylvania, a Promissory Note is often accompanied by various other documents. Each of these forms serves a specific purpose, ensuring that both parties are clear about their obligations and rights. Below is a list of commonly used documents alongside the Pennsylvania Promissory Note.

- Loan Agreement: This detailed document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as the primary contract between the lender and borrower.

- Security Agreement: If the loan is secured, this document specifies the collateral that the borrower pledges to the lender. It details the rights of the lender in case of default.

- Personal Guarantee: This form is often used when a business borrows money. It holds an individual personally liable for the debt if the business fails to repay the loan.

- Disclosure Statement: Required by law in many cases, this document provides borrowers with essential information about the loan, including fees, terms, and potential risks associated with borrowing.

- Amortization Schedule: This is a table that outlines each payment over the life of the loan, showing how much goes toward interest and how much reduces the principal balance.

- Default Notice: If a borrower fails to make payments, this document formally notifies them of the default and outlines the lender's rights and potential actions.

- Release of Liability: Once the loan is repaid, this document confirms that the borrower has fulfilled their obligations, releasing them from any further liability under the Promissory Note.

- Assignment of Note: This document allows the lender to transfer their rights under the Promissory Note to another party, ensuring the new party can collect payments.

- Motor Vehicle Power of Attorney: This document allows a vehicle owner to authorize another individual to manage vehicle-related tasks on their behalf, such as registration and title transfers. For more information, visit OnlineLawDocs.com.

- Loan Modification Agreement: If the terms of the loan need to be changed, this document outlines the new terms and conditions agreed upon by both parties.

Understanding these documents can greatly enhance the clarity and security of any lending arrangement. Each plays a crucial role in protecting the interests of both lenders and borrowers, ensuring that all parties are aware of their rights and responsibilities throughout the loan process.

Steps to Filling Out Pennsylvania Promissory Note

Filling out the Pennsylvania Promissory Note form is an important step in documenting a loan agreement. Once you complete the form, you will have a clear record of the terms agreed upon by both parties. This can help avoid misunderstandings and protect your interests.

- Begin by writing the date at the top of the form.

- In the first section, enter the name and address of the borrower. Make sure to include any relevant contact information.

- Next, provide the name and address of the lender. This should also include contact details.

- State the principal amount of the loan clearly. This is the total amount being borrowed.

- Specify the interest rate, if applicable. Write this as a percentage.

- Outline the repayment terms. Include details on how often payments will be made and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable.

- Sign and date the form at the bottom. The borrower should also sign, confirming their agreement to the terms.

- Make copies of the signed document for both the lender and borrower for their records.

Common mistakes

-

Not Including All Necessary Details: One common mistake is failing to provide complete information. The note should include the full names and addresses of both the borrower and the lender. Missing this information can lead to confusion or disputes later.

-

Incorrectly Stating the Loan Amount: It's crucial to accurately state the amount being borrowed. Some individuals mistakenly write the amount in words or numbers incorrectly. Ensure that both formats match to avoid any ambiguity.

-

Omitting Payment Terms: Clearly outlining the payment terms is essential. This includes the interest rate, repayment schedule, and any late fees. If these details are vague or missing, it can create misunderstandings about what is expected.

-

Not Signing the Document: Lastly, a significant error is neglecting to sign the promissory note. Both parties must sign the document for it to be legally binding. Without signatures, the note may not hold up in court if disputes arise.

Get Clarifications on Pennsylvania Promissory Note

What is a Pennsylvania Promissory Note?

A Pennsylvania Promissory Note is a written agreement in which one party promises to pay a specific amount of money to another party at a predetermined time or on demand. This document serves as a legal record of the debt and outlines the terms of repayment, including interest rates, payment schedules, and any consequences for non-payment. It is essential for both the lender and borrower to clearly understand the terms before signing.

What information is typically included in a Promissory Note?

Several key elements are usually included in a Pennsylvania Promissory Note:

- Parties Involved: The names and addresses of both the borrower and lender.

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The percentage of interest that will be charged on the loan.

- Payment Terms: Details on how and when payments will be made, including due dates.

- Default Terms: Conditions that define what happens if the borrower fails to make payments.

Is a Promissory Note legally binding in Pennsylvania?

Yes, a Promissory Note is legally binding in Pennsylvania, provided it meets certain requirements. For it to be enforceable, the note must be in writing, signed by the borrower, and contain clear terms regarding the repayment of the loan. If these conditions are met, the lender can take legal action to recover the owed amount if the borrower defaults.

Can a Promissory Note be modified after it has been signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is advisable to document any modifications in writing, with both parties signing the revised terms. This helps to avoid misunderstandings and provides a clear record of the agreed-upon changes.

What should I do if the borrower defaults on the Promissory Note?

If a borrower defaults on a Promissory Note, the lender has several options:

- Contact the borrower to discuss the situation and explore possible solutions.

- Review the terms of the note to understand the default provisions.

- Consider sending a formal demand letter requesting payment.

- If necessary, seek legal advice to understand the options for pursuing collection through the court system.

Each situation is unique, so it is important to assess the circumstances carefully before taking action.