Printable Pennsylvania Operating Agreement Template

Find Other Popular Operating Agreement Templates for Specific States

How to Create an Operating Agreement for an Llc - It can include provisions for indemnification of members.

In Texas, ensuring a smooth transaction when buying or selling a vehicle involves utilizing the Motor Vehicle Bill of Sale form, which is essential for documenting the details of the sale. This form can be conveniently found on sites like OnlineLawDocs.com, helping to safeguard the interests of both the buyer and seller while streamlining the vehicle registration process for the new owner.

How to Make an Operating Agreement - The agreement specifies the processes for adding or removing members.

Ohio Llc Operating Agreement Template - An Operating Agreement helps prevent disputes among LLC members.

Llc Operating Agreement Georgia - It serves as a reference to resolve disputes among members by detailing agreed-upon processes.

Misconceptions

Understanding the Pennsylvania Operating Agreement form is crucial for anyone involved in a business partnership or LLC. However, several misconceptions often arise. Here are seven common misunderstandings about this important document:

- All businesses in Pennsylvania are required to have an Operating Agreement. Many people believe that every business must have this document. In reality, while it is highly recommended for LLCs, it is not a legal requirement in Pennsylvania.

- An Operating Agreement is the same as the Articles of Organization. Some assume these two documents are interchangeable. However, the Articles of Organization are filed with the state to officially form the LLC, while the Operating Agreement outlines the internal workings and management structure of the business.

- The Operating Agreement cannot be changed once it is signed. This is a common myth. An Operating Agreement can be amended as needed, provided all members agree to the changes and the amendments are documented properly.

- Operating Agreements are only necessary for large businesses. Many think that only larger companies need this document. In fact, even small businesses benefit from having an Operating Agreement to clarify roles and responsibilities.

- Operating Agreements are only for multi-member LLCs. Some believe that single-member LLCs do not need an Operating Agreement. However, having one can still provide legal protection and clarity regarding the management of the business.

- There is a standard Operating Agreement that everyone should use. While templates are available, each Operating Agreement should be tailored to fit the specific needs and circumstances of the business and its members.

- Once created, the Operating Agreement is no longer relevant. This misconception leads many to neglect their Operating Agreement. In reality, it should be reviewed regularly and updated as the business evolves or as laws change.

By understanding these misconceptions, business owners can better appreciate the value of a well-crafted Operating Agreement and ensure their business operates smoothly.

Documents used along the form

When forming a business in Pennsylvania, particularly a limited liability company (LLC), several documents complement the Operating Agreement. Each document serves a specific purpose and helps ensure that the business operates smoothly and legally. Below is a list of important forms and documents often used alongside the Pennsylvania Operating Agreement.

- Articles of Organization: This document officially establishes the LLC with the state. It includes basic information such as the company name, address, and the registered agent.

- Bylaws: While not required for LLCs, bylaws outline the internal rules governing the company’s operations and management structure. They provide clarity on decision-making processes.

- Member Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their investment and stake in the company.

- Operating Procedures: This document details the day-to-day operations of the business. It can include guidelines on employee responsibilities, customer interactions, and operational workflows.

- Tax Forms: Various tax forms, including IRS Form SS-4 for obtaining an Employer Identification Number (EIN), are essential for tax purposes. They help the business comply with federal and state tax regulations.

- Business Licenses: Depending on the nature of the business, specific licenses may be required to operate legally. This can include local, state, and federal permits.

- Non-Disclosure Agreements (NDAs): These agreements protect sensitive information shared between members or with third parties. They help maintain confidentiality and safeguard business interests.

- IRS 2553 Form: This form is essential for small businesses looking to elect S corporation status, allowing potential tax benefits. For more information, visit https://smarttemplates.net/fillable-irs-2553.

- Partnership Agreements: If the LLC has multiple members, a partnership agreement can clarify the roles, responsibilities, and profit-sharing arrangements among members.

- Annual Reports: Some states require LLCs to file annual reports. These documents provide updated information about the company’s structure and financial status to the state.

Each of these documents plays a vital role in the establishment and operation of an LLC in Pennsylvania. Ensuring that all necessary paperwork is in order can help prevent legal complications and promote a successful business venture.

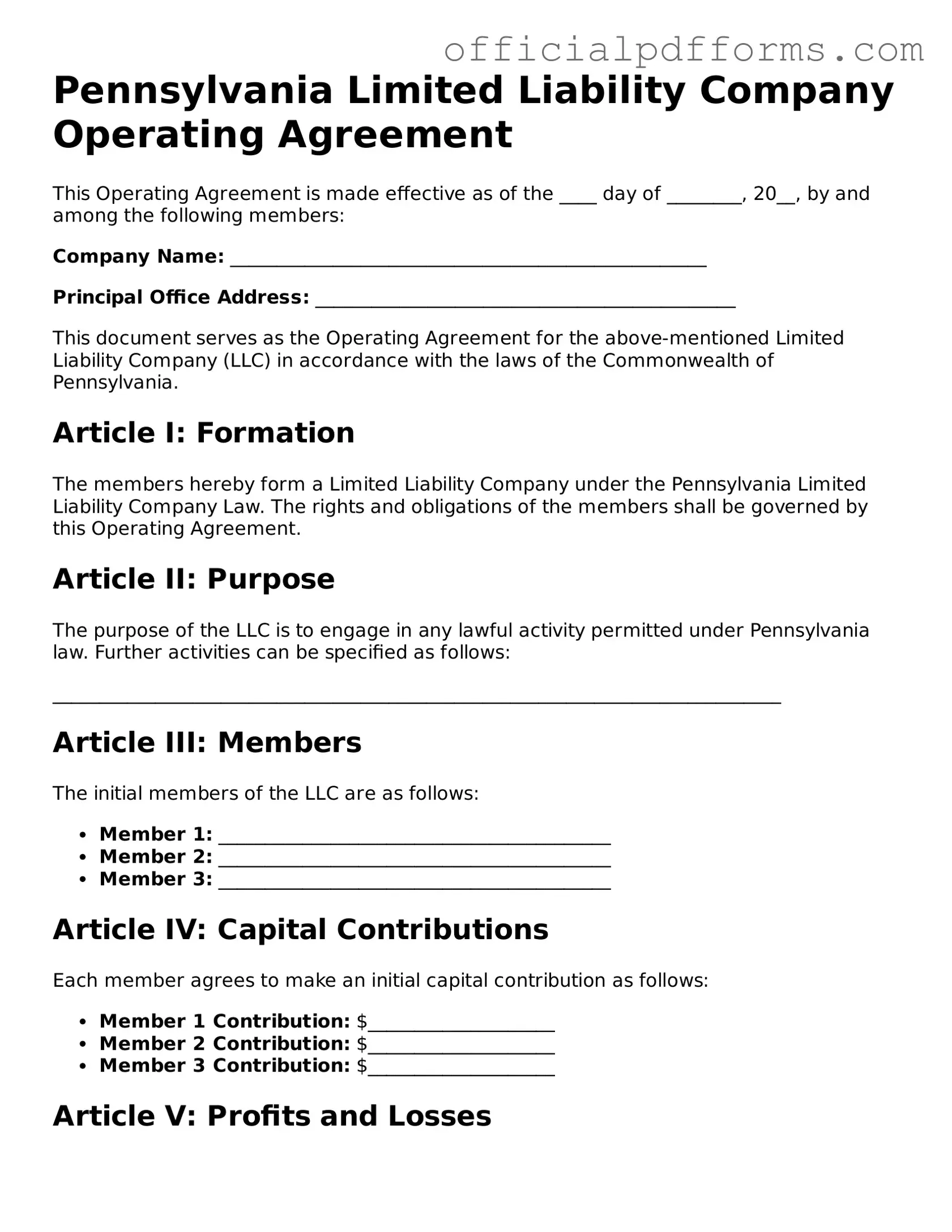

Steps to Filling Out Pennsylvania Operating Agreement

After gathering all necessary information, you can proceed to fill out the Pennsylvania Operating Agreement form. This document outlines the structure and rules for your business. It is important to ensure all sections are completed accurately to avoid issues later.

- Begin by entering the name of your business at the top of the form. Make sure it matches the name registered with the state.

- Next, provide the principal office address of your business. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the business. Each member should have their own line.

- Specify the purpose of the business. Clearly describe what services or products your business will offer.

- Indicate the management structure. Decide if the business will be member-managed or manager-managed and check the appropriate box.

- Detail the voting rights of each member. Specify how decisions will be made and what percentage of votes is required for different types of decisions.

- Outline the profit and loss distribution. Explain how profits and losses will be shared among members.

- Include any additional provisions that may be relevant to your business. This can cover topics like dispute resolution or amendments to the agreement.

- Finally, have all members sign and date the form. Ensure that each signature is dated to validate the agreement.

Common mistakes

-

Not including all members: It is crucial to list all members involved in the business. Omitting a member can lead to disputes later.

-

Failing to specify ownership percentages: Clearly stating each member's ownership percentage helps prevent misunderstandings about profit sharing and decision-making authority.

-

Ignoring the management structure: Clearly define how the business will be managed. Specify whether it will be member-managed or manager-managed to avoid confusion.

-

Not addressing profit and loss distribution: Outline how profits and losses will be distributed among members. This ensures everyone understands their financial rights.

-

Leaving out dispute resolution procedures: Include a plan for resolving disputes. This can save time and money if conflicts arise in the future.

-

Neglecting to update the agreement: Life changes. Regularly review and update the Operating Agreement to reflect any changes in membership or business structure.

-

Not having the agreement signed: Ensure all members sign the Operating Agreement. A signed document is essential for it to be legally binding.

-

Overlooking state-specific requirements: Familiarize yourself with Pennsylvania's specific requirements for Operating Agreements. Not following these can result in legal complications.

Get Clarifications on Pennsylvania Operating Agreement

What is a Pennsylvania Operating Agreement?

A Pennsylvania Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Pennsylvania. It defines the roles and responsibilities of the members, how profits and losses will be distributed, and the procedures for making decisions within the company.

Is an Operating Agreement required in Pennsylvania?

No, Pennsylvania does not legally require LLCs to have an Operating Agreement. However, having one is highly recommended. It provides clarity on the business operations and can help prevent disputes among members. Additionally, a well-drafted agreement can strengthen the limited liability protection of the members.

What should be included in a Pennsylvania Operating Agreement?

While the contents can vary based on the specific needs of the LLC, a typical Operating Agreement should include:

- The name and purpose of the LLC

- The names and addresses of the members

- How profits and losses will be allocated

- Management structure (member-managed or manager-managed)

- Voting rights and procedures

- How new members can be added

- Procedures for resolving disputes

- Amendment procedures for the agreement

Can I create my own Operating Agreement?

Yes, you can create your own Operating Agreement. Many resources are available online to help guide you through the process. However, it is important to ensure that your agreement complies with Pennsylvania laws and meets the specific needs of your LLC. Consulting with a legal professional can provide additional assurance that your document is sound.

How does an Operating Agreement affect liability protection?

An Operating Agreement can enhance liability protection for LLC members. By clearly outlining the structure and operations of the business, it helps demonstrate that the LLC is a separate entity from its members. This separation is crucial in maintaining the limited liability status, protecting personal assets from business debts or legal claims.

How do I amend an Operating Agreement?

To amend an Operating Agreement, follow the procedures outlined in the original document. Typically, amendments require a vote or consent from the members. It is essential to document any changes in writing and update the agreement accordingly to reflect the new terms.

What happens if we don’t have an Operating Agreement?

If an LLC does not have an Operating Agreement, Pennsylvania law will default to the state’s LLC statutes. This can lead to uncertainty in management and operations, potentially resulting in disputes among members. Without a clear agreement, members may not have a defined process for decision-making, profit distribution, or handling disputes.

How can I ensure my Operating Agreement is legally binding?

To ensure that your Operating Agreement is legally binding, it should be in writing and signed by all members. While notarization is not required, having the document notarized can provide additional proof of authenticity. Keep a copy of the signed agreement in your business records to refer to when needed.

Can the Operating Agreement be used in court?

Yes, an Operating Agreement can be used in court if disputes arise among members. It serves as evidence of the agreed-upon terms and can help resolve conflicts by providing a clear reference to the members’ intentions. Courts generally uphold the terms of a properly executed Operating Agreement, making it an important document for LLCs.