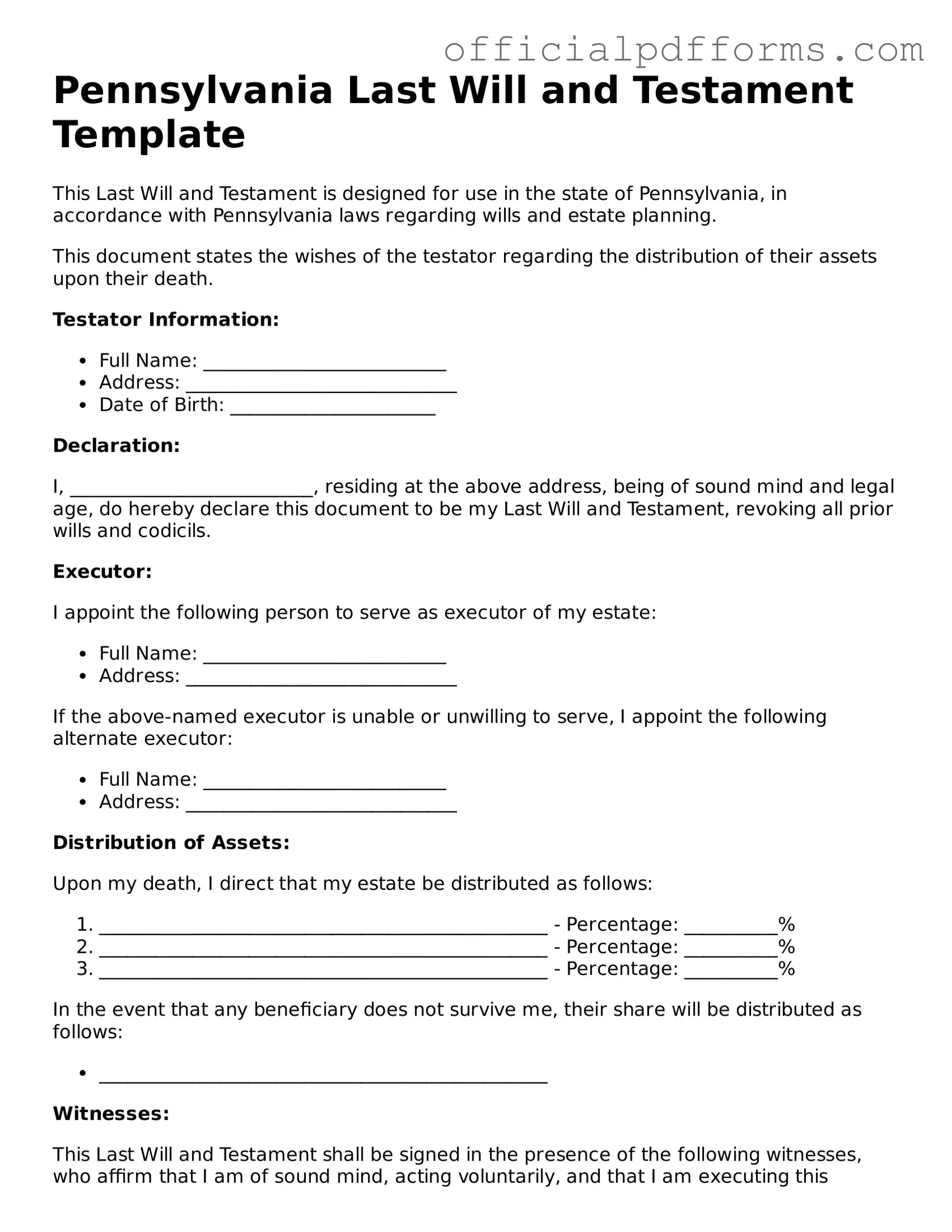

Printable Pennsylvania Last Will and Testament Template

Find Other Popular Last Will and Testament Templates for Specific States

Is a Handwritten Will Legal in Nc - This document is crucial for anyone who wants to ensure their estate is handled according to their wishes.

For those seeking to understand the nuances of property transfer, a thorough grasp of the Quitclaim Deed process is key. This effective Quitclaim Deed approach offers essential insights into executing a title transfer, particularly valuable for family situations or quick transactions.

Living Will Form Nj - Specifies beneficiaries who will inherit the deceased's property and possessions.

Last Will and Testament Ohio - A Last Will can appoint guardians for minors, ensuring their welfare is prioritized.

Misconceptions

When it comes to creating a Last Will and Testament in Pennsylvania, many people hold certain misconceptions that can lead to confusion or even legal issues down the line. Here are ten common misunderstandings, along with clarifications to help you navigate the process more effectively.

-

Myth: A handwritten will is not valid in Pennsylvania.

This is not true. Pennsylvania does allow handwritten wills, known as holographic wills, as long as they are signed by the testator and reflect their intentions.

-

Myth: You need an attorney to create a valid will.

While having an attorney can provide valuable guidance, it is not legally required. Individuals can create their own wills, provided they meet the state’s requirements.

-

Myth: A will can be verbal.

In Pennsylvania, a will must be in writing to be valid. Verbal wills, or oral wills, are not recognized in this state.

-

Myth: Once a will is made, it cannot be changed.

This is a common misconception. Wills can be amended or revoked at any time, as long as the testator is of sound mind and follows the proper legal procedures.

-

Myth: All assets must go through probate.

Not all assets are subject to probate. For example, assets held in joint tenancy or those with designated beneficiaries typically bypass the probate process.

-

Myth: A will determines who gets your life insurance benefits.

Life insurance policies typically have their own designated beneficiaries, which take precedence over what is stated in a will.

-

Myth: Only wealthy individuals need a will.

Everyone can benefit from having a will, regardless of their financial situation. A will helps ensure that your wishes are honored and can simplify the process for your loved ones.

-

Myth: You can use any template for your will.

While templates can be helpful, they must comply with Pennsylvania laws to be valid. Using a generic template may not meet all legal requirements.

-

Myth: Witnesses to a will must be related to the testator.

This is incorrect. Witnesses should be disinterested parties, meaning they should not be beneficiaries of the will to avoid potential conflicts of interest.

-

Myth: A will is only necessary if you have minor children.

While having a will is crucial for parents, it is equally important for anyone who wants to ensure their assets are distributed according to their wishes after death.

Understanding these misconceptions can help you make informed decisions about your estate planning. If you have questions or need assistance, consider reaching out to a legal professional who can provide personalized advice based on your situation.

Documents used along the form

When preparing a Last Will and Testament in Pennsylvania, it’s essential to consider other legal documents that may complement your will. These forms can help ensure that your wishes are honored and that your loved ones are taken care of after your passing. Below is a list of commonly used documents that often accompany a Last Will and Testament.

- Durable Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you become incapacitated. It grants authority to make decisions on your behalf, ensuring your financial matters are handled according to your wishes.

- Healthcare Power of Attorney: Similar to the Durable Power of Attorney, this form designates someone to make medical decisions for you if you are unable to do so. It ensures your healthcare preferences are respected during difficult times.

- Sample Tax Return Transcript: This document can be vital for verifying income and is particularly useful in the estate planning process, as highlighted by OnlineLawDocs.com.

- Living Will: A Living Will outlines your preferences regarding medical treatment and end-of-life care. It provides guidance to your loved ones and healthcare providers about your wishes in situations where you cannot communicate them.

- Revocable Living Trust: This legal arrangement allows you to place your assets into a trust during your lifetime. It can help avoid probate, making the transfer of your assets smoother and more private after your death.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow you to name beneficiaries directly. Keeping these designations updated is crucial, as they can override your will.

- Letter of Intent: While not a legally binding document, a Letter of Intent can provide guidance to your executor or loved ones about your wishes, funeral arrangements, or the distribution of personal items. It serves as a personal touch to your estate planning.

- Pet Trust: If you have pets, a Pet Trust ensures they will be cared for according to your wishes after your death. This document can outline who will take care of your pets and how funds should be allocated for their care.

By considering these additional documents alongside your Pennsylvania Last Will and Testament, you can create a comprehensive plan that addresses your financial, medical, and personal wishes. This proactive approach provides peace of mind for you and your loved ones, ensuring that your intentions are clear and respected.

Steps to Filling Out Pennsylvania Last Will and Testament

After obtaining the Pennsylvania Last Will and Testament form, you will need to complete it carefully. This process involves providing essential information about your assets, beneficiaries, and any specific wishes you have regarding your estate. Follow these steps to ensure the form is filled out correctly.

- Start with your personal information. Write your full name, address, and date of birth at the top of the form.

- Identify your beneficiaries. List the names and relationships of the individuals or organizations you wish to inherit your assets.

- Specify your executor. Choose a trusted person to manage your estate and write their name and contact information.

- Detail your assets. Clearly outline your property, bank accounts, investments, and any other valuables you want to include in your will.

- Include specific bequests. If you want to leave particular items or amounts of money to certain people, list these clearly.

- Address guardianship. If you have minor children, name a guardian for them in case of your passing.

- Sign and date the form. Make sure to do this in front of witnesses, as required by Pennsylvania law.

- Have the witnesses sign. They must also provide their names and addresses on the form.

Once you have completed the form, store it in a safe place. Consider sharing its location with your executor or trusted family members. This will ensure that your wishes are followed when the time comes.

Common mistakes

-

Not being specific about beneficiaries. Many people assume that their loved ones will understand what they mean. However, vague descriptions can lead to confusion and disputes.

-

Failing to name an executor. The executor is responsible for carrying out the wishes outlined in the will. Without a designated person, the court may appoint someone who may not align with your intentions.

-

Overlooking the need for witnesses. Pennsylvania law requires that a will be signed in the presence of two witnesses. Neglecting this step can render the will invalid.

-

Not updating the will. Life changes such as marriage, divorce, or the birth of a child can impact your estate plan. Failing to revise your will accordingly can lead to unintended consequences.

-

Using outdated forms. Laws can change, and using an old version of the will form may not comply with current regulations. Always ensure you have the latest version.

-

Neglecting to include a residuary clause. This clause addresses what happens to any assets not specifically mentioned in the will. Without it, those assets may be distributed according to state law rather than your wishes.

-

Failing to consider tax implications. Some assets may be subject to estate taxes. Not factoring this in can lead to unexpected financial burdens for your beneficiaries.

-

Not keeping the will in a safe place. A will should be easily accessible after your passing. Hiding it or placing it in a location that is not known to your loved ones can complicate matters.

Get Clarifications on Pennsylvania Last Will and Testament

What is a Last Will and Testament in Pennsylvania?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. In Pennsylvania, this document allows individuals to specify beneficiaries for their property, appoint guardians for minor children, and designate an executor to manage their estate. It is an essential tool for ensuring that your wishes are respected and that your loved ones are taken care of according to your preferences.

Who can create a Last Will and Testament in Pennsylvania?

In Pennsylvania, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. It is important that the person understands the nature of their decisions and the implications of the will. There are no specific requirements regarding residency, but it is advisable for Pennsylvania residents to follow state laws to ensure the will is valid.

What are the requirements for a valid will in Pennsylvania?

For a will to be considered valid in Pennsylvania, it must meet several criteria:

- The will must be in writing.

- The testator (the person creating the will) must sign the document at the end.

- The signing must be witnessed by at least two individuals who are present at the same time.

- The witnesses should not be beneficiaries of the will to avoid potential conflicts of interest.

It is also advisable to consult with a legal professional to ensure that all state-specific requirements are met.

Can I change or revoke my will in Pennsylvania?

Yes, individuals can change or revoke their will at any time while they are still alive. To make changes, you can either create a new will that explicitly revokes the previous one or add a codicil, which is an amendment to the existing will. It is essential to follow the same formalities required for creating a will to ensure that the changes are legally binding. If you decide to revoke your will, it is best to destroy the original document and any copies to avoid confusion.

What happens if I die without a will in Pennsylvania?

If an individual passes away without a will, they are considered to have died "intestate." In this situation, Pennsylvania's intestacy laws will determine how the deceased's assets are distributed. Typically, the estate will be divided among surviving relatives according to a specific hierarchy, which may not align with the deceased's wishes. This can lead to complications and disputes among family members. Therefore, having a will in place is crucial to ensure that your assets are distributed according to your desires.

Do I need an attorney to create a Last Will and Testament in Pennsylvania?

While it is not legally required to have an attorney to create a will in Pennsylvania, consulting with one is highly recommended. An attorney can provide valuable guidance, help ensure that your will complies with state laws, and assist in addressing complex family situations or specific wishes. Having professional assistance can help avoid potential legal issues in the future, making the process smoother for your loved ones.