Printable Pennsylvania Durable Power of Attorney Template

Find Other Popular Durable Power of Attorney Templates for Specific States

New Jersey Power of Attorney - This document can be tailored for various specific powers, such as selling property or managing investments.

For anyone looking to simplify the management of their vehicle transactions, the Texas Motor Vehicle Power of Attorney form serves as an essential tool, enabling a designated person to act on behalf of the vehicle owner. This process can be particularly beneficial for individuals dealing with situations such as being out of state, experiencing health issues, or simply seeking convenience. To access the necessary documentation and guidance for this process, you can visit OnlineLawDocs.com.

Poa Financial Form - This form helps prevent delays in decision-making during difficult times, ensuring your affairs are in order.

How to Notarize a Power of Attorney in Ohio - Plan ahead—having a Durable Power of Attorney is a proactive step in estate planning.

Does Durable Power of Attorney Cover Medical - Review and update periodically to reflect your current wishes.

Misconceptions

Understanding the Pennsylvania Durable Power of Attorney (DPOA) form is crucial for making informed decisions about your legal and financial matters. Unfortunately, several misconceptions can lead to confusion. Here are ten common misconceptions about the DPOA form in Pennsylvania, along with clarifications.

- A Durable Power of Attorney is only for the elderly. Many people think this document is only necessary for older adults. In reality, anyone over 18 can benefit from having a DPOA, especially if they want to prepare for unexpected situations.

- The DPOA takes away my rights. Some believe that signing a DPOA means they will lose control over their decisions. This is not true. As long as you are capable of making decisions, the DPOA does not limit your rights.

- All powers of attorney are the same. This is a misconception. DPOAs can be tailored to fit specific needs, while other types of powers of attorney may not have the same durability or scope.

- A DPOA is only for financial matters. While many use it for financial decisions, a DPOA can also cover healthcare decisions, depending on how it is drafted.

- My DPOA must be notarized to be valid. In Pennsylvania, a DPOA must be signed by the principal and two witnesses, but it does not necessarily require notarization. However, notarization can add an extra layer of legitimacy.

- Once I sign a DPOA, I cannot change it. This is incorrect. You can revoke or change your DPOA at any time, as long as you are mentally competent to do so.

- The agent must be a lawyer. Many think that only lawyers can serve as agents in a DPOA. In fact, anyone you trust can be your agent, as long as they are at least 18 years old.

- A DPOA is a one-size-fits-all document. This is misleading. Each DPOA can be customized to meet individual needs, allowing you to specify the powers granted to your agent.

- My DPOA will automatically end if I become incapacitated. On the contrary, a DPOA remains effective even if you become incapacitated, which is one of its key features.

- I don’t need a DPOA if I have a will. This is a common misunderstanding. A will only takes effect after your death, while a DPOA is crucial for managing your affairs while you are still alive but unable to make decisions.

By dispelling these misconceptions, individuals can better understand the importance of a Durable Power of Attorney and how it can serve their needs effectively.

Documents used along the form

When considering a Durable Power of Attorney (DPOA) in Pennsylvania, it's essential to understand that this document often works in conjunction with other legal forms. Each document serves a specific purpose and can help ensure that your wishes are honored, especially in matters of health care and financial management. Here’s a list of commonly used forms alongside the DPOA:

- Living Will: This document outlines your preferences for medical treatment in situations where you may not be able to communicate your wishes. It provides guidance to healthcare providers and loved ones regarding life-sustaining measures.

- IRS W-9 Form: This form is crucial for individuals and entities to report their taxpayer identification number, ensuring the proper amount of taxes is reported and paid. For more information, visit smarttemplates.net/fillable-irs-w-9.

- Healthcare Power of Attorney: Similar to a DPOA, this form specifically designates someone to make medical decisions on your behalf if you become incapacitated. It complements the Living Will by allowing a trusted person to interpret your wishes.

- Will: A will is a legal document that specifies how your assets should be distributed upon your death. It can also name guardians for minor children and appoint an executor to manage your estate.

- Revocable Trust: This document allows you to place your assets into a trust during your lifetime, which can then be managed by you or a designated trustee. It helps avoid probate and can provide for your needs if you become incapacitated.

- Advance Directive: This comprehensive document combines elements of a Living Will and a Healthcare Power of Attorney. It details your healthcare preferences and appoints someone to make decisions for you when you cannot.

- Financial Power of Attorney: While the DPOA can cover financial matters, a specific Financial Power of Attorney can give broader powers to someone to manage your financial affairs, including banking, investments, and property management.

- HIPAA Authorization: This form allows you to authorize specific individuals to access your medical records and information. It ensures that your health care agents can make informed decisions based on your medical history.

- Property Deed: If you own real estate, a property deed outlines ownership and can be important for estate planning. It may specify how the property should be handled after your death.

Understanding these documents can empower you to make informed decisions about your future and ensure that your wishes are respected. Consulting with a legal professional can help clarify how these forms work together and assist you in creating a comprehensive plan that meets your needs.

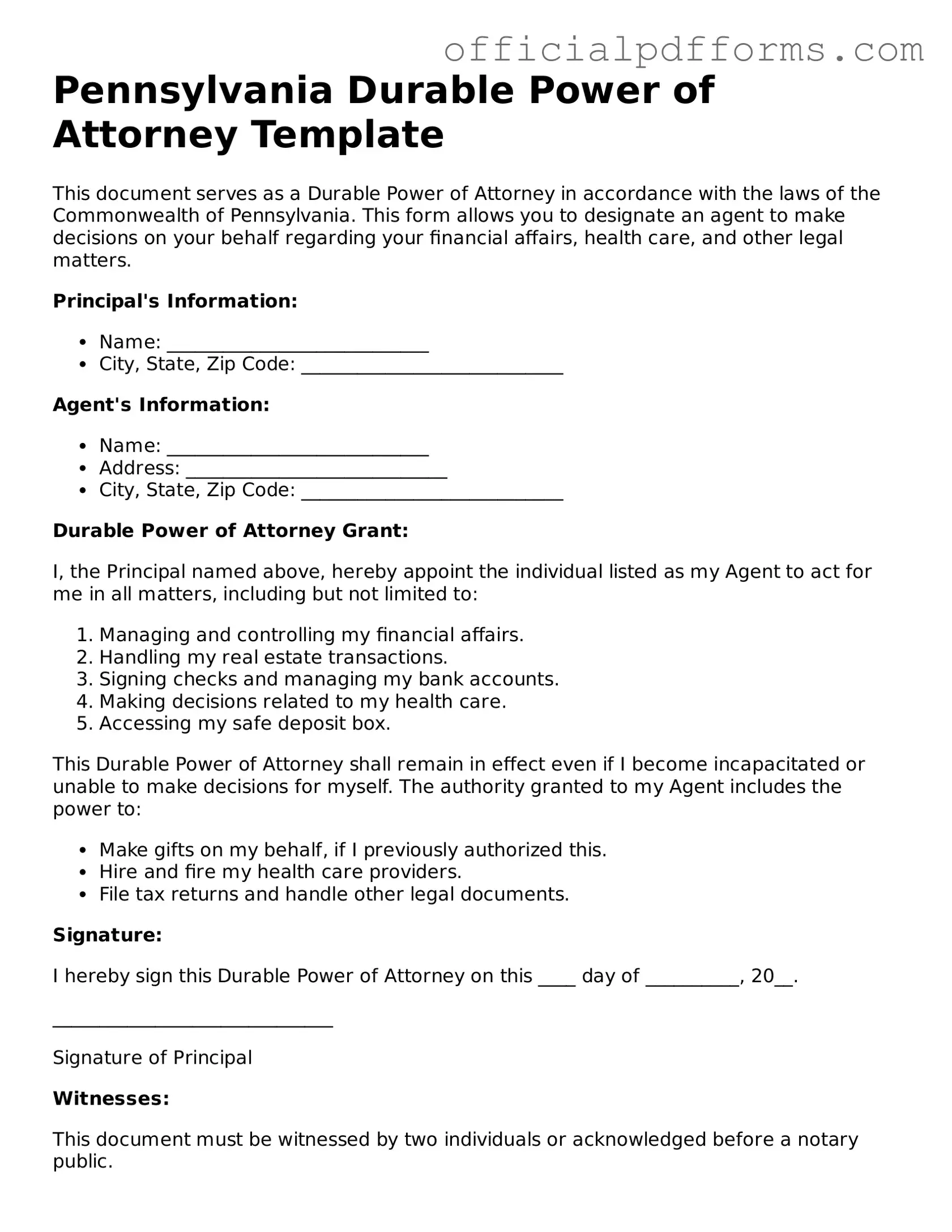

Steps to Filling Out Pennsylvania Durable Power of Attorney

Filling out the Pennsylvania Durable Power of Attorney form is a straightforward process. This document allows you to appoint someone to make decisions on your behalf if you become unable to do so. Follow these steps to complete the form accurately.

- Obtain the Pennsylvania Durable Power of Attorney form. You can find it online or at a local legal office.

- Start by entering your name and address at the top of the form. Ensure that the information is current and accurate.

- Next, identify the person you are appointing as your agent. Provide their full name, address, and contact information.

- Specify the powers you are granting to your agent. You can choose to give them broad authority or limit their powers to specific areas.

- Include any additional instructions or limitations you want to impose on your agent's authority.

- Sign and date the form in the designated area. Your signature must be witnessed by at least one person, who should also sign the form.

- If required, have the document notarized to ensure its validity. This may not be necessary, but it can provide additional legal protection.

- Keep a copy of the completed form for your records. Provide a copy to your agent and any relevant family members or professionals.

Common mistakes

-

Not Specifying Powers Clearly: Many individuals fail to clearly define the powers they wish to grant. This can lead to confusion or disputes later on. It's essential to be specific about what decisions the agent can make.

-

Forgetting to Sign and Date: Some people neglect to sign and date the form. Without a signature, the document is not valid. Ensure that all required signatures are included to avoid issues.

-

Not Having Witnesses or Notarization: Pennsylvania law requires that the Durable Power of Attorney be either witnessed or notarized. Failing to meet this requirement can invalidate the document.

-

Choosing the Wrong Agent: Selecting an agent who may not act in your best interest can be a critical mistake. It’s vital to choose someone trustworthy and capable of handling the responsibilities outlined in the document.

Get Clarifications on Pennsylvania Durable Power of Attorney

What is a Durable Power of Attorney in Pennsylvania?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make financial and legal decisions on your behalf if you become unable to do so. In Pennsylvania, this document remains effective even if you become incapacitated. This means that your appointed agent can continue to manage your affairs without interruption.

Who can be appointed as an agent under a Durable Power of Attorney?

You can choose any competent adult to be your agent. This could be a family member, friend, or trusted advisor. It’s important to select someone who understands your wishes and can act in your best interest. You can also appoint multiple agents to act together or separately, but be aware that this can sometimes lead to confusion or disagreements.

What powers can I grant to my agent?

In Pennsylvania, you can grant your agent a wide range of powers, including:

- Managing bank accounts and investments

- Paying bills and taxes

- Buying or selling property

- Making decisions about your healthcare, if specified

It’s essential to clearly outline the powers you wish to grant. You can choose to give broad authority or limit it to specific tasks.

How do I create a Durable Power of Attorney in Pennsylvania?

Creating a Durable Power of Attorney involves a few straightforward steps:

- Choose your agent carefully.

- Complete the DPOA form, ensuring it meets Pennsylvania's legal requirements.

- Sign the document in the presence of a notary public.

Once completed, keep the original document in a safe place and provide copies to your agent and any relevant financial institutions. It’s wise to review the document periodically to ensure it still reflects your wishes.