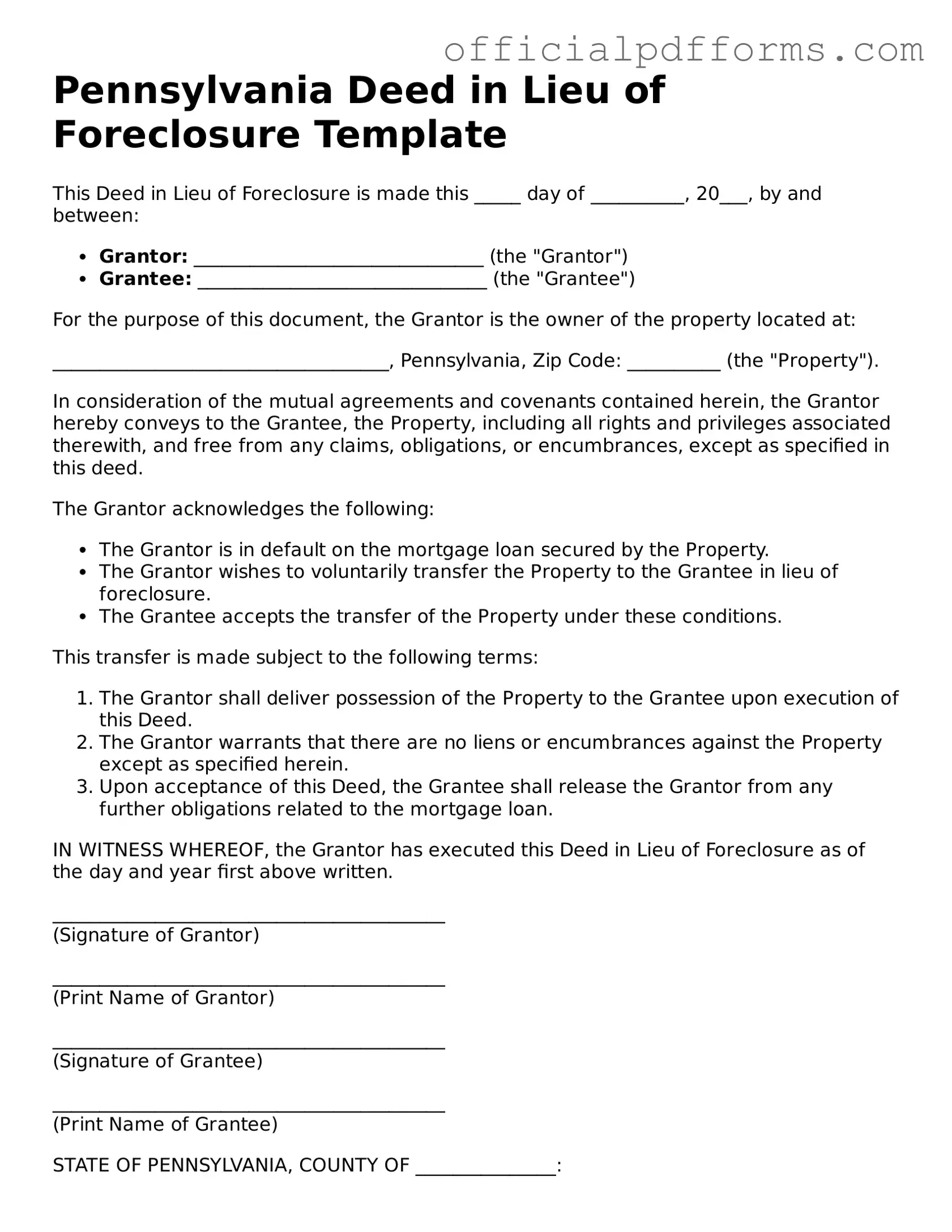

Printable Pennsylvania Deed in Lieu of Foreclosure Template

Find Other Popular Deed in Lieu of Foreclosure Templates for Specific States

Deed in Lieu of Mortgage - Lenders may have specific criteria that borrowers must meet for approval.

Will I Owe Money After a Deed in Lieu of Foreclosure - A Deed in Lieu can simplify the transfer process compared to traditional selling methods.

The New York Trailer Bill of Sale form is a document that records the transfer of ownership of a trailer from the seller to the buyer. It serves as a proof of purchase and is essential for the registration process in New York. This form contains important details of the transaction, ensuring a clear and legal transfer of ownership, and for more information, you can visit OnlineLawDocs.com.

Georgia Foreclosure - A Deed in Lieu may include a walk-through inspection by the lender prior to acceptance.

Misconceptions

Many homeowners facing foreclosure in Pennsylvania may have misconceptions about the Deed in Lieu of Foreclosure process. Here are seven common misunderstandings:

- It eliminates all debt immediately. A Deed in Lieu of Foreclosure does not automatically erase all debt. The lender may still pursue any remaining balance if the property sells for less than the mortgage amount.

- It is a quick fix to avoid foreclosure. While a Deed in Lieu can be faster than a foreclosure process, it still requires negotiation with the lender, which can take time.

- Homeowners can just walk away from their mortgage. This is not true. Homeowners must formally agree to transfer ownership of the property to the lender, which involves specific legal steps.

- It will not affect credit scores. A Deed in Lieu of Foreclosure can negatively impact credit scores, similar to a foreclosure, as it reflects that the homeowner could not meet their mortgage obligations.

- All lenders accept Deeds in Lieu. Not all lenders offer this option. Some may prefer to proceed with foreclosure instead.

- It absolves the homeowner of all liabilities. Homeowners may still be liable for other debts related to the property, such as unpaid property taxes or homeowners association fees.

- It is a simple process. While it may seem straightforward, navigating the legal and financial implications can be complex and often requires professional assistance.

Understanding these misconceptions can help homeowners make informed decisions about their options when facing financial difficulties.

Documents used along the form

A Deed in Lieu of Foreclosure can be a useful option for homeowners facing financial difficulties. However, several other documents may be necessary to complete the process effectively. Here’s a list of forms and documents that are often used alongside the Pennsylvania Deed in Lieu of Foreclosure form.

- Mortgage Agreement: This is the original document that outlines the terms of the loan between the borrower and the lender. It includes details like the loan amount, interest rate, and repayment schedule.

- Notice of Default: This document formally notifies the borrower that they are in default on their mortgage. It typically includes the amount owed and a deadline to remedy the default.

- Loan Modification Agreement: If the borrower and lender agree to change the terms of the original mortgage, this document reflects those changes, such as a lower interest rate or extended repayment period.

- Texas Notice to Quit Form: When addressing lease violations, it's important to utilize a thorough Texas Notice to Quit form guide to ensure proper communication with tenants.

- Release of Liability: This document releases the borrower from any further obligations under the mortgage after the Deed in Lieu is executed, ensuring they are no longer responsible for the debt.

- Property Condition Disclosure: This form requires the borrower to disclose any known issues with the property, which can affect its value and the lender's decision.

- Affidavit of Title: This sworn statement confirms the borrower’s ownership of the property and that there are no other claims against it, providing assurance to the lender.

- Title Insurance Policy: This insurance protects the lender against any claims or defects in the title that may arise after the transfer of ownership.

- Settlement Statement: This document outlines all financial transactions related to the transfer of the property, including any fees or costs incurred during the process.

- Release of Mortgage: Once the Deed in Lieu is accepted, this document officially releases the mortgage lien from the property, clearing the title for the new owner.

- Loan Payoff Statement: This statement details the total amount needed to pay off the existing mortgage, including any fees or penalties, providing clarity for the borrower.

Understanding these documents can help streamline the process of a Deed in Lieu of Foreclosure. Each document plays a vital role in ensuring that both the borrower and lender are protected and that the transfer of property occurs smoothly.

Steps to Filling Out Pennsylvania Deed in Lieu of Foreclosure

After completing the Pennsylvania Deed in Lieu of Foreclosure form, the next steps typically involve submitting the form to the appropriate parties. This usually includes the lender and possibly the local county office. It is important to ensure that all required documents are in order to avoid any delays in the process.

- Obtain the Pennsylvania Deed in Lieu of Foreclosure form from a reliable source, such as the Pennsylvania Department of Community and Economic Development website.

- Fill in the names and addresses of all parties involved, including the borrower and the lender.

- Provide a description of the property. This should include the property's address and any relevant legal descriptions.

- Indicate the date of the deed. This is the date when the form is being signed.

- Sign the form. Ensure that all borrowers sign the document. If there are multiple borrowers, each must provide their signature.

- Have the form notarized. A notary public must witness the signatures to validate the document.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the lender. Follow any specific submission guidelines they may have.

- File the deed with the local county office if required. Check with your county to see if this step is necessary.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. This includes missing names, addresses, or property descriptions. Every section must be filled out accurately to avoid delays.

-

Not Understanding the Terms: Some people do not fully grasp the implications of signing the deed. They may overlook how it affects their credit score or future housing options. It’s essential to read and understand all terms before proceeding.

-

Ignoring Lender Requirements: Each lender may have specific requirements or additional documentation needed. Failing to check these can lead to rejection of the deed. Always confirm what your lender expects.

-

Neglecting Legal Advice: Many individuals skip consulting with a legal professional. This can result in misunderstandings or mistakes that could have been avoided. Seeking guidance ensures that all aspects are considered.

Get Clarifications on Pennsylvania Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Pennsylvania?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option allows the homeowner to settle their mortgage debt without going through the lengthy and costly foreclosure process. By choosing this route, the homeowner may also mitigate some negative impacts on their credit score compared to a foreclosure.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to consider:

- Avoiding Foreclosure: It helps you sidestep the foreclosure process, which can be stressful and time-consuming.

- Less Impact on Credit: A deed in lieu may have a lesser impact on your credit score than a foreclosure.

- Quick Resolution: The process is generally faster than foreclosure, allowing you to move on more quickly.

- Relief from Debt: You can eliminate the mortgage debt associated with the property.

What are the requirements to complete a Deed in Lieu of Foreclosure?

To successfully execute a Deed in Lieu of Foreclosure in Pennsylvania, you typically need to meet the following criteria:

- The property must be your primary residence.

- You must be facing financial hardship, such as job loss or medical expenses.

- You should have tried to sell the property but were unable to do so.

- The lender must agree to the deed in lieu arrangement.

It's important to communicate openly with your lender throughout this process.

How does the process work?

The process generally follows these steps:

- Contact Your Lender: Start by reaching out to your lender to discuss your situation and express your interest in a deed in lieu.

- Submit Required Documentation: Provide necessary documents, such as proof of income and financial hardship.

- Negotiate Terms: Work with your lender to agree on the terms, including any potential deficiency judgments.

- Sign the Deed: Once agreed upon, sign the deed transferring ownership to the lender.

- Complete the Process: The lender will then file the deed, officially transferring ownership.

Each situation is unique, so it’s advisable to consult with a legal professional to ensure you understand the implications and requirements.