Printable Pennsylvania Deed Template

Find Other Popular Deed Templates for Specific States

How to Obtain the Deed to My House - Once executed, a Deed is typically recorded in county records to provide public notice of the transfer.

In addition to its role in defining shipping terms, the FedEx Bill of Lading form can often be accessed and downloaded from various online resources, one of which is https://smarttemplates.net/fillable-fedex-bill-of-lading, providing users with a fillable version that simplifies the process for both shippers and recipients.

Warranty Deed Form Ohio - When selling a property, it’s crucial to provide the correct type of deed.

Nc Deed Transfer Form - A signed Deed becomes enforceable upon acceptance by both parties.

Discharge of Mortgage Form Nj - A properly drafted deed can protect both parties' interests.

Misconceptions

When dealing with the Pennsylvania Deed form, misunderstandings can lead to confusion. Here are seven common misconceptions:

-

All deeds are the same.

Many people think that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with specific uses and protections.

-

A deed must be notarized to be valid.

While notarization is highly recommended for a deed to be enforceable, it is not always a strict requirement in Pennsylvania. However, having a notary can help prevent disputes.

-

You don’t need to record a deed.

Some believe that simply signing a deed makes it valid. However, recording the deed with the county is crucial for public notice and protecting ownership rights.

-

Only attorneys can prepare a deed.

Although it is wise to consult an attorney, individuals can prepare their own deeds. However, they should ensure they follow all legal requirements.

-

Once a deed is signed, it can’t be changed.

People often think that a signed deed is final. In fact, deeds can be amended or revoked, but this process must be done correctly to be legally binding.

-

Deeds are only for transferring property.

While the primary function of a deed is to transfer ownership, it can also be used to create life estates or establish easements, among other purposes.

-

All property transfers require a new deed.

Some assume that every property transfer necessitates a new deed. However, in certain cases, existing deeds can be used, especially in family transfers or when property is placed in a trust.

Understanding these misconceptions can help individuals navigate the complexities of property ownership in Pennsylvania more effectively.

Documents used along the form

When transferring property in Pennsylvania, the Deed form is a crucial document, but it is often accompanied by several other forms and documents that facilitate the process. Each of these documents serves a specific purpose and helps ensure that the transfer is legally sound and properly recorded.

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable transfer taxes. It ensures that the state and local governments receive the correct amount of revenue from the transaction.

- Affidavit of Residence: This document may be needed to confirm the residency status of the seller. It helps clarify whether the property is the seller's primary residence, which can affect tax implications.

- Title Search Report: Conducting a title search is essential to verify that the seller has clear ownership of the property. This report outlines any liens, encumbrances, or claims against the property that could impact the sale.

- Seller’s Disclosure Statement: This statement provides potential buyers with information about the property's condition. Sellers are typically required to disclose known issues, which can help prevent future disputes.

- Operating Agreement: To ensure clarity on management and financial responsibilities, it is essential for LLCs to have an Operating Agreement, which can be obtained from OnlineLawDocs.com.

- Settlement Statement: Also known as a HUD-1, this document details all financial aspects of the transaction. It includes costs associated with the sale, such as closing costs and fees, ensuring transparency for both the buyer and seller.

These documents play a vital role in the property transfer process in Pennsylvania. Ensuring that all necessary forms are completed and submitted can help facilitate a smooth transaction and protect the interests of all parties involved.

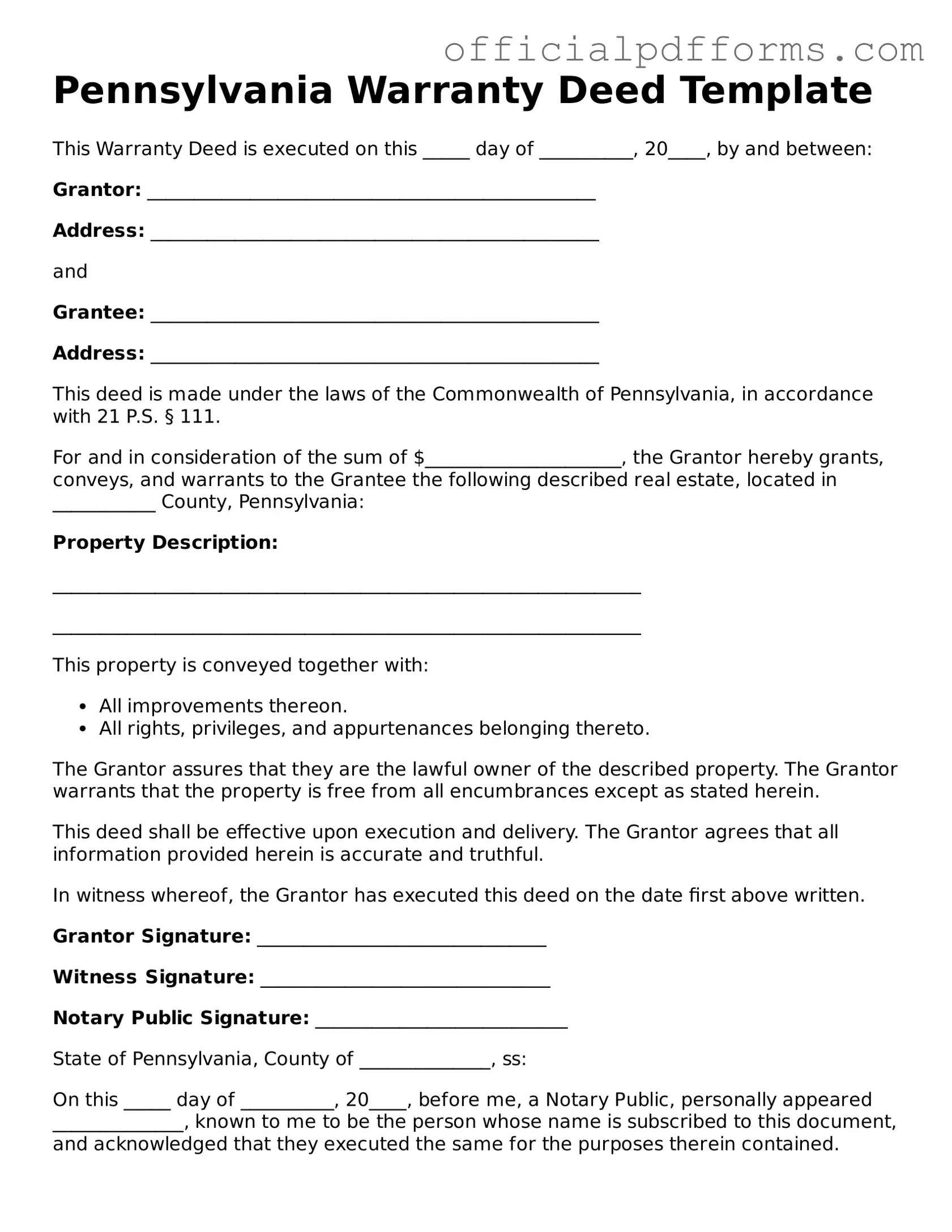

Steps to Filling Out Pennsylvania Deed

Once you have the Pennsylvania Deed form in hand, the next step is to carefully fill it out to ensure that all necessary information is accurately provided. Completing the form correctly is essential for the transfer of property ownership to be legally recognized. Below are the steps to guide you through the process.

- Begin by entering the date at the top of the form. This should reflect the date when the deed is being executed.

- Identify the grantor, who is the current owner of the property. Provide their full name and address in the designated area.

- Next, list the grantee, or the person receiving the property. Include their full name and address as well.

- Clearly describe the property being transferred. This includes the address and any legal descriptions that may apply, such as lot numbers or parcel identifiers.

- Indicate the consideration, or the amount paid for the property, if applicable. This can be a specific dollar amount or a statement indicating that it is a gift.

- Include any additional terms or conditions of the transfer, if necessary. This may involve special agreements or stipulations regarding the property.

- Both the grantor and grantee must sign the form. Ensure that signatures are dated and printed clearly beneath each signature.

- Have the deed notarized. This step is crucial as it adds a layer of authenticity to the document.

- Finally, file the completed deed with the appropriate county office to officially record the transfer of ownership.

Common mistakes

-

Incorrect Names: One common mistake is not using the full legal names of all parties involved. It's essential to ensure that names match exactly with official identification documents.

-

Missing Signatures: All required signatures must be present. Often, individuals forget to sign or have all parties sign in the appropriate places.

-

Improper Notarization: The deed must be notarized correctly. Failing to have a notary public witness the signing can lead to issues with the document's validity.

-

Incorrect Property Description: A precise description of the property is crucial. Mistakes in the legal description can cause confusion and may affect future transactions.

-

Omitting the Consideration Amount: The deed should state the consideration amount, which is the price paid for the property. Omitting this can raise questions about the transaction.

-

Failure to Record the Deed: After completing the deed, it must be recorded with the county recorder's office. Neglecting this step can lead to complications in proving ownership.

-

Not Reviewing Local Requirements: Each county may have specific requirements for deeds. Not checking local regulations can result in additional hurdles or rejection of the deed.

Get Clarifications on Pennsylvania Deed

What is a Pennsylvania Deed form?

A Pennsylvania Deed form is a legal document used to transfer ownership of real estate in Pennsylvania. It outlines the details of the property being transferred, including its legal description, the names of the parties involved, and any relevant terms of the transfer. The deed must be signed and notarized to be valid.

What types of deeds are available in Pennsylvania?

In Pennsylvania, several types of deeds can be used, including:

- Warranty Deed: Guarantees that the grantor has clear title to the property and has the right to sell it.

- Quitclaim Deed: Transfers any interest the grantor may have in the property without any guarantees.

- Special Warranty Deed: Offers limited warranties, only covering the time the grantor owned the property.

How do I fill out a Pennsylvania Deed form?

To fill out a Pennsylvania Deed form, follow these steps:

- Provide the names and addresses of the grantor (seller) and grantee (buyer).

- Include the legal description of the property. This can usually be found on the current deed or tax records.

- State the consideration, or the amount paid for the property.

- Sign the deed in front of a notary public.

Ensure that all information is accurate to avoid issues during the transfer process.

Do I need to have the deed notarized?

Yes, a Pennsylvania Deed must be notarized to be legally valid. The grantor must sign the deed in the presence of a notary public, who will then affix their seal. This step is crucial as it helps prevent fraud and ensures the authenticity of the document.

Where do I file the Pennsylvania Deed form?

The completed Pennsylvania Deed form should be filed with the Recorder of Deeds in the county where the property is located. Filing the deed ensures that the transfer of ownership is officially recorded and becomes part of the public record. There may be a filing fee, so it is advisable to check with the local office for specific requirements.

What happens after I file the deed?

Once the deed is filed, it becomes a public record. The new ownership is officially recognized, and the grantee will receive a copy of the recorded deed. It is important for the grantee to keep this document safe, as it serves as proof of ownership. Additionally, the local tax authority may update their records to reflect the new owner, which can affect property tax assessments.