Printable Pennsylvania Articles of Incorporation Template

Find Other Popular Articles of Incorporation Templates for Specific States

Ga Corporation - It includes the corporation's name, which must be unique and compliant with state rules.

Understanding the importance of a Sample Tax Return Transcript form is crucial, as it not only provides insights into an individual's financial standing but also serves as a valuable resource for various applications, including loan processing and income verification. For more information on this essential document, you can visit OnlineLawDocs.com, which offers detailed guidance on obtaining and utilizing your tax return transcript effectively.

How to Get a Copy of Your Articles of Incorporation - Informed completion of the form can facilitate smooth operational launch.

Misconceptions

When it comes to the Pennsylvania Articles of Incorporation form, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- All businesses must file Articles of Incorporation. Many people think that every type of business needs to file this document. However, only corporations are required to do so. Sole proprietorships and partnerships do not need to file Articles of Incorporation.

- Filing Articles of Incorporation guarantees a successful business. While this form is necessary for legal recognition, it does not ensure that a business will succeed. Success depends on various factors, including planning, management, and market conditions.

- Articles of Incorporation are the same as a business license. This is not true. The Articles of Incorporation establish the existence of a corporation, while a business license permits a business to operate in a specific location.

- You can’t change the Articles of Incorporation once filed. Many believe that these documents are set in stone. In reality, amendments can be made if changes are necessary, such as altering the corporate name or purpose.

- Filing is a one-time process. Some assume that after filing the Articles of Incorporation, no further action is needed. In fact, corporations must also file annual reports and pay franchise taxes to maintain their status.

- Any form of business can use the Articles of Incorporation. This form is specifically for corporations. Other business structures, like LLCs or partnerships, require different forms.

- There is no fee for filing. Some people think that filing Articles of Incorporation is free. However, there is typically a filing fee that varies depending on the type of corporation.

- All information in the Articles is private. Many believe that the details in these documents are confidential. In reality, they are public records, meaning anyone can access them.

- Legal assistance is not necessary. Some think they can fill out the form without help. While it's possible to file independently, consulting a legal expert can help avoid mistakes and ensure compliance with state laws.

Documents used along the form

When forming a corporation in Pennsylvania, the Articles of Incorporation is a crucial document. However, several other forms and documents are often required or recommended to ensure compliance with state laws and to facilitate smooth operations. Here are some of the key documents you may need:

- Bylaws: These are the internal rules that govern how the corporation operates. Bylaws outline the responsibilities of directors, how meetings are conducted, and how decisions are made.

- IRS 2553 Form: This form is essential for small businesses to elect S corporation status for tax purposes, allowing them to be taxed as pass-through entities. Understanding and correctly filing the https://smarttemplates.net/fillable-irs-2553/ is crucial for businesses aiming to benefit from S corporation advantages.

- Organizational Meeting Minutes: After incorporation, the initial board of directors should hold an organizational meeting. The minutes from this meeting document important decisions, such as appointing officers and adopting bylaws.

- Federal Employer Identification Number (EIN): This number is essential for tax purposes. It is required for hiring employees, opening bank accounts, and filing tax returns.

- State Business License: Depending on the nature of the business, a specific license may be required to operate legally in Pennsylvania. This ensures compliance with local regulations.

- Annual Reports: Many corporations must file annual reports with the state. These reports provide updated information about the business and help maintain good standing.

Collecting and submitting these documents alongside the Articles of Incorporation can streamline the incorporation process. Being well-prepared helps ensure that your new corporation is set up for success from the start.

Steps to Filling Out Pennsylvania Articles of Incorporation

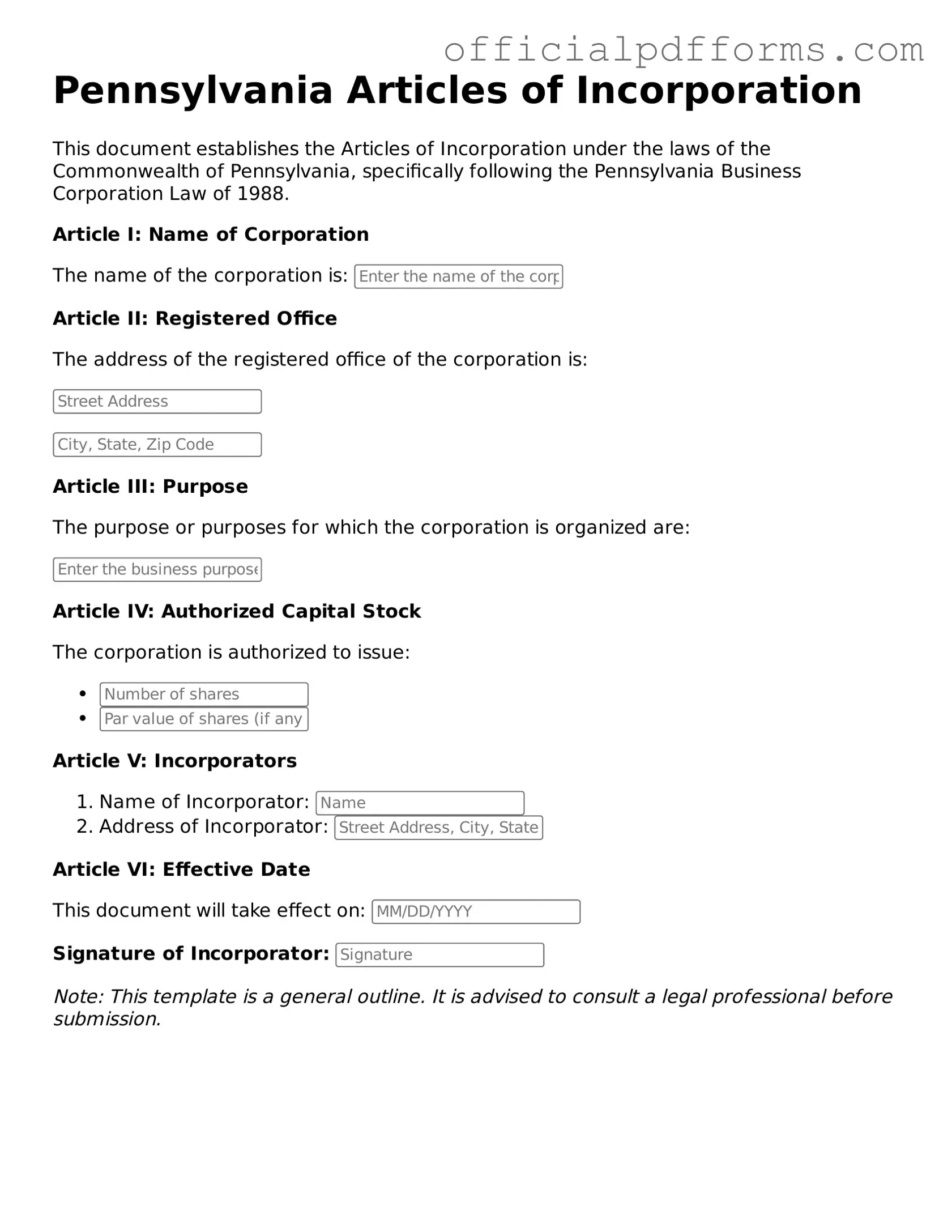

Once you have the Pennsylvania Articles of Incorporation form in hand, it's time to complete it accurately. This document is essential for establishing your business as a corporation in Pennsylvania. Following these steps will ensure that you provide all necessary information clearly and correctly.

- Begin by entering the name of your corporation. Ensure that the name complies with Pennsylvania naming requirements and is unique.

- Fill in the address of the corporation's registered office. This address must be a physical location in Pennsylvania.

- Provide the name and address of the incorporator. This person will be responsible for filing the Articles of Incorporation.

- Indicate the purpose of the corporation. You can state a general purpose or be specific about the business activities.

- Include the number of shares the corporation is authorized to issue. Specify if there are different classes of shares and their respective rights.

- Sign and date the form. The incorporator must sign to validate the document.

- Review the completed form for accuracy and completeness. Double-check all entries to avoid delays.

- Prepare the filing fee. Check the current fee schedule as it may vary.

- Submit the form along with the filing fee to the Pennsylvania Department of State, either online or by mail.

After submitting your Articles of Incorporation, you will receive confirmation from the state. This process typically takes a few days to a couple of weeks, depending on the volume of submissions. Once approved, you can move forward with your business operations.

Common mistakes

-

Omitting Required Information: One of the most common mistakes is failing to provide all necessary details. The Articles of Incorporation form requires specific information such as the corporation's name, registered office address, and the purpose of the business. Missing any of these elements can lead to delays or rejection of the application.

-

Choosing an Inappropriate Name: Selecting a name that is too similar to an existing corporation can cause issues. The name must be unique and not misleading. Conducting a thorough search through the Pennsylvania Department of State’s business name database is essential to avoid this pitfall.

-

Incorrectly Stating the Purpose: The purpose of the corporation must be clearly defined. Some individuals may use vague language or overly broad descriptions. It’s important to be specific about the business activities to avoid complications later on.

-

Neglecting to Include the Registered Agent: Every corporation in Pennsylvania must designate a registered agent. This agent is responsible for receiving legal documents. Failing to list a registered agent or providing incorrect information can lead to legal challenges.

-

Improperly Completing the Form: The Articles of Incorporation form must be filled out correctly. This includes ensuring that all sections are completed accurately and legibly. Errors in spelling, numbers, or signatures can result in processing delays.

-

Ignoring Filing Fees: Each submission of the Articles of Incorporation requires a filing fee. Some individuals forget to include this payment or mistakenly send the wrong amount. This oversight can prevent the application from being processed.

Get Clarifications on Pennsylvania Articles of Incorporation

What is the Pennsylvania Articles of Incorporation form?

The Pennsylvania Articles of Incorporation form is a legal document that establishes a corporation in the state of Pennsylvania. This form is essential for anyone looking to create a corporation, as it provides the state with necessary information about the business. It includes details such as the corporation's name, purpose, registered office address, and the names of the initial directors.

Who needs to file the Articles of Incorporation?

Anyone wishing to start a corporation in Pennsylvania must file the Articles of Incorporation. This includes individuals starting a new business, as well as existing businesses that want to change their structure to a corporation. Non-profit organizations also need to file this form to gain legal recognition.

What information is required on the form?

The Articles of Incorporation form requires several key pieces of information, including:

- The name of the corporation, which must be unique and not already in use.

- The purpose of the corporation, which outlines what the business will do.

- The registered office address in Pennsylvania.

- The names and addresses of the initial directors.

- The number of shares the corporation is authorized to issue, if applicable.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or by mail. If filing online, you can visit the Pennsylvania Department of State's website and complete the form electronically. For mail submissions, you will need to print the completed form and send it to the appropriate address along with the required filing fee. Ensure all information is accurate to avoid delays in processing.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, your corporation is officially recognized by the state. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. After this, you should consider obtaining an Employer Identification Number (EIN) from the IRS, opening a business bank account, and complying with any local business licenses or permits required for your operations.