Fill in a Valid Payroll Check Form

Common PDF Forms

4 Point Inspection Form - Photographs of roof conditions should accompany this assessment to provide visual context.

To facilitate the transfer of motorcycle ownership in Texas, it is crucial to complete a Texas Motorcycle Bill of Sale form, which can be accessed through resources like OnlineLawDocs.com. This document not only details the transaction but also serves as a formal receipt for the buyer, offering peace of mind and legal protection for both parties involved.

Free Printable Physical Exam Forms - Your Social Security Number is required for administrative purposes, including insurance verification.

Gift Certificate Templates - Present the gift of flexibility with our no-hassle gift certificate option.

Misconceptions

Understanding the Payroll Check form is crucial for both employers and employees. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

-

Payroll checks are always issued weekly.

This is not true. The frequency of payroll checks can vary significantly depending on the employer's policies. Some companies pay bi-weekly, while others may opt for monthly payments.

-

Payroll checks are the same as pay stubs.

While both documents relate to employee compensation, they serve different purposes. A payroll check is the actual payment, while a pay stub provides a detailed breakdown of earnings and deductions.

-

All deductions on payroll checks are mandatory.

This misconception overlooks the fact that some deductions, like contributions to retirement plans or charitable donations, may be voluntary. Employees can often choose whether to participate in these programs.

-

Employers can change payroll check amounts at any time.

This is misleading. Changes to payroll checks must typically follow legal guidelines and company policies. Employers must provide notice and, in some cases, obtain employee consent before making adjustments.

-

Payroll checks are only for salaried employees.

In reality, payroll checks are issued to both salaried and hourly employees. Regardless of how an employee is compensated, they receive a payroll check reflecting their earnings.

-

Direct deposit eliminates the need for payroll checks.

While direct deposit is a popular method of payment, it does not entirely eliminate the payroll check. Employees may still receive a paper check if they prefer or if their employer does not offer direct deposit.

-

Payroll checks do not require any record-keeping.

This is a critical error. Both employers and employees should maintain accurate records of payroll checks for tax purposes and to resolve any potential disputes regarding payments.

By clarifying these misconceptions, both employers and employees can better navigate the complexities of payroll processes.

Documents used along the form

When managing payroll, various forms and documents work in tandem with the Payroll Check form to ensure smooth operations and compliance with regulations. Understanding these documents can help streamline the payroll process and enhance accuracy.

- W-4 Form: This form is completed by employees to indicate their tax withholding preferences. It helps employers determine how much federal income tax to withhold from each paycheck.

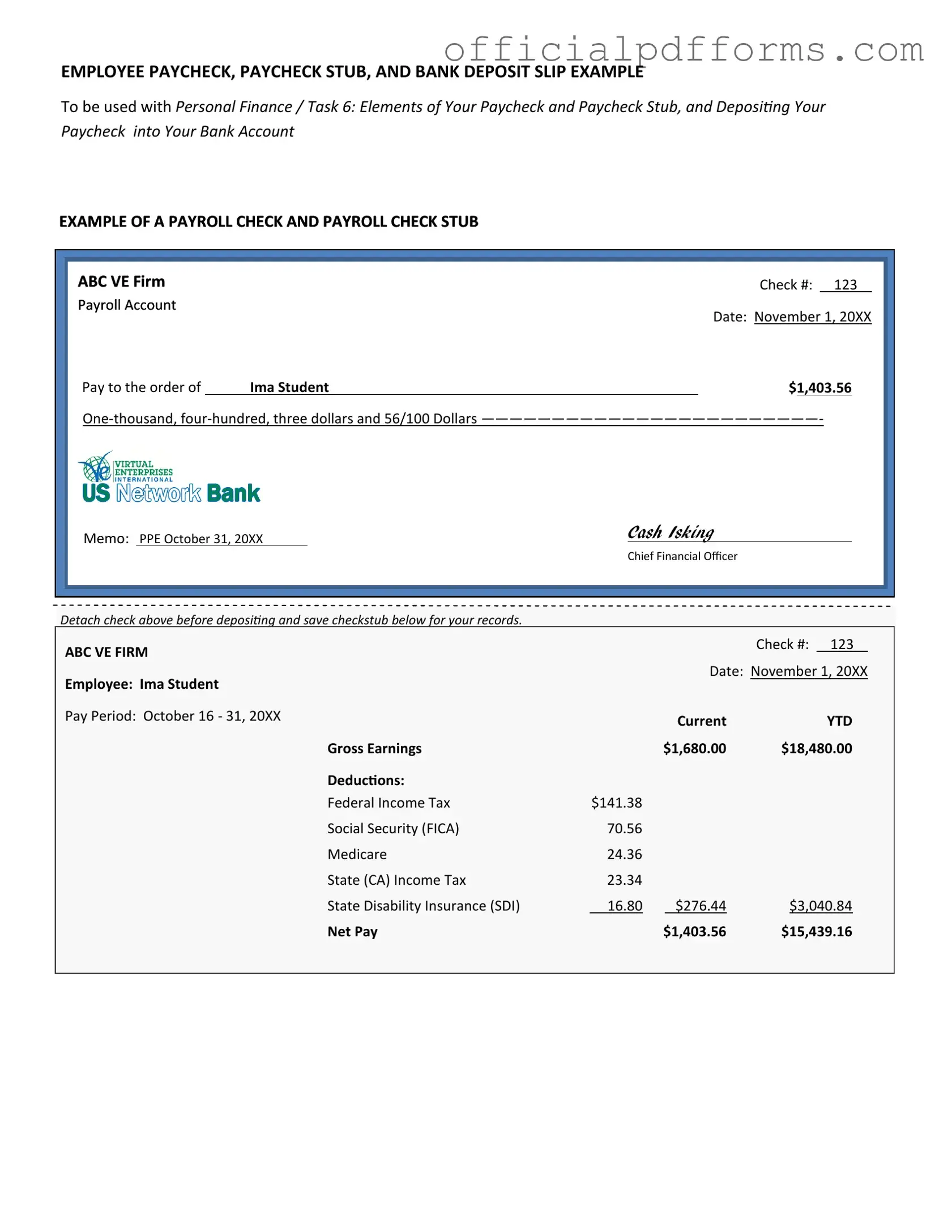

- Paystub: A paystub accompanies the payroll check and provides a detailed breakdown of an employee's earnings, deductions, and net pay for the pay period.

- W-9 Form: This form is necessary for individuals and entities to provide their taxpayer identification number to those who will pay them income, ensuring the correct amount of taxes is reported and paid. For more information, visit https://smarttemplates.net/fillable-irs-w-9/.

- Direct Deposit Authorization Form: Employees fill out this form to authorize their employer to deposit their paycheck directly into their bank account, simplifying the payment process.

- Timesheet: This document tracks the hours worked by employees. It can be used for hourly workers to calculate pay accurately based on the hours logged.

- Employee Information Form: This form collects essential details about the employee, such as their name, address, and Social Security number, which are crucial for payroll processing.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state taxes. Employees complete it to specify their state tax withholding preferences, ensuring compliance with state laws.

- Payroll Register: A payroll register is a summary document that lists all employees, their earnings, deductions, and net pay for a specific pay period, serving as a record for the employer.

By familiarizing yourself with these forms and documents, you can enhance the efficiency of payroll processing. Each plays a vital role in ensuring that employees are paid accurately and on time while maintaining compliance with tax regulations.

Steps to Filling Out Payroll Check

Once you have the Payroll Check form ready, it's time to fill it out carefully. Ensure that all the necessary information is accurate to avoid any issues with processing. Follow these steps to complete the form correctly.

- Start by entering the employee's full name in the designated space at the top of the form.

- Next, write the employee's identification number, which is usually their Social Security Number or employee ID.

- Fill in the pay period dates. Indicate the start and end dates for the period being paid.

- Specify the total hours worked during that pay period in the appropriate box.

- Next, calculate the gross pay by multiplying the hours worked by the employee's hourly rate or entering the agreed salary amount.

- If applicable, deduct any taxes or other withholdings. Enter these amounts in the designated fields.

- Finally, write the net pay, which is the amount the employee will receive after deductions.

- Sign and date the form at the bottom to confirm its accuracy.

Common mistakes

-

Failing to include the correct employee identification number. This number is essential for tax purposes and payroll accuracy.

-

Incorrectly entering the pay period dates. Accurate dates ensure that employees are compensated for the correct timeframe.

-

Not specifying the payment method. Whether it’s a check or direct deposit, clarity is crucial for processing payments.

-

Omitting necessary deductions. Employees might miss out on important benefits if deductions are not accurately calculated.

-

Using outdated tax information. Tax rates can change, and using old information can lead to incorrect withholdings.

-

Neglecting to sign the form. A missing signature can delay the payroll process and cause unnecessary complications.

-

Not double-checking for typos. Simple mistakes can lead to significant issues, such as incorrect payments or delayed processing.

Get Clarifications on Payroll Check

What is a Payroll Check form?

The Payroll Check form is a document used by employers to issue payment to their employees. It outlines the amount earned, deductions, and the net pay that the employee will receive. This form is essential for maintaining accurate records of employee compensation and tax withholdings.

Who needs to fill out the Payroll Check form?

Typically, the Payroll Check form is filled out by the employer or the payroll department. However, employees may need to provide specific information, such as their hours worked or any deductions, to ensure the form is accurate. It's important for both parties to collaborate to avoid any errors.

What information is required on the Payroll Check form?

The Payroll Check form generally requires the following information:

- Employee's name and identification number

- Pay period dates

- Hours worked or salary amount

- Deductions (taxes, benefits, etc.)

- Net pay amount

Providing complete and accurate information helps ensure that employees receive their correct pay on time.

How often is the Payroll Check form issued?

The frequency of issuing the Payroll Check form depends on the employer's payroll schedule. Common pay periods include weekly, bi-weekly, or monthly. Employees should check with their HR department to understand the specific schedule that applies to them.

What should I do if I notice an error on my Payroll Check form?

If you spot an error on your Payroll Check form, it's important to address it promptly. Contact your HR or payroll department immediately. They can guide you through the process of correcting the mistake, whether it's an issue with hours worked, deductions, or any other discrepancies.

Can I receive my pay electronically instead of through a Payroll Check?

Yes, many employers offer direct deposit as an option for receiving pay. This means your earnings can be deposited directly into your bank account. If you're interested in this option, check with your employer to see if it's available and what steps you need to take to enroll.