Valid Partial Release of Lien Document

Consider More Types of Partial Release of Lien Documents

Vehicle Release of Liability Form Pdf - Validates the resolution of vehicle accident claims efficiently.

Fedex Manager - Customers can authorize FedEx to leave packages without a recipient being present on-site.

Understanding the importance of a Release of Liability form is essential for anyone participating in high-risk activities, as it helps clarify the legal responsibilities of both parties involved. For more information, you can visit toptemplates.info/release-of-liability/, which outlines the key elements and benefits of this critical document.

Tattoo Consent Form Pdf - Clients must read and understand all sections of the Tattoo Release form before signing.

Misconceptions

When dealing with the Partial Release of Lien form, several misconceptions can lead to confusion. Here are four common misunderstandings:

- It completely removes the lien from the property. Many believe that a partial release entirely eliminates the lien. In reality, it only releases a portion of the property from the lien, while the remaining area may still be encumbered.

- It is only necessary for large projects. Some think that partial releases are relevant only for significant construction projects. However, any property improvement, regardless of size, can necessitate a partial release if multiple properties are involved.

- It guarantees payment to the contractor. A common belief is that filing a partial release ensures that contractors will be paid. This is not the case; it simply indicates that a specific part of the property is no longer under lien, but does not guarantee payment for work performed.

- It can be done verbally. Some assume that a verbal agreement suffices for a partial release. In fact, a written form is required to properly document the release and protect all parties involved.

Understanding these misconceptions can help navigate the complexities of property liens more effectively.

Documents used along the form

A Partial Release of Lien form is often accompanied by several other documents that help clarify the terms and conditions surrounding a construction project or property transaction. Understanding these related forms can provide a clearer picture of the obligations and rights of all parties involved. Below is a list of common documents used alongside a Partial Release of Lien.

- Notice of Intent to Lien: This document notifies property owners that a lien may be filed if payment is not received for work performed or materials supplied.

- Vehicle Release of Liability: Essential for informing state departments that the seller is no longer liable for any issues related to the vehicle after the sale, this document can be found at smarttemplates.net.

- Mechanic's Lien: A legal claim against a property for unpaid work or materials, this document secures the contractor's right to payment.

- Final Release of Lien: This form is used to indicate that all debts have been settled, releasing the property from any lien claims.

- Contractor's Affidavit: A sworn statement by the contractor confirming that all subcontractors and suppliers have been paid, ensuring no further liens can be filed.

- Subcontractor's Waiver and Release: This document releases the contractor from liability for payment to subcontractors once payment has been made.

- Payment Application: A request for payment submitted by contractors or subcontractors, detailing the work completed and the amount owed.

- Work Completion Certificate: A document that certifies that the work has been completed according to the contract terms, often required for final payment.

- Property Deed: This legal document outlines ownership of the property and may be referenced in lien-related matters to establish rightful ownership.

Understanding these related forms can enhance the comprehension of the lien process and ensure that all parties are protected. Proper documentation is essential in real estate transactions, especially in construction, where financial obligations must be clearly defined and acknowledged.

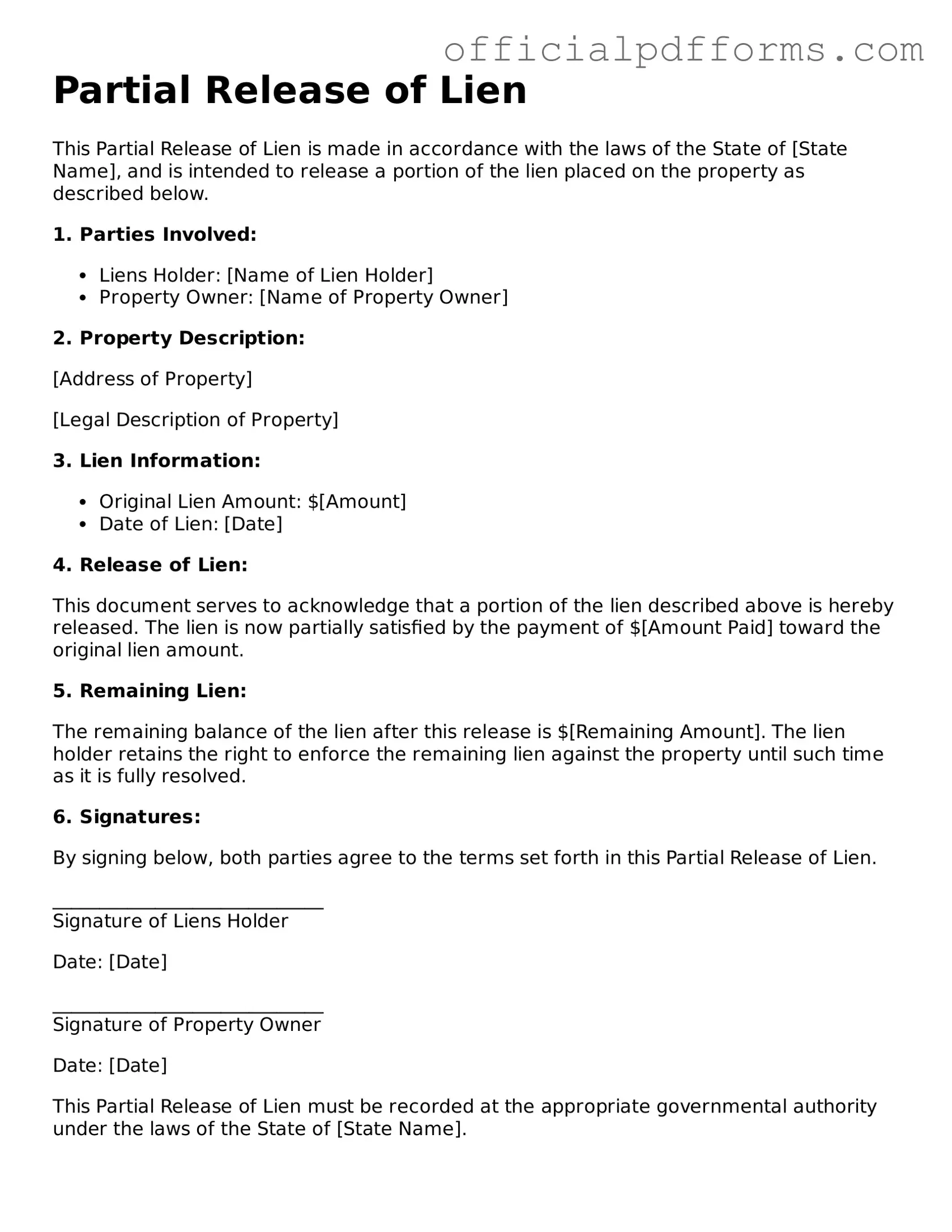

Steps to Filling Out Partial Release of Lien

After you complete the Partial Release of Lien form, you will need to submit it to the appropriate parties involved in the lien. Make sure to keep copies for your records. This will help ensure that everyone is aware of the changes regarding the lien.

- Begin by entering the date at the top of the form.

- Provide the name of the lien claimant in the designated space.

- Write the address of the lien claimant below their name.

- In the next section, fill in the name of the property owner or debtor.

- Enter the address of the property owner or debtor.

- Identify the property by including its legal description or address.

- Specify the amount of the lien that is being released.

- Include any relevant information about the original lien, such as the date it was recorded and the recording number.

- Sign the form where indicated, and include your printed name and title.

- Have the form notarized if required by your state’s laws.

- Make copies of the completed form for your records.

- Submit the form to the appropriate parties, such as the property owner or local recording office.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. This includes the property address, the names of the parties involved, and specific amounts related to the lien. Omitting any of this information can lead to confusion or delays in processing.

-

Incorrect Signatures: Another frequent error occurs when the form is not signed by the correct parties. Ensure that all required signatures are obtained, as a missing signature can invalidate the release. Additionally, the signers should have the authority to release the lien.

-

Not Notarizing the Document: Many people overlook the need for notarization. A Partial Release of Lien often requires a notary to verify the identities of the signers. Failing to have the document notarized can render it unenforceable.

-

Misunderstanding the Scope of Release: Lastly, some individuals misinterpret what the Partial Release of Lien entails. It’s essential to understand that this form only releases a portion of the lien, not the entire amount owed. Miscommunication about the scope can lead to disputes later on.

Get Clarifications on Partial Release of Lien

What is a Partial Release of Lien?

A Partial Release of Lien is a legal document that removes a portion of a lien from a property. This occurs when a debt has been partially paid or when specific obligations have been fulfilled. By executing this document, the lienholder agrees to release their claim on a designated part of the property, allowing for more flexibility in ownership or financing.

When should I use a Partial Release of Lien?

This form is typically used when a property owner has made partial payments on a debt secured by a lien. It can also be applicable when a contractor or subcontractor has completed a portion of their work and wishes to release their claim on that completed work. Common scenarios include:

- Partial payment of a construction loan.

- Completion of specific phases in a construction project.

- Negotiations with a creditor to settle part of a debt.

Who needs to sign the Partial Release of Lien?

The Partial Release of Lien must be signed by the lienholder, which could be a contractor, subcontractor, or financial institution. Additionally, the property owner may need to sign the document to acknowledge the release. This ensures that all parties are aware of the changes to the lien status.

How do I file a Partial Release of Lien?

To file a Partial Release of Lien, follow these steps:

- Complete the Partial Release of Lien form with accurate information.

- Obtain the necessary signatures from the lienholder and property owner.

- File the completed form with the appropriate county or state office where the original lien was recorded.

- Keep a copy of the filed document for your records.

Is there a fee associated with filing a Partial Release of Lien?

Yes, there may be a filing fee associated with submitting a Partial Release of Lien. The fee varies by jurisdiction and can depend on the specific office where the document is filed. It is advisable to check with the local recording office for the exact amount and acceptable payment methods.

What happens if I do not file a Partial Release of Lien?

If a Partial Release of Lien is not filed, the lien will remain in place for the entire amount owed, even if partial payments have been made. This can affect the property owner's ability to sell or refinance the property. It may also lead to complications if the lienholder attempts to enforce the lien for the remaining balance.