Fill in a Valid P 45 It Form

Common PDF Forms

What Is a Bol - This form may also be necessary to satisfy insurance requirements.

To further understand the importance of having a comprehensive Operating Agreement, it is essential to note that it not only governs the internal affairs of an LLC but also serves as a reference point in potential disputes among members. For templates and additional resources, you can visit https://toptemplates.info/, where you will find useful information to guide you in drafting this critical document.

Facial Consent Form Template - This consent allows us to provide tailored facial treatments.

Misconceptions

- Misconception 1: The P45 form is only needed for employees who leave a job voluntarily.

- Misconception 2: The P45 is not important and can be discarded.

- Misconception 3: Employers do not need to provide a P45 if the employee is moving to a new job.

- Misconception 4: The P45 can be completed by the employee.

- Misconception 5: The P45 is only relevant for tax purposes.

- Misconception 6: A P45 is the same as a P60.

This is incorrect. The P45 is required for all employees leaving a job, regardless of the circumstances, including resignations, layoffs, and terminations.

In fact, the P45 is a crucial document. It provides necessary information for tax purposes and is needed when starting a new job or applying for benefits.

This is false. Employers are obligated to issue a P45 when an employee leaves, even if they are moving to another job. The new employer will require this document to ensure proper tax deductions.

The P45 must be completed by the employer. Employees should provide accurate information to their employer to ensure the form is filled out correctly.

While the P45 is primarily a tax document, it also serves as proof of employment and can be necessary for various applications, including loans and housing.

This is not true. A P45 is issued when an employee leaves a job, while a P60 is provided at the end of the tax year, summarizing total pay and deductions for the year.

Documents used along the form

The P45 form is essential when an employee leaves a job. However, there are several other forms and documents that often accompany it. Each of these documents serves a specific purpose and helps ensure a smooth transition for both the employee and the employer.

- P60: This document summarizes an employee's total pay and deductions for the tax year. It is issued at the end of the tax year and is important for tax returns.

- P11D: Employers use this form to report benefits and expenses provided to employees. It is crucial for calculating tax liabilities on non-cash benefits.

- Motor Vehicle Power of Attorney Form: For individuals needing assistance with vehicle transactions, the Motor Vehicle Power of Attorney can simplify the process of handling registrations and titles without being present.

- Jobseeker's Allowance Claim Form: If an employee is unemployed after leaving a job, they may need this form to claim benefits. It helps assess eligibility for financial support.

- P50: This form is used to claim a tax refund when an employee stops working. It is important for those who have overpaid taxes during their employment.

- P85: Employees who leave the UK for work or other reasons can use this form to inform HMRC of their departure. It helps in managing tax affairs while abroad.

- New Employee Form: When starting a new job, employers may require this form to collect personal information from the new hire. It helps set up payroll and tax deductions correctly.

Understanding these forms can simplify the process of leaving a job and transitioning to a new one. Keeping all necessary documents organized will help ensure that everything is handled correctly and efficiently.

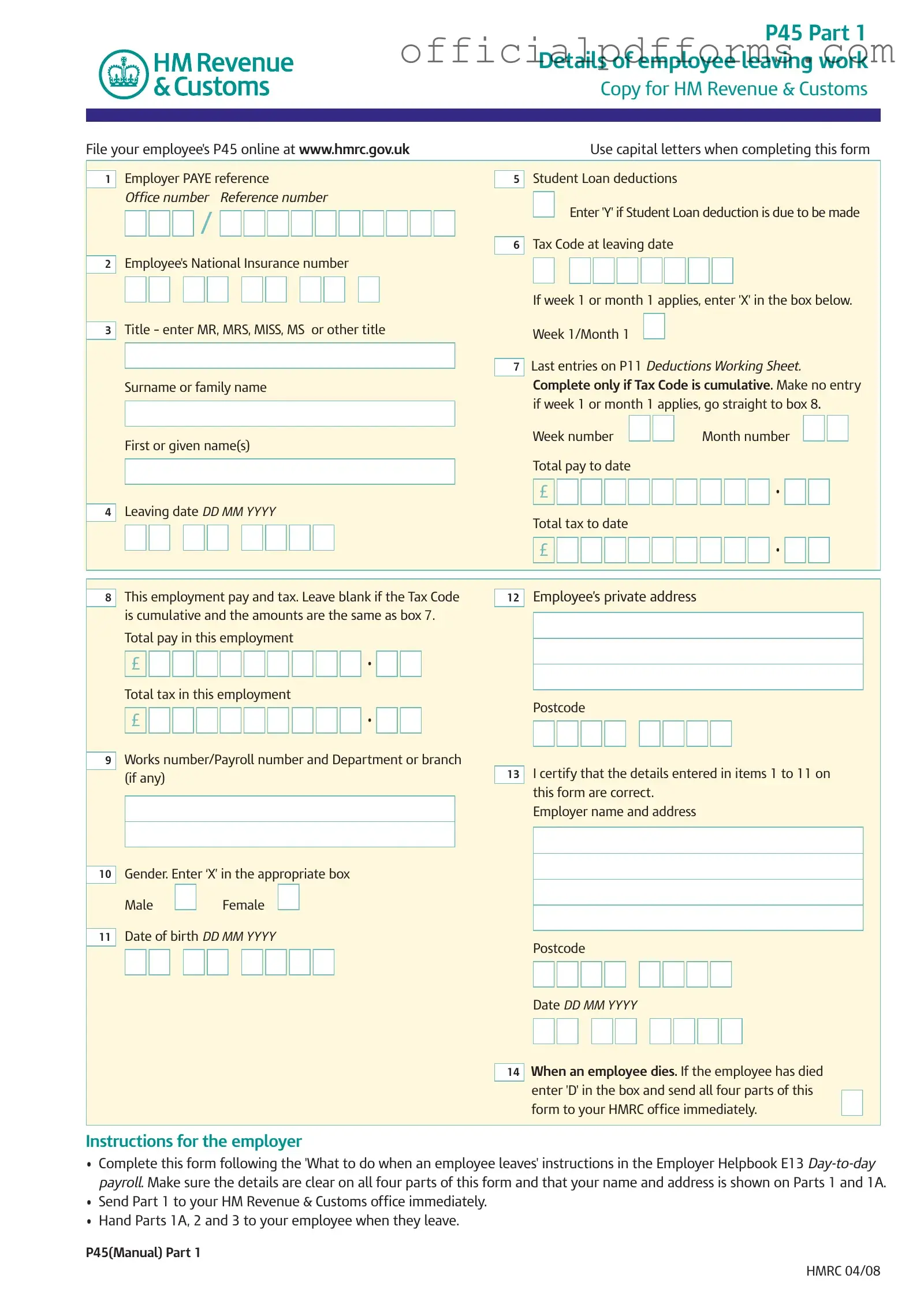

Steps to Filling Out P 45 It

Filling out the P45 It form is a straightforward process. Follow these steps carefully to ensure all necessary information is correctly entered. This will help facilitate a smooth transition for the employee leaving their job.

- Begin with Part 1 of the form. Write the employer's PAYE reference in the designated box.

- Enter the office number and reference number in the respective fields.

- Fill in the employee's National Insurance number.

- Indicate the employee's title (MR, MRS, MISS, MS, or other) in the appropriate box.

- Provide the employee's surname or family name.

- Enter the employee's first or given name(s).

- Record the leaving date in the format DD MM YYYY.

- Input the total pay to date and total tax to date, using the amounts from the last entries on the P11 Deductions Working Sheet.

- Complete the employee’s private address and postcode.

- Indicate the employee's gender by marking ‘X’ in the appropriate box.

- Fill in the employee's date of birth in the format DD MM YYYY.

- Sign and date the form to certify that the details entered are correct.

- If applicable, indicate if the employee has died by entering 'D' in the designated box.

After completing the form, send Part 1 to HM Revenue & Customs immediately. Provide Parts 1A, 2, and 3 to the employee upon their departure. This ensures they have the necessary documentation for their next steps.

Common mistakes

-

Inaccurate Personal Information: Many individuals fail to provide accurate personal details, such as their name, National Insurance number, or date of birth. This can lead to complications in tax records and delays in processing.

-

Incorrect Tax Code Entry: It is common for people to misinterpret their tax code. Entering the wrong tax code can result in incorrect tax deductions, which may require adjustments later.

-

Omitting Student Loan Information: Some individuals neglect to indicate whether they have a student loan deduction. This omission can affect future repayments and tax calculations.

-

Misunderstanding Week 1/Month 1 Rules: Failing to correctly apply the week 1 or month 1 basis can lead to erroneous tax calculations. If applicable, individuals must mark the appropriate box; otherwise, it could result in overtaxation.

-

Failure to Sign and Date: A common mistake is not signing or dating the form. This step is crucial, as it certifies that the information provided is accurate and complete.

Get Clarifications on P 45 It

What is a P45 form and why is it important?

The P45 form is a document issued by an employer when an employee leaves their job. It contains important information about the employee’s earnings and tax contributions during their employment. This form is crucial for both the employee and their new employer. For the employee, it helps ensure that they are taxed correctly in their new job. For the new employer, the P45 provides the necessary details to set up the employee’s tax code and deductions accurately.

What should I do with my P45 once I receive it?

Once you receive your P45, it’s essential to keep it safe as it is a key document for your tax records. Here are a few steps to follow:

- Store it in a safe place, as copies are not available.

- If you start a new job, give Parts 2 and 3 of the P45 to your new employer. This will help them set up your tax correctly.

- If you are claiming Jobseeker's Allowance or Employment and Support Allowance, take your P45 to your Jobcentre Plus office.

By following these steps, you can avoid potential tax issues in the future.

What if I lose my P45?

If you lose your P45, don’t panic. You can request a replacement from your previous employer. They are required to keep records of your employment and should be able to provide you with a new copy. If that’s not possible, you can contact HM Revenue & Customs (HMRC) for guidance on how to proceed. Keep in mind that you may need to provide details about your employment to help HMRC assist you effectively.

What happens if I don’t provide my P45 to my new employer?

Failing to provide your P45 to your new employer can lead to complications with your tax deductions. Without this form, your new employer may use an emergency tax code, which could result in higher tax deductions than necessary. This means you might end up paying too much tax until the correct information is processed. To avoid this situation, it’s best to provide your P45 as soon as you start your new job.