Valid Owner Financing Contract Document

Consider More Types of Owner Financing Contract Documents

Purchase Agreement Addendum - This document is essential for addressing issues pertaining to any third-party involvement in the purchase.

To ensure a smooth transaction, it is essential for potential buyers and sellers to familiarize themselves with the necessary documentation, especially the Minnesota Real Estate Purchase Agreement. This form is not only a legal contract but also a safeguard for both parties, detailing every aspect of the sale. Those interested in navigating the property market should explore resources like All Minnesota Forms to access essential templates and guidelines, further streamlining the purchasing process.

Misconceptions

Owner financing can be a great option for both buyers and sellers, but several misconceptions often arise. Here are five common misunderstandings about owner financing contracts:

- Owner financing is only for buyers with poor credit. Many people believe that owner financing is a last resort for those who cannot qualify for traditional loans. In reality, it can also be an attractive option for buyers with good credit who want to avoid the lengthy bank approval process.

- All owner financing agreements are the same. This is not true. Each owner financing contract can vary significantly based on the terms negotiated between the buyer and seller. It's essential to customize the agreement to fit the specific needs of both parties.

- The seller has no protections in an owner financing deal. Some think that sellers are at a disadvantage in owner financing arrangements. However, sellers can include various protections, such as a due-on-sale clause or the right to foreclose if the buyer defaults on payments.

- Owner financing is always a risky investment. While there are risks involved, owner financing can also be a secure investment for sellers if they conduct thorough due diligence on the buyer and set clear terms in the contract.

- Buyers have to pay a large down payment. Many believe that a hefty down payment is mandatory in owner financing deals. However, down payment amounts can be negotiated and may vary widely depending on the agreement between the buyer and seller.

Understanding these misconceptions can help both buyers and sellers make informed decisions about owner financing contracts.

Documents used along the form

When engaging in owner financing, several documents play a crucial role in ensuring that both parties understand their rights and responsibilities. These documents help to clarify the terms of the agreement and protect the interests of both the buyer and the seller. Below is a list of forms and documents commonly used in conjunction with an Owner Financing Contract.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms. It includes details such as the loan amount, interest rate, and repayment schedule.

- Deed of Trust: This legal document secures the loan by transferring the title of the property to a trustee until the loan is paid off. It protects the lender's interest in the property.

- Disclosure Statement: This form provides important information about the terms of the financing, including any fees or potential risks. It ensures transparency between the parties involved.

- Real Estate Purchase Agreement: This document is essential in a property transaction, outlining terms such as purchase price and contingencies. For an insightful template, you can refer to https://nvforms.com/fillable-real-estate-purchase-agreement-pdf-template.

- Purchase Agreement: This document outlines the terms of the sale, including the purchase price and any contingencies. It serves as the foundation for the owner financing arrangement.

- Title Insurance Policy: This insurance protects the buyer and lender from any issues related to the property’s title. It ensures that the title is clear of any liens or disputes.

- Property Inspection Report: Conducting an inspection can reveal the condition of the property and any necessary repairs. This report helps buyers make informed decisions.

- Escrow Agreement: This document establishes the terms under which an escrow agent will hold funds and documents until all conditions of the sale are met.

- Loan Application: This form collects information about the buyer's financial situation. It helps the seller assess the buyer's ability to repay the loan.

- Amortization Schedule: This schedule details each payment over the life of the loan, including principal and interest breakdowns. It provides clarity on how the loan will be repaid over time.

Using these documents in conjunction with the Owner Financing Contract can facilitate a smoother transaction process. Each form serves a specific purpose, ensuring that both parties are protected and informed throughout the financing arrangement.

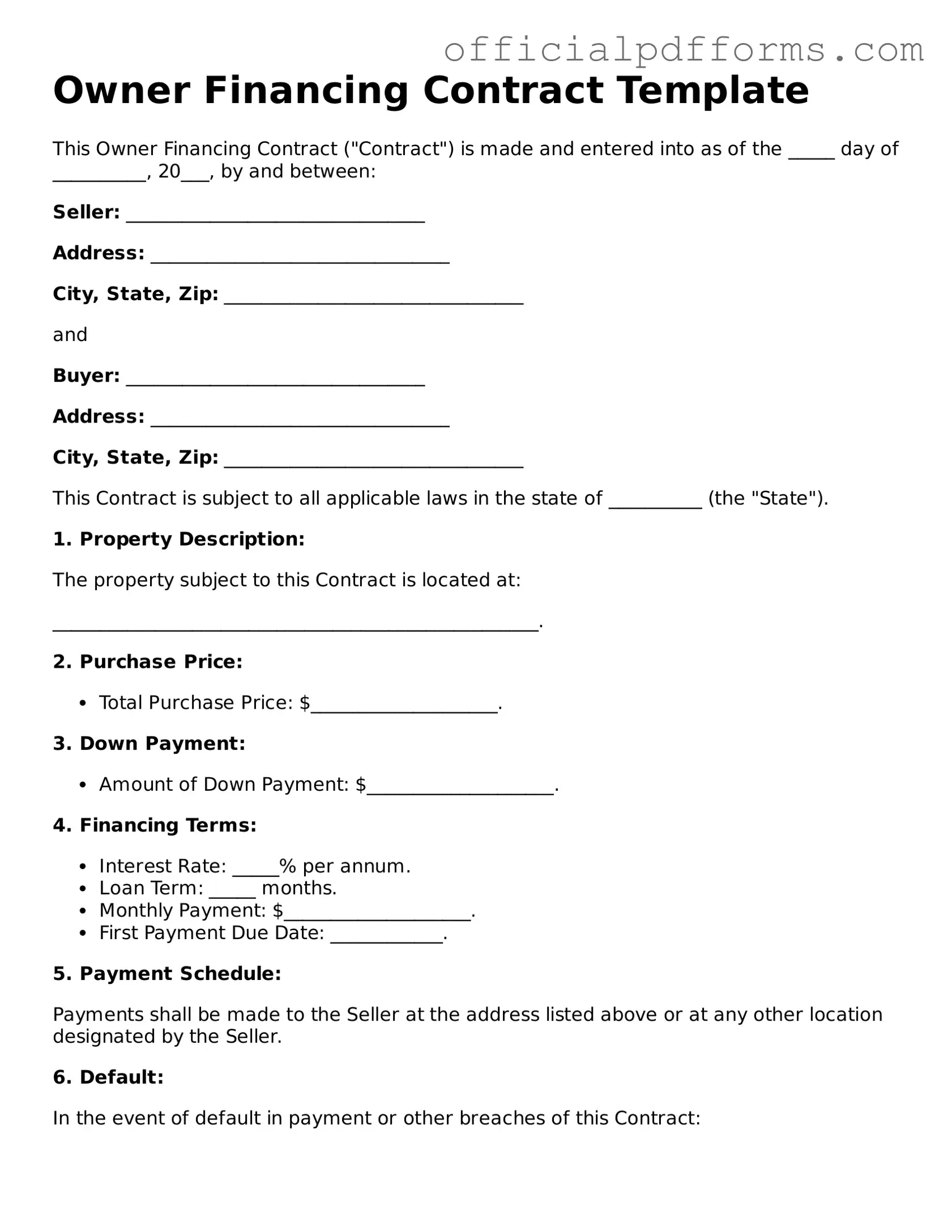

Steps to Filling Out Owner Financing Contract

Filling out the Owner Financing Contract form is a straightforward process. This document is essential for establishing the terms of a financing agreement between the seller and the buyer. Follow these steps carefully to ensure that all necessary information is included and accurate.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of both the seller and the buyer. Make sure to include contact information for both parties.

- Clearly state the property address that is being financed. Include any relevant details about the property.

- Specify the total purchase price of the property. This amount should be clearly stated in both numbers and words.

- Indicate the down payment amount. This is the initial payment made by the buyer.

- Detail the financing terms. Include the interest rate, the loan term, and the monthly payment amount.

- Include any additional terms or conditions that both parties agree upon. This might cover things like maintenance responsibilities or payment schedules.

- Have both parties sign and date the form at the bottom. Ensure that each party receives a copy of the signed contract.

Once the form is completed, review it carefully to confirm that all information is correct. Both parties should retain a copy for their records. This agreement will guide the financing process and protect the interests of everyone involved.

Common mistakes

-

Failing to provide accurate personal information. Buyers and sellers must ensure that their names, addresses, and contact details are correct.

-

Neglecting to specify the purchase price. It is essential to clearly state the total amount being financed to avoid misunderstandings.

-

Omitting the interest rate. The contract should include the interest rate applicable to the financing agreement, as this affects monthly payments.

-

Not detailing the payment schedule. Buyers and sellers should outline the frequency of payments, whether monthly, quarterly, or annually.

-

Forgetting to include the term of the loan. Clearly defining the duration of the financing is crucial for both parties.

-

Failing to address late payment penalties. Including terms regarding penalties for late payments can help prevent future disputes.

-

Not specifying the consequences of default. It is important to outline what will happen if either party fails to meet their obligations under the contract.

-

Overlooking the need for signatures. Both parties must sign and date the contract for it to be legally binding.

Get Clarifications on Owner Financing Contract

What is an Owner Financing Contract?

An Owner Financing Contract is an agreement between a property seller and a buyer that allows the buyer to purchase the property directly from the seller without involving traditional mortgage lenders. In this arrangement, the seller acts as the bank, providing financing to the buyer. This can be beneficial for buyers who may not qualify for a conventional loan, and it can offer sellers a way to sell their property more quickly.

What are the key terms included in an Owner Financing Contract?

Key terms in an Owner Financing Contract typically include:

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Down Payment: The initial amount the buyer pays upfront, which reduces the overall loan amount.

- Interest Rate: The rate at which interest will be charged on the remaining balance, which can be fixed or variable.

- Repayment Schedule: This outlines how often the buyer will make payments and for how long.

- Default Terms: Conditions under which the seller can take back the property if the buyer fails to make payments.

What are the advantages of using an Owner Financing Contract?

Owner financing can offer several advantages for both parties:

- Flexibility: Sellers can negotiate terms that suit their financial needs, while buyers may find it easier to meet the seller's requirements than those of a bank.

- Faster Transactions: Without the lengthy approval process of traditional financing, transactions can close more quickly.

- Potential Tax Benefits: Sellers may benefit from capital gains tax deferral, while buyers can sometimes deduct interest payments on their taxes.

Are there any risks associated with Owner Financing Contracts?

Yes, there are risks to consider. For buyers, the main risk is the potential for foreclosure if they fail to make payments. Sellers also face risks, such as the buyer defaulting on the loan. Additionally, if the buyer does not maintain the property, it could decrease in value, affecting the seller's investment. It’s crucial for both parties to fully understand the terms and seek legal advice if necessary to mitigate these risks.