Valid Operating Agreement Document

Operating Agreement Forms for Individual US States

Operating Agreement Document Subtypes

Fill out Popular Documents

Rent Increase Letter Template - Helps landlords provide rationale for their pricing decisions.

A Bill of Sale in Arizona is a legal document that records the transfer of ownership of personal property from one party to another. This form outlines key details such as the buyer's and seller's information, a description of the item, and the sale price. To ensure a smooth transfer, consider filling out the form by clicking on the provided Bill of Sale form.

Rental Verification Form - Provide information about care and maintenance of the rental unit.

Test Drive Form Pdf - The dealership is not responsible for personal belongings left inside the vehicle.

Misconceptions

Understanding the Operating Agreement form is crucial for anyone involved in a business partnership or LLC. However, several misconceptions can lead to confusion. Here are six common misconceptions:

-

Operating Agreements are optional for LLCs.

Many believe that LLCs do not need an Operating Agreement. While it's true that some states allow LLCs to operate without one, having an Operating Agreement is highly recommended. It clarifies ownership and management roles, helping to prevent disputes.

-

All Operating Agreements are the same.

This misconception overlooks the fact that Operating Agreements can vary significantly based on the needs of the business and its members. Each agreement should be tailored to reflect the specific goals and structure of the LLC.

-

Once created, an Operating Agreement cannot be changed.

Some individuals think that an Operating Agreement is set in stone. In reality, members can amend the agreement as needed, provided that the process for doing so is outlined within the document itself.

-

Operating Agreements are only for multi-member LLCs.

This belief is incorrect. Even single-member LLCs can benefit from having an Operating Agreement. It helps establish the business as a separate entity and can provide clarity regarding management and operational procedures.

-

Operating Agreements are only necessary for legal purposes.

While legal compliance is important, Operating Agreements serve a broader purpose. They also facilitate smooth business operations by outlining procedures for decision-making, profit distribution, and conflict resolution.

-

You can use a generic template for any Operating Agreement.

Using a one-size-fits-all template can lead to issues. Each business has unique needs, and a generic template may not address specific circumstances or state laws, potentially leading to complications down the line.

Being aware of these misconceptions can help ensure that you create a comprehensive and effective Operating Agreement that meets the needs of your business.

Documents used along the form

An Operating Agreement is a vital document for any LLC, outlining the management structure and operational procedures. However, several other forms and documents often accompany it to ensure comprehensive governance and compliance. Below is a list of some common documents that you may encounter alongside an Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create your LLC. It includes essential information such as the name of the business, its address, and the names of its members.

- Member Resolutions: These are formal decisions made by the members of the LLC. They can cover various topics, such as approving significant expenditures or changes in membership.

- Bylaws: While not always required for LLCs, bylaws can provide additional guidelines on how the business operates. They often include rules for meetings, voting procedures, and member responsibilities.

- Membership Certificates: These documents serve as proof of ownership in the LLC. They can help clarify each member's stake in the business and can be useful for transferring ownership.

- Articles of Incorporation: This document is crucial for establishing a corporation in California and must be filed with the California Secretary of State. It provides key information about the business, including its name, purpose, and management structure. For those seeking templates, visit Free Business Forms.

- Financial Statements: Regular financial statements, such as balance sheets and income statements, are essential for tracking the financial health of the LLC. They can also be crucial for tax purposes.

- Tax Forms: Depending on the structure of your LLC, you may need to file specific tax forms with the IRS and state tax authorities. These forms help ensure compliance with tax regulations.

Each of these documents plays a significant role in the overall operation and governance of an LLC. Understanding their purpose can help you manage your business more effectively and maintain compliance with legal requirements.

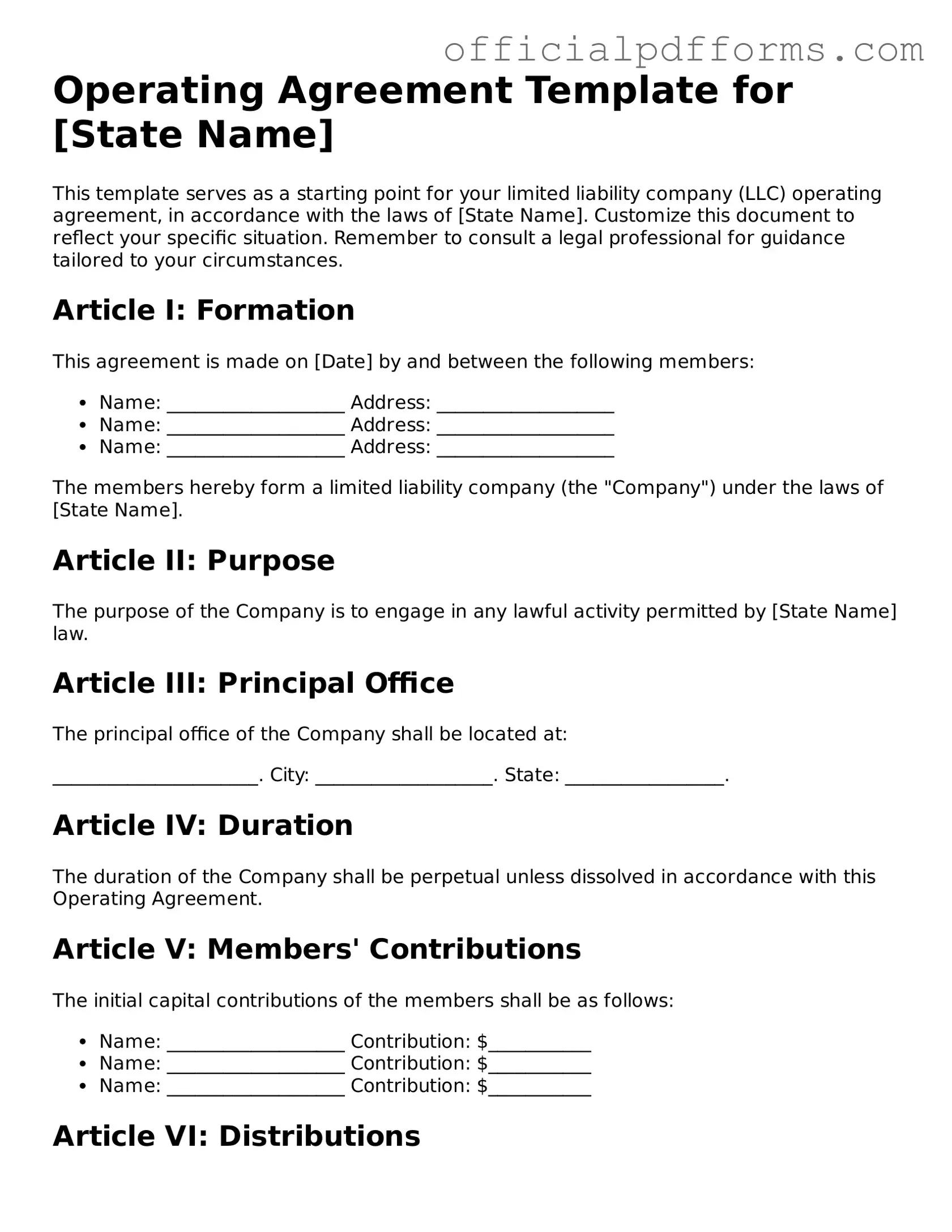

Steps to Filling Out Operating Agreement

Once you have gathered all necessary information, you can proceed to fill out the Operating Agreement form. This document will help outline the management structure and operational guidelines for your business. Follow these steps carefully to ensure that all sections are completed accurately.

- Begin with the name of your LLC. Write the full legal name as registered with the state.

- Provide the principal office address. This should be a physical location where the business operates.

- List the names and addresses of all members. Include each member's full name and their respective addresses.

- Specify the management structure. Indicate whether the LLC will be managed by members or designated managers.

- Outline the percentage of ownership for each member. Clearly state how much of the LLC each member owns.

- Detail the capital contributions. Document what each member is contributing to the business, whether it be cash, property, or services.

- Include the profit and loss distribution. Explain how profits and losses will be allocated among members.

- State the rules for meetings. Specify how often meetings will occur and the notice required for members.

- Define the process for adding or removing members. Clearly outline how changes in membership will be handled.

- Conclude with the signatures of all members. Each member should sign and date the document to validate it.

Common mistakes

-

Failing to include all members' names and addresses. Every member of the LLC should be clearly identified to avoid confusion.

-

Not specifying the ownership percentages. Clearly outlining how much of the company each member owns helps prevent disputes.

-

Omitting the management structure. It is important to define whether the LLC will be member-managed or manager-managed.

-

Neglecting to outline the decision-making process. A clear process for how decisions will be made can help streamline operations.

-

Not including provisions for adding new members. This can lead to complications if the business grows and new members need to be brought on board.

-

Failing to address member withdrawal or termination. It is essential to have a plan in place for what happens if a member leaves the LLC.

-

Ignoring the distribution of profits and losses. Clearly stating how profits and losses will be shared can prevent misunderstandings later.

-

Not including a dispute resolution process. Having a method for resolving conflicts can save time and resources in the long run.

-

Using vague language. Clear and specific language helps ensure that all members understand their rights and responsibilities.

-

Failing to review and update the agreement regularly. As the business evolves, the Operating Agreement should be revisited to reflect any changes.

Get Clarifications on Operating Agreement

What is an Operating Agreement?

An Operating Agreement is a crucial document for limited liability companies (LLCs). It outlines the management structure, operational procedures, and the rights and responsibilities of the members. While not always legally required, having an Operating Agreement can help prevent misunderstandings among members and provide a clear framework for decision-making.

Why is an Operating Agreement important?

The importance of an Operating Agreement cannot be overstated. It serves several key purposes:

- Defines the roles of each member, ensuring everyone understands their responsibilities.

- Establishes procedures for handling disputes, which can save time and money in the long run.

- Provides guidelines for profit distribution, ensuring transparency among members.

- Helps protect the limited liability status of the LLC by demonstrating that it is a separate legal entity.

Who should create the Operating Agreement?

All members of the LLC should collaborate to create the Operating Agreement. It is vital that every member's input is considered to foster a sense of ownership and commitment. While members can draft the agreement themselves, consulting with a legal professional can ensure that the document complies with state laws and adequately addresses the specific needs of the business.

What should be included in an Operating Agreement?

An effective Operating Agreement should cover a variety of topics, including:

- The name and purpose of the LLC.

- The names and addresses of the members.

- Capital contributions from each member.

- Management structure and voting rights.

- Procedures for adding or removing members.

- Distribution of profits and losses.

- Dispute resolution mechanisms.

Can an Operating Agreement be amended?

Yes, an Operating Agreement can be amended. In fact, it is often necessary to update the agreement as the business evolves. Members should establish a clear process for making amendments, which may include a specific voting requirement or the need for written consent from all members. Documenting any changes is essential to maintain clarity and legal integrity.

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it may be subject to default rules set by state law. These rules can vary significantly and may not reflect the members' intentions or preferences. Without a clear agreement, members might face challenges in decision-making, profit distribution, and resolving disputes, potentially leading to legal complications down the line.