Printable Ohio Transfer-on-Death Deed Template

Find Other Popular Transfer-on-Death Deed Templates for Specific States

Does Pennsylvania Have a Transfer on Death Deed - A Transfer-on-Death Deed is typically a one-time filing and does not need to be renewed annually.

In addition to serving as a contract, the FedEx Bill of Lading form also plays a vital role in ensuring that shippers are aware of their responsibilities and can easily access necessary resources related to their shipments. For those looking for a convenient way to manage this process, it's useful to explore tools available online, such as smarttemplates.net/fillable-fedex-bill-of-lading/, which can aid in efficiently filling out and processing the required documentation.

Transfer on Death Deed Illinois Cost - A highly personalized approach to transferring property to loved ones.

Misconceptions

The Ohio Transfer-on-Death Deed (TOD) is a tool that allows individuals to transfer real estate to beneficiaries upon their death without going through the probate process. However, several misconceptions surround this deed that can lead to confusion and misinformed decisions. Below are six common misconceptions about the Ohio Transfer-on-Death Deed form, along with clarifications.

- It automatically transfers property upon signing. Many believe that simply signing the TOD deed results in an immediate transfer of property. In reality, the transfer only occurs upon the death of the property owner.

- It can only be used for single-family homes. Some individuals think that the TOD deed is limited to residential properties. However, it can be used for various types of real estate, including commercial properties and vacant land.

- Once a TOD deed is created, it cannot be changed. This misconception suggests that the deed is set in stone once executed. In fact, the property owner retains the right to revoke or modify the deed at any time before their death.

- Beneficiaries automatically assume ownership responsibilities. There is a belief that beneficiaries take on ownership responsibilities immediately after the property owner’s death. In truth, they do not have legal ownership or responsibilities until the transfer is formally completed.

- The TOD deed avoids all taxes. Some think that using a TOD deed completely bypasses tax obligations. While it can help avoid probate taxes, beneficiaries may still be subject to income or property taxes upon receiving the property.

- It is only useful for wealthy individuals. There is a notion that the TOD deed is only beneficial for those with substantial assets. In reality, it can be a valuable estate planning tool for anyone who wishes to simplify the transfer of their property, regardless of wealth.

Understanding these misconceptions is crucial for anyone considering the use of a Transfer-on-Death Deed in Ohio. By clarifying these points, individuals can make informed decisions that align with their estate planning goals.

Documents used along the form

The Ohio Transfer-on-Death Deed form is a useful tool for individuals looking to transfer real estate to beneficiaries upon their death without the need for probate. However, several other documents may accompany this form to ensure a smooth transfer process and clarify intentions. Below are five commonly used documents in conjunction with the Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets, including property, should be distributed after their death. It can complement the Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Affidavit of Death: This document serves as proof of the death of the property owner. It may be required by the county recorder's office to finalize the transfer of property to the beneficiaries.

- New York Residential Lease Agreement: For those renting property in New York, it is important to have a OnlineLawDocs.com to ensure all terms are legally binding and clear.

- Beneficiary Designation Form: Often used for financial accounts and insurance policies, this form allows individuals to name beneficiaries directly. It ensures that these assets are transferred outside of probate, similar to the Transfer-on-Death Deed.

- Power of Attorney: A legal document that grants someone the authority to act on behalf of another person in legal or financial matters. This can be important if the property owner becomes incapacitated before their death.

- Title Search Report: This report provides a detailed history of the property title. It confirms ownership and identifies any liens or claims against the property, which is essential before executing a transfer.

Using these documents in conjunction with the Ohio Transfer-on-Death Deed can help clarify intentions and ensure a seamless transfer of property to beneficiaries. Always consider consulting with a professional to ensure all necessary documents are prepared correctly.

Steps to Filling Out Ohio Transfer-on-Death Deed

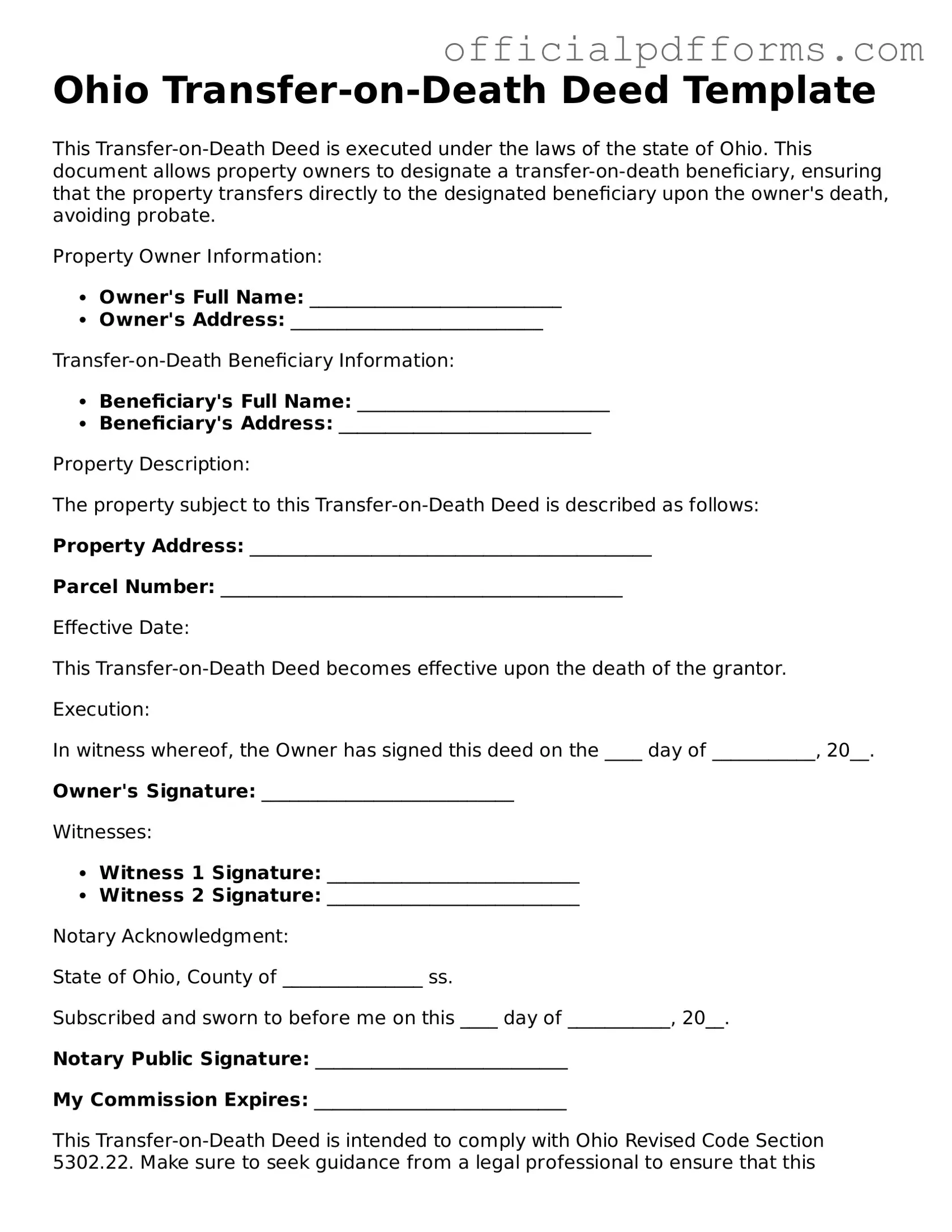

After obtaining the Ohio Transfer-on-Death Deed form, it’s essential to fill it out accurately to ensure the smooth transfer of property upon death. This process involves providing specific information about the property and the beneficiaries. Following these steps will guide you through completing the form correctly.

- Obtain the form: Download or request a physical copy of the Ohio Transfer-on-Death Deed form from a reliable source.

- Identify the property: Clearly describe the property you wish to transfer. Include the address and any relevant legal descriptions.

- Provide your information: Fill in your name and address as the current owner of the property. Ensure this information is accurate.

- List the beneficiaries: Enter the names and addresses of the individuals or entities you want to inherit the property. Make sure to include all intended beneficiaries.

- Sign the form: You must sign the deed in the presence of a notary public. This step is crucial for the deed to be legally valid.

- Notarization: Have the notary public complete their section on the form, confirming your identity and the authenticity of your signature.

- File the deed: Submit the completed and notarized form to the county recorder’s office where the property is located. Be aware of any filing fees that may apply.

Once you have submitted the deed, it will be recorded in the public records. This step ensures that your wishes regarding the transfer of the property are documented and legally recognized. It’s advisable to keep a copy for your records and to inform the beneficiaries about the deed and its implications.

Common mistakes

-

Incomplete Information: One common mistake is not filling in all required fields. Ensure that names, addresses, and property details are fully completed.

-

Incorrect Property Description: Failing to accurately describe the property can lead to confusion. Use the legal description found in the property deed.

-

Not Notarizing the Deed: A Transfer-on-Death Deed must be notarized to be valid. Forgetting this step can render the document ineffective.

-

Improper Witness Signatures: If the deed requires witnesses, ensure they are present during the signing. Missing signatures can cause issues later.

-

Filing in the Wrong County: The deed must be filed in the county where the property is located. Filing it elsewhere can complicate the transfer process.

-

Not Updating the Deed: Life changes, such as marriage or divorce, may require updates to the deed. Failing to make these changes can lead to disputes.

-

Overlooking Tax Implications: Some individuals forget to consider the tax consequences of transferring property. Consult a tax professional for guidance.

-

Neglecting to Inform Beneficiaries: It’s important to communicate with those named in the deed. Surprises can lead to misunderstandings or conflicts.

-

Using Incorrect Forms: Ensure you are using the latest version of the Transfer-on-Death Deed form. Outdated forms may not be accepted.

-

Failing to Keep Copies: Always keep copies of the signed deed for your records. This can be crucial for future reference and verification.

Get Clarifications on Ohio Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Ohio?

A Transfer-on-Death Deed (TOD) is a legal document that allows a property owner to designate one or more beneficiaries who will automatically receive the property upon the owner's death. This process helps avoid probate, making the transfer of property smoother and quicker for the beneficiaries. The deed must be recorded with the county recorder's office to be valid.

Who can create a Transfer-on-Death Deed?

Any individual who is the sole owner or a co-owner of real estate in Ohio can create a Transfer-on-Death Deed. The property owner must be of sound mind and at least 18 years old. Additionally, the deed can be used for various types of property, including residential, commercial, and vacant land.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, follow these steps:

- Obtain the appropriate form from your county recorder's office or a reliable legal forms website.

- Fill in the required information, including the property description, your name, and the names of the beneficiaries.

- Sign the deed in front of a notary public.

- File the completed deed with the county recorder's office where the property is located.

Make sure to keep a copy of the filed deed for your records.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must complete a new TOD deed or a revocation form and file it with the county recorder's office. It is important to ensure that any changes are properly recorded to avoid confusion later.

What happens if a beneficiary predeceases me?

If a beneficiary named in your Transfer-on-Death Deed passes away before you, their share of the property will generally go to their heirs, unless the deed specifies otherwise. If you want to ensure that the property goes to someone else in such a case, consider updating the deed to reflect your wishes.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, transferring property through a Transfer-on-Death Deed does not trigger immediate tax consequences for the property owner. However, beneficiaries may be responsible for property taxes once they inherit the property. It is advisable to consult a tax professional to understand the specific implications based on your situation.

Is legal assistance necessary to create a Transfer-on-Death Deed?

While it is possible to create a Transfer-on-Death Deed without legal assistance, consulting with an attorney can provide peace of mind. An attorney can help ensure that the deed is completed correctly and complies with Ohio laws. This can prevent potential issues in the future and ensure that your wishes are clearly articulated.