Printable Ohio Tractor Bill of Sale Template

Find Other Popular Tractor Bill of Sale Templates for Specific States

Farm Equipment Bill of Sale - The form may include a statement regarding the tractor's mileage.

To facilitate a smooth transaction, both parties involved should carefully complete the Florida Motor Vehicle Bill of Sale form, which can be accessed online for convenience at https://smarttemplates.net/fillable-florida-motor-vehicle-bill-of-sale, ensuring that all necessary details are accurately recorded to avoid any future disputes.

Do Tractors Need to Be Registered - Completion of a Tractor Bill of Sale ensures compliance with state regulations for vehicle sales.

Misconceptions

When it comes to the Ohio Tractor Bill of Sale form, several misconceptions often arise. Understanding the facts can help ensure a smooth transaction. Here are nine common misconceptions:

- It's only necessary for new tractors. Many believe that a bill of sale is only needed for new purchases. In reality, it is important for both new and used tractors to document the sale.

- Only the seller needs to sign it. Some think that only the seller's signature is required. However, both the buyer and seller should sign the bill of sale to validate the transaction.

- A bill of sale is not a legal document. Many people assume that a bill of sale holds no legal weight. In fact, it serves as a legal record of the transaction and can protect both parties in case of disputes.

- It’s only for private sales. Some believe that this form is only necessary for private sales. In truth, it is also useful for transactions between businesses and individuals.

- You don’t need to include the tractor's VIN. There is a misconception that the Vehicle Identification Number (VIN) is optional. Including the VIN is crucial for identifying the tractor and preventing fraud.

- Once signed, the bill of sale is final and cannot be changed. Many think that the document cannot be altered once signed. While it is best to complete it accurately from the start, amendments can be made if both parties agree.

- It’s only necessary for tractors. Some people think this form is exclusive to tractors. However, it can also be used for other types of agricultural equipment.

- There’s a standard format that must be followed. A common misconception is that there is a specific format for the bill of sale. While certain details should be included, the format can vary based on individual needs.

- It’s not needed if the tractor is registered. Some believe that if the tractor is already registered, a bill of sale is unnecessary. However, the bill of sale is still important for transferring ownership officially.

By clearing up these misconceptions, individuals can navigate the process of buying or selling a tractor in Ohio with confidence.

Documents used along the form

When completing a transaction involving a tractor in Ohio, several other forms and documents may be needed alongside the Ohio Tractor Bill of Sale. These documents help ensure that the sale is properly recorded and that both parties are protected throughout the process. Below is a list of commonly used forms in conjunction with the Tractor Bill of Sale.

- Title Transfer Document: This document is essential for transferring ownership of the tractor from the seller to the buyer. It includes information such as the vehicle identification number (VIN), the seller’s and buyer’s details, and the sale price.

- Trailer Bill of Sale: Similar to the Ohio Tractor Bill of Sale, the New York Trailer Bill of Sale is crucial for documenting the transfer of ownership of a trailer. For more information, you can visit OnlineLawDocs.com.

- Odometer Disclosure Statement: Required by federal law for vehicles under 10 years old, this statement verifies the mileage on the tractor at the time of sale. Both the buyer and seller must sign it to confirm accuracy.

- Affidavit of Ownership: This form may be needed if the seller cannot provide a title. It serves as a sworn statement affirming that the seller is the rightful owner of the tractor and has the authority to sell it.

- Sales Tax Exemption Certificate: If the buyer qualifies for a tax exemption, this certificate must be completed to ensure that sales tax is not charged during the transaction.

- Bill of Sale for Equipment: If the tractor comes with additional equipment, this document outlines the specifics of the equipment included in the sale, ensuring clarity for both parties.

- Insurance Documentation: Buyers may need to provide proof of insurance before the tractor can be registered in their name. This document confirms that the buyer has obtained the necessary coverage.

Having these documents prepared can facilitate a smoother transaction process and help avoid potential disputes later on. It is advisable for both buyers and sellers to review all forms carefully to ensure that all necessary information is accurately recorded.

Steps to Filling Out Ohio Tractor Bill of Sale

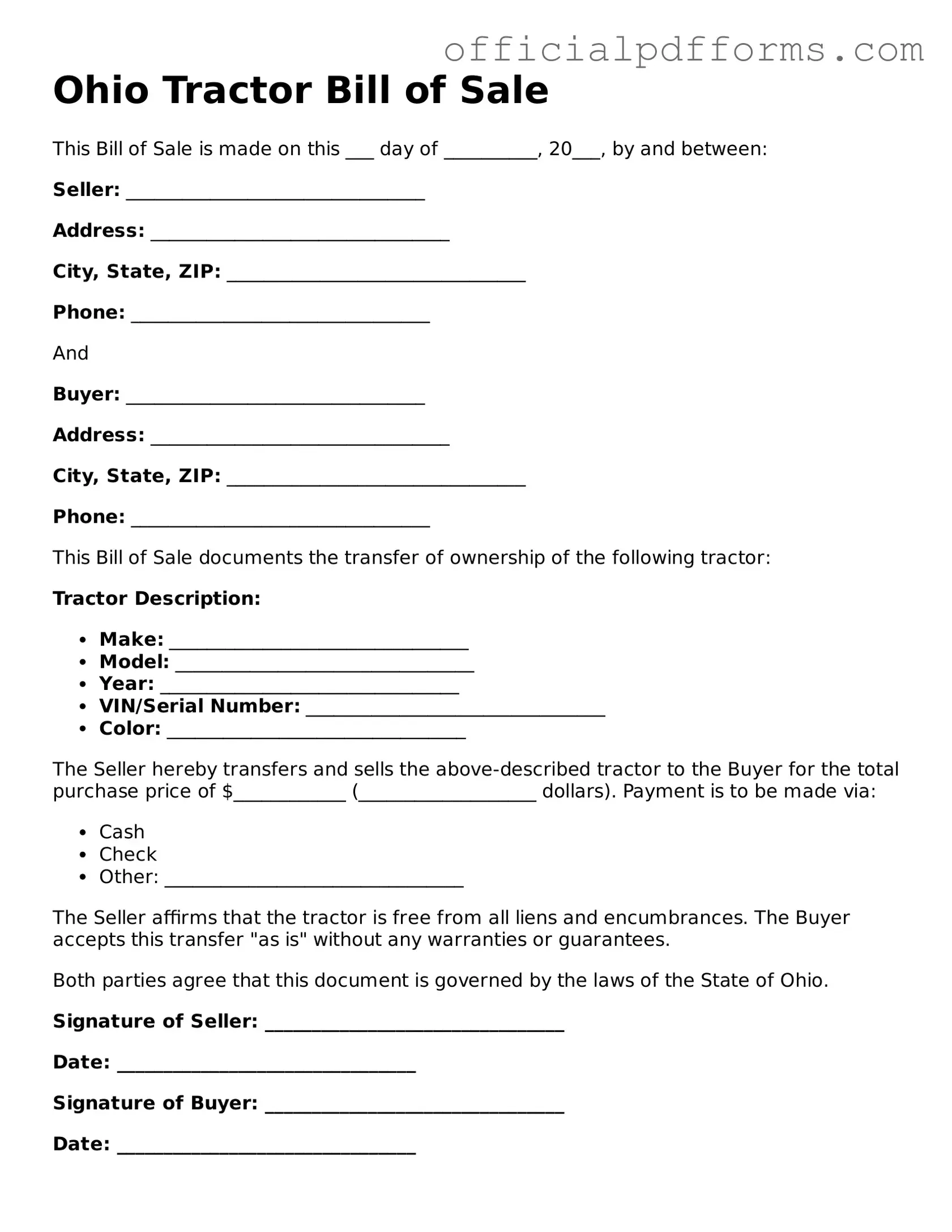

Filling out the Ohio Tractor Bill of Sale form is an important step in transferring ownership of a tractor. Once you complete the form, it should be signed by both the buyer and the seller. After that, keep a copy for your records and provide one to the buyer. Follow these steps to ensure the form is filled out correctly.

- Begin by entering the date of the sale at the top of the form.

- Next, provide the full name and address of the seller.

- Then, fill in the buyer's full name and address.

- In the next section, describe the tractor. Include details like the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the purchase price of the tractor clearly.

- Both the seller and buyer should sign the form to confirm the sale.

- Finally, make sure to keep a copy of the completed form for your records.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or issues with the sale. Ensure that all sections are completed, including names, addresses, and vehicle details.

-

Incorrect Vehicle Identification Number (VIN): Double-check the VIN for accuracy. An incorrect VIN can create confusion and may complicate the registration process.

-

Missing Signatures: Both the buyer and seller must sign the form. Omitting a signature can render the document invalid.

-

Not Including the Date: Forgetting to date the bill of sale can lead to disputes about when the transaction took place.

-

Failure to Provide Payment Details: Clearly state the sale price and payment method. This information is important for both parties and for tax purposes.

-

Ignoring State-Specific Requirements: Each state may have unique requirements for a bill of sale. Make sure to familiarize yourself with Ohio's specific regulations.

-

Not Keeping a Copy: It’s essential to retain a copy of the completed bill of sale for your records. This can serve as proof of ownership transfer.

-

Using Incorrect Terminology: Ensure that the terms used in the document are clear and accurate. Misunderstandings can arise from vague language.

-

Neglecting to Include Additional Terms: If there are any special conditions or warranties regarding the sale, make sure to include them in the bill of sale.

Get Clarifications on Ohio Tractor Bill of Sale

What is the Ohio Tractor Bill of Sale form?

The Ohio Tractor Bill of Sale form is a legal document used to transfer ownership of a tractor from one person to another in the state of Ohio. It includes essential details about the transaction, such as the buyer's and seller's information, the tractor's description, and the sale price.

Why do I need a Bill of Sale for my tractor?

A Bill of Sale serves as proof of the transaction between the buyer and seller. It protects both parties by documenting the details of the sale, which can be important for tax purposes or in case of disputes. Additionally, it may be required for registering the tractor with the state.

What information is required on the Ohio Tractor Bill of Sale?

The form should include the following information:

- Names and addresses of the buyer and seller

- Details of the tractor, including make, model, year, and Vehicle Identification Number (VIN)

- Sale price

- Date of the sale

- Signatures of both the buyer and seller

Is the Ohio Tractor Bill of Sale form required to register my tractor?

Yes, if you plan to register your tractor in Ohio, you will need a Bill of Sale. It is one of the documents that the Ohio Bureau of Motor Vehicles (BMV) may require to complete the registration process.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale as long as it includes all necessary information and meets state requirements. However, using a standardized form can help ensure that you don’t miss any critical details.

Do I need a notary for the Ohio Tractor Bill of Sale?

A notary is not required for the Bill of Sale in Ohio, but having it notarized can add an extra layer of security and authenticity to the document. It may also be beneficial if the transaction is large or if there are concerns about potential disputes.

What should I do with the Bill of Sale after the transaction?

After the transaction, both the buyer and seller should keep a copy of the Bill of Sale for their records. The buyer will need it for registration purposes, while the seller may want it as proof of the sale.

Can I use the Ohio Tractor Bill of Sale for other types of vehicles?

The Ohio Tractor Bill of Sale is specifically designed for tractors. For other types of vehicles, such as cars or motorcycles, you should use the appropriate Bill of Sale form that corresponds to that vehicle type to ensure compliance with state regulations.