Printable Ohio Quitclaim Deed Template

Find Other Popular Quitclaim Deed Templates for Specific States

Quitclaim Deed Forms - This deed is quick and efficient for property transfers.

Quit Claim Deed North Carolina - It is essential for both parties to understand the risks involved.

For individuals looking to simplify their legal processes, our guide on the Power of Attorney document is invaluable. This form enables you to appoint someone who can act in your best interests, whether for financial matters or healthcare decisions.

New Jersey Deed Transfer Form - The deed is often filed with the county recorder for legal protection.

Quick Claim Deed - When you want to give away your interest in a property, a quitclaim deed is the simplest option.

Misconceptions

The Ohio Quitclaim Deed is a common legal document used for transferring property ownership. However, several misconceptions exist regarding its use and implications. Below are eight common misconceptions clarified.

-

A Quitclaim Deed transfers ownership completely and unconditionally.

This is not accurate. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the title is clear or free of liens.

-

Using a Quitclaim Deed is the same as using a Warranty Deed.

These two types of deeds serve different purposes. A Warranty Deed provides a guarantee of clear title, while a Quitclaim Deed does not offer any such assurance.

-

A Quitclaim Deed can only be used between family members.

This is a misconception. While Quitclaim Deeds are often used among family members, they can be used in any property transfer situation.

-

Once a Quitclaim Deed is signed, it cannot be revoked.

A Quitclaim Deed can be revoked under certain circumstances, such as mutual agreement between the parties involved or by executing a new deed.

-

A Quitclaim Deed eliminates the need for a title search.

This is misleading. Even with a Quitclaim Deed, conducting a title search is advisable to ensure there are no undisclosed issues with the property.

-

All states have the same rules regarding Quitclaim Deeds.

Each state has its own laws governing Quitclaim Deeds. It is essential to understand Ohio's specific regulations and requirements.

-

A Quitclaim Deed can be used to transfer property into a trust.

This is true, but the process may involve additional documentation to ensure the trust is properly established and recognized.

-

Quitclaim Deeds are only for residential properties.

This is incorrect. Quitclaim Deeds can be used for any type of property, including commercial and vacant land.

Documents used along the form

When transferring property in Ohio, the Quitclaim Deed is a common document used. However, several other forms and documents may accompany it to ensure a smooth and legally sound transaction. Here’s a brief overview of some essential documents often used alongside the Ohio Quitclaim Deed.

- Property Transfer Tax Affidavit: This form is required to report the transfer of property for tax purposes. It helps local authorities assess any transfer taxes that may be due upon the sale or transfer of the property.

- Title Search Report: A title search report provides a detailed history of the property’s ownership. This document is crucial for verifying that the seller has the legal right to transfer the property and that there are no liens or claims against it.

- Affidavit of Title: This sworn statement is often used to affirm the seller’s ownership of the property and to disclose any known issues that might affect the title. It serves to protect the buyer by ensuring transparency in the transaction.

- Closing Statement: This document summarizes the financial aspects of the property transfer, including the sale price, closing costs, and any adjustments. It provides a clear overview of what each party is responsible for financially at closing.

- Sample Tax Return Transcript: This document can provide verification of income crucial for various processes, and further details can be found at OnlineLawDocs.com.

- Power of Attorney: In some cases, the seller may not be able to attend the closing in person. A power of attorney allows another person to act on their behalf, ensuring that the transaction can proceed smoothly even in their absence.

Understanding these additional documents can help ensure that the property transfer process in Ohio is clear and effective. Each plays a vital role in protecting the interests of both buyers and sellers, making the overall transaction more secure.

Steps to Filling Out Ohio Quitclaim Deed

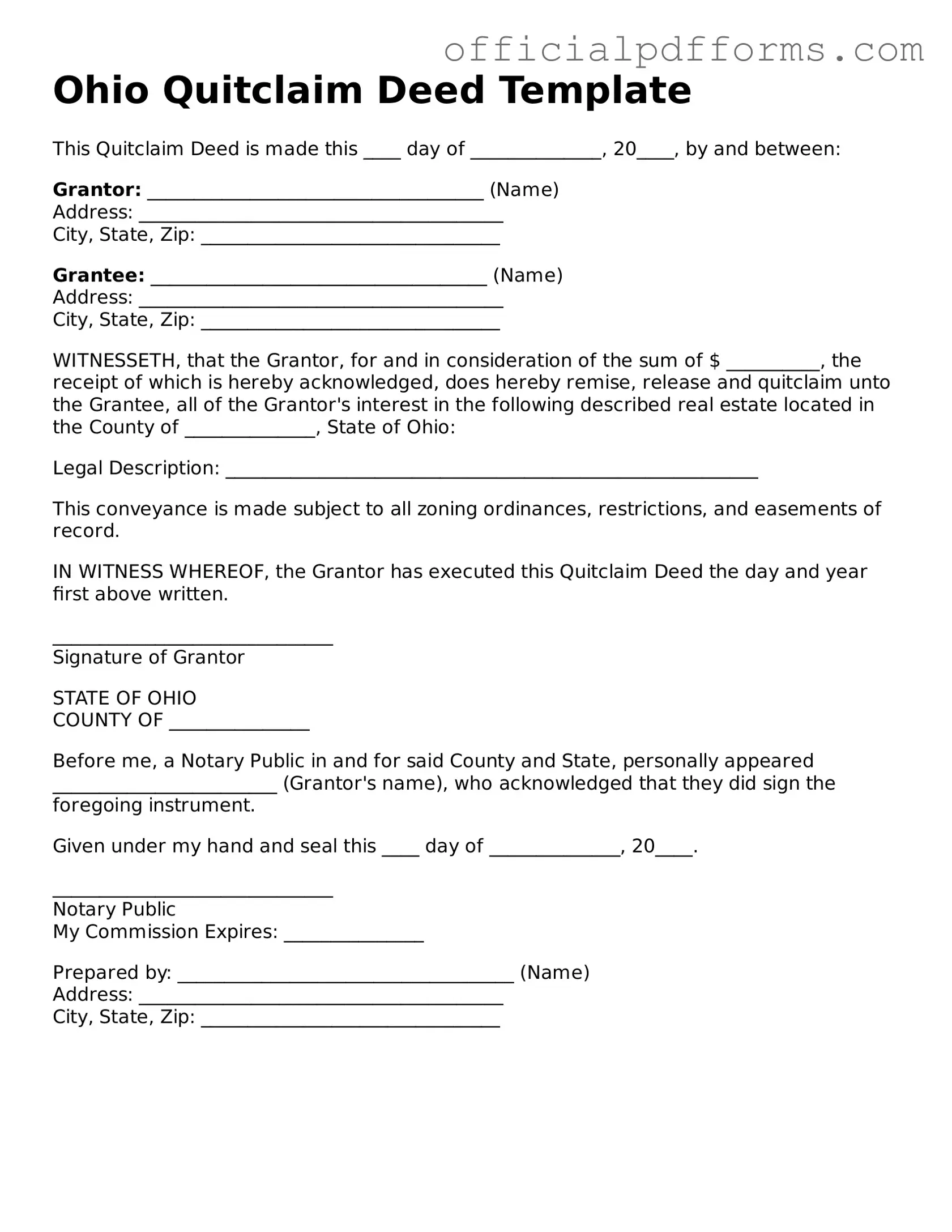

Once you have your Ohio Quitclaim Deed form ready, it’s time to fill it out accurately. This process is crucial to ensure that the transfer of property is legally recognized. Follow these steps carefully to complete the form correctly.

- Obtain the Form: Download the Ohio Quitclaim Deed form from a reliable source or obtain a hard copy from your local county recorder’s office.

- Identify the Grantor: In the designated section, write the full name of the person or entity transferring the property. Make sure to include their address.

- Identify the Grantee: Next, fill in the name of the person or entity receiving the property. Again, include their address for clarity.

- Describe the Property: Provide a clear and accurate description of the property being transferred. Include the address and any relevant legal description, such as lot number or parcel number.

- Consideration Amount: Indicate the consideration amount, which is the value exchanged for the property. This can be a nominal amount, such as $1, if the transfer is a gift.

- Signatures: Both the grantor and any witnesses must sign the document. Ensure that the signatures are dated appropriately.

- Notarization: Have the document notarized. This step is essential for validating the deed and ensuring it is legally binding.

- Filing the Deed: Finally, take the completed and notarized Quitclaim Deed to your local county recorder’s office for filing. Pay any required fees at this time.

After you’ve filled out and filed the form, the transfer of property is officially recorded. Keep a copy of the deed for your records, as it serves as proof of ownership. If you have any further questions or need assistance, consider reaching out to a legal professional.

Common mistakes

-

Incorrect Grantee Information: People often misspell the name of the person receiving the property. Ensure the name is accurate and matches legal documents.

-

Failure to Include a Legal Description: A common mistake is not providing a complete legal description of the property. This description should include boundaries and any relevant details.

-

Not Signing the Deed: Some individuals forget to sign the deed. A signature is essential for the document to be valid.

-

Omitting Notarization: The deed must be notarized. Failing to have a notary public witness the signing can invalidate the deed.

-

Incorrectly Filling Out Dates: Mistakes in the date can lead to confusion about when the transfer occurred. Always double-check the date for accuracy.

-

Not Including Consideration: Some people forget to mention the consideration, or payment, for the property. Even if it’s a nominal amount, it should be stated.

-

Leaving Out Previous Owner Information: It is important to list the previous owner’s name. This helps clarify the chain of title for the property.

-

Filing in the Wrong County: Ensure that the deed is filed in the correct county where the property is located. Filing in the wrong jurisdiction can complicate matters.

Get Clarifications on Ohio Quitclaim Deed

What is a Quitclaim Deed in Ohio?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. In Ohio, this type of deed is often used when the property is being transferred between family members, during divorce settlements, or in situations where the grantor does not wish to make any warranties about the title. Unlike a warranty deed, a quitclaim deed does not guarantee that the grantor holds clear title to the property, meaning there may be existing claims or liens against it.

How do I complete an Ohio Quitclaim Deed?

To complete a Quitclaim Deed in Ohio, follow these steps:

- Obtain the form: You can find a Quitclaim Deed form at local county recorder offices or online legal resources.

- Fill in the necessary information: This includes the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a legal description of the property, and any relevant addresses.

- Sign the document: The grantor must sign the deed in the presence of a notary public. This step is crucial as it verifies the identity of the signer.

- File the deed: Once completed and notarized, the Quitclaim Deed should be filed with the county recorder's office where the property is located. There may be a small fee for recording.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. While both documents transfer ownership of property, a Warranty Deed provides a guarantee that the grantor holds clear title and has the right to sell the property. In contrast, a Quitclaim Deed offers no such assurances. This makes Quitclaim Deeds riskier for the grantee, as they may inherit any existing issues with the property title.

Can I use a Quitclaim Deed to transfer property to myself?

Yes, you can use a Quitclaim Deed to transfer property to yourself. This might be done for various reasons, such as changing the way the title is held (for example, from individual ownership to joint ownership with a spouse). However, consider consulting a legal professional to ensure that the transfer is done correctly and to understand any potential implications.

Are there any tax implications when using a Quitclaim Deed?

Generally, transferring property through a Quitclaim Deed may not trigger immediate tax consequences. However, it is important to consider potential gift tax implications if the property is transferred without receiving adequate compensation. Additionally, property taxes may be reassessed based on the new ownership. Consulting a tax professional can provide clarity on any specific tax obligations associated with your situation.

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it cannot be unilaterally revoked. However, the grantor and grantee can agree to execute a new deed that reverses the transfer or creates a different arrangement. It's advisable to consult with a legal professional to understand the best course of action if you wish to change the ownership status.

Where can I find an Ohio Quitclaim Deed form?

You can find an Ohio Quitclaim Deed form in several places:

- Online legal resources that provide templates and forms.

- Your local county recorder's office, which may have forms available for public use.

- Legal stationery stores that sell various property-related forms.

Always ensure that the form you use complies with Ohio state laws and includes all necessary information.