Printable Ohio Promissory Note Template

Find Other Popular Promissory Note Templates for Specific States

Loan Note Template - Having an attorney review the promissory note can protect both lender and borrower interests.

Understanding the significance of a Release of Liability form is essential for anyone engaging in potentially risky activities, as this legal document ensures that one party does not hold the other accountable for any unforeseen incidents. This type of form is particularly vital in contexts like sports events or adventure tourism, where the likelihood of injuries is heightened. For more information and templates related to this important legal tool, visit toptemplates.info/.

Simple Promissory Note Template - Paying off a promissory note can enhance financial trust and responsibility.

Misconceptions

Below are seven common misconceptions about the Ohio Promissory Note form, along with clarifications for each.

- All promissory notes must be notarized. Many believe that notarization is required for a promissory note to be valid. However, notarization is not mandatory in Ohio. The note is enforceable as long as it meets the basic requirements of being written, signed, and containing the necessary terms.

- Promissory notes can only be used for loans. While promissory notes are often associated with loans, they can also be used for other types of financial agreements. They serve as a written promise to pay, which can apply to various transactions.

- The terms of a promissory note cannot be modified. Some people think that once a promissory note is signed, its terms are set in stone. In reality, the parties involved can mutually agree to modify the terms at any time, as long as the changes are documented properly.

- Only individuals can issue a promissory note. This misconception overlooks the fact that businesses and organizations can also issue promissory notes. Any entity capable of entering into a contract can create a promissory note.

- Interest rates must be included in a promissory note. Many assume that every promissory note must specify an interest rate. However, it is possible to create a note that is interest-free. The key is to clearly outline the repayment terms.

- Promissory notes are only enforceable in court. Some individuals believe that promissory notes can only be enforced through legal action. In fact, many parties resolve disputes related to promissory notes through negotiation or mediation before resorting to court.

- All promissory notes are the same across states. While many principles apply universally, each state has its own laws governing promissory notes. The Ohio Promissory Note form has specific requirements that may differ from those in other states.

Documents used along the form

When entering into a loan agreement in Ohio, a Promissory Note is often a central document. However, several other forms and documents may accompany it to ensure clarity and legal protection for all parties involved. Below is a list of commonly used documents that can complement a Promissory Note.

- Loan Agreement: This is a more detailed document that outlines the terms of the loan, including repayment schedules, interest rates, and any collateral involved. It serves to clarify the obligations of both the borrower and the lender.

- Security Agreement: If the loan is secured by collateral, this document specifies what assets are being used as security. It provides the lender with rights to the collateral if the borrower defaults on the loan.

- Disclosure Statement: This document informs the borrower about the terms of the loan, including any fees, penalties, and the total cost of borrowing. It ensures that the borrower is fully aware of their financial obligations.

- Personal Guarantee: In some cases, a lender may require a personal guarantee from a third party. This document holds the guarantor responsible for the loan if the primary borrower fails to repay it.

- Amortization Schedule: This is a table that outlines each payment over the life of the loan, detailing how much of each payment goes toward principal and interest. It helps borrowers understand their repayment process.

- Loan Payment Receipt: After each payment, a receipt should be issued to the borrower. This document serves as proof of payment and can be important for record-keeping.

- Notice to Quit Form: To ensure proper notification to tenants, utilize the essential Notice to Quit guidelines to effectively manage lease violations.

- Default Notice: If the borrower misses a payment, the lender may issue a default notice. This document formally notifies the borrower of their default status and outlines potential consequences.

- Modification Agreement: If the terms of the loan need to be changed, this document outlines the new terms agreed upon by both parties. It is essential for maintaining clear communication and expectations.

- Release of Lien: Once the loan is paid off, this document is issued by the lender to confirm that the borrower has fulfilled their obligations. It releases any claims the lender had on the collateral.

Each of these documents plays a crucial role in the lending process, providing structure and protection for both borrowers and lenders. Understanding these forms can help ensure a smoother transaction and reduce the risk of misunderstandings in the future.

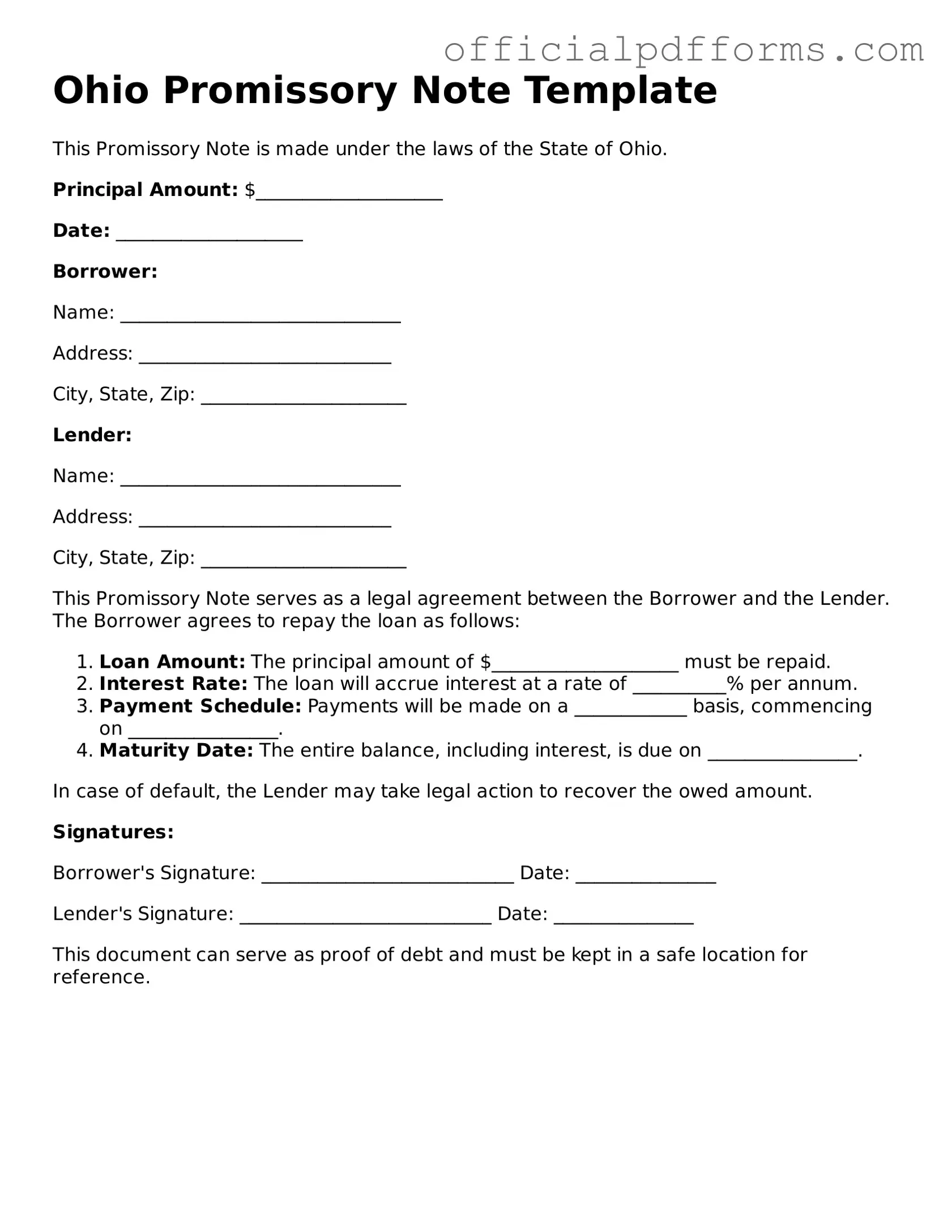

Steps to Filling Out Ohio Promissory Note

Once you have the Ohio Promissory Note form in hand, you can begin filling it out. This document will require specific information about the loan agreement. Follow the steps below to complete the form accurately.

- Start by entering the date at the top of the form. Use the format month/day/year.

- Fill in the name of the borrower. This is the person or entity receiving the loan.

- Next, provide the address of the borrower. Include the street address, city, state, and zip code.

- Enter the name of the lender. This is the individual or organization providing the loan.

- Provide the lender's address, including street address, city, state, and zip code.

- Indicate the principal amount of the loan. This is the total amount borrowed.

- Specify the interest rate. This should be stated as a percentage.

- Outline the repayment schedule. Include how often payments will be made (e.g., monthly, quarterly).

- Detail the due date for the final payment. This is when the loan must be fully repaid.

- Sign and date the form at the bottom. The borrower must sign, and the date of signing should be included.

After completing the form, make sure to keep a copy for your records. The signed document should be given to the lender, who will retain it for their files. Ensure that both parties understand the terms outlined in the note.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the names of the borrower and lender, can lead to confusion and potential legal issues.

-

Incorrect Amount: Entering the wrong loan amount is a common mistake. Double-check the figures to ensure accuracy.

-

Missing Signatures: Both parties must sign the note. Omitting a signature can render the document invalid.

-

Improper Date: Forgetting to include the date or entering an incorrect date can create complications in the repayment schedule.

-

Ignoring Terms: Not clearly defining the repayment terms, such as interest rates or due dates, can lead to misunderstandings later.

-

Failure to Notarize: In some cases, notarization may be required. Skipping this step can affect the enforceability of the note.

-

Using Ambiguous Language: Vague terms can lead to disputes. Be specific about the obligations and rights of each party.

-

Not Keeping Copies: Failing to retain a copy of the signed document can create issues if disputes arise. Always keep a record for your files.

Get Clarifications on Ohio Promissory Note

What is a Promissory Note in Ohio?

A Promissory Note is a legal document that outlines a promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. In Ohio, this document serves as evidence of a debt and includes details such as the amount owed, the interest rate, and the repayment schedule. It is important for both the lender and the borrower to understand the terms outlined in the note to ensure clarity and prevent disputes.

Who can use a Promissory Note in Ohio?

Any individual or business can use a Promissory Note in Ohio. This includes personal loans between friends or family members, as well as formal agreements between businesses. Both parties involved should ensure that they fully understand the terms of the agreement and seek legal advice if necessary, especially for larger amounts or complex situations.

What are the essential elements of an Ohio Promissory Note?

For a Promissory Note to be valid in Ohio, it should generally include the following elements:

- The names and addresses of the borrower and lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any penalties for late payment.

- Signatures of both the borrower and lender.

Including these elements helps ensure that the note is enforceable in a court of law if necessary.

Is a Promissory Note legally binding in Ohio?

Yes, a Promissory Note is legally binding in Ohio as long as it meets the necessary requirements. When both parties sign the document, they are agreeing to the terms laid out in the note. If either party fails to uphold their end of the agreement, the other party may have legal grounds to pursue repayment or other remedies through the court system.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to create a written amendment to the original note that outlines the specific changes. This helps to avoid confusion and ensures that both parties are aware of the new terms. Both parties should sign this amendment to make it valid.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults on the Promissory Note, the lender has several options. They may choose to contact the borrower to discuss the situation and seek a resolution. If this does not work, the lender can pursue legal action to recover the owed amount. This could involve filing a lawsuit in a court. It is important for both parties to understand the consequences of defaulting on the note and to communicate openly about any issues that arise.

Where can I find a Promissory Note template for Ohio?

Promissory Note templates can be found online through various legal websites, or you may consult with an attorney who can provide a customized document tailored to your specific needs. It is crucial to ensure that any template you use complies with Ohio laws and meets the requirements necessary for enforceability. Having a properly drafted note can help protect the interests of both the lender and the borrower.