Printable Ohio Operating Agreement Template

Find Other Popular Operating Agreement Templates for Specific States

How to Make an Operating Agreement - This form may aid in dispute resolution through clearly defined processes.

In addition to outlining essential terms and conditions, the California Vehicle Purchase Agreement form can also be obtained from reliable sources such as toptemplates.info, ensuring that both buyers and sellers have access to accurate and compliant documentation for their vehicle transactions.

Llc Operating Agreement Georgia - The Operating Agreement can specify procedures for adding or removing members from the LLC.

How to Create an Operating Agreement for an Llc - The agreement can detail the process of conflict management.

Misconceptions

When it comes to the Ohio Operating Agreement, several misconceptions can lead to confusion for business owners. Understanding these misunderstandings can help ensure that your business operates smoothly and in compliance with state laws.

- Misconception 1: An Operating Agreement is optional for LLCs in Ohio.

- Misconception 2: The Operating Agreement must be filed with the state.

- Misconception 3: All Operating Agreements are the same.

- Misconception 4: Once created, the Operating Agreement cannot be changed.

- Misconception 5: An Operating Agreement only addresses management issues.

- Misconception 6: You can create an Operating Agreement without legal assistance.

While it is true that Ohio does not legally require LLCs to have an Operating Agreement, it is highly recommended. This document outlines the management structure and operating procedures of the LLC, helping to prevent disputes among members.

Many believe that the Operating Agreement needs to be submitted to the Ohio Secretary of State. In reality, this document is kept internally among the members and does not need to be filed, providing privacy regarding your business's internal workings.

Operating Agreements can vary significantly based on the specific needs and goals of the LLC. Each agreement should be tailored to reflect the unique structure, management style, and financial arrangements of the business.

Some people think that the Operating Agreement is a permanent document. However, it can be amended if all members agree to the changes. This flexibility allows the agreement to evolve as the business grows or changes direction.

While management is a key focus, the Operating Agreement also covers financial arrangements, member responsibilities, and procedures for adding or removing members. It serves as a comprehensive guide for the operation of the LLC.

Although it is possible to draft your own Operating Agreement, seeking legal assistance can ensure that the document meets all legal requirements and adequately protects the interests of all members. Professional guidance can help avoid potential pitfalls down the line.

Documents used along the form

An Ohio Operating Agreement is a crucial document for limited liability companies (LLCs) as it outlines the management structure and operating procedures of the business. However, it is often accompanied by several other important forms and documents that help establish and maintain the LLC's legal standing. Below is a list of commonly used documents alongside the Ohio Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the company name, address, and the names of the members.

- Member Consent Form: This form is used to document the agreement of all members regarding important decisions, such as admitting new members or approving major business actions.

- Bylaws: While not always required, bylaws provide additional rules and guidelines for the LLC’s operations. They cover areas such as voting procedures and member responsibilities.

- Tax Return Transcript: This document offers a comprehensive overview of an LLC's income and tax activities. It is essential for verifying income and may be required for loan applications or other financial assessments. For more details, check OnlineLawDocs.com.

- Operating Procedures: This document details the day-to-day operations of the LLC, including roles and responsibilities of members, financial management, and conflict resolution processes.

- Annual Reports: Many states require LLCs to file annual reports to maintain good standing. This document updates the state on the company’s status, including any changes in membership or address.

- Tax Forms: Depending on the structure of the LLC, various tax forms may be necessary for state and federal compliance. These forms ensure that the business meets its tax obligations.

These documents work together to provide a comprehensive framework for the operation and governance of an LLC in Ohio. Ensuring that all necessary forms are completed and filed correctly can help safeguard the business and its members.

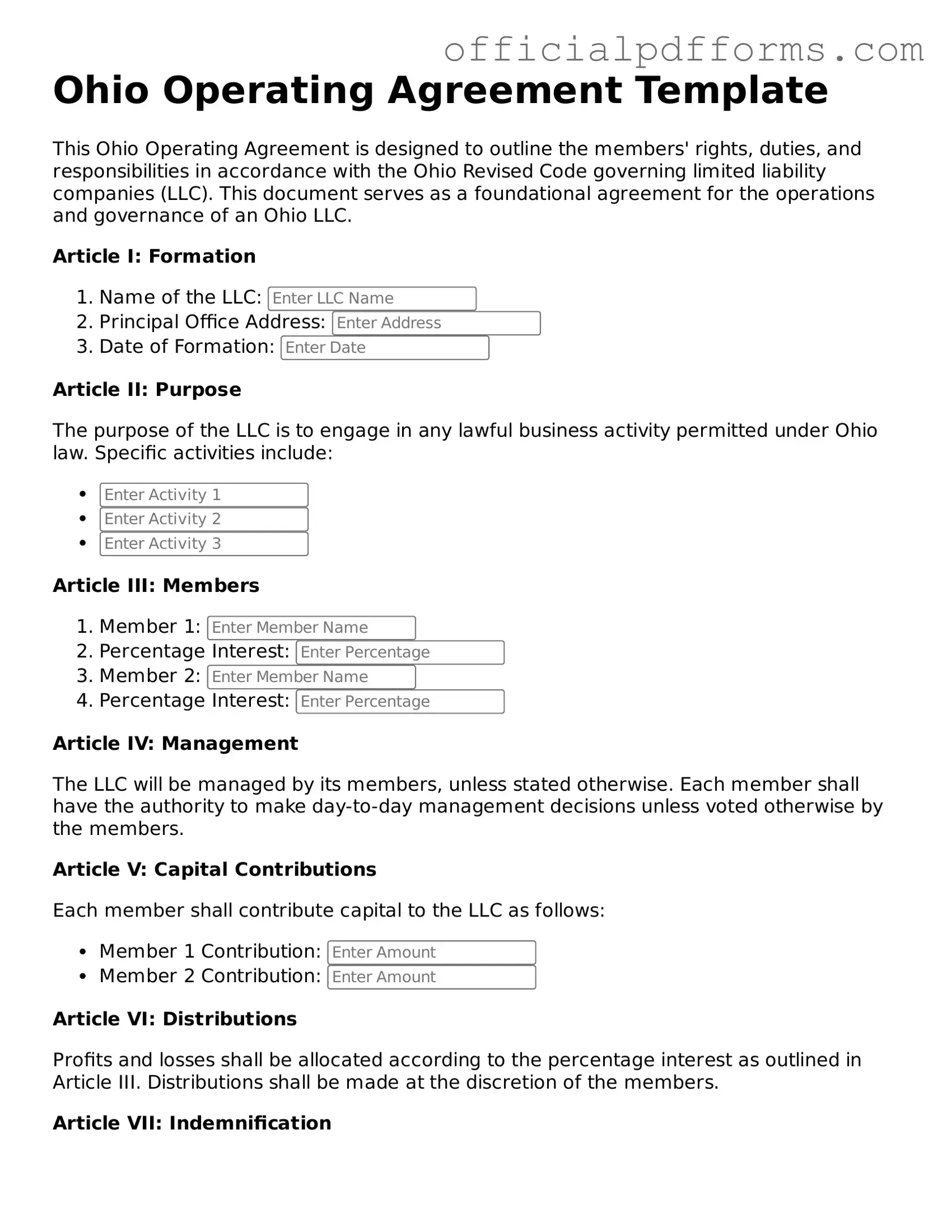

Steps to Filling Out Ohio Operating Agreement

Completing the Ohio Operating Agreement form is an important step for organizing your business. This document outlines the management structure and operational procedures for your company. Follow these steps to ensure that you fill out the form accurately and completely.

- Begin by entering the name of your LLC at the top of the form. Make sure the name matches the one registered with the state.

- Provide the principal office address of your LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Include their percentage of ownership in the company.

- Outline the management structure. Indicate whether the LLC will be managed by its members or by appointed managers.

- Detail the purpose of the LLC. This can be a brief statement describing the nature of your business activities.

- Include provisions for the distribution of profits and losses among members. Specify how and when these distributions will occur.

- Address the process for adding or removing members. Clearly outline the procedures to ensure transparency.

- Sign and date the form. Ensure that all members also sign if required.

After completing the form, review it for accuracy. Ensure that all information is correct and that all required signatures are present. Once verified, you can proceed with filing the document with the appropriate state agency.

Common mistakes

-

Neglecting to Include Member Information: It is crucial to list all members of the LLC accurately. Omitting a member can lead to disputes later on.

-

Failing to Define Roles and Responsibilities: Each member’s role should be clearly outlined. Without this, confusion and miscommunication can arise.

-

Ignoring Profit and Loss Distribution: Specify how profits and losses will be shared among members. This prevents misunderstandings about financial expectations.

-

Overlooking Decision-Making Processes: Establish how decisions will be made, whether by majority vote or unanimous consent. This clarity helps avoid conflicts.

-

Not Including an Exit Strategy: It’s important to have a plan for what happens if a member wants to leave the LLC. This can save time and stress in the future.

-

Using Vague Language: Be specific in all terms and conditions. Ambiguity can lead to different interpretations and potential legal issues.

-

Failing to Review and Update the Agreement: As circumstances change, so should the Operating Agreement. Regular reviews ensure it remains relevant and effective.

Get Clarifications on Ohio Operating Agreement

What is an Ohio Operating Agreement?

An Ohio Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Ohio. It details the rights and responsibilities of the members, how profits and losses are distributed, and the procedures for making decisions within the company.

Is an Operating Agreement required in Ohio?

No, an Operating Agreement is not legally required in Ohio. However, having one is highly recommended. It helps prevent misunderstandings among members and provides a clear framework for the operation of the LLC. Without it, Ohio state laws will dictate the rules, which may not align with the members' intentions.

Who should create the Operating Agreement?

The members of the LLC should create the Operating Agreement. It is best if all members participate in the drafting process to ensure that everyone's interests and concerns are addressed. If necessary, members may seek assistance from a legal professional to ensure the document meets their needs.

What should be included in the Operating Agreement?

Key components of an Ohio Operating Agreement typically include:

- Company name and principal office address

- Purpose of the LLC

- Member contributions and ownership percentages

- Management structure (member-managed or manager-managed)

- Voting rights and decision-making processes

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution methods

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. Members should follow the procedures outlined in the original agreement for making changes. It is important to document any amendments in writing and have all members agree to the changes to avoid future disputes.

How does the Operating Agreement affect liability protection?

The Operating Agreement itself does not provide liability protection. However, having a well-drafted agreement helps establish the LLC as a separate legal entity. This separation is crucial for protecting members' personal assets from business liabilities. Following the terms of the Operating Agreement also reinforces the legitimacy of the LLC in the eyes of the law.

Where should I keep the Operating Agreement?

The Operating Agreement should be kept in a safe place, such as a secure file or a safe deposit box. All members should have access to a copy. It is advisable to review the agreement regularly and keep it updated as the business evolves or membership changes.