Printable Ohio Motor Vehicle Bill of Sale Template

Find Other Popular Motor Vehicle Bill of Sale Templates for Specific States

Trailer Bill of Sale Georgia - Facilitates registration of the vehicle under the new owner.

Auto Bill of Sale Template - Can be required by some states for tax documentation purposes.

For further information and access to important resources, you can visit PDF Documents Hub, which provides helpful guides on filling out the Asurion F-017-08 MEN form effectively to enhance your claims process.

Nc Bill of Sale - It protects the seller from liability after the sale is complete.

Printable Vehicle Bill of Sale Nj - Should be filled out completely to avoid misunderstandings.

Misconceptions

The Ohio Motor Vehicle Bill of Sale form is a crucial document in the process of transferring ownership of a vehicle. However, several misconceptions surround its use and requirements. Below are four common misunderstandings:

-

It is not necessary to have a Bill of Sale for vehicle transactions.

Many people believe that a Bill of Sale is optional when buying or selling a vehicle in Ohio. In reality, while it is not legally required, having a Bill of Sale provides essential proof of the transaction and can help resolve disputes in the future.

-

The Bill of Sale must be notarized.

Some individuals think that the Bill of Sale must be notarized to be valid. In Ohio, notarization is not a requirement for the Bill of Sale. However, having it notarized can add an extra layer of authenticity and may be beneficial in certain situations.

-

Only the seller needs to sign the Bill of Sale.

This misconception leads many to believe that only the seller's signature is necessary. In fact, both the buyer and the seller should sign the document to ensure that both parties acknowledge the transaction and its terms.

-

The Bill of Sale replaces the title transfer process.

Some people mistakenly think that completing a Bill of Sale is sufficient to transfer ownership of a vehicle. While the Bill of Sale documents the sale, it does not replace the need to complete the title transfer through the Ohio Bureau of Motor Vehicles (BMV).

Documents used along the form

When buying or selling a vehicle in Ohio, the Motor Vehicle Bill of Sale form is essential for documenting the transaction. However, several other forms and documents may also be necessary to ensure a smooth transfer of ownership and compliance with state regulations. Below is a list of commonly used forms and documents that accompany the Ohio Motor Vehicle Bill of Sale.

- Title Transfer Form: This document is crucial for officially transferring ownership of the vehicle from the seller to the buyer. It must be signed by both parties and submitted to the Ohio Bureau of Motor Vehicles (BMV).

- Application for Certificate of Title: This form is needed when applying for a new title after purchasing a vehicle. It includes details about the vehicle and the new owner.

- Odometer Disclosure Statement: This statement is required for vehicles less than ten years old. It verifies the mileage on the vehicle at the time of sale to prevent fraud.

- California Bill of Sale Form: To facilitate vehicle transactions, guiding users through the step-by-step California bill of sale form process ensures compliance and clarity for both parties involved.

- Vehicle Registration Application: After acquiring a vehicle, the new owner must fill out this application to register the vehicle with the state and obtain license plates.

- Proof of Insurance: Buyers must provide proof of insurance coverage for the vehicle before it can be registered. This document demonstrates that the vehicle is insured as required by Ohio law.

- Emissions Testing Certificate: Depending on the county, some vehicles may need to pass an emissions test before registration. This certificate shows compliance with environmental standards.

- Sales Tax Receipt: A receipt indicating that sales tax has been paid on the vehicle purchase may be required. This document serves as proof of tax payment to the state.

- Power of Attorney: If the seller cannot be present for the transaction, a Power of Attorney may be needed to authorize another person to sign documents on their behalf.

By gathering these documents, both buyers and sellers can facilitate a more efficient and legally compliant vehicle transaction in Ohio. Understanding the importance of each form helps ensure that all necessary steps are taken for a successful transfer of ownership.

Steps to Filling Out Ohio Motor Vehicle Bill of Sale

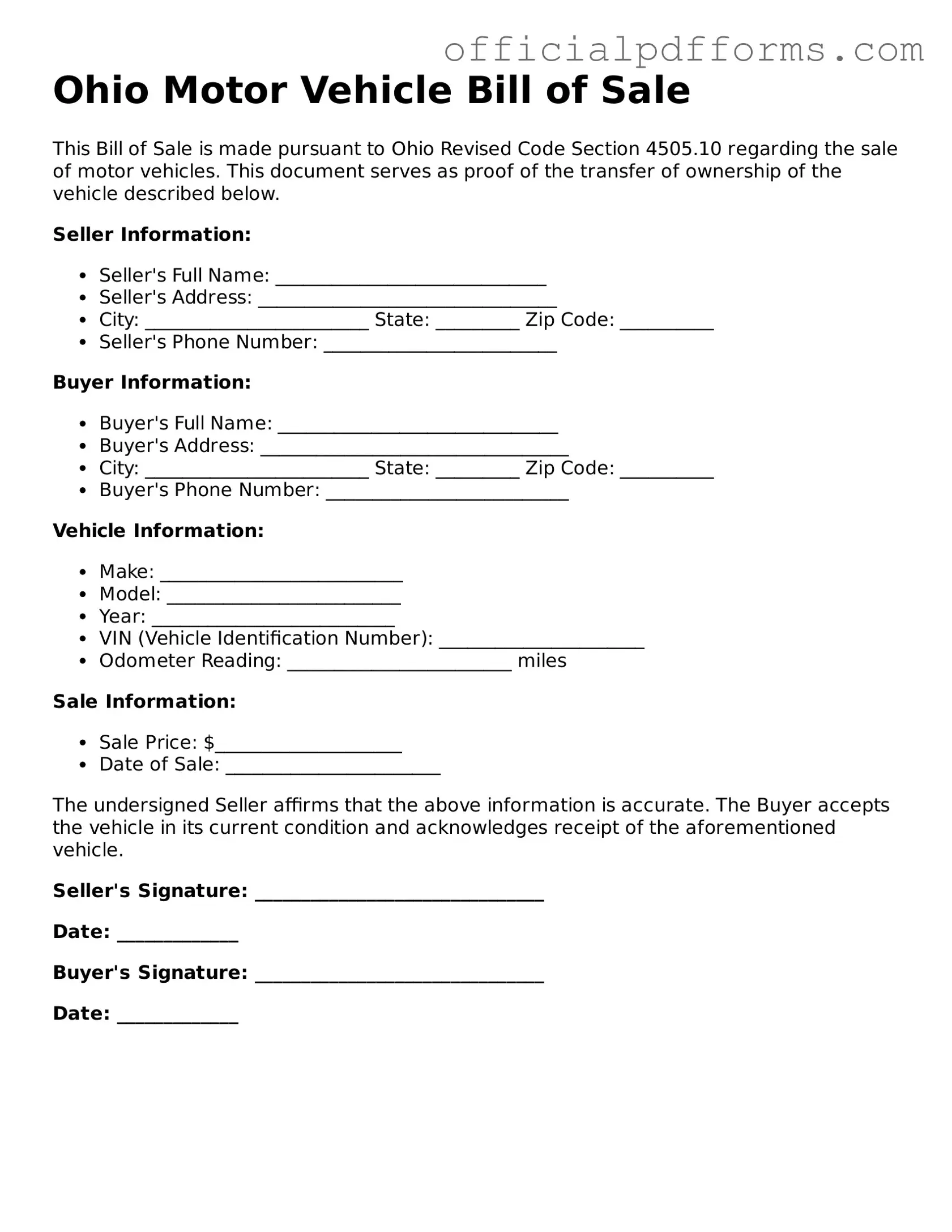

After obtaining the Ohio Motor Vehicle Bill of Sale form, it is essential to complete it accurately to ensure a smooth transfer of ownership. Follow the steps below to fill out the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller in the designated section.

- Next, fill in the buyer's full name and address.

- In the vehicle description area, include the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the purchase price of the vehicle clearly.

- Both the seller and buyer should sign and date the form at the bottom.

- If applicable, include any additional terms or conditions of the sale in the provided space.

Once the form is completed, ensure that both parties retain a copy for their records. This documentation is important for future reference and may be required for vehicle registration purposes.

Common mistakes

-

Not including all necessary information: It's crucial to fill out every section of the form. Missing details like the vehicle identification number (VIN) or the sale price can create issues later.

-

Incorrect VIN: Double-check the VIN. An error here can lead to complications when registering the vehicle or transferring ownership.

-

Using the wrong date: Ensure the date of the sale is accurate. An incorrect date can lead to confusion regarding ownership transfer and tax obligations.

-

Failing to sign the document: Both the seller and the buyer must sign the bill of sale. Without signatures, the document is not legally binding.

-

Not providing a copy: After completing the form, both parties should keep a copy. This serves as proof of the transaction and can be important for future reference.

-

Leaving out the odometer reading: It’s essential to include the current odometer reading. This protects both parties from potential disputes about the vehicle's mileage.

-

Ignoring state-specific requirements: Ohio may have specific requirements for the bill of sale. Be aware of any additional information that may need to be included.

-

Not notarizing the document: While notarization isn’t always required, it can add an extra layer of authenticity and protection for both parties.

-

Rushing through the process: Take your time when filling out the form. Rushing can lead to mistakes that may complicate the sale later on.

Get Clarifications on Ohio Motor Vehicle Bill of Sale

What is the Ohio Motor Vehicle Bill of Sale form?

The Ohio Motor Vehicle Bill of Sale is a legal document that records the transfer of ownership of a vehicle from one party to another. It serves as proof of sale and includes important details about the vehicle and the transaction. This form is essential for both buyers and sellers to ensure a smooth transfer of ownership and to comply with state regulations.

Why do I need a Bill of Sale for my vehicle?

A Bill of Sale is important for several reasons:

- It provides a record of the transaction, which can be useful for tax purposes or future disputes.

- It helps establish the buyer's ownership of the vehicle, which is necessary for registration and title transfer.

- It protects the seller by documenting that the vehicle has been sold and that they are no longer responsible for it.

What information is required on the Bill of Sale?

The Bill of Sale should include the following details:

- The full names and addresses of both the buyer and the seller.

- The vehicle identification number (VIN).

- The make, model, year, and color of the vehicle.

- The sale price of the vehicle.

- The date of the sale.

- Any warranties or representations made by the seller.

Do I need to have the Bill of Sale notarized?

In Ohio, notarization is not required for a Bill of Sale to be valid. However, having it notarized can add an extra layer of protection for both parties. It can help verify the identities of the buyer and seller, making the document more credible in case of any future disputes.

Can I use a generic Bill of Sale template?

While you can use a generic Bill of Sale template, it is advisable to use the specific Ohio Motor Vehicle Bill of Sale form. This ensures that all required information is included and that the document complies with Ohio state laws. Using the correct form can help prevent issues during the title transfer process.

What should I do after completing the Bill of Sale?

Once the Bill of Sale is completed and signed by both parties, the seller should provide a copy to the buyer. The buyer will then need to take this document to the local Bureau of Motor Vehicles (BMV) to register the vehicle and transfer the title. Keeping a copy for personal records is also a good practice for both parties.

Is a Bill of Sale the same as a title?

No, a Bill of Sale is not the same as a title. The Bill of Sale documents the sale of the vehicle, while the title is the official document that proves ownership. The title must be transferred to the new owner at the BMV, and the Bill of Sale serves as proof of that transfer.

What if I lose my Bill of Sale?

If you lose your Bill of Sale, it may be difficult to prove the transaction took place. It’s important to keep a copy in a safe place. If you cannot find it, you may need to contact the seller to see if they can provide another copy. In some cases, you may also be able to create a new Bill of Sale, but it should be signed by both parties again to be valid.

Are there any fees associated with the Bill of Sale?

There are typically no fees associated with creating a Bill of Sale itself, as it is a document that can be filled out without cost. However, there may be fees when registering the vehicle and transferring the title at the BMV. It’s a good idea to check with your local BMV for specific fee information related to these processes.