Printable Ohio Last Will and Testament Template

Find Other Popular Last Will and Testament Templates for Specific States

Online Will Georgia - This document signifies the culmination of a person’s wishes and dreams for their loved ones.

To ensure a smooth transaction process, it is crucial to understand the significance of a Bill of Sale, especially when dealing with high-value items. By utilizing the Texas Bill of Sale form, buyers and sellers can clearly outline the terms of the sale, protecting both parties involved. For additional resources and templates, visit OnlineLawDocs.com, which provides comprehensive information on drafting and executing a Bill of Sale correctly.

Is a Handwritten Will Legal in Nc - A Last Will articulates your wishes and helps guide your loved ones through a challenging time.

Misconceptions

When it comes to creating a Last Will and Testament in Ohio, many people hold misconceptions that can lead to confusion and potential issues down the line. Here are six common misunderstandings:

- Misconception 1: A handwritten will is not valid in Ohio.

- Misconception 2: You don’t need witnesses for a will to be valid.

- Misconception 3: A will can distribute assets that are not in the estate.

- Misconception 4: You can change your will as many times as you want.

- Misconception 5: Once a will is created, it can’t be contested.

- Misconception 6: All assets will go through probate.

While it's true that a handwritten will, also known as a holographic will, can be valid in Ohio, it must meet specific criteria. The testator must write the will in their own handwriting, and it must clearly express their intentions.

In Ohio, a will generally requires the signatures of at least two witnesses who are present when the testator signs the document. Without these witnesses, the will may be challenged in court.

A will only controls the distribution of assets that are part of the deceased’s estate at the time of death. Assets held in joint tenancy or those with designated beneficiaries, such as life insurance policies, are not governed by the will.

While you can change your will, it’s important to do so properly. Any changes should be made through a formal amendment, known as a codicil, or by creating an entirely new will that revokes the previous one.

A will can be contested in Ohio for several reasons, including lack of capacity, undue influence, or improper execution. It’s essential to ensure that the will is created and executed correctly to minimize the risk of challenges.

Not all assets are subject to probate. Certain assets, like those in a living trust or those with designated beneficiaries, can pass outside of probate, allowing for a quicker distribution to heirs.

Documents used along the form

When preparing a Last Will and Testament in Ohio, several other forms and documents may also be necessary to ensure all aspects of estate planning are covered. Each document serves a specific purpose and can help clarify the wishes of the individual making the will.

- Durable Power of Attorney: This document allows an individual to appoint someone to make financial and legal decisions on their behalf if they become incapacitated.

- Healthcare Power of Attorney: This form designates a person to make medical decisions for an individual when they are unable to do so themselves, ensuring their healthcare preferences are honored.

- Living Will: A living will outlines an individual's preferences regarding medical treatment and end-of-life care. It provides guidance to healthcare providers and family members.

- Revocable Living Trust: This document allows an individual to place their assets into a trust during their lifetime, which can help avoid probate and manage assets after death.

- Real Estate Purchase Agreement: When engaging in property transactions, refer to our detailed Real Estate Purchase Agreement guidelines to ensure a smooth process and legal compliance.

- Affidavit of Heirship: This form is used to establish the heirs of a deceased person. It can simplify the process of transferring property without a will.

Each of these documents plays a crucial role in comprehensive estate planning. Utilizing them can help ensure that an individual's wishes are clearly communicated and legally recognized.

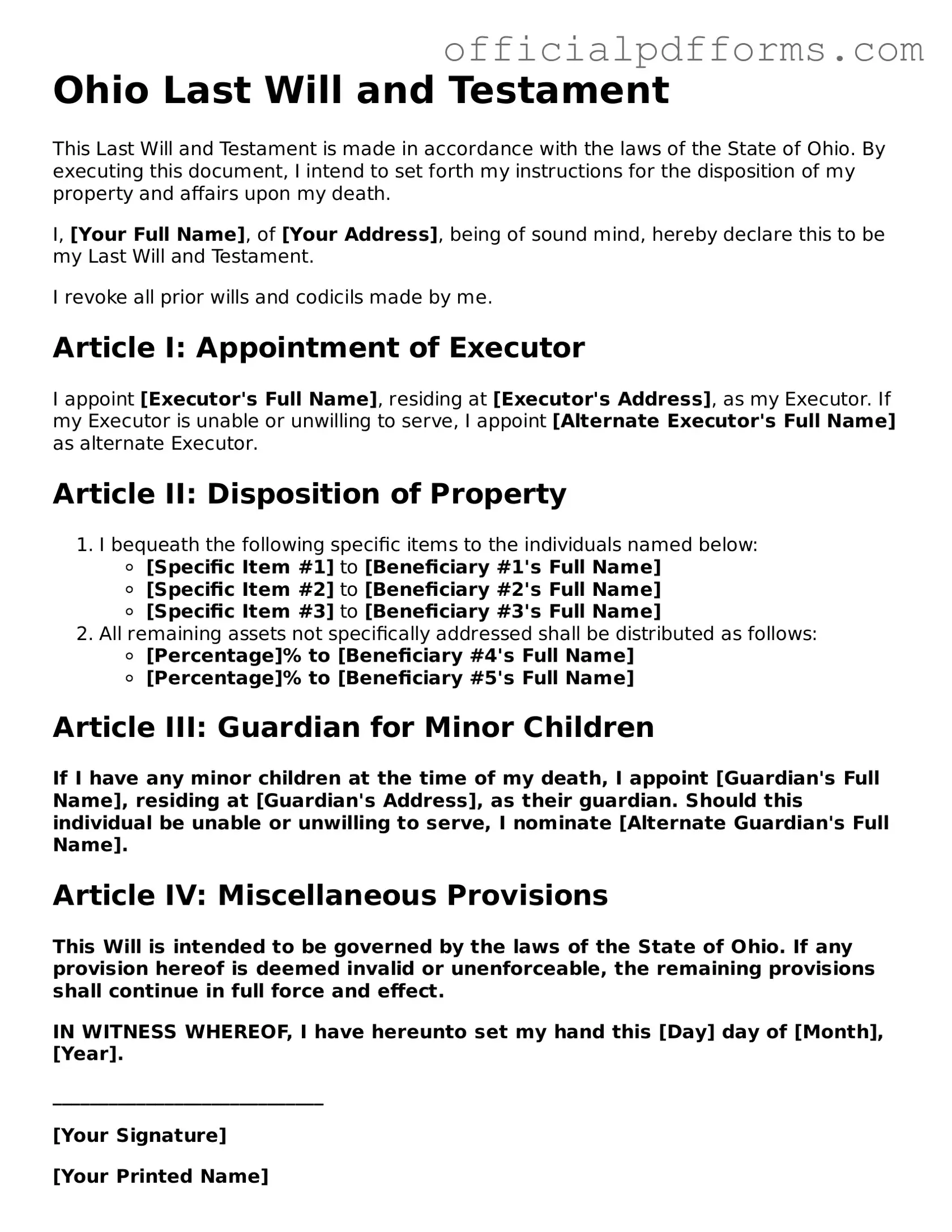

Steps to Filling Out Ohio Last Will and Testament

Filling out the Ohio Last Will and Testament form is an important step in ensuring that your wishes are honored after your passing. Once you have completed the form, it will need to be signed and witnessed according to Ohio law. Below are the steps to help you fill out the form accurately.

- Begin by entering your full name at the top of the form. Ensure that it matches your identification documents.

- Next, provide your current address. This should be your permanent residence.

- Specify the date on which you are completing the will. This helps establish the timeline of your wishes.

- Identify the executor of your will. This person will be responsible for carrying out your wishes. Include their full name and address.

- List your beneficiaries. Clearly state who will inherit your assets. Include their names and relationship to you.

- Detail any specific bequests. If you want to leave particular items or amounts of money to certain individuals, specify those here.

- Include a residuary clause. This addresses what happens to any remaining assets not specifically mentioned in the will.

- Sign the document in the designated area. Your signature indicates that you agree with the contents of the will.

- Have at least two witnesses sign the will. They must be present when you sign the document, and they should also include their names and addresses.

- Store the completed will in a safe place. Inform your executor or a trusted family member of its location.

Common mistakes

-

Not signing the will: One of the most common mistakes is failing to sign the will. A will must be signed by the person making it (the testator) to be valid. Without a signature, the will may not be recognized by the court.

-

Not having witnesses: In Ohio, a will typically needs to be witnessed by at least two people. If the will is not properly witnessed, it could be deemed invalid. Ensure that the witnesses are not beneficiaries of the will to avoid conflicts.

-

Failing to update the will: Life changes such as marriage, divorce, or the birth of children can affect your wishes. Not updating the will after significant life events can lead to confusion and disputes among heirs.

-

Ambiguous language: Using unclear or vague terms can lead to misunderstandings. It is important to be specific about who receives what and under what conditions. Clear language helps prevent disputes among beneficiaries.

-

Not including a residuary clause: A residuary clause specifies what happens to any remaining assets not mentioned in the will. Omitting this clause can result in unintended distribution of assets, potentially leading to legal issues.

Get Clarifications on Ohio Last Will and Testament

What is a Last Will and Testament in Ohio?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. In Ohio, this document allows individuals to specify beneficiaries, appoint an executor, and make decisions regarding guardianship for minor children. It serves to ensure that a person's wishes are honored and can help prevent disputes among family members.

Who can create a Last Will and Testament in Ohio?

In Ohio, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. The individual must be capable of understanding the implications of their decisions. There are no specific requirements regarding the legal education or experience of the person creating the will, but it is advisable to seek guidance to ensure compliance with state laws.

What are the requirements for a valid Last Will and Testament in Ohio?

For a Last Will and Testament to be considered valid in Ohio, it must meet several key requirements:

- The will must be in writing.

- The testator (the person creating the will) must sign the document.

- The will must be witnessed by at least two individuals who are present at the same time.

- Witnesses must sign the will in the presence of the testator.

It is important that the will is executed properly to avoid challenges in probate court.

Can I change my Last Will and Testament after it has been created?

Yes, individuals can change their Last Will and Testament at any time while they are alive and mentally competent. This can be done by creating a new will or by making a codicil, which is an amendment to the existing will. It is essential to follow the same legal requirements for signing and witnessing when making changes to ensure that the modifications are valid.

What happens if I die without a Last Will and Testament in Ohio?

If a person dies without a Last Will and Testament, they are said to have died "intestate." In this case, Ohio law dictates how the deceased's assets will be distributed. Generally, the estate will be divided among surviving relatives according to a specific order of priority established by state law. This can lead to outcomes that may not align with the deceased's wishes, making it important to have a will in place.