Printable Ohio Employment Verification Template

Find Other Popular Employment Verification Templates for Specific States

Peachcare for Kids Income - Can be requested by educational institutions for enrollment verification.

When participating in high-risk activities, understanding the importance of a Release of Liability form is essential, as it can significantly protect both parties involved. For further information on how to properly utilize this legal document, you can visit https://toptemplates.info/.

Misconceptions

Understanding the Ohio Employment Verification form is crucial for both employers and employees. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings.

- The form is optional for employers. Many believe that completing the employment verification form is not mandatory. In reality, employers are required to provide this form to verify employment status when requested.

- Employees can refuse to provide their information. Some think that employees can simply decline to fill out the form. However, providing accurate information is essential for the verification process, and refusal may lead to complications.

- All employers must use the same version of the form. There is a misconception that a standardized form exists for all employers. In fact, while the form must meet specific criteria, employers can adapt it to fit their needs, as long as it includes necessary information.

- The form only applies to full-time employees. Some individuals assume that the employment verification form is only for full-time workers. However, it applies to all employees, regardless of their work status, including part-time and temporary workers.

- Verification is only needed for new hires. Many believe that employment verification is only necessary for new employees. In truth, it can be requested at any time, particularly during background checks or loan applications.

- Employers cannot charge for completing the form. There is a belief that employers can impose fees for filling out the verification form. In reality, employers should not charge employees for this service, as it is part of their responsibility.

- The form guarantees employment. Some individuals think that filling out the employment verification form ensures job security. However, the form is merely a tool for verification and does not guarantee continued employment.

- Personal information is not protected. A common misconception is that the information provided on the form is not confidential. In fact, employers must handle this information with care and in accordance with privacy laws.

- Only HR can complete the form. Many believe that only human resources personnel can fill out the employment verification form. In reality, any authorized representative of the employer can complete it, as long as they have the necessary information.

By addressing these misconceptions, both employers and employees can navigate the employment verification process with greater clarity and confidence.

Documents used along the form

When completing the Ohio Employment Verification form, you may also need to gather additional documents to support your request or application. Below is a list of commonly used forms and documents that can complement the Employment Verification process.

- W-2 Form: This form shows the total annual wages earned by an employee and the taxes withheld. It is often required for verifying income during loan applications or tax filings.

- Pay Stubs: Recent pay stubs provide proof of current employment and income. They can help verify an employee's salary and work hours.

- Employment Offer Letter: This letter outlines the terms of employment, including job title, salary, and start date. It serves as a formal confirmation of the employment agreement.

- California Lease Agreement: Familiarizing yourself with the California Lease Agreement form is essential for understanding the rental terms; for more details, you can read the form.

- Tax Returns: Personal tax returns can be used to verify income and employment history. They provide a comprehensive view of an individual’s earnings over a year.

- Social Security Card: This card is often required to confirm identity and eligibility for employment. It contains the employee's Social Security number, which is crucial for tax purposes.

- Identification Documents: A government-issued ID, such as a driver's license or passport, is necessary to confirm identity. This helps prevent identity theft and ensures the accuracy of the employment verification process.

Gathering these documents along with the Ohio Employment Verification form can help streamline your verification process. Being prepared will make it easier to provide the necessary information to employers or agencies that require it.

Steps to Filling Out Ohio Employment Verification

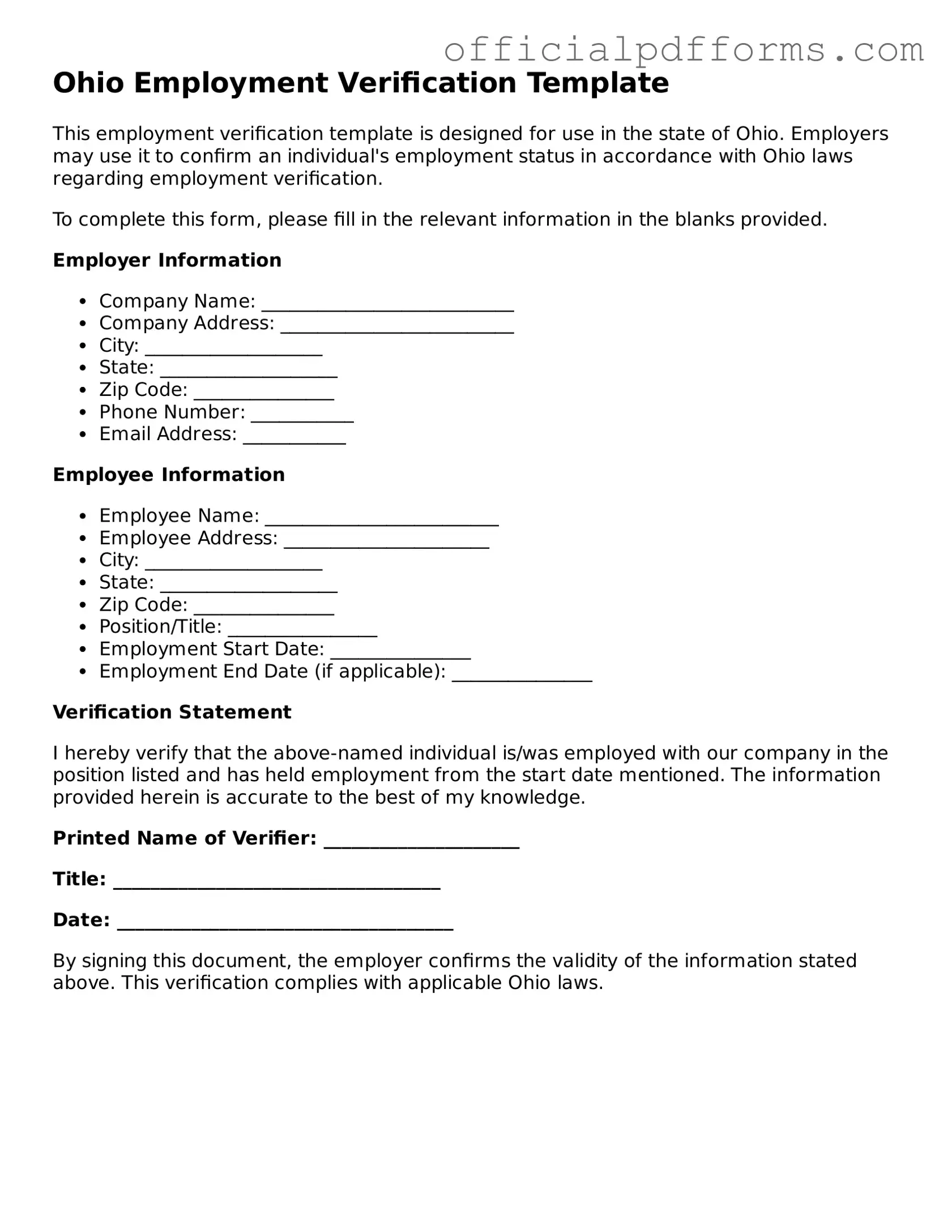

After obtaining the Ohio Employment Verification form, you will need to complete it with accurate and relevant information. This ensures that your employment status is confirmed properly. Follow the steps below to fill out the form correctly.

- Begin with your personal information. Fill in your full name, address, and contact number at the top of the form.

- Provide your Social Security number. This is essential for identification purposes.

- Next, enter your employer’s details. Include the company name, address, and phone number.

- Indicate your job title and the dates of your employment. Be sure to specify the start date and end date, if applicable.

- Fill in your salary information. Include your current salary or hourly wage as requested on the form.

- If required, sign and date the form at the bottom. Your signature verifies that the information provided is accurate.

- Finally, review the form for any errors before submitting it. Ensure all fields are filled out completely.

Common mistakes

-

Incomplete Information: One common mistake is not filling out all required fields. Make sure to provide complete details about the employee, including their full name, job title, and dates of employment.

-

Incorrect Dates: Double-check the employment dates. Providing the wrong start or end date can lead to confusion and may delay the verification process.

-

Missing Signatures: Forgetting to sign the form is another frequent error. Ensure that the form is signed by an authorized representative of the company.

-

Providing Outdated Information: Using old records can lead to inaccuracies. Always verify that the information reflects the current status of the employee.

-

Not Using Official Company Letterhead: Submitting the form without the company’s letterhead may raise questions about its authenticity. Always use official letterhead when submitting the verification.

-

Ignoring Privacy Considerations: Employees have rights regarding their personal information. Ensure that you only disclose information that is necessary and authorized by the employee.

Get Clarifications on Ohio Employment Verification

What is the Ohio Employment Verification form?

The Ohio Employment Verification form is a document used to confirm an individual's employment status. Employers or authorized representatives complete this form to provide verification to third parties, such as lenders or government agencies, regarding a person's job position, salary, and employment duration.

Who needs to complete the Ohio Employment Verification form?

Typically, employers are responsible for completing the form. Employees may request this verification for various reasons, including applying for loans, renting property, or seeking government assistance. It is essential for employers to respond promptly to these requests to assist their employees.

What information is included in the Ohio Employment Verification form?

The form generally includes the following details:

- Employee's name

- Employee's job title

- Employment start date

- Current employment status (active or terminated)

- Salary or hourly wage

- Employer's contact information

How does an employee request an employment verification?

An employee can request an employment verification by contacting their employer's human resources department. A formal written request may be necessary, specifying the purpose of the verification and any deadlines for submission. Clear communication helps ensure timely processing.

Is there a fee associated with the Ohio Employment Verification form?

Generally, there should be no fee for completing the Ohio Employment Verification form. Employers typically provide this service as part of their responsibilities. However, some employers may have specific policies regarding administrative fees, so it is advisable to confirm with the HR department.

How long does it take to receive the completed form?

The time frame for receiving a completed Ohio Employment Verification form can vary. Typically, employers aim to process requests within a few business days. However, delays may occur during busy periods or if additional information is needed. Employees should allow sufficient time for processing.

Can an employer refuse to complete the form?

Employers may refuse to complete the form under certain circumstances. For example, if the employee has not authorized the verification or if the request lacks sufficient information, the employer may decline. Employers should communicate any reasons for refusal clearly to the employee.

What should an employee do if their employment verification is incorrect?

If an employee notices inaccuracies in their employment verification, they should promptly contact their employer's HR department. Providing any necessary documentation or evidence will help rectify the situation. Employers have a responsibility to correct errors in a timely manner.

Are there any legal requirements for completing the Ohio Employment Verification form?

While there are no specific state laws mandating the use of the Ohio Employment Verification form, employers must comply with federal regulations regarding employment verification. This includes providing accurate information and maintaining confidentiality. Employers should be aware of relevant laws to avoid potential legal issues.

Can employment verification be done electronically?

Yes, many employers now offer electronic methods for completing employment verification. This can streamline the process and make it more efficient. Employees should inquire whether their employer supports electronic verification and what the specific procedures are.