Printable Ohio Durable Power of Attorney Template

Find Other Popular Durable Power of Attorney Templates for Specific States

Poa Financial Form - Investing time in the creation of this form can foster family trust and clarity regarding your wishes.

When engaging in any purchase transaction, it is essential to utilize a reliable resource for documentation, such as the Texas Bill of Sale. This form can be conveniently accessed through OnlineLawDocs.com, ensuring that all necessary details of the sale and transfer of personal property are meticulously recorded. It not only serves as a legal proof of purchase but also plays a critical role in maintaining accurate personal records.

Durable Power of Attorney Nc - A Durable Power of Attorney remains effective despite changes in your mental capacity.

New Jersey Power of Attorney - Having a Durable Power of Attorney in place is an act of responsible planning for your future.

Misconceptions

Understanding the Ohio Durable Power of Attorney (DPOA) is crucial for anyone considering this important legal document. However, several misconceptions can lead to confusion. Here are nine common misunderstandings about the Ohio DPOA, clarified for your benefit.

-

Misconception 1: A Durable Power of Attorney is only for financial matters.

This is not true. While many people use a DPOA for financial decisions, it can also cover health care and other personal matters. The scope depends on how the document is drafted.

-

Misconception 2: A DPOA can only be created when someone is incapacitated.

In fact, a Durable Power of Attorney can be established at any time, as long as the individual is mentally competent. It is often recommended to set one up before any potential incapacity occurs.

-

Misconception 3: The agent must be a lawyer or financial expert.

Not at all. The agent can be a trusted family member or friend. The key is to choose someone who will act in your best interests and understands your wishes.

-

Misconception 4: A DPOA is a one-size-fits-all document.

This is misleading. The DPOA can be tailored to fit individual needs and preferences. Specific powers can be granted or limited based on personal circumstances.

-

Misconception 5: A DPOA automatically expires upon the principal's death.

This is correct. However, many people mistakenly believe it can still be used after death. In reality, the authority granted to the agent ends when the principal passes away.

-

Misconception 6: A DPOA can override a person's wishes.

While the agent has authority to make decisions, they are legally obligated to act in accordance with the principal's wishes. The DPOA should reflect the principal's values and desires.

-

Misconception 7: A DPOA is the same as a living will.

These are distinct documents. A living will outlines medical treatment preferences, while a DPOA grants someone the authority to make decisions on your behalf, including health care decisions.

-

Misconception 8: Once a DPOA is signed, it cannot be changed.

This is not true. A Durable Power of Attorney can be revoked or modified at any time, as long as the principal is competent. Regularly reviewing the document is a good practice.

-

Misconception 9: A DPOA is only necessary for older adults.

This is a narrow view. Anyone, regardless of age, can benefit from having a DPOA in place. Unexpected events can happen at any age, making it wise to prepare in advance.

Being informed about these misconceptions can help you make better decisions regarding your legal planning. A Durable Power of Attorney is a valuable tool that can provide peace of mind for you and your loved ones.

Documents used along the form

When creating a Durable Power of Attorney (DPOA) in Ohio, it’s essential to consider other documents that can complement this important legal tool. Each of these forms serves a unique purpose and can help ensure your wishes are respected, especially in matters of health care and financial decisions. Below is a list of documents commonly used alongside the Ohio Durable Power of Attorney.

- Living Will: This document outlines your preferences regarding medical treatment in situations where you may be unable to communicate your wishes. It typically addresses end-of-life care and life-sustaining treatments.

- Health Care Power of Attorney: Similar to a DPOA but focused solely on health care decisions, this document allows you to appoint someone to make medical decisions on your behalf if you are incapacitated.

- Financial Power of Attorney: While the DPOA can include financial matters, a separate Financial Power of Attorney can be created to specifically designate someone to manage your financial affairs, including banking and property transactions.

- Will: A will outlines how you want your assets distributed after your death. It can also name guardians for minor children and specify funeral arrangements, providing peace of mind for your loved ones.

- Trust: A trust can help manage your assets during your lifetime and dictate how they should be distributed after your death, often avoiding the probate process and providing privacy.

- IRS 2553 Form: This form is essential for small businesses looking to elect S corporation status for tax purposes, and you can find more information at smarttemplates.net/fillable-irs-2553/.

- HIPAA Release Form: This document allows designated individuals access to your medical records and information, ensuring that your health care agents can make informed decisions.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow you to designate beneficiaries directly. These designations supersede a will and should be kept up to date.

- Asset Inventory: An asset inventory lists your properties, bank accounts, and other valuables. This document can simplify the process for your agents or executors when managing your estate.

- Advance Directive: This is a broader term that encompasses both a Living Will and a Health Care Power of Attorney, providing a comprehensive approach to your health care preferences.

By considering these documents in conjunction with your Durable Power of Attorney, you can create a comprehensive plan that addresses both your financial and health care needs. Taking these steps ensures that your wishes are honored and that your loved ones are prepared to act on your behalf when necessary.

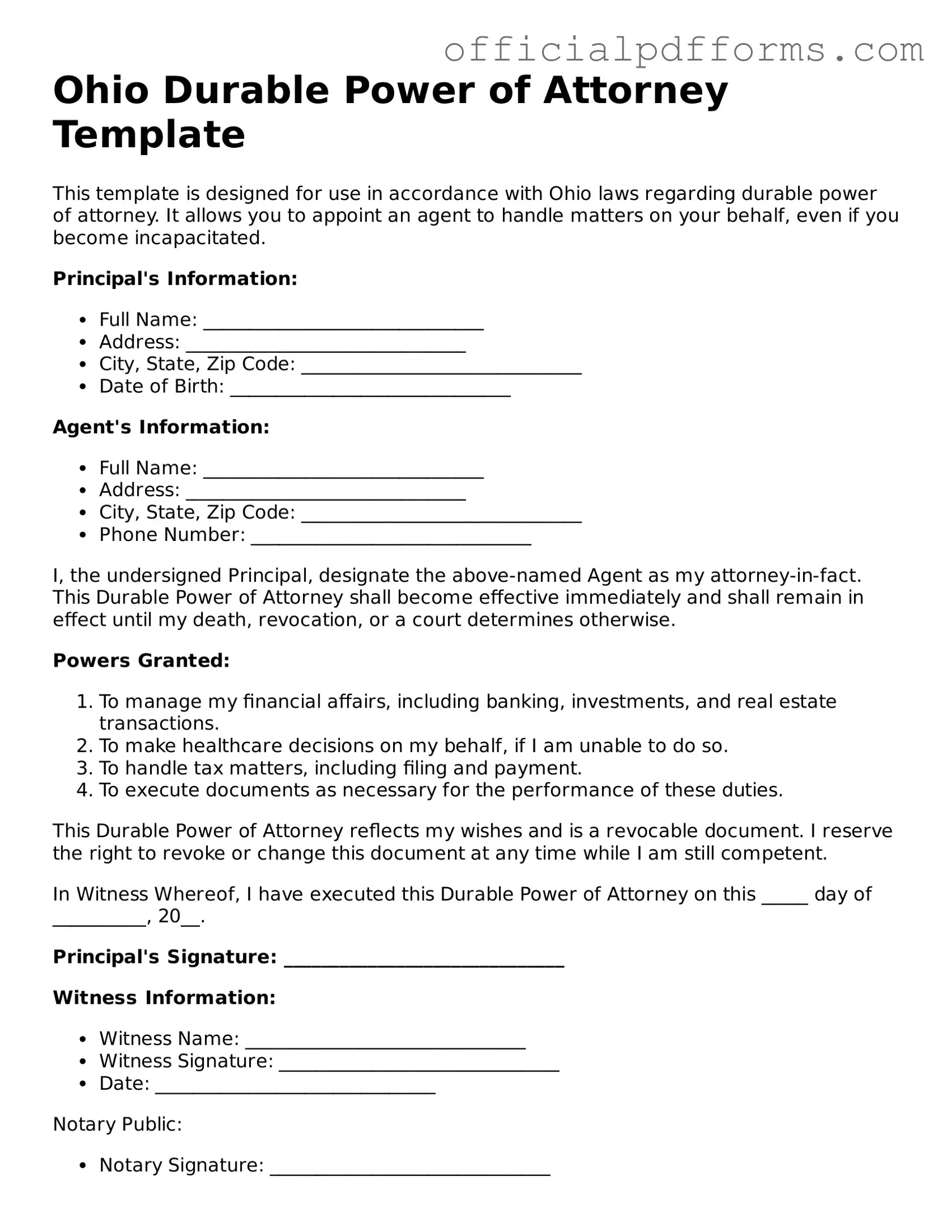

Steps to Filling Out Ohio Durable Power of Attorney

Filling out the Ohio Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are handled according to your wishes if you become unable to manage them yourself. After completing the form, you will need to sign it in front of a notary public to make it legally binding. Be sure to keep a copy for your records and share it with your designated agent.

- Obtain a copy of the Ohio Durable Power of Attorney form. You can find it online or request it from a legal professional.

- Read through the entire form carefully to understand the sections you will need to fill out.

- Fill in your full name and address in the designated area at the top of the form.

- Identify the person you are appointing as your agent. Provide their full name and address in the appropriate section.

- Decide if you want to give your agent broad powers or limit their authority. If limiting, clearly specify the powers you wish to grant.

- Include any specific instructions or wishes you have regarding your finances or healthcare decisions, if applicable.

- Sign and date the form in the presence of a notary public to validate it.

- Make copies of the signed form for your records and for your agent.

Common mistakes

-

Failing to clearly identify the principal. It's crucial to provide the full legal name and address of the person granting authority.

-

Not specifying the powers granted. A general statement may lead to confusion. Clearly outline the specific powers the agent will have.

-

Ignoring the date of execution. The document must be dated to establish when the powers take effect.

-

Neglecting to sign in the appropriate places. The principal must sign the document, and witnesses may also need to sign, depending on the requirements.

-

Overlooking the need for witnesses or notarization. Depending on the situation, having the document witnessed or notarized may be necessary for validity.

-

Using outdated forms. Always ensure the form is the latest version, as laws and requirements can change.

-

Not providing copies to relevant parties. After completion, the principal should distribute copies to the agent and any institutions that may need it.

-

Failing to revoke previous powers of attorney. If a new document is created, previous ones should be formally revoked to avoid confusion.

-

Assuming all agents have the same authority. If multiple agents are appointed, clarify if they have joint or separate powers to avoid conflicts.

Get Clarifications on Ohio Durable Power of Attorney

What is a Durable Power of Attorney in Ohio?

A Durable Power of Attorney (DPOA) in Ohio is a legal document that allows you to appoint someone you trust to make decisions on your behalf if you become unable to do so. This document remains effective even if you become incapacitated. It is important to choose a person who understands your wishes and can act in your best interest.

Who can be appointed as an agent under a Durable Power of Attorney?

In Ohio, you can appoint anyone as your agent, as long as they are at least 18 years old and capable of making decisions. This can be a family member, friend, or even a professional, such as an attorney. It is crucial to select someone who is trustworthy and understands your values and preferences.

What powers can be granted through a Durable Power of Attorney?

You can grant a wide range of powers to your agent, including but not limited to:

- Managing your financial affairs, such as paying bills and handling investments.

- Making healthcare decisions, including medical treatment options.

- Handling real estate transactions on your behalf.

- Managing your business interests, if applicable.

It is essential to specify the powers you want to grant clearly. You can choose to give broad authority or limit the powers to specific areas, depending on your needs.

How do I create a Durable Power of Attorney in Ohio?

Creating a Durable Power of Attorney in Ohio involves several steps:

- Choose your agent wisely, ensuring they understand your wishes.

- Obtain the Ohio Durable Power of Attorney form, which can be found online or through legal resources.

- Complete the form, clearly outlining the powers you are granting.

- Sign the document in the presence of a notary public or two witnesses, as required by Ohio law.

Once completed, provide copies of the document to your agent and any relevant institutions, such as banks or healthcare providers.

Can I revoke a Durable Power of Attorney in Ohio?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To do so, you should create a written notice of revocation and provide it to your agent and any institutions that may have a copy of the original document. It is advisable to destroy the original DPOA form to prevent any confusion. Always ensure that your intentions are clear to avoid any misunderstandings.