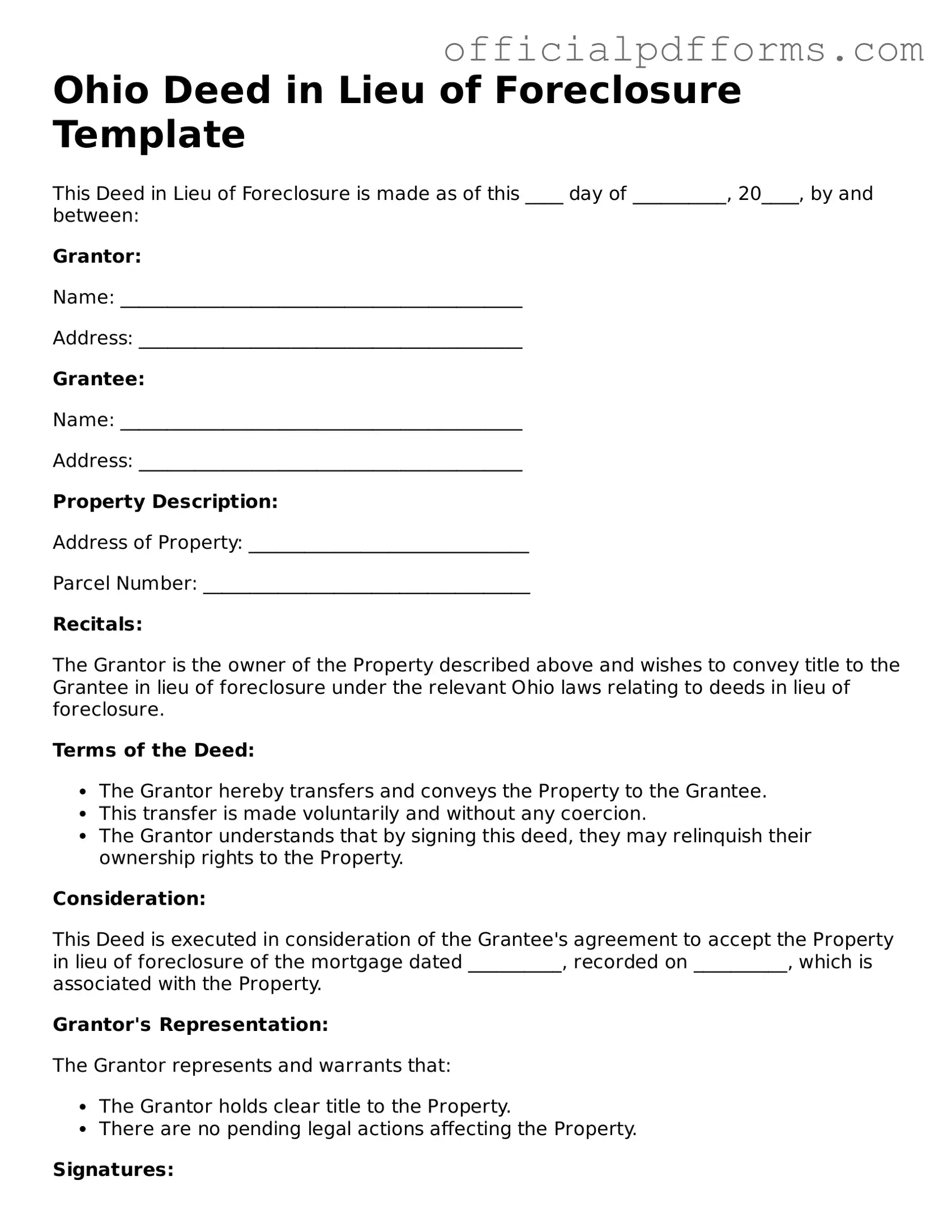

Printable Ohio Deed in Lieu of Foreclosure Template

Find Other Popular Deed in Lieu of Foreclosure Templates for Specific States

Georgia Foreclosure - Homeowners may receive a tax form for any forgiven amount from the lender.

Understanding the nuances of a New York Residential Lease Agreement is essential for both landlords and tenants to ensure a smooth rental experience, as highlighted on OnlineLawDocs.com. This agreement not only formalizes their relationship but also provides clear guidelines on crucial aspects like rent payment, duration of the lease, and obligations for property maintenance.

Deed in Lieu of Mortgage - Can lead to a fresh start for homeowners inputting financial stress.

Deed in Lieu of Mortgage - Lenders may require that properties be returned in satisfactory condition.

Misconceptions

Understanding the Ohio Deed in Lieu of Foreclosure form is essential for homeowners facing financial difficulties. However, several misconceptions can lead to confusion and poor decision-making. Here are seven common misconceptions:

- It eliminates all debts associated with the property. Many people believe that signing a deed in lieu of foreclosure cancels all debts. In reality, it only transfers ownership of the property to the lender, and the homeowner may still owe other debts.

- It is a quick and easy process. While a deed in lieu of foreclosure can be faster than a foreclosure, it still requires negotiation and approval from the lender. The process can take time and involve various steps.

- It has no impact on credit scores. Homeowners often think that a deed in lieu of foreclosure will not affect their credit. However, it is reported to credit agencies and can significantly lower credit scores.

- All lenders accept deeds in lieu of foreclosure. Not every lender offers this option. Some lenders may prefer to pursue foreclosure instead, depending on their policies and the specific circumstances of the loan.

- It is the same as a short sale. A deed in lieu of foreclosure is different from a short sale. In a short sale, the property is sold for less than the mortgage balance with lender approval, while a deed in lieu involves transferring ownership back to the lender without a sale.

- Homeowners can stay in the property after signing. Some homeowners mistakenly believe they can remain in the property after signing a deed in lieu. Generally, once ownership is transferred, the lender has the right to evict the former owner.

- It is only for those who are behind on payments. While many who pursue a deed in lieu are struggling with payments, it is not exclusively for those in default. Homeowners facing financial difficulties but still current on payments may also consider this option.

Recognizing these misconceptions can help homeowners make informed decisions regarding their financial situations and the potential benefits and drawbacks of a deed in lieu of foreclosure.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer their property to the lender to avoid foreclosure. This process often involves several other forms and documents that facilitate the transaction. Below is a list of common documents associated with this process.

- Loan Modification Agreement: This document outlines the new terms of the mortgage, including interest rates and payment schedules, after a modification has been agreed upon.

- Notice of Default: This notice informs the homeowner that they have fallen behind on mortgage payments and that the lender may initiate foreclosure proceedings if the debt is not addressed.

- Property Inspection Report: A report detailing the condition of the property, often required by the lender to assess its value and any potential issues before accepting the deed.

- Release of Liability: This document releases the homeowner from further obligations related to the mortgage after the property has been transferred to the lender.

- Settlement Statement: A detailed account of all financial transactions related to the deed transfer, including any fees, credits, and debits associated with the process.

- Affidavit of Title: A sworn statement by the homeowner confirming their ownership of the property and that there are no undisclosed liens or claims against it.

- FedEx Bill of Lading: This document serves as a critical contract between the shipper and FedEx, detailing shipment terms and responsibilities. For additional details, you can refer to the official form here: https://smarttemplates.net/fillable-fedex-bill-of-lading.

- Title Insurance Policy: This policy protects the lender from any future claims against the property’s title that may arise after the deed transfer.

- Quitclaim Deed: A document used to transfer any interest the homeowner has in the property to the lender without guaranteeing that the title is clear.

- Credit Counseling Certificate: A document that proves the homeowner has received counseling regarding their financial situation, often required before proceeding with a deed in lieu.

These documents are essential in ensuring a smooth and legally compliant transition during the deed in lieu of foreclosure process. Each serves a specific purpose, contributing to the overall clarity and security of the transaction for both the homeowner and the lender.

Steps to Filling Out Ohio Deed in Lieu of Foreclosure

Once you have the Ohio Deed in Lieu of Foreclosure form, you will need to complete it carefully. After filling out the form, you will submit it to the appropriate county recorder's office. This step is essential to ensure the transfer of property ownership is legally recognized.

- Begin by entering the date at the top of the form.

- Provide the names of the parties involved. This includes the grantor (the property owner) and the grantee (the lender or bank).

- Fill in the property description. Include the street address, city, county, and any other identifying information about the property.

- Indicate the reason for the deed in lieu of foreclosure. Briefly state that the property is being transferred to the lender to avoid foreclosure.

- Sign the form in the designated area. The grantor must sign it in front of a notary public.

- Have the signature notarized. The notary will verify the identity of the signer and affix their seal to the document.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the county recorder’s office where the property is located. Check for any filing fees that may apply.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. This includes not specifying the correct address, parcel number, or legal description. A vague or incomplete description can lead to issues in the transfer process.

-

Missing Signatures: All required parties must sign the document. If any signatures are missing, the deed may not be valid. This includes the signature of the property owner and, in some cases, the lender's representative.

-

Not Notarizing the Document: A deed in lieu of foreclosure typically requires notarization. Failing to have the document notarized can result in the deed being challenged or deemed invalid.

-

Ignoring State-Specific Requirements: Each state may have specific requirements or additional forms that need to be included. Not being aware of Ohio's particular rules can lead to complications in the process.

-

Overlooking Tax Implications: Some individuals forget to consider the potential tax consequences of a deed in lieu of foreclosure. It’s important to understand how this transfer may affect tax liabilities before proceeding.

Get Clarifications on Ohio Deed in Lieu of Foreclosure

- Current financial situation

- Property value compared to the mortgage balance

- Efforts made to sell the property

- It can help avoid the negative impact of a foreclosure on credit scores.

- Homeowners may be able to negotiate a more favorable outcome, such as a waiver of deficiency judgments.

- The process is often quicker and less expensive than a traditional foreclosure.

- Homeowners may still face tax implications on forgiven debt.

- Not all lenders may accept a Deed in Lieu of Foreclosure.

- It may not be possible to negotiate favorable terms.

- The homeowner contacts the lender to express interest in a Deed in Lieu of Foreclosure.

- Both parties negotiate terms, including any potential forgiveness of debt.

- A formal agreement is drafted, and the homeowner signs over the deed.

- The lender takes possession of the property.

- Proof of income and financial hardship.

- Current mortgage documents.

- Any relevant tax documents.

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option can be beneficial for both parties, as it allows the homeowner to avoid the lengthy and often costly foreclosure process.

Who is eligible for a Deed in Lieu of Foreclosure in Ohio?

Eligibility for a Deed in Lieu of Foreclosure generally depends on the lender's policies and the specific circumstances of the homeowner. Typically, homeowners facing financial difficulties and unable to maintain mortgage payments may qualify. Factors that lenders may consider include:

What are the advantages of a Deed in Lieu of Foreclosure?

There are several advantages to this process, including:

What are the potential disadvantages?

While there are benefits, there are also potential drawbacks to consider:

How does the process work?

The process typically involves several steps:

What documents are needed for a Deed in Lieu of Foreclosure?

Homeowners will usually need to provide various documents, which may include:

Can a Deed in Lieu of Foreclosure affect my credit score?

Yes, a Deed in Lieu of Foreclosure can impact a homeowner's credit score. However, it may have a less severe effect compared to a full foreclosure. The specific impact can vary based on individual circumstances and the overall credit history of the homeowner.