Printable Ohio Deed Template

Find Other Popular Deed Templates for Specific States

Nc Deed Transfer Form - The Deed is legal proof of the transfer of property interests.

Quit Claim Deed Form Georgia - It serves as proof of ownership for real estate transactions.

To facilitate an efficient shipping process, it is important for shippers to utilize the FedEx Bill of Lading form accurately, ensuring that all relevant information is filled in. By using this form, shippers agree to the specific terms laid out by FedEx, which are critical for smooth transportation of goods. For more detailed guidance and resources regarding the form, shippers can visit https://smarttemplates.net/fillable-fedex-bill-of-lading/.

What Does a Deed Look Like in Pa - In the case of a transfer via a Will, a Deed may still be necessary for formal ownership transfer.

How to Obtain the Deed to My House - The form may include a description of the property being transferred.

Misconceptions

Understanding the Ohio Deed form is crucial for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

-

All deeds are the same. Many people believe that all deed forms serve the same purpose. In reality, there are different types of deeds, such as warranty deeds, quitclaim deeds, and special purpose deeds, each serving distinct functions.

-

Only a lawyer can prepare a deed. While it is advisable to consult a lawyer for complex transactions, individuals can prepare a deed themselves if they understand the requirements and language involved.

-

A deed must be notarized to be valid. Notarization is important for many deeds, but not all deeds require it. Some may be valid without a notary, depending on the circumstances and local laws.

-

Once a deed is signed, it cannot be changed. Many people think that a deed is final once executed. However, deeds can be amended or revoked, provided the proper legal processes are followed.

-

All property transfers require a deed. While most property transfers do involve a deed, some transactions, like certain leases or easements, may not require a formal deed.

-

Deeds do not need to be recorded. Some believe that recording a deed is optional. In Ohio, recording is essential to protect ownership rights and establish a public record.

-

Only the seller must sign the deed. It is a common misconception that only the seller's signature is necessary. In many cases, the buyer’s signature is also required, especially in certain types of deeds.

Clarifying these misconceptions can help ensure smoother property transactions and better understanding of the Ohio Deed form.

Documents used along the form

When dealing with property transactions in Ohio, several forms and documents complement the Ohio Deed form. Each of these documents serves a specific purpose and helps ensure a smooth transfer of ownership. Below is a list of commonly used forms that you may encounter.

- Property Transfer Tax Affidavit: This form is required to report the sale of property and calculate the transfer tax owed to the state and local governments.

- Title Insurance Policy: This document protects the buyer and lender from any claims against the property’s title. It ensures that the title is clear and free from disputes.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and declares that there are no outstanding liens or encumbrances.

- Residential Lease Agreement: This important document outlines the terms and responsibilities between landlords and tenants, ensuring a clear understanding of the rental relationship. For a detailed example, visit OnlineLawDocs.com.

- Purchase Agreement: This contract outlines the terms and conditions of the sale between the buyer and seller. It includes details like the sale price and any contingencies.

- Closing Statement: This document summarizes all financial transactions related to the property sale, including fees, taxes, and the final amount due at closing.

- Power of Attorney: If a party cannot be present at the closing, this document allows someone else to act on their behalf in signing the necessary paperwork.

- Homestead Exemption Application: This form can help homeowners reduce their property taxes. It’s often filed after the purchase to claim the exemption for primary residences.

Understanding these documents can make the property transfer process more manageable. Each form plays a vital role in ensuring that everything is in order and legally sound. Always consider consulting with a professional for guidance tailored to your specific situation.

Steps to Filling Out Ohio Deed

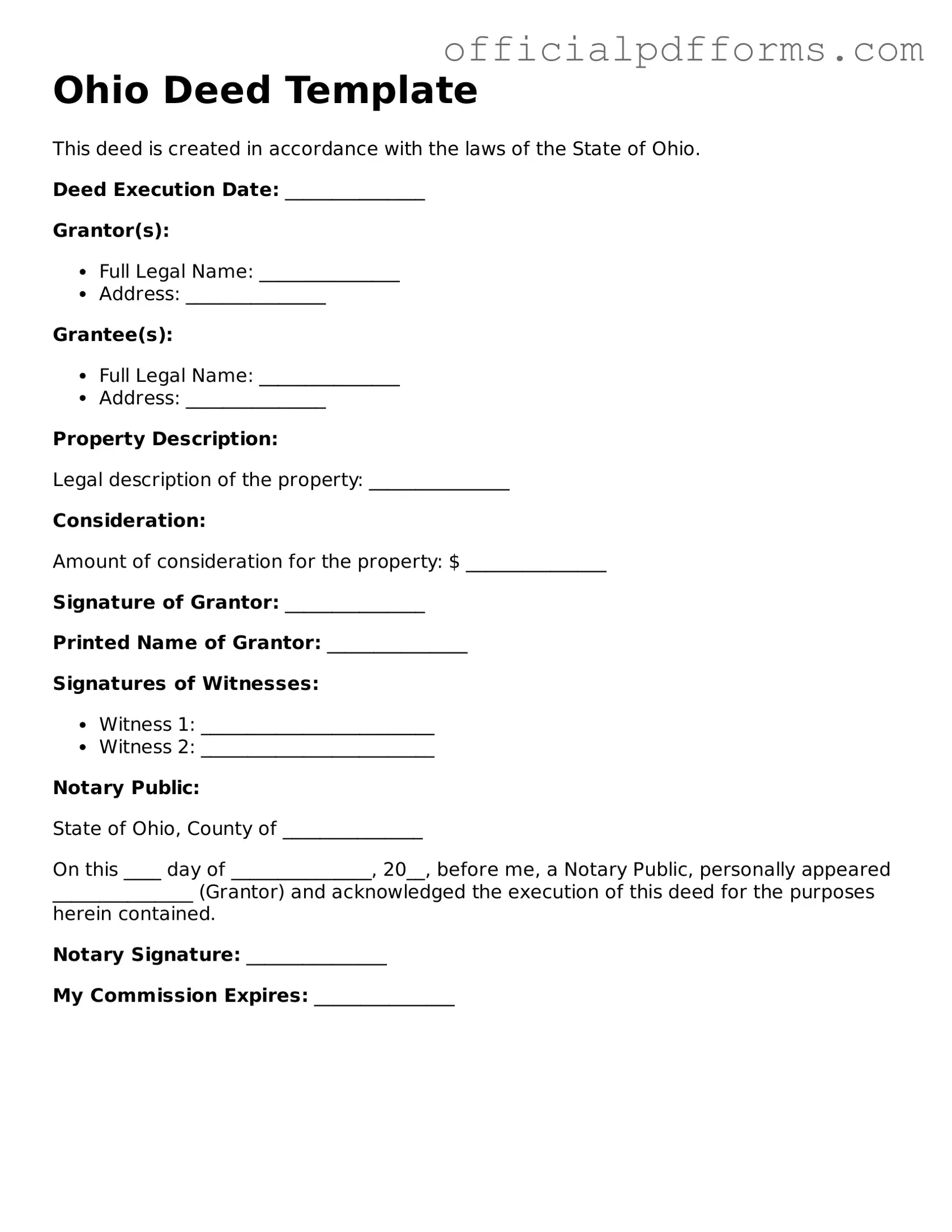

Once you have gathered the necessary information, you are ready to complete the Ohio Deed form. This document will require specific details about the property and the parties involved. Ensure that all information is accurate to avoid any issues during the recording process.

- Obtain the Ohio Deed form from a reliable source, such as a county recorder's office or an official website.

- Begin by filling in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property) in the designated fields.

- Provide the address of the property being transferred, including the street address, city, state, and zip code.

- Include a legal description of the property. This may be found in previous deeds or property tax records.

- Specify the consideration, which is the amount paid for the property, or state if it is a gift.

- Indicate the date of the transaction.

- Have the grantor sign the form in the presence of a notary public. The notary will also sign and stamp the document.

- Check for any additional requirements specific to your county, such as additional signatures or forms.

- Make copies of the completed deed for your records.

- Submit the original deed to the county recorder's office for recording.

Common mistakes

-

Incorrect Grantee Information: People often misspell the names of the grantees or fail to include middle initials. This can lead to confusion and potential legal issues later.

-

Missing Signatures: A common mistake is forgetting to sign the deed. All required parties must sign for the deed to be valid.

-

Improper Notarization: Some individuals neglect to have the deed notarized or use an unqualified notary. This step is crucial for the deed's acceptance.

-

Inaccurate Property Description: Failing to provide a precise legal description of the property can create problems. A vague or incorrect description may lead to disputes.

-

Wrong Date: Entering an incorrect date can invalidate the deed. Always double-check the date before submitting the form.

-

Omitting Consideration Amount: Some people forget to include the amount of consideration, which is the price paid for the property. This information is essential for the deed.

-

Failure to Use the Correct Deed Type: Different types of deeds exist, such as warranty deeds and quitclaim deeds. Choosing the wrong type can affect ownership rights.

-

Not Checking Local Requirements: Each county may have specific requirements for deeds. Ignoring these can lead to rejections or delays.

-

Improper Formatting: Some individuals do not follow the required formatting guidelines. This can include font size, margins, and spacing, which may affect acceptance.

-

Neglecting to Record the Deed: After filling out the deed, failing to record it with the county recorder’s office can lead to issues with ownership claims in the future.

Get Clarifications on Ohio Deed

- Warranty Deed: Provides the highest level of protection to the buyer, guaranteeing that the seller holds clear title to the property.

- Quitclaim Deed: Transfers whatever interest the seller has in the property without any guarantees about the title.

- Special Warranty Deed: Similar to a warranty deed, but only guarantees the title against defects that occurred during the seller's ownership.

- Provide the names and addresses of the grantor (seller) and grantee (buyer).

- Include a legal description of the property being transferred.

- State the consideration (price) for the transfer.

- Sign the deed in front of a notary public.

What is an Ohio Deed form?

An Ohio Deed form is a legal document used to transfer ownership of real property from one party to another in the state of Ohio. It outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions of the transfer.

What types of deeds are available in Ohio?

Ohio recognizes several types of deeds, including:

How do I fill out an Ohio Deed form?

To fill out an Ohio Deed form, follow these steps:

Do I need to have the deed notarized?

Yes, in Ohio, a deed must be signed in front of a notary public to be legally valid. The notary will verify the identities of the parties involved and witness the signing of the document.

Where do I file the Ohio Deed form?

You should file the completed deed with the county recorder’s office in the county where the property is located. This ensures that the transfer is officially recorded and becomes part of the public record.

Is there a fee to file the deed?

Yes, there is typically a fee to file a deed in Ohio. The fee varies by county, so it’s best to check with your local county recorder’s office for specific amounts.

What happens if I don’t file the deed?

If you don’t file the deed, the transfer of ownership may not be recognized legally. This can lead to issues with property rights and future transactions, as the public record will not reflect the change in ownership.

Can I create my own Ohio Deed form?

While you can create your own deed form, it’s recommended to use a standard form or consult with a legal professional. This helps ensure that all necessary information is included and that the document complies with Ohio laws.

What is the purpose of a deed?

The primary purpose of a deed is to provide a clear record of ownership and the terms of the property transfer. It protects the rights of the buyer and seller, ensuring that the transaction is legally binding.

Can a deed be challenged after it’s filed?

Yes, a deed can be challenged in certain circumstances, such as if there was fraud, coercion, or if the grantor lacked the legal capacity to sign the deed. Legal action may be necessary to resolve disputes over ownership.