Printable Ohio Articles of Incorporation Template

Find Other Popular Articles of Incorporation Templates for Specific States

Ga Corporation - Timely filing can help avoid penalties or delays in the formation process.

Pa Corporation - The Articles typically specify the number of shares the corporation is authorized to issue.

Llc Articles of Organization Nj - Incorporators must provide details about the number of shares the corporation is authorized to issue.

When engaging in the sale or purchase of a motorcycle in Texas, it is crucial to utilize a Texas Motorcycle Bill of Sale form, which helps to protect both parties involved. For those seeking a reliable source for this document, OnlineLawDocs.com offers a convenient option to ensure all necessary information is captured accurately and legally.

How to Get a Copy of Your Articles of Incorporation - The form requires the corporation's name, which must be unique and not misleading.

Misconceptions

Understanding the Ohio Articles of Incorporation form is essential for anyone looking to start a business in Ohio. However, several misconceptions often arise regarding this document. Below are five common misconceptions and clarifications about them.

- All businesses must file Articles of Incorporation. Not all business entities are required to file this document. Only corporations need to submit Articles of Incorporation. Other business structures, like sole proprietorships or partnerships, do not require this form.

- Filing Articles of Incorporation guarantees legal protection. While filing does provide a level of legal protection, it does not shield owners from all liabilities. Personal liability can still exist in certain situations, such as if personal guarantees are made.

- Articles of Incorporation can be filed at any time. There are specific times when filing is more beneficial. For example, filing at the beginning of the fiscal year can help in tax planning and compliance.

- Once filed, Articles of Incorporation cannot be changed. This is not true. Amendments can be made to the Articles of Incorporation after they have been filed. However, the process for making changes must be followed according to Ohio law.

- Filing fees are the same for all types of corporations. Fees can vary depending on the type of corporation being formed. For instance, nonprofit organizations may have different fees compared to for-profit corporations.

Addressing these misconceptions can help individuals navigate the process of incorporating a business in Ohio more effectively.

Documents used along the form

When forming a corporation in Ohio, the Articles of Incorporation are just the beginning. Several other documents and forms may be necessary to ensure compliance with state regulations and to establish your business properly. Here’s a list of important forms you might need to consider.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. It includes details about meetings, voting rights, and the roles of officers and directors.

- Organizational Meeting Minutes: After incorporation, the first meeting of the board of directors should be documented. These minutes capture decisions made regarding the corporation's structure and operations.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This document provides the state with updated information about the corporation’s structure and operations.

- Employer Identification Number (EIN) Application: This form is necessary for tax purposes. The EIN is used to identify your business for federal tax obligations and is required for hiring employees.

- State Business License: Depending on your business type and location, you may need to obtain a license to operate legally within your city or county.

- Fictitious Name Registration: If your corporation plans to operate under a name different from its legal name, you may need to register that fictitious name with the state.

- IRS W-9 Form: This vital document is used to provide taxpayer identification numbers for income reporting and can be filled out using resources like smarttemplates.net/fillable-irs-w-9.

- Annual Report: Many states require corporations to file annual reports. This document provides updated information about the business and ensures compliance with state regulations.

Gathering these documents can streamline the incorporation process and help establish a solid foundation for your business. Make sure to review each requirement carefully to ensure compliance with Ohio laws.

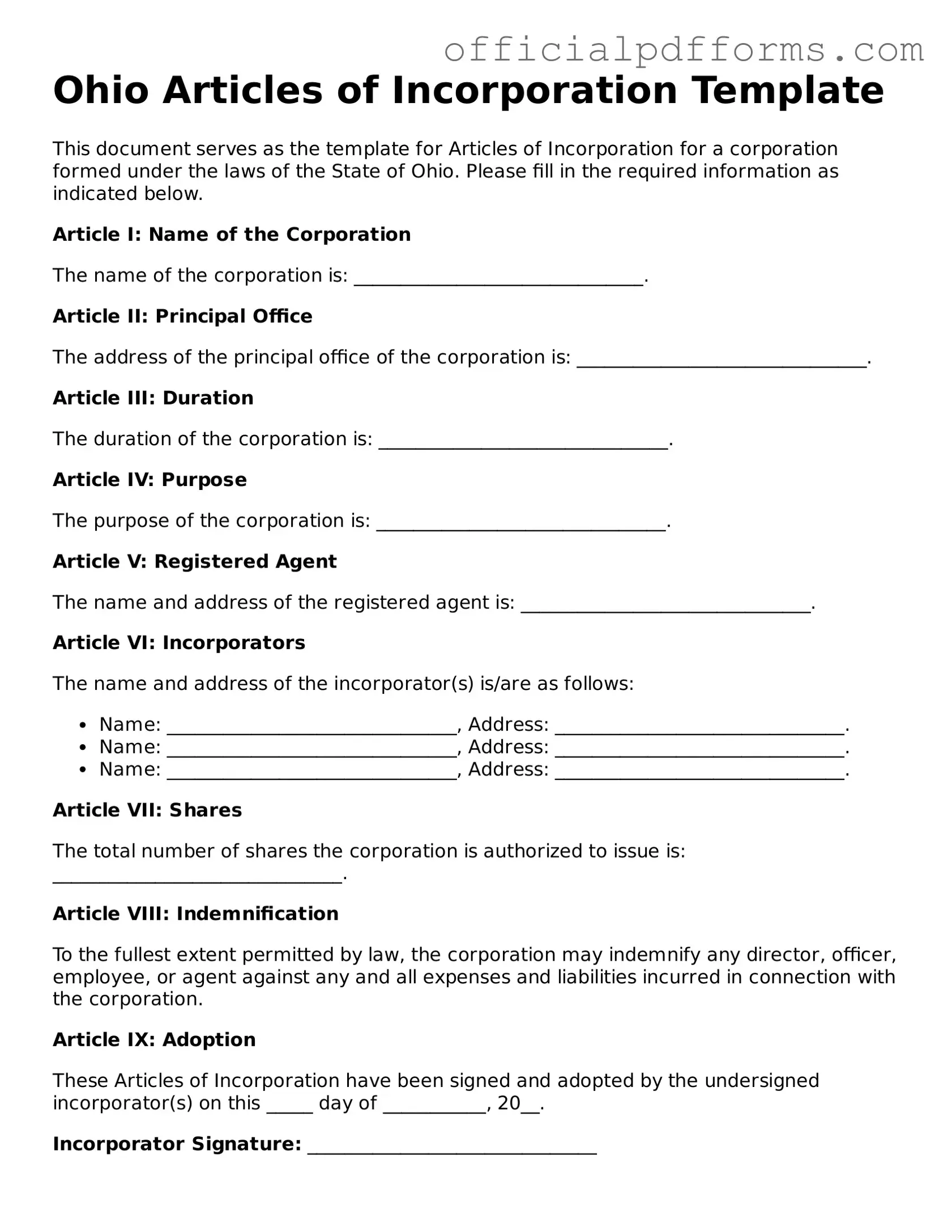

Steps to Filling Out Ohio Articles of Incorporation

After completing the Ohio Articles of Incorporation form, the next step is to submit it to the Ohio Secretary of State along with the required filing fee. This process officially establishes your corporation in the state.

- Obtain the Ohio Articles of Incorporation form from the Ohio Secretary of State's website or office.

- Fill in the name of your corporation. Ensure it complies with Ohio naming requirements.

- Provide the purpose of your corporation. This should be a brief statement outlining the business activities.

- List the address of the corporation's principal office. Include the street address, city, state, and ZIP code.

- Designate a registered agent. This individual or entity will receive legal documents on behalf of the corporation.

- Include the name and address of the registered agent, ensuring it is complete and accurate.

- State the number of shares the corporation is authorized to issue, if applicable.

- Indicate whether the corporation will have members and provide any additional provisions as necessary.

- Sign and date the form. This should be done by the incorporator or an authorized individual.

- Prepare the filing fee, which can be paid by check or credit card, depending on the submission method.

- Submit the completed form and fee to the Ohio Secretary of State, either online, by mail, or in person.

Common mistakes

-

Incorrect Business Name: One of the most common mistakes is failing to choose a unique name for the corporation. The name must not only be distinguishable from existing entities but also comply with Ohio naming rules, such as including "Corporation," "Incorporated," or an abbreviation like "Inc."

-

Improper Purpose Statement: The purpose of the corporation must be clearly stated. Many people write vague or overly broad statements. A specific purpose helps clarify the corporation's activities and can prevent future legal issues.

-

Missing Registered Agent Information: Every corporation in Ohio must designate a registered agent. Omitting this information can lead to delays or rejections. The registered agent must have a physical address in Ohio and be available during business hours.

-

Incorrect Number of Shares: When specifying the number of shares the corporation is authorized to issue, individuals often make errors. They may list an incorrect number or forget to include both the total number of shares and the par value, if applicable.

-

Failure to Sign the Document: It may seem obvious, but forgetting to sign the Articles of Incorporation is a frequent oversight. The document must be signed by the incorporators to be valid. Without signatures, the filing cannot be processed.

-

Inaccurate Filing Fees: Each filing requires a specific fee. People sometimes miscalculate the amount due or fail to include payment altogether. It's crucial to check the current fee schedule and ensure that the payment method is acceptable.

Get Clarifications on Ohio Articles of Incorporation

What are the Ohio Articles of Incorporation?

The Ohio Articles of Incorporation is a legal document that establishes a corporation in the state of Ohio. This form is essential for anyone looking to create a new business entity. By filing this document with the Ohio Secretary of State, you officially register your corporation, allowing it to operate legally. The Articles of Incorporation outline key details about your business, such as its name, purpose, and structure.

What information do I need to provide when filling out the form?

When completing the Ohio Articles of Incorporation, you'll need to include several important pieces of information:

- Corporation Name: Ensure the name is unique and complies with Ohio naming rules.

- Principal Office Address: Provide the physical address where the corporation will conduct business.

- Registered Agent: Designate an individual or business entity responsible for receiving legal documents on behalf of the corporation.

- Incorporators: List the names and addresses of the individuals who are forming the corporation.

- Purpose: Clearly state the purpose of your corporation, which can be broad or specific.

How do I file the Articles of Incorporation in Ohio?

Filing the Articles of Incorporation in Ohio can be done online or by mail. Here’s how:

- Online Filing: Visit the Ohio Secretary of State’s website. Create an account or log in, complete the form, and pay the filing fee using a credit card.

- Mail Filing: Download the Articles of Incorporation form from the website. Fill it out, print it, and send it to the Secretary of State’s office along with a check for the filing fee.

Regardless of the method, ensure all information is accurate to avoid delays in processing.

What is the cost to file the Articles of Incorporation?

The filing fee for the Ohio Articles of Incorporation varies depending on the type of corporation you are forming. As of October 2023, the fee is generally around $99 for a standard corporation. However, additional fees may apply for expedited processing or if you choose to file online. Always check the Ohio Secretary of State’s website for the most current fee schedule and payment options.