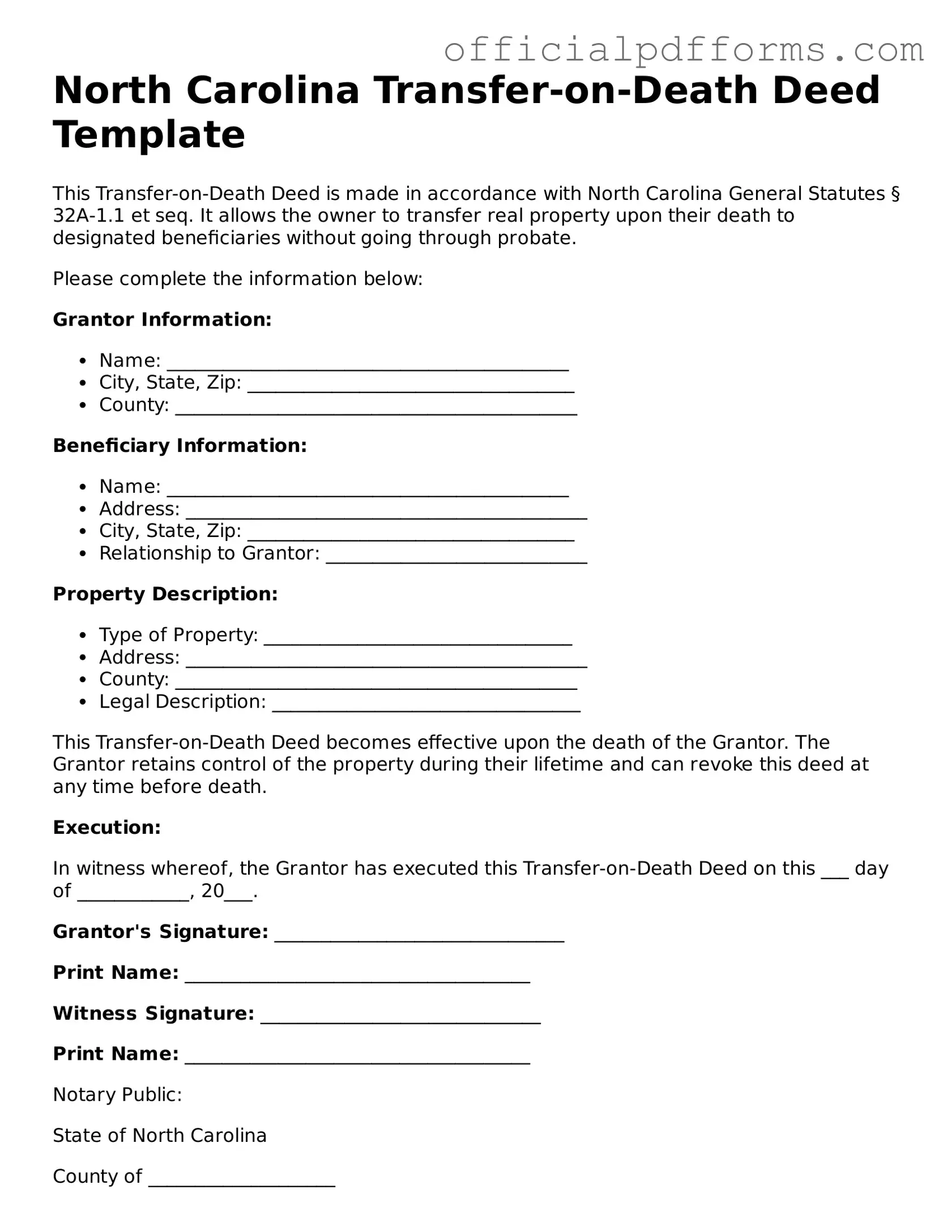

Printable North Carolina Transfer-on-Death Deed Template

Find Other Popular Transfer-on-Death Deed Templates for Specific States

Does a Beneficiary Deed Avoid Probate - The beneficiary named in the deed has no claim to the property until the owner passes away.

To simplify the process of transferring motorcycle ownership, it is advisable to use a Texas Motorcycle Bill of Sale form, which can be found on various legal websites, including OnlineLawDocs.com, ensuring all necessary details are captured for a smooth transaction.

Transfer on Death Deed Illinois Cost - There are typically no costs associated with activating the transfer upon death.

Misconceptions

Understanding the North Carolina Transfer-on-Death Deed can be challenging, and there are several misconceptions that people often have about this legal document. Here are four common misunderstandings:

-

It automatically transfers property upon the owner's death.

Many people believe that once they fill out a Transfer-on-Death Deed, their property is immediately transferred to the designated beneficiary upon their death. However, this is not the case. The deed only takes effect after the owner's death, and the property remains under the owner's control during their lifetime.

-

It eliminates the need for a will.

Some individuals think that by using a Transfer-on-Death Deed, they no longer need a will. While the deed does allow for direct transfer of property, it does not cover other assets or matters that a will might address. A comprehensive estate plan often includes both a will and a Transfer-on-Death Deed.

-

It can be revoked or changed easily.

There is a belief that once a Transfer-on-Death Deed is created, it can be easily changed or revoked at any time. While it is possible to revoke or modify the deed, doing so requires following specific legal procedures. Simply deciding to change your mind is not enough; formal steps must be taken to ensure the changes are legally recognized.

-

It affects the property owner's ability to sell or mortgage the property.

Some people worry that executing a Transfer-on-Death Deed limits their ability to sell or mortgage the property. This is a misconception. The property owner retains full rights to manage the property as they see fit, including selling or mortgaging it, until their death.

By understanding these misconceptions, individuals can make more informed decisions about their estate planning options in North Carolina.

Documents used along the form

The North Carolina Transfer-on-Death Deed form is a crucial document for those looking to transfer property upon death without going through probate. However, several other forms and documents often accompany this deed to ensure a smooth transition of property ownership and to address related legal matters. Below is a list of essential documents that may be used alongside the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets should be distributed upon their death. It can complement a Transfer-on-Death Deed by providing instructions for other assets not covered by the deed.

- Living Will: A living will specifies an individual’s wishes regarding medical treatment and life support in the event they are unable to communicate. While not directly related to property transfer, it is important for overall estate planning.

- Power of Attorney: This form allows a person to designate someone else to make decisions on their behalf, including financial and property-related matters. It can be vital if the property owner becomes incapacitated before death.

- Affidavit of Heirship: This document is used to establish the identity of heirs when a property owner dies without a will. It can help clarify ownership if the Transfer-on-Death Deed is contested.

- Trailer Bill of Sale: For those looking to ensure proper ownership transfer, the comprehensive Trailer Bill of Sale documentation is crucial for legal compliance and protection.

- Deed of Trust: This legal document secures a loan by transferring the title of the property to a trustee until the borrower repays the loan. It may be relevant if the property has outstanding debts that need to be addressed.

- Property Tax Exemption Forms: These forms are necessary for claiming any exemptions on property taxes, which can be beneficial for heirs inheriting property. Ensuring these forms are completed can save money in the long run.

- Notice of Death: This document informs relevant parties and authorities of a person's passing. It is often required to officially update property records and can help in the transfer process.

Utilizing these documents in conjunction with the North Carolina Transfer-on-Death Deed can streamline the estate planning process. It is essential to ensure all forms are completed accurately to avoid complications in the future. Proper planning today can lead to peace of mind tomorrow.

Steps to Filling Out North Carolina Transfer-on-Death Deed

Once you have the North Carolina Transfer-on-Death Deed form in hand, it’s essential to fill it out accurately to ensure that your wishes regarding property transfer are clearly documented. This process involves several straightforward steps that require attention to detail. Here’s how to complete the form effectively.

- Obtain the form: Download the North Carolina Transfer-on-Death Deed form from a reliable source or obtain a physical copy from a local legal office.

- Identify the property: Clearly describe the property you wish to transfer. Include the address, parcel number, and any other identifying details.

- List the owner(s): Provide the full names of the current owner(s) of the property. Ensure that the names match those on the property title.

- Designate the beneficiary: Write the full name of the person or entity that will receive the property upon your passing. Include their relationship to you if applicable.

- Include additional beneficiaries (if desired): If you want to name more than one beneficiary, list them clearly, specifying how the property will be divided among them.

- Sign the form: The owner(s) must sign the deed in the presence of a notary public. This step is crucial for the validity of the document.

- Notarization: Have the notary public complete their section of the form, confirming that they witnessed the signature(s).

- Record the deed: Take the completed and notarized form to the local register of deeds office to officially record it. This step makes the deed effective and publicly accessible.

After completing these steps, you will have a properly filled-out Transfer-on-Death Deed ready for recording. This deed will facilitate the transfer of your property to the designated beneficiary without going through probate. Ensure you keep a copy for your records and inform your beneficiary about the deed to avoid any confusion in the future.

Common mistakes

-

Inaccurate Property Description: Failing to provide a precise legal description of the property can lead to confusion and disputes. Always use the description found in the property deed.

-

Improper Signatures: The form must be signed by the property owner. Not obtaining the required signatures can render the deed invalid.

-

Not Notarizing the Document: A Transfer-on-Death Deed must be notarized. Skipping this step can invalidate the deed.

-

Missing Witnesses: In North Carolina, the deed must be witnessed. Failing to have the required number of witnesses can cause issues during probate.

-

Not Recording the Deed: After completing the form, it must be recorded with the county register of deeds. Neglecting to do so means the deed may not be enforceable.

-

Incorrect Beneficiary Information: Listing the wrong beneficiaries or not providing full names can lead to complications in transferring the property.

-

Failure to Understand Revocation: Many do not realize that a Transfer-on-Death Deed can be revoked. Not understanding this can lead to unintended consequences.

-

Ignoring Tax Implications: Some individuals overlook potential tax consequences of transferring property upon death. Consulting a tax advisor is advisable.

Get Clarifications on North Carolina Transfer-on-Death Deed

What is a Transfer-on-Death Deed in North Carolina?

A Transfer-on-Death Deed (TOD Deed) allows property owners in North Carolina to transfer real estate to a designated beneficiary upon their death. This deed does not take effect until the owner's death, allowing the owner to retain full control of the property during their lifetime.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in North Carolina can use a TOD Deed. This includes homeowners, landowners, and individuals holding property in their name. However, it cannot be used by entities like corporations or partnerships.

How does a Transfer-on-Death Deed work?

The property owner completes the TOD Deed form, naming one or more beneficiaries. The deed must be signed, notarized, and recorded with the county register of deeds. Upon the owner’s death, the property automatically transfers to the designated beneficiary without going through probate.

What are the benefits of using a Transfer-on-Death Deed?

- Allows for easy transfer of property without probate.

- Retains full control of the property during the owner's lifetime.

- Can be revoked or changed at any time before the owner's death.

- Offers a straightforward way to pass property to heirs.

Are there any limitations to a Transfer-on-Death Deed?

Yes, there are some limitations. A TOD Deed cannot be used for property held in a trust, for properties subject to a mortgage that prohibits transfers, or for properties owned jointly with rights of survivorship. Additionally, the deed must comply with North Carolina laws regarding execution and recording.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked by the property owner at any time before their death. This can be done by recording a new deed that explicitly states the revocation or by executing a new TOD Deed that names different beneficiaries.

What happens if the beneficiary predeceases the owner?

If the designated beneficiary dies before the property owner, the TOD Deed will not transfer the property to that beneficiary. The owner should consider naming an alternate beneficiary to ensure the property still transfers as intended.

Is there a fee to record a Transfer-on-Death Deed?

Yes, there is a recording fee that varies by county in North Carolina. It is important to check with the local register of deeds for the exact amount. Recording the deed is essential for it to be legally effective.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney to create a TOD Deed, consulting with one is advisable. An attorney can provide guidance to ensure the deed is properly executed and complies with all state laws.

Where can I obtain a Transfer-on-Death Deed form?

Transfer-on-Death Deed forms can be obtained online from various legal websites or through the North Carolina Secretary of State’s website. Local county offices may also provide forms and additional information regarding the process.