Printable North Carolina Real Estate Purchase Agreement Template

Find Other Popular Real Estate Purchase Agreement Templates for Specific States

Pa Purchase Agreement - It provides details on the purchase price and financing arrangements.

Purchase Agreement Real Estate - A clear description of the property is crucial in this document.

How to Make a Purchase Agreement - Minimizes misunderstandings with clear language on obligations.

The Free And Invoice PDF form serves as a critical tool for business transactions, designed to provide a detailed record of services rendered or goods supplied between two parties. This document not only facilitates a clear understanding of the transaction but also ensures that both parties have a written account for their records. For those looking to create their own, resources such as smarttemplates.net/fillable-free-and-invoice-pdf/ can be invaluable in obtaining customizable templates that cater to specific business needs. It's an essential asset for maintaining transparency and efficiency in business dealings.

Midland Title Toledo - The Real Estate Purchase Agreement includes information about the property’s legal description.

Misconceptions

When navigating the North Carolina Real Estate Purchase Agreement form, several misconceptions can arise. Understanding these common misunderstandings can help buyers and sellers approach the process with greater clarity and confidence.

- Misconception 1: The agreement is only for residential properties.

- Misconception 2: Once signed, the agreement cannot be changed.

- Misconception 3: The purchase agreement guarantees a sale.

- Misconception 4: Only real estate agents can fill out the form.

- Misconception 5: The agreement includes all necessary disclosures.

- Misconception 6: The earnest money is non-refundable.

- Misconception 7: The agreement does not require legal review.

- Misconception 8: The form is the same across all states.

This form can be used for both residential and commercial real estate transactions. It is not limited to just one type of property.

In reality, amendments can be made to the agreement as long as all parties involved consent to the changes and sign the amended document.

Signing the agreement does not guarantee that the sale will go through. Various factors, such as inspections and financing, can affect the final outcome.

While agents are often involved, buyers and sellers can also complete the form themselves, provided they understand the terms and conditions.

The purchase agreement does not automatically include all disclosures required by law. Sellers must provide separate disclosures regarding property conditions.

Earnest money can be refundable under certain circumstances, such as if the buyer backs out due to contingencies outlined in the agreement.

While it is not mandatory, having a legal professional review the agreement is highly recommended to ensure all terms are understood and legally sound.

Each state has its own specific forms and regulations. The North Carolina Real Estate Purchase Agreement is tailored to meet the legal requirements of North Carolina.

Documents used along the form

In the process of buying or selling real estate in North Carolina, several important documents accompany the Real Estate Purchase Agreement. Each of these documents serves a specific purpose and plays a crucial role in ensuring a smooth transaction. Below is a list of commonly used forms and documents that often accompany the purchase agreement.

- Due Diligence Agreement: This document outlines the buyer's right to inspect the property and conduct necessary investigations before finalizing the purchase. It typically includes a specified period during which the buyer can withdraw from the agreement without penalty.

- Property Disclosure Statement: Sellers are often required to provide this statement, which details the condition of the property and any known issues. This transparency helps buyers make informed decisions.

- Lead-Based Paint Disclosure: For homes built before 1978, sellers must provide this disclosure to inform buyers about potential lead hazards. It aims to protect buyers, especially families with young children.

- Financing Addendum: This document outlines the terms of the buyer's financing, including loan amounts, interest rates, and contingencies. It helps clarify the buyer's financial obligations in the transaction.

- Settlement Statement: Also known as a closing statement, this document itemizes all costs associated with the sale, including fees, taxes, and commissions. It provides a clear overview of the financial aspects of the transaction.

- Rental Application Form: This document is essential for landlords to screen potential tenants before granting a lease. It collects vital information regarding the applicant's background and rental history, ensuring a better selection process. You can find more information at OnlineLawDocs.com.

- Title Commitment: This document is issued by a title company and outlines the state of the property's title. It ensures that the title is clear of liens and encumbrances before the sale is completed.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide details about the association's rules, regulations, and fees. Buyers should review these to understand their responsibilities as homeowners.

- Offer to Purchase: This is a preliminary document that outlines the buyer's offer to purchase the property, including the price and terms. It is often the first step in the negotiation process.

- Closing Disclosure: This document provides final details about the mortgage loan, including the terms, monthly payments, and closing costs. It must be provided to the buyer at least three days before closing.

Understanding these documents can facilitate a smoother real estate transaction. Each plays a vital role in protecting the interests of both buyers and sellers, ensuring that all parties are informed and prepared for the closing process.

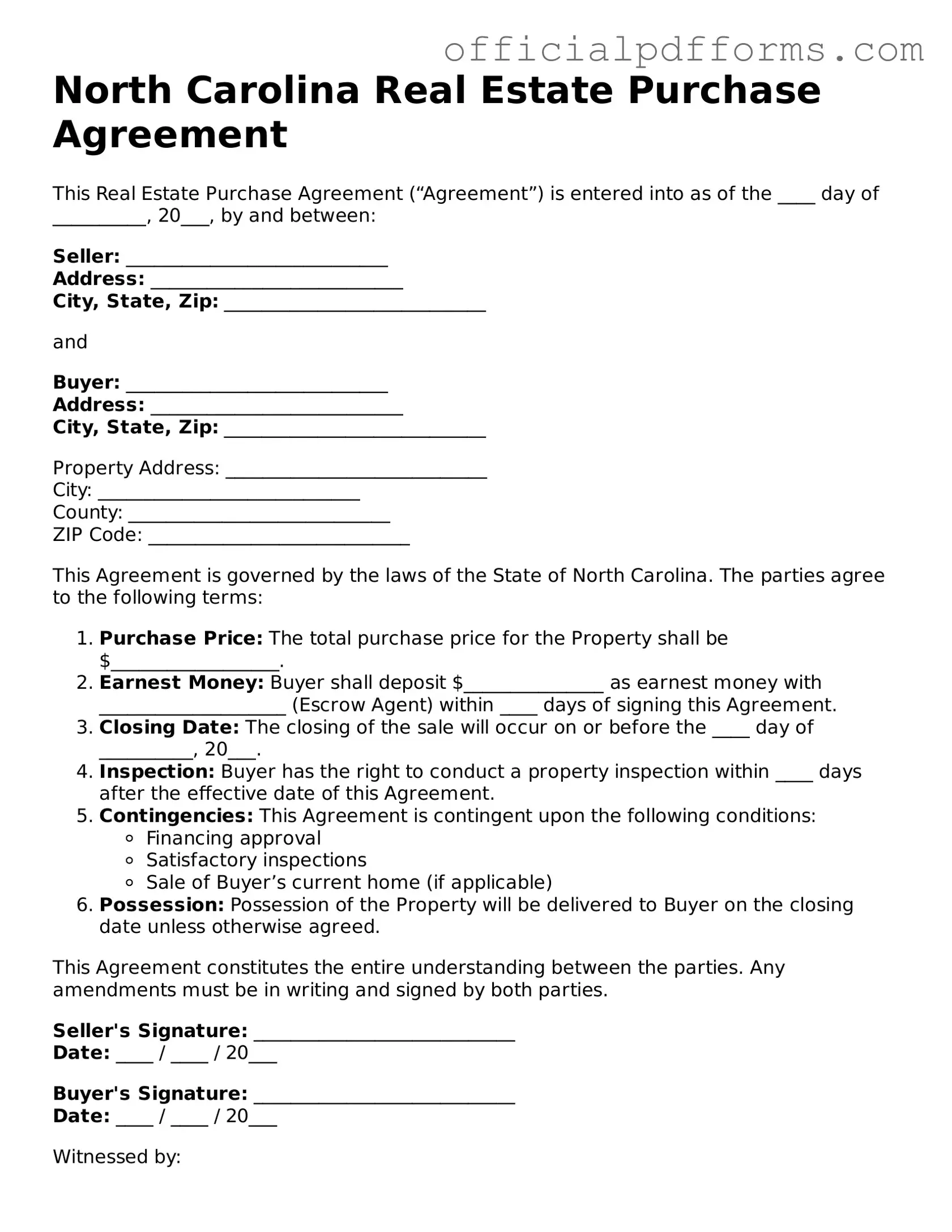

Steps to Filling Out North Carolina Real Estate Purchase Agreement

Completing the North Carolina Real Estate Purchase Agreement form is an important step in the home buying process. After filling out this form, both the buyer and seller will have a clear understanding of the terms of the sale, which can help facilitate a smooth transaction.

- Begin by entering the date at the top of the form.

- Fill in the names and contact information of the buyer(s) and seller(s).

- Provide the property address, including city, county, and zip code.

- Specify the purchase price in the designated section.

- Outline the earnest money deposit amount and the method of payment.

- Indicate any contingencies, such as financing or inspection requirements.

- Detail the closing date and any specific terms related to the closing process.

- Include any additional terms or conditions that are relevant to the agreement.

- Ensure all parties sign and date the form where indicated.

Common mistakes

-

Not Reading the Entire Agreement: Many buyers and sellers skim through the document without understanding all the terms. This can lead to confusion and potential disputes later on.

-

Missing Signatures: Failing to sign the agreement can render it invalid. Ensure that all required parties sign the document before submission.

-

Incorrect Property Description: It's crucial to provide an accurate description of the property. Errors can cause legal issues down the line.

-

Neglecting to Include Contingencies: Buyers often forget to add contingencies, such as financing or inspection. These protect the buyer's interests.

-

Not Specifying the Purchase Price: Clearly stating the purchase price is essential. Leaving it blank can create misunderstandings.

-

Ignoring Deadlines: Each section of the agreement may have deadlines. Missing these can jeopardize the transaction.

-

Overlooking Closing Costs: Buyers and sellers should discuss who will cover closing costs. Failing to address this can lead to unexpected expenses.

-

Assuming All Terms Are Standard: Every real estate transaction is unique. Don't assume that all terms are standard; customize them to fit your situation.

Get Clarifications on North Carolina Real Estate Purchase Agreement

What is a North Carolina Real Estate Purchase Agreement?

The North Carolina Real Estate Purchase Agreement is a legally binding document used in real estate transactions. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement includes crucial details such as the purchase price, closing date, and any contingencies that must be met before the sale is finalized. By clearly defining the expectations of both parties, the agreement helps prevent misunderstandings and disputes.

What are the key components of the agreement?

Several essential elements make up the North Carolina Real Estate Purchase Agreement. These components ensure that both the buyer and seller are on the same page. Key components include:

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Property Description: A detailed description of the property, including the address and legal description.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing, inspections, or repairs.

- Closing Date: The date when the property transfer will occur and the buyer takes possession.

- Earnest Money: A deposit made by the buyer to demonstrate serious intent to purchase.

How does the agreement protect both the buyer and seller?

The North Carolina Real Estate Purchase Agreement provides protection for both parties involved in the transaction. For buyers, it ensures that they have a legal recourse if the seller fails to meet the agreed-upon terms. For sellers, the agreement secures their interests by outlining the buyer's obligations, including financial commitments. By including contingencies, both parties can address potential issues that may arise, such as the need for repairs or the buyer's ability to secure financing.

Can the agreement be modified after it is signed?

Yes, the North Carolina Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability. Common reasons for modifications include changes in the closing date, adjustments to the purchase price, or alterations to contingencies. Open communication between both parties is key to successfully navigating any amendments to the agreement.