Printable North Carolina Quitclaim Deed Template

Find Other Popular Quitclaim Deed Templates for Specific States

Quick Claim Deed - This type of deed helps clarify ownership of property among co-owners.

The Texas Real Estate Purchase Agreement is a vital document that facilitates property transactions. Understanding the importance of a well-structured form can streamline the buying and selling process. For comprehensive guidance, consider our resource on the customized Real Estate Purchase Agreement requirements to ensure all your needs are met.

Quitclaim Deed Forms - It may also be used to correct previous property deed errors.

Misconceptions

Many people have misunderstandings about the North Carolina Quitclaim Deed form. Here are five common misconceptions:

-

A quitclaim deed transfers ownership of property without warranties. This is true, but many believe it means the transfer is unsafe. While a quitclaim deed does not guarantee clear title, it is still a valid way to transfer property rights.

-

Quitclaim deeds are only for family members. While they are often used in family transactions, anyone can use a quitclaim deed to transfer property. Friends, business partners, or even strangers can use this form.

-

Using a quitclaim deed is the same as selling property. This is misleading. A quitclaim deed does not involve a sale or exchange of money. It simply transfers whatever interest the grantor has in the property.

-

Quitclaim deeds are only useful in divorce cases. Although they are commonly used to divide property during divorce, quitclaim deeds can serve many purposes, including transferring property to a trust or correcting a title issue.

-

Once a quitclaim deed is signed, it cannot be changed. This is incorrect. While a quitclaim deed is effective once signed and delivered, parties can create a new deed to change ownership or clarify terms if needed.

Documents used along the form

When dealing with property transfers in North Carolina, a Quitclaim Deed is often used. However, several other forms and documents may accompany this deed to ensure a smooth transaction. Below is a list of commonly used documents that can help clarify ownership, establish rights, or fulfill legal requirements.

- General Warranty Deed: This document provides a guarantee that the grantor holds clear title to the property and has the right to sell it. It offers the highest level of protection to the buyer.

- Special Warranty Deed: Similar to a general warranty deed, this document only guarantees that the grantor has not caused any issues with the title during their ownership. It does not cover any previous claims.

- Bill of Sale: The Texas Bill of Sale form is crucial for documenting transactions involving personal property, serving as proof of purchase. It is commonly used for various sales, including vehicles and boats. For more information, visit OnlineLawDocs.com.

- Bill of Sale: This document is used to transfer ownership of personal property, such as appliances or furniture, that may be included in the sale of real estate.

- Affidavit of Title: This sworn statement confirms the seller’s ownership of the property and discloses any liens or encumbrances. It provides assurance to the buyer regarding the title's status.

- Property Disclosure Statement: This document requires the seller to disclose any known issues with the property, such as structural problems or pest infestations, to the buyer.

- Closing Statement: Also known as a HUD-1 statement, this document outlines all the financial details of the transaction, including costs, fees, and the final amount due at closing.

- Title Insurance Policy: This policy protects the buyer and lender from any future claims against the property’s title. It ensures that the buyer has clear ownership.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including the purchase price, contingencies, and closing date. It serves as a binding agreement between the buyer and seller.

- Deed of Trust: This document secures a loan by placing the property as collateral. It involves three parties: the borrower, the lender, and a trustee.

- Power of Attorney: This legal document allows one person to act on behalf of another in property transactions. It can be crucial if the seller is unable to be present at closing.

Each of these documents plays a vital role in property transactions. Understanding their purpose can help you navigate the complexities of real estate dealings in North Carolina more effectively.

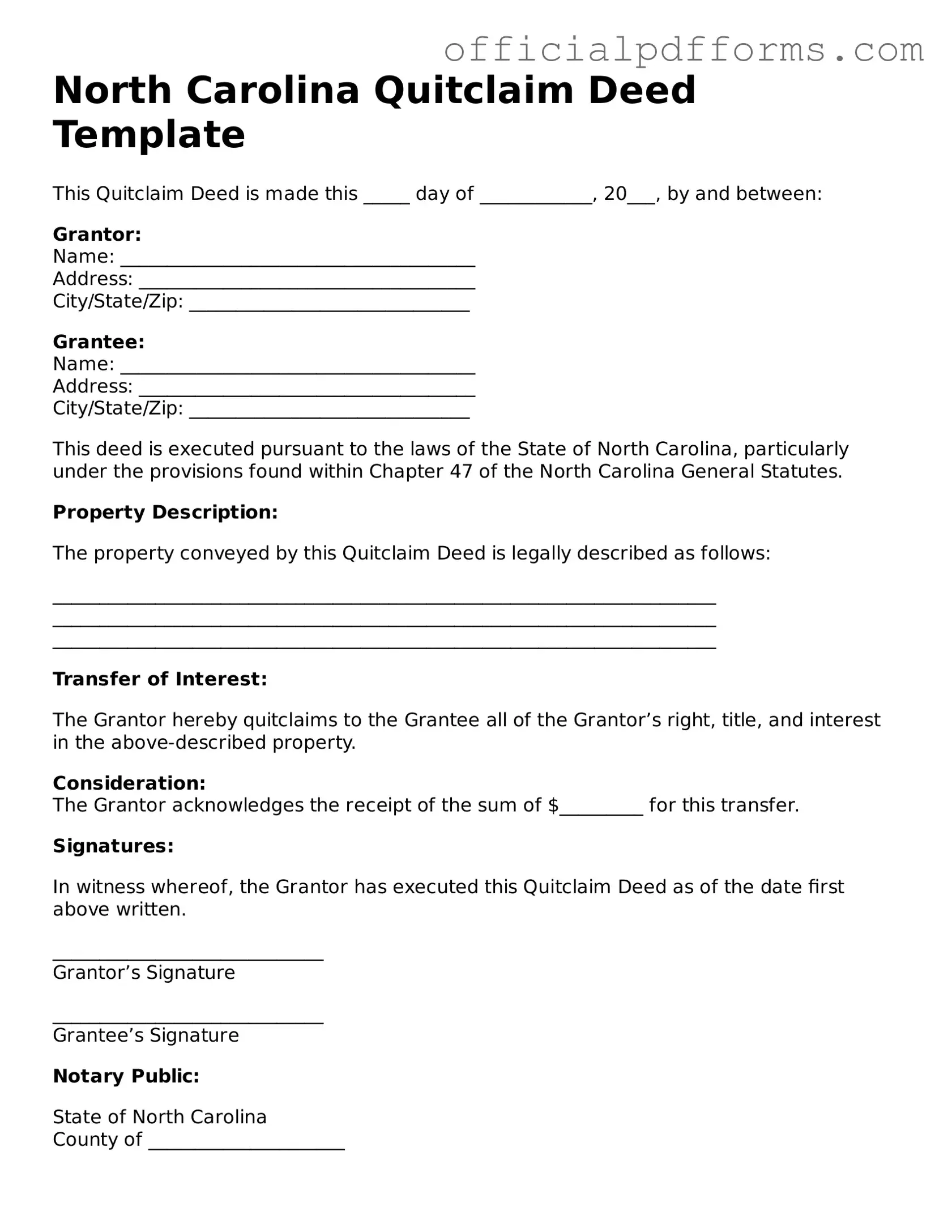

Steps to Filling Out North Carolina Quitclaim Deed

After obtaining the North Carolina Quitclaim Deed form, you will need to complete it accurately to ensure proper transfer of property rights. Follow the steps below to fill out the form correctly.

- Identify the Grantor: Enter the full name of the person or entity transferring the property rights. Ensure the name is spelled correctly.

- Identify the Grantee: Write the full name of the person or entity receiving the property rights. Double-check for accuracy.

- Property Description: Provide a complete legal description of the property being transferred. This may include the address, parcel number, or other identifying information.

- Consideration: State the amount of money or other consideration exchanged for the property, if applicable. If no consideration is exchanged, you may indicate that as well.

- Signatures: Both the grantor and grantee must sign the form. Ensure that signatures are dated and that the signers are authorized to act on behalf of any entities.

- Notarization: Have the document notarized. The notary will confirm the identities of the signers and witness the signing.

- Filing: After completing the form, file it with the appropriate county register of deeds office. Check for any required fees.

Common mistakes

-

Not including the correct names of the parties involved. It's crucial that the grantor (the person transferring the property) and the grantee (the person receiving the property) are correctly identified. Any misspelling can lead to legal complications.

-

Failing to provide a complete legal description of the property. A vague description can create confusion and may not meet the requirements for a valid deed.

-

Not signing the document in front of a notary public. A quitclaim deed must be notarized to be legally valid. Without this step, the deed may not hold up in court.

-

Overlooking the requirement for witnesses. Some states require witnesses to sign the deed. Check local laws to ensure compliance.

-

Neglecting to include the date of the transaction. The date helps establish when the transfer occurred, which can be important for legal and tax purposes.

-

Not checking for outstanding liens or encumbrances on the property. Ignoring this can lead to unexpected financial burdens for the grantee.

-

Using outdated or incorrect forms. Always ensure you are using the most current version of the quitclaim deed form for North Carolina.

-

Forgetting to file the deed with the appropriate county office. After completing the form, it must be recorded to make the transfer official.

-

Assuming that a quitclaim deed is the same as a warranty deed. A quitclaim deed offers no guarantees about the property’s title, which can lead to misunderstandings.

Get Clarifications on North Carolina Quitclaim Deed

What is a Quitclaim Deed in North Carolina?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. In North Carolina, it allows the grantor (the person transferring the property) to relinquish any claim they may have to the property without guaranteeing that they hold clear title. This type of deed is often used among family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed?

Consider using a Quitclaim Deed in the following situations:

- Transferring property between family members, such as from a parent to a child.

- Clearing up title issues, such as removing an ex-spouse's name after a divorce.

- Transferring property into or out of a trust.

- Making a gift of property without a sale.

How do I complete a Quitclaim Deed in North Carolina?

To complete a Quitclaim Deed, follow these steps:

- Obtain a blank Quitclaim Deed form. These can often be found online or at legal stationery stores.

- Fill in the names of the grantor and grantee, as well as the property description.

- Sign the document in front of a notary public.

- File the completed deed with the local Register of Deeds office in the county where the property is located.

Do I need a lawyer to prepare a Quitclaim Deed?

While it is not legally required to have a lawyer prepare a Quitclaim Deed, consulting with one can be beneficial. A lawyer can ensure that the deed is filled out correctly and that all legal requirements are met, reducing the risk of future disputes.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantee, meaning the grantee may receive less protection regarding the property’s title.

Are there any taxes associated with a Quitclaim Deed?

In North Carolina, there may be tax implications when transferring property using a Quitclaim Deed. While the deed itself does not incur a transfer tax, it’s important to consider potential capital gains taxes or other tax consequences based on the property’s value and your specific situation. Consulting a tax professional is advisable.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked unilaterally. If the grantor wishes to regain ownership, they would need to execute another deed to transfer the property back, which may involve additional legal processes.

How do I find a Quitclaim Deed for a property?

To find a Quitclaim Deed for a specific property, visit the local Register of Deeds office in the county where the property is located. Many counties also provide online access to property records, allowing you to search for recorded deeds by name or property address.