Printable North Carolina Promissory Note Template

Find Other Popular Promissory Note Templates for Specific States

Loan Note Template - In business dealings, promissory notes can streamline cash flow by formalizing credit terms.

For those navigating the process of RV transactions in Texas, understanding the specifics of the comprehensive RV Bill of Sale document is crucial. This form not only facilitates the transfer of ownership but also ensures that all necessary details such as the vehicle identification and sales terms are meticulously documented.

Simple Promissory Note Template - Recourse options for the lender can be specified within the note.

Misconceptions

Understanding the North Carolina Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are seven common misunderstandings:

- It must be notarized. Many believe that a promissory note must be notarized to be valid. In North Carolina, notarization is not a requirement for the note to be enforceable, although it can provide additional proof of authenticity.

- Only banks can issue promissory notes. This is not true. Individuals and businesses can create promissory notes for personal loans or business transactions without involving a bank.

- All promissory notes are the same. Each promissory note can be tailored to fit specific agreements between parties. The terms, interest rates, and repayment schedules can vary significantly.

- Verbal agreements are sufficient. While verbal agreements can be made, they are difficult to enforce. A written promissory note provides clarity and legal backing, making it easier to resolve disputes.

- Interest rates must be fixed. Some people think that interest rates in a promissory note must remain fixed. In reality, they can be variable, depending on the agreement between the parties.

- Defaulting on a promissory note is not serious. Defaulting can have serious consequences, including damage to credit scores and potential legal action. It is crucial to understand the implications of failing to repay the loan.

- Once signed, a promissory note cannot be changed. While it is true that changes can complicate things, parties can amend a promissory note if both agree to the new terms. Proper documentation of any changes is essential.

By addressing these misconceptions, you can navigate the complexities of promissory notes more confidently. Always consider seeking advice if you have specific questions or concerns.

Documents used along the form

When entering into a financial agreement in North Carolina, a Promissory Note is often the cornerstone document. However, several other forms and documents can accompany it to ensure clarity and legal protection for all parties involved. Here’s a look at some of these essential documents.

- Loan Agreement: This document outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive overview of the borrowing terms.

- Boat Bill of Sale: Essential for the transfer of ownership of a boat, the Boat Bill of Sale is a necessary document in California that can be accessed at onlinelawdocs.com.

- Security Agreement: If the loan is secured by collateral, this document details the assets pledged as security. It establishes the lender’s rights in case of default and ensures that the borrower understands the implications of using collateral.

- Personal Guarantee: Often required for business loans, this document holds an individual personally responsible for the debt if the business defaults. It provides an additional layer of security for the lender.

- Disclosure Statement: This document is designed to inform the borrower about the terms of the loan, including any fees or penalties. It promotes transparency and helps prevent misunderstandings.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components over the life of the loan. It aids borrowers in understanding how their payments will affect the total debt over time.

- Default Notice: In the event of missed payments, this document formally notifies the borrower of their default status. It outlines the consequences and the next steps the lender may take to recover the owed amount.

Having these documents in place can significantly enhance the security and clarity of a lending arrangement. It’s crucial for both lenders and borrowers to be aware of their rights and responsibilities, ensuring a smoother financial transaction.

Steps to Filling Out North Carolina Promissory Note

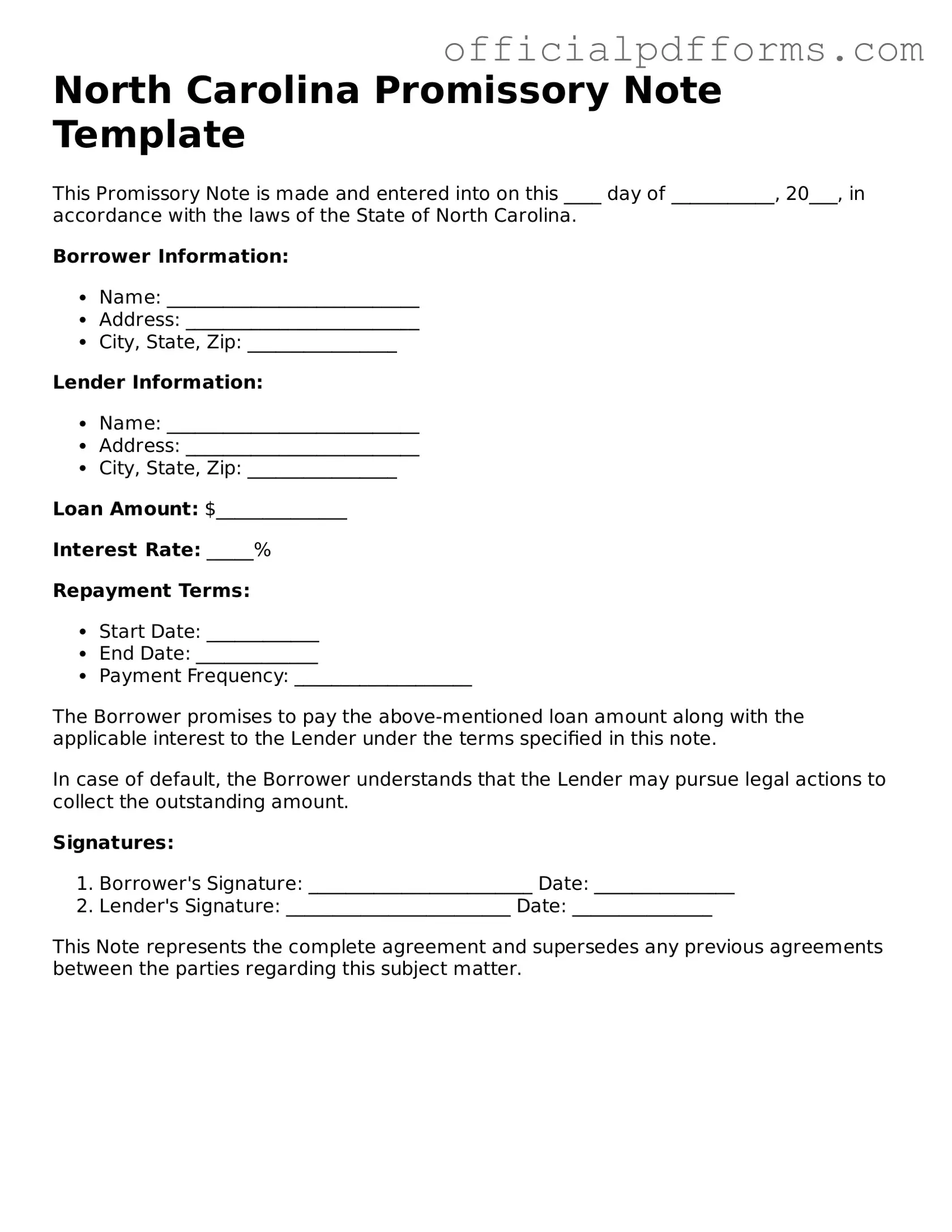

Once you have the North Carolina Promissory Note form in hand, it’s time to fill it out accurately. This document will outline the terms of the loan agreement between the borrower and the lender. Make sure to have all necessary information ready before you start filling out the form.

- Begin by entering the date at the top of the form. Use the format month/day/year.

- In the first blank, write the name of the borrower. This is the person or entity receiving the loan.

- Next, enter the address of the borrower. Include the street address, city, state, and zip code.

- In the following section, write the name of the lender. This is the individual or organization providing the loan.

- Provide the lender's address, including the street address, city, state, and zip code.

- Specify the loan amount in the designated space. Write it in both numbers and words for clarity.

- Next, indicate the interest rate, if applicable. Write this as a percentage.

- Detail the repayment schedule. Specify how often payments are due (e.g., monthly, quarterly) and the total number of payments.

- Include any late fees that may apply if a payment is missed. Clearly state the amount or percentage for late fees.

- In the signature section, both the borrower and lender should sign and date the form. Ensure that all parties understand the terms before signing.

After completing the form, review it carefully to ensure all information is accurate. Both parties should keep a copy for their records. It’s advisable to consult with a legal professional if there are any uncertainties about the terms or conditions outlined in the note.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to confusion or disputes later. Ensure that names, addresses, and loan amounts are clearly stated.

-

Incorrect Dates: Entering the wrong date can affect the validity of the note. Always double-check the date of the agreement and any payment due dates.

-

Ambiguous Terms: Using vague language can create misunderstandings. Clearly define the terms of the loan, including interest rates and repayment schedules.

-

Missing Signatures: A promissory note is not valid without the necessary signatures. Ensure both the borrower and lender sign the document.

-

Not Keeping Copies: Failing to keep a copy of the signed note can lead to complications. Always retain a copy for your records, as it serves as proof of the agreement.

-

Ignoring State Laws: Each state has specific requirements for promissory notes. Familiarize yourself with North Carolina’s laws to ensure compliance.

Get Clarifications on North Carolina Promissory Note

What is a North Carolina Promissory Note?

A North Carolina Promissory Note is a written agreement in which one party (the borrower) promises to pay a specified sum of money to another party (the lender) at a predetermined date or on demand. This document outlines the terms of the loan, including the interest rate, payment schedule, and any penalties for late payments. It serves as a legal record of the debt and protects the rights of both parties involved.

What information is typically included in a Promissory Note?

A standard North Carolina Promissory Note includes the following key elements:

- Borrower and Lender Information: Names and addresses of both parties.

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Payment Terms: Details on how and when payments will be made.

- Default Conditions: Circumstances under which the borrower would be considered in default.

- Signatures: Both parties must sign the document to make it legally binding.

Is a Promissory Note legally binding in North Carolina?

Yes, a Promissory Note is legally binding in North Carolina, provided it meets certain requirements. It must be in writing, clearly outline the terms of the agreement, and be signed by both the borrower and the lender. If these conditions are met, the note can be enforced in a court of law if the borrower fails to repay the loan as agreed.

Can I modify a Promissory Note after it has been signed?

Yes, modifications to a Promissory Note can be made after it has been signed. However, both parties must agree to the changes and document them in writing. It is advisable to create an amendment to the original note that outlines the new terms, and both parties should sign this amendment to ensure its enforceability.

What should I do if the borrower defaults on the Promissory Note?

If the borrower defaults on the Promissory Note, the lender has several options:

- Communication: Reach out to the borrower to discuss the missed payments and see if a resolution can be reached.

- Negotiation: Consider negotiating a new payment plan or terms that might be more manageable for the borrower.

- Legal Action: If no resolution is found, the lender may pursue legal action to recover the owed amount. This may involve filing a lawsuit in a North Carolina court.

It is often beneficial to consult with a legal professional before taking any action to ensure that all steps are handled appropriately.