Printable North Carolina Prenuptial Agreement Template

Find Other Popular Prenuptial Agreement Templates for Specific States

Ohio Prenup - Legally binding agreement enforceable in court.

To better understand the importance of a Release of Liability form, it is essential to recognize that this document is designed to protect parties from future claims by clarifying the responsibilities associated with engaging in risky activities. For more information and to access templates, you can visit OnlineLawDocs.com, which provides valuable resources on this legal instrument.

Pennsylvania Prenup - A prenuptial agreement can set boundaries around personal spending.

Georgia Prenup - The contract can help maintain harmony by reducing conflict during a divorce.

New Jersey Prenup - It is advisable to have each partner seek independent legal advice before signing.

Misconceptions

When it comes to prenuptial agreements in North Carolina, many people have misconceptions that can lead to misunderstandings. Here are nine common myths and the truths behind them.

-

Prenuptial agreements are only for the wealthy.

This is a common belief, but prenuptial agreements can benefit anyone. They provide a way to clarify financial responsibilities and expectations, regardless of income level.

-

Prenuptial agreements are unromantic.

While discussing finances before marriage may feel awkward, a prenuptial agreement can actually strengthen a relationship. It fosters open communication about finances, which is crucial for a healthy marriage.

-

Prenuptial agreements are only enforceable if signed well in advance.

While it is advisable to sign a prenuptial agreement well before the wedding, North Carolina courts can still enforce agreements signed closer to the wedding date, provided both parties had ample time to review and understand the terms.

-

All prenuptial agreements are the same.

Each prenuptial agreement is unique and should be tailored to the specific circumstances of the couple. This means that the terms can vary widely based on individual needs and preferences.

-

Prenuptial agreements can cover anything.

While prenuptial agreements can address many financial matters, they cannot include provisions regarding child custody or child support. These issues are determined based on the best interests of the child at the time of divorce.

-

Prenuptial agreements are only for divorce situations.

Although they are often associated with divorce, prenuptial agreements can also provide clarity during the marriage. They can help manage expectations regarding finances and property, reducing conflict in the future.

-

Prenuptial agreements are difficult to enforce.

If properly drafted and executed, prenuptial agreements can be enforceable in court. They must be fair, entered into voluntarily, and both parties should have independent legal representation.

-

Prenuptial agreements are only for first marriages.

Many people entering second or subsequent marriages choose to create prenuptial agreements to protect their assets and ensure fair treatment of children from previous relationships.

-

Prenuptial agreements are permanent and cannot be changed.

In fact, prenuptial agreements can be modified or revoked at any time, as long as both parties agree to the changes in writing. This flexibility allows couples to adapt to changing circumstances.

Understanding these misconceptions can help couples approach prenuptial agreements with a clearer perspective, allowing for informed decisions that benefit their future together.

Documents used along the form

A prenuptial agreement is an important document for couples considering marriage. It outlines the financial rights and responsibilities of each partner in the event of divorce or separation. Along with this agreement, several other forms and documents may be utilized to ensure a comprehensive understanding of the couple's financial and legal obligations. Below is a list of related documents that are often used in conjunction with a North Carolina prenuptial agreement.

- Financial Disclosure Statement: This document provides a detailed account of each partner's financial situation, including income, assets, debts, and liabilities. It ensures transparency and allows both parties to make informed decisions.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It can address changes in financial circumstances or clarify financial arrangements that were not covered in the prenuptial agreement.

- Separation Agreement: If a couple decides to separate, this document outlines the terms of their separation, including asset division, child custody, and support arrangements. It can be legally binding and serves to protect both parties' interests.

- Will: A will specifies how a person's assets will be distributed upon their death. It is crucial for couples to have a will to ensure their wishes are honored and to protect their spouse's inheritance rights.

- Power of Attorney: This document allows one partner to make financial or medical decisions on behalf of the other in case of incapacity. It is an essential tool for ensuring that decisions can be made quickly and according to the partner's wishes.

- Power of Attorney Form: When planning your affairs, use the necessary Power of Attorney document resources to ensure decisions can be made on your behalf effectively.

- Living Trust: A living trust can help manage assets during a person's lifetime and dictate how those assets will be distributed after death. It may offer benefits such as avoiding probate and providing privacy regarding asset distribution.

- Child Custody Agreement: If children are involved, this agreement outlines the terms of custody and visitation rights. It is crucial for establishing the responsibilities of each parent and ensuring the child's best interests are prioritized.

- Debt Agreement: This document specifies how debts incurred during the marriage will be handled. It can clarify which partner is responsible for certain debts, helping to avoid disputes in the future.

These documents complement a prenuptial agreement by addressing various aspects of financial and legal arrangements in a marriage. Couples should consider each document's importance and seek legal advice to ensure their rights and interests are adequately protected.

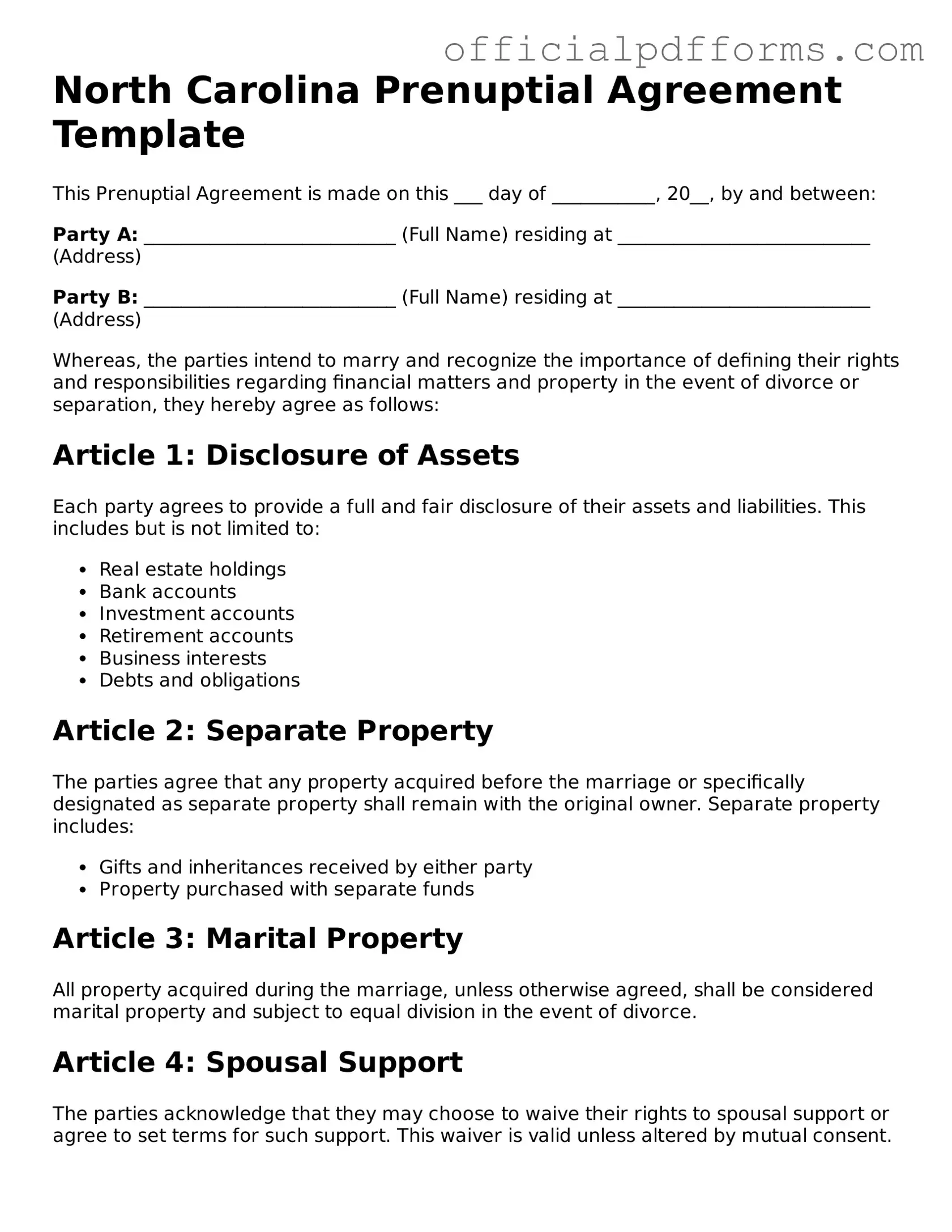

Steps to Filling Out North Carolina Prenuptial Agreement

Filling out the North Carolina Prenuptial Agreement form is an important step for couples considering marriage. It allows both parties to outline their financial rights and responsibilities before tying the knot. To ensure that the form is completed accurately and comprehensively, follow the steps outlined below. This process may require thoughtful discussion between both parties to ensure clarity and mutual understanding.

- Begin by gathering personal information for both parties. This includes full names, addresses, and dates of birth.

- Next, clearly outline the assets and liabilities of each party. List all properties, bank accounts, investments, debts, and any other financial obligations.

- Discuss and agree on how assets and debts will be handled during the marriage and in the event of a divorce. Document these agreements in the form.

- Include any specific terms or conditions that both parties want to address in the agreement. This may involve provisions for spousal support or inheritance rights.

- Review the completed form together to ensure that all information is accurate and that both parties understand the terms outlined.

- Sign the document in the presence of a notary public. This step is crucial as it adds a layer of legal validity to the agreement.

- Make copies of the signed agreement for both parties to keep for their records.

Once the form is filled out and signed, it is advisable to store it in a safe place. Both parties should have access to the document, as it may be referred to in the future. Open communication about the agreement can help maintain transparency and trust in the relationship.

Common mistakes

-

Inadequate Disclosure of Assets: Failing to fully disclose all assets and debts can lead to disputes later. Both parties should provide a complete list of their financial situation.

-

Not Seeking Legal Advice: Many individuals skip consulting with an attorney. Legal counsel can clarify terms and ensure the agreement is enforceable.

-

Using Ambiguous Language: Vague terms can create confusion. Clear and specific language is essential to avoid misinterpretation.

-

Ignoring State Laws: Each state has specific requirements for prenuptial agreements. Not adhering to North Carolina laws can invalidate the document.

-

Failing to Update the Agreement: Life circumstances change. Failing to revise the agreement after significant life events can render it outdated.

-

Not Including a Sunset Clause: A sunset clause sets a time limit on the agreement's validity. Omitting this can lead to complications in the future.

-

Signing Under Duress: Signing the agreement under pressure can lead to claims of coercion. Both parties must sign voluntarily for the agreement to hold up in court.

-

Neglecting to Consider Future Inheritance: Future inheritances may not be addressed. It's important to consider how these assets will be treated in the agreement.

Get Clarifications on North Carolina Prenuptial Agreement

What is a prenuptial agreement in North Carolina?

A prenuptial agreement, often called a prenup, is a legal document that a couple creates before getting married. This agreement outlines how assets and debts will be divided in the event of divorce or separation. In North Carolina, prenups can also specify other matters, such as spousal support. The agreement must be in writing and signed by both parties to be enforceable.

Why should I consider a prenuptial agreement?

Couples may choose to create a prenuptial agreement for several reasons, including:

- Protecting individual assets acquired before marriage.

- Clarifying financial responsibilities during the marriage.

- Reducing conflict in the event of a divorce.

- Ensuring that children from previous relationships are considered in asset distribution.

What should be included in a North Carolina prenuptial agreement?

A comprehensive prenuptial agreement may include:

- A list of each party's assets and debts.

- Provisions for the division of property acquired during the marriage.

- Details about spousal support or alimony.

- How to handle debts incurred during the marriage.

- Provisions for any children from previous relationships.

It is important that both parties fully disclose their financial situations to ensure fairness and transparency.

How do I create a valid prenuptial agreement in North Carolina?

To create a valid prenuptial agreement, follow these steps:

- Consult with a qualified attorney who specializes in family law.

- Discuss your financial situation and goals with your partner.

- Draft the agreement, ensuring it complies with North Carolina laws.

- Both parties should review the document with their own legal counsel.

- Sign the agreement in the presence of a notary public.

Taking these steps can help ensure that the agreement is legally binding and enforceable.

Can a prenuptial agreement be changed after marriage?

Yes, a prenuptial agreement can be modified or revoked after marriage. Both parties must agree to the changes, and the modifications should be documented in writing. It is advisable to have the revised agreement reviewed by legal counsel to ensure its validity.

What happens if a prenuptial agreement is not enforced?

If a prenuptial agreement is not enforced, the court may decide asset division and spousal support based on North Carolina's laws. This could lead to outcomes that differ significantly from what the couple originally intended. To avoid this, it is crucial to ensure that the agreement is clear, fair, and legally binding.