Printable North Carolina Operating Agreement Template

Find Other Popular Operating Agreement Templates for Specific States

Ohio Llc Operating Agreement Template - An Operating Agreement helps define the business's mission and vision.

How to Create an Operating Agreement for an Llc - The agreement can provide procedures for dissolving the LLC.

The use of a California Vehicle Purchase Agreement form is essential to ensure clarity and protection for both buyers and sellers during vehicle transactions in California. When properly filled out, this document captures vital details such as the sale price, vehicle description, and relevant warranties or guarantees. To find a reliable template for this form, you can visit https://toptemplates.info/, which provides comprehensive resources to simplify the process.

Operating Agreement Llc Pa - The Operating Agreement can set forth rules for transferring ownership interests.

Misconceptions

Operating agreements are essential documents for limited liability companies (LLCs) in North Carolina. However, several misconceptions surround them. Understanding these can help business owners make informed decisions.

- Misconception 1: An operating agreement is not necessary for a single-member LLC.

- Misconception 2: The operating agreement must be filed with the state.

- Misconception 3: An operating agreement is a one-time document.

- Misconception 4: All members must agree on every aspect of the operating agreement.

- Misconception 5: The operating agreement can only be amended with a formal vote.

While it is true that single-member LLCs are not legally required to have an operating agreement, having one can provide clarity on management and operations. It also helps establish the separation between personal and business assets.

This is incorrect. In North Carolina, the operating agreement is an internal document. It does not need to be filed with the Secretary of State, but it should be kept on record for reference.

Operating agreements should be treated as living documents. As businesses evolve, so too should their operating agreements. Regular reviews and updates are essential to reflect changes in management, ownership, or business goals.

While it is ideal for all members to have input, it is not always necessary for unanimous agreement on every provision. The operating agreement can outline decision-making processes, allowing for majority rules or other methods.

Although formal voting is a common method for amending an operating agreement, it is not the only way. The document can specify alternative methods for amendments, such as written consent or informal agreements, as long as all members are aware and in agreement.

Documents used along the form

When forming a limited liability company (LLC) in North Carolina, the Operating Agreement is a crucial document. However, several other forms and documents are often used in conjunction with it to ensure proper compliance and organization. Below is a list of these important documents, each serving a specific purpose in the management and operation of your LLC.

- Articles of Organization: This foundational document is filed with the North Carolina Secretary of State to officially create your LLC. It includes essential details such as the company name, address, and registered agent information.

- Bylaws: Although not required for LLCs, bylaws can outline the internal rules and procedures for the company. They can help clarify the roles of members and managers, ensuring smooth operations.

- Member Resolution: This document is used to record decisions made by the members of the LLC. It can cover a variety of topics, from approving new members to authorizing significant expenditures.

- Operating Procedures: These guidelines detail the day-to-day operations of the LLC. They can include policies on financial management, employee conduct, and decision-making processes.

- Sample Tax Return Transcript: This document can be crucial for verifying income and financial planning purposes, and you can find more details about it at OnlineLawDocs.com.

- Membership Certificates: Issuing membership certificates can serve as formal recognition of ownership in the LLC. They can enhance the legitimacy of ownership stakes among members.

- Tax Identification Number (EIN) Application: Obtaining an Employer Identification Number from the IRS is essential for tax purposes. This number is necessary for opening a business bank account and filing taxes.

- Annual Report: In North Carolina, LLCs must file an annual report to maintain good standing. This document updates the state on the company's information, including any changes in management or structure.

Each of these documents plays a vital role in the establishment and ongoing management of your LLC. Understanding their purposes can help ensure that your business operates smoothly and remains compliant with state regulations.

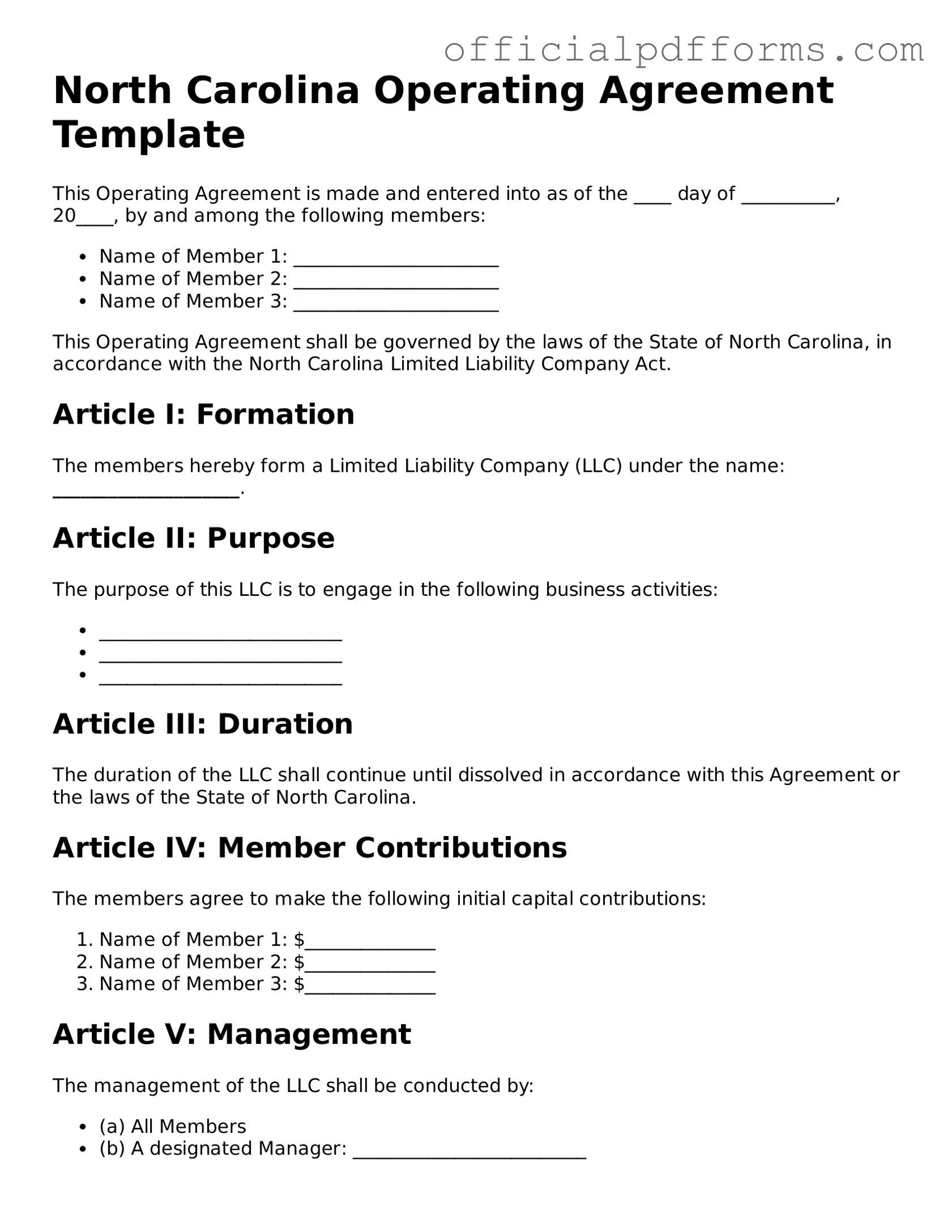

Steps to Filling Out North Carolina Operating Agreement

After obtaining the North Carolina Operating Agreement form, you will need to complete it accurately. This document is essential for outlining the management structure and operating procedures of your business. Follow these steps to fill out the form correctly.

- Begin by entering the name of your LLC at the top of the form.

- Provide the principal office address of your LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC.

- Specify the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Outline the purpose of your LLC. This should be a brief description of what your business will do.

- Detail the capital contributions of each member. Include the amount of money or property each member is contributing to the LLC.

- Explain how profits and losses will be distributed among members. Be clear about the percentages or amounts.

- Include any additional provisions that you think are necessary. This can cover things like decision-making processes or transfer of ownership.

- Have all members sign and date the agreement at the bottom of the form. Ensure that the signatures are legible.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays. Ensure that every section is filled out completely.

-

Incorrect Member Names: Using incorrect or misspelled names for members can create confusion. Double-check the spelling against official documents.

-

Neglecting to Specify Ownership Percentages: Not clearly stating each member's ownership percentage can lead to disputes later. Clearly define the shares held by each member.

-

Missing Signatures: Omitting signatures from members can invalidate the agreement. Ensure all required parties sign the document.

-

Not Including an Effective Date: Failing to specify when the agreement takes effect can lead to misunderstandings. Clearly indicate the effective date.

-

Ignoring Amendment Procedures: Not outlining how amendments will be made can create challenges if changes are needed. Include clear procedures for future modifications.

-

Overlooking State-Specific Requirements: Each state may have unique requirements. Familiarize yourself with North Carolina’s specific regulations regarding operating agreements.

-

Using Vague Language: Ambiguous terms can lead to different interpretations. Use clear and precise language to avoid confusion.

Get Clarifications on North Carolina Operating Agreement

What is a North Carolina Operating Agreement?

An Operating Agreement in North Carolina is a vital document for Limited Liability Companies (LLCs). It outlines the management structure and operating procedures of the LLC. While North Carolina does not legally require an Operating Agreement, having one is highly recommended. This document serves as a roadmap for the members, clarifying their rights and responsibilities. It can help prevent misunderstandings and disputes by setting clear expectations from the outset.

Why should my LLC have an Operating Agreement?

Having an Operating Agreement is crucial for several reasons:

- Clarification of Roles: It defines the roles and responsibilities of each member, ensuring everyone knows their duties.

- Management Structure: The agreement outlines how decisions will be made, whether by majority vote or unanimous consent, providing a clear process for governance.

- Protection of Limited Liability: An Operating Agreement helps reinforce the LLC's status as a separate legal entity, which can protect members from personal liability.

- Dispute Resolution: It includes procedures for resolving conflicts among members, helping to maintain harmony within the business.

What should be included in the Operating Agreement?

When drafting an Operating Agreement for your North Carolina LLC, consider including the following key elements:

- Basic Information: The name of the LLC, its principal address, and the purpose of the business.

- Member Information: Names and addresses of all members, along with their respective ownership percentages.

- Management Structure: Details on whether the LLC will be member-managed or manager-managed.

- Voting Rights: Procedures for voting on important matters, including how votes will be counted.

- Profit and Loss Distribution: How profits and losses will be allocated among members.

- Amendment Procedures: How the Operating Agreement can be modified in the future.

Can I change the Operating Agreement after it is created?

Yes, you can change your Operating Agreement after it has been created. In fact, it’s a good practice to review and update the agreement periodically, especially when significant changes occur within the business, such as adding or removing members, or altering the management structure. Most Operating Agreements include a section that outlines the process for making amendments. Typically, changes require a vote from the members, ensuring that everyone is in agreement with the new terms.