Printable North Carolina Last Will and Testament Template

Find Other Popular Last Will and Testament Templates for Specific States

Online Will Georgia - This form can be changed at any time during the individual's life, reflecting new circumstances or wishes.

Last Will and Testament Ohio - By detailing your estate in a will, you can provide for loved ones in times of need.

Living Will Form Nj - Can be as simple or complex as needed, based on the person's circumstances.

For those navigating the complexities of RV transactions, this comprehensive guide to the RV Bill of Sale in Texas is invaluable. It ensures that all necessary details are recorded, providing security to both buyer and seller. To learn more about this important document, visit the essential RV Bill of Sale resource.

Last Will and Testament Template Illinois - Can specify conditions under which beneficiaries receive their inheritance.

Misconceptions

When it comes to creating a Last Will and Testament in North Carolina, many people hold misconceptions that can lead to confusion or even legal issues. Understanding the truth behind these myths is essential for ensuring that your wishes are honored after your passing. Here are nine common misconceptions:

- A handwritten will is not valid. Many believe that a will must be typed and formally printed to be valid. However, North Carolina recognizes handwritten wills, known as holographic wills, as long as they are signed by the testator and reflect their intentions.

- Only lawyers can create a will. While having a lawyer can provide valuable guidance, individuals can create their own wills. It’s important, however, to ensure that the will meets state requirements.

- Wills are only for wealthy individuals. This misconception overlooks the fact that anyone with assets, regardless of their value, should consider having a will. A will helps ensure that personal wishes are respected, no matter the size of the estate.

- Once created, a will cannot be changed. Many people think that a will is set in stone once it is signed. In reality, wills can be amended or revoked at any time as long as the testator is of sound mind.

- All debts must be paid before any distribution of assets. While it is true that debts must be settled, the estate will handle these obligations. Beneficiaries do not need to pay debts out of their own pockets before receiving their inheritance.

- My spouse automatically inherits everything. Although spouses often have significant rights to inherit, this is not always the case. A will can specify different distributions, and it’s essential to clearly outline intentions.

- Witnesses can be beneficiaries. In North Carolina, witnesses to a will cannot be beneficiaries if they want to inherit under that will. This rule helps avoid conflicts of interest and ensures the will’s integrity.

- Verbal wills are legally binding. Some people mistakenly believe that a spoken will holds the same weight as a written one. In North Carolina, a will must be in writing to be valid.

- Having a will avoids probate. While a will outlines how assets should be distributed, it does not bypass the probate process. All wills must go through probate, which is the legal process of administering the estate.

Understanding these misconceptions can empower individuals to make informed decisions about their estate planning. A well-crafted will can provide peace of mind and ensure that one's wishes are carried out effectively.

Documents used along the form

When preparing a Last Will and Testament in North Carolina, it is beneficial to consider several other documents that can complement your estate planning. Each of these documents serves a specific purpose, helping to ensure that your wishes are clearly communicated and legally upheld.

- Living Will: This document outlines your preferences regarding medical treatment and end-of-life care. It provides guidance to healthcare providers and family members about your wishes if you become unable to communicate them yourself.

- Durable Power of Attorney: A Durable Power of Attorney allows you to designate someone to make financial and legal decisions on your behalf if you become incapacitated. This ensures that your affairs are managed according to your wishes.

- Bill of Sale: This document is essential for the sale and transfer of motor vehicle ownership, ensuring that both parties are protected during the transaction. For more information and resources, visit OnlineLawDocs.com.

- Health Care Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants someone the authority to make healthcare decisions for you. It is crucial for ensuring that your medical preferences are honored when you cannot speak for yourself.

- Revocable Living Trust: A Revocable Living Trust allows you to place your assets into a trust during your lifetime. This can help avoid probate, simplify the transfer of assets upon your death, and provide more control over how your assets are distributed.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow you to name beneficiaries directly. Keeping these designations up to date is essential for ensuring that your assets are distributed according to your wishes without going through probate.

By considering these documents alongside your Last Will and Testament, you can create a comprehensive estate plan that addresses your needs and protects your loved ones. Each form plays a vital role in ensuring that your intentions are clear and legally recognized.

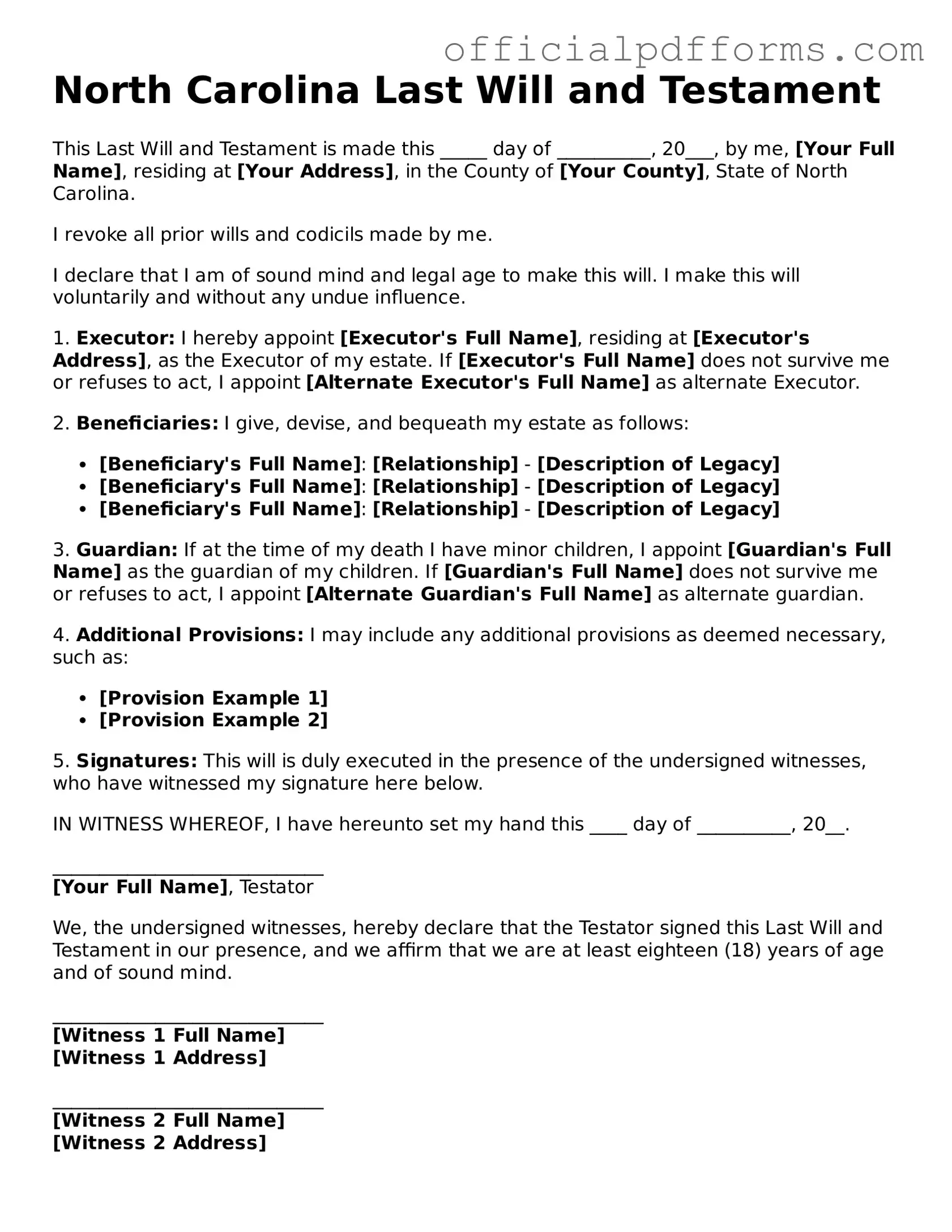

Steps to Filling Out North Carolina Last Will and Testament

Completing the North Carolina Last Will and Testament form is an important step in ensuring that your wishes are carried out after your passing. Once you have filled out the form, it will need to be signed and witnessed according to state laws to be considered valid. Below are the steps to guide you through the process of filling out the form.

- Begin by clearly writing your full name at the top of the form. Make sure it matches the name on your legal documents.

- Next, state your address. Include your street address, city, state, and zip code to avoid any confusion.

- Indicate the date on which you are completing the will. This helps establish the timeline of your wishes.

- Designate an executor. This is the person who will carry out your wishes. Write their full name and contact information.

- List your beneficiaries. These are the individuals or organizations that will inherit your assets. Be specific about what each person will receive.

- If you have minor children, appoint a guardian for them. Write the name of the person you trust to care for your children.

- Include any specific instructions regarding your funeral or burial wishes, if desired. This can provide clarity for your loved ones.

- Review the form for accuracy. Ensure all names, addresses, and details are correct to avoid any disputes later.

- Sign the document in the presence of at least two witnesses. They should also sign the will, acknowledging that they witnessed your signature.

- Store the completed will in a safe place. Inform your executor and loved ones where it can be found when needed.

Common mistakes

-

Not Being Clear About Intentions: Many individuals fail to clearly express their wishes regarding the distribution of their assets. Ambiguities can lead to disputes among heirs.

-

Overlooking Witness Requirements: In North Carolina, a will must be signed by at least two witnesses. Forgetting to have witnesses present can invalidate the will.

-

Failing to Date the Document: A will should always be dated. Without a date, it can be difficult to determine which version of the will is the most current.

-

Not Revoking Previous Wills: If a new will is created, it’s essential to explicitly revoke any prior wills. Otherwise, confusion may arise about which will is valid.

-

Inadequate Asset Description: When listing assets, vague descriptions can lead to misunderstandings. Be specific about what you own and how you wish to distribute it.

-

Ignoring State Laws: Each state has its own laws governing wills. Failing to comply with North Carolina's specific requirements can render the will invalid.

-

Neglecting to Update the Will: Life changes, such as marriage, divorce, or the birth of a child, should prompt a review and possible update of your will.

-

Choosing the Wrong Executor: Selecting someone who is untrustworthy or unable to handle the responsibilities of an executor can complicate the probate process.

-

Failing to Discuss Plans with Family: Open conversations about your will can help prevent surprises and conflicts among family members after your passing.

-

Not Seeking Professional Help: While it’s possible to create a will on your own, consulting with a legal professional can help ensure that all aspects are properly addressed.

Get Clarifications on North Carolina Last Will and Testament

What is a Last Will and Testament in North Carolina?

A Last Will and Testament is a legal document that outlines how a person's assets and property should be distributed after their death. In North Carolina, this document also allows individuals to name guardians for their minor children and specify funeral arrangements. Creating a will ensures that your wishes are followed and can help avoid disputes among family members.

Who can create a Last Will and Testament in North Carolina?

In North Carolina, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. It is important that the individual understands the nature of their assets and the implications of their decisions. If someone is not of sound mind, their will may be challenged in court.

What are the requirements for a valid will in North Carolina?

For a will to be considered valid in North Carolina, it must meet several requirements:

- The will must be in writing.

- The person creating the will (the testator) must sign it at the end.

- At least two witnesses must sign the will in the presence of the testator.

These witnesses cannot be beneficiaries of the will to ensure impartiality.

Can I change my Last Will and Testament after it is created?

Yes, you can change your Last Will and Testament at any time while you are alive and of sound mind. To make changes, you can either create a new will that revokes the previous one or add a codicil, which is an amendment to the existing will. It is advisable to follow the same formalities as the original will to ensure the changes are legally binding.

What happens if I die without a will in North Carolina?

If you die without a will, you are considered to have died "intestate." In this case, North Carolina law determines how your assets will be distributed. Typically, your property will be divided among your closest relatives, such as your spouse, children, or parents. This process can be lengthy and may lead to disputes among family members, which is why having a will is recommended.

How can I ensure my Last Will and Testament is properly executed?

To ensure your Last Will and Testament is properly executed, consider the following steps:

- Consult with an attorney who specializes in estate planning to guide you through the process.

- Make sure you follow all legal requirements for signing and witnessing your will.

- Store the will in a safe place and inform your loved ones where it can be found.

Taking these steps can help prevent any issues or challenges after your passing.