Printable North Carolina Lady Bird Deed Template

Misconceptions

The North Carolina Lady Bird Deed is a powerful estate planning tool, but several misconceptions can lead to confusion. Here are seven common misunderstandings about this form:

- It’s only for married couples. Many people believe that Lady Bird Deeds are exclusively for married couples. In reality, anyone can utilize this form, including single individuals and partners, to transfer property while retaining certain rights.

- It avoids probate entirely. While a Lady Bird Deed can simplify the transfer of property and may help avoid probate, it does not guarantee that all aspects of an estate will bypass probate. Other assets may still require probate proceedings.

- It’s the same as a regular deed. A Lady Bird Deed differs significantly from a traditional deed. It allows the property owner to retain control during their lifetime, with the property automatically passing to beneficiaries upon death, which is not the case with standard deeds.

- It eliminates tax implications. Some individuals think that using a Lady Bird Deed means there are no tax consequences. However, tax implications can still arise, particularly regarding capital gains tax and property taxes, depending on the circumstances.

- It’s a one-size-fits-all solution. The Lady Bird Deed may not be suitable for every situation. Each individual’s estate planning needs are unique, and other options may be more appropriate based on specific circumstances.

- It’s irrevocable. Unlike some estate planning tools, a Lady Bird Deed can be revoked or modified by the property owner at any time during their lifetime, allowing for flexibility in estate planning.

- It requires a lawyer to create. While consulting a lawyer is advisable for complex situations, individuals can create a Lady Bird Deed without legal assistance, provided they understand the requirements and implications.

Understanding these misconceptions can help individuals make informed decisions regarding their estate planning strategies. It is always wise to seek professional advice tailored to specific needs.

Documents used along the form

The North Carolina Lady Bird Deed is a unique tool used for estate planning, allowing property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This deed can simplify the transfer process and potentially avoid probate. However, it is often accompanied by other forms and documents that further clarify intentions and ensure compliance with legal standards. Below is a list of commonly used documents alongside the Lady Bird Deed.

- Durable Power of Attorney: This document grants someone the authority to make financial and legal decisions on behalf of the property owner if they become incapacitated. It is crucial for ensuring that the owner’s wishes are honored even when they cannot communicate them.

- Living Will: A living will outlines an individual’s preferences regarding medical treatment in situations where they are unable to express their wishes. This document complements the Lady Bird Deed by addressing health care decisions separately from property management.

- Transfer on Death Deed (TODD): Similar to the Lady Bird Deed, a TODD allows property owners to designate beneficiaries who will automatically inherit the property upon the owner's death, thus bypassing probate. However, it does not allow for retained control during the owner's lifetime.

- Revocable Trust: A revocable trust holds assets for the benefit of the trustor during their lifetime and allows for easy transfer upon death. This document can work in tandem with the Lady Bird Deed to provide a comprehensive estate plan that addresses both property and other assets.

- Operating Agreement: This document outlines the ownership and operating procedures of a limited liability company (LLC), serving as a key tool in establishing rules and responsibilities among members within the LLC. For more information, visit OnlineLawDocs.com.

- Quitclaim Deed: This deed transfers whatever interest the grantor has in a property without making any guarantees about the title. It can be used to transfer property to a trust or another individual as part of estate planning efforts.

Incorporating these documents can enhance the effectiveness of a Lady Bird Deed, ensuring a comprehensive approach to estate planning. Each form serves a distinct purpose, addressing various aspects of property and health care management, ultimately providing peace of mind for property owners and their families.

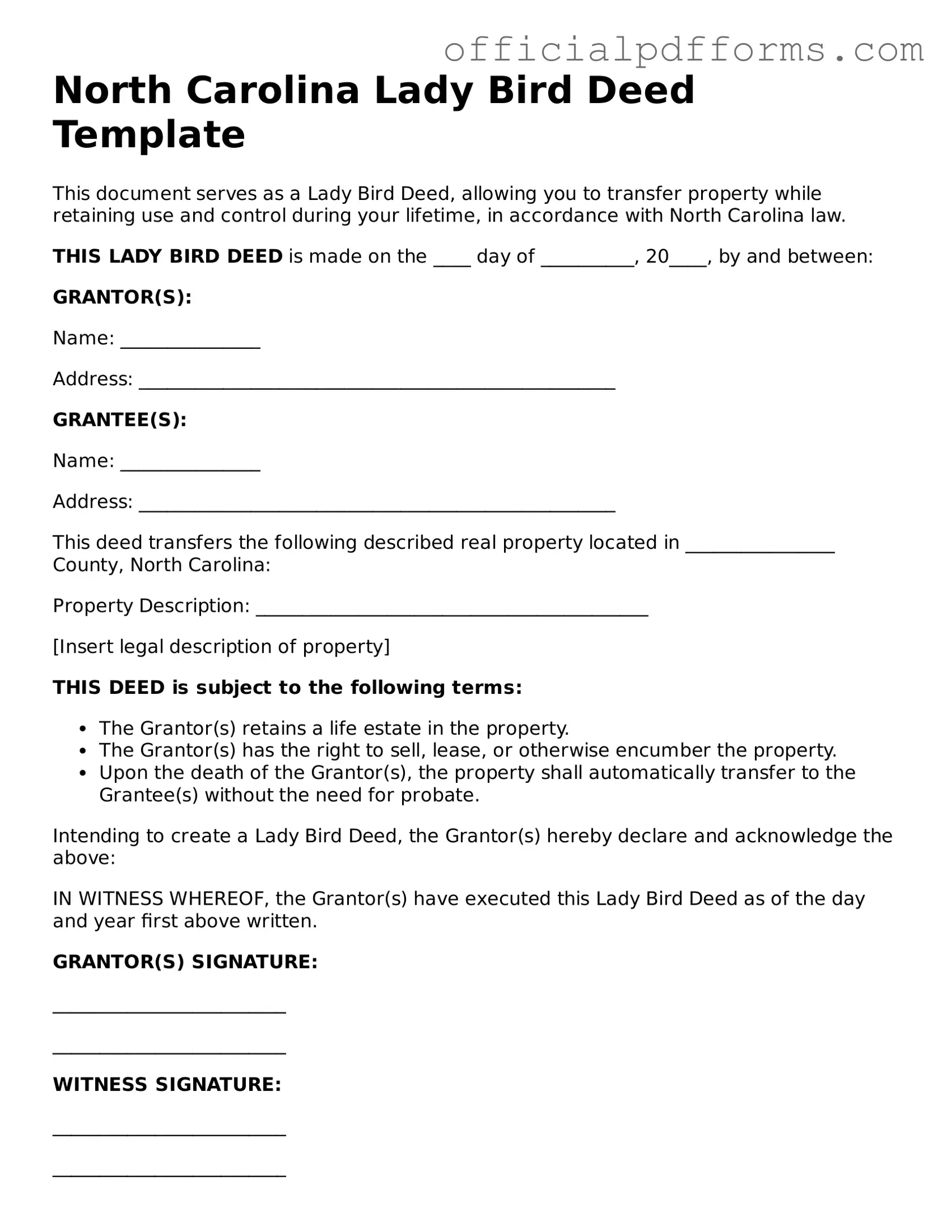

Steps to Filling Out North Carolina Lady Bird Deed

After obtaining the North Carolina Lady Bird Deed form, you will need to complete it accurately to ensure proper property transfer. Follow these steps carefully to fill out the form correctly.

- Identify the Property: Begin by entering the full legal description of the property. This includes the address and any relevant parcel numbers.

- Grantor Information: Fill in your name as the current owner of the property. Include your address and any other required identifying information.

- Grantee Information: Specify the name(s) of the individual(s) who will receive the property. Make sure to include their addresses as well.

- Transfer Details: Indicate the type of transfer you are making. This may involve checking specific boxes or filling in additional details about the nature of the transfer.

- Signatures: Sign the form in the designated area. Ensure that you also date the signature appropriately.

- Notary Acknowledgment: Take the form to a notary public. The notary will need to witness your signature and provide their own signature and seal.

- File the Deed: After notarization, file the completed deed with the appropriate county register of deeds office. Check local regulations for any filing fees.

Completing these steps will help ensure that your Lady Bird Deed is filled out correctly and is ready for processing. Take your time to review each section before submitting the form.

Common mistakes

-

Incorrect Names: People often misspell their names or the names of the beneficiaries. It's crucial to ensure that all names are accurate and match legal documents.

-

Missing Signatures: Some individuals forget to sign the form. A signature is essential for the deed to be valid.

-

Not Notarizing: Failing to have the deed notarized is a common oversight. Notarization adds a layer of authenticity and is often required for the deed to be recognized.

-

Improper Property Description: Providing an inaccurate or vague description of the property can lead to confusion. The legal description should be precise and detailed.

-

Ignoring State Requirements: Each state has specific laws regarding deeds. It's important to be aware of North Carolina's requirements to avoid complications.

-

Overlooking Tax Implications: Some individuals do not consider the potential tax consequences of transferring property through a Lady Bird Deed. Understanding these implications is essential for proper estate planning.

-

Not Updating the Deed: After changes in circumstances, such as a divorce or the death of a beneficiary, people often neglect to update the deed. Regular reviews are necessary to ensure it reflects current intentions.

-

Failing to Inform Beneficiaries: Not discussing the deed with beneficiaries can lead to misunderstandings later. Open communication is key to ensuring everyone is on the same page.

-

Confusing Lady Bird Deeds with Other Types: Some individuals confuse Lady Bird Deeds with other estate planning tools. Understanding the unique features of a Lady Bird Deed is essential for effective use.

-

Not Seeking Professional Help: Many people attempt to fill out the form without consulting a legal expert. Professional guidance can help avoid mistakes and ensure compliance with the law.

Get Clarifications on North Carolina Lady Bird Deed

-

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their real estate to beneficiaries while retaining the right to use and control the property during their lifetime. This type of deed can help avoid probate and may provide tax benefits.

-

How does a Lady Bird Deed work in North Carolina?

In North Carolina, a Lady Bird Deed enables the property owner to maintain full control over the property until their death. The owner can sell, mortgage, or change the beneficiaries at any time. Upon the owner's passing, the property automatically transfers to the named beneficiaries without going through probate.

-

Who can use a Lady Bird Deed?

Any individual who owns real estate in North Carolina can use a Lady Bird Deed. It is particularly beneficial for those who want to ensure their property passes directly to their heirs while avoiding the complexities of probate.

-

What are the benefits of using a Lady Bird Deed?

- Avoids probate, simplifying the transfer process.

- Allows the owner to retain control over the property during their lifetime.

- Potential tax advantages for beneficiaries.

- Flexibility to change beneficiaries or sell the property at any time.

-

Are there any drawbacks to a Lady Bird Deed?

While Lady Bird Deeds offer many advantages, there are some drawbacks to consider. For instance, if the property owner needs to qualify for Medicaid, the deed could impact eligibility. Additionally, it may not be recognized in all states, which could complicate matters if the property is sold or transferred out of state.

-

How do I create a Lady Bird Deed in North Carolina?

Creating a Lady Bird Deed involves drafting the deed with specific language that establishes the life estate and the remainder interest. It is advisable to work with an attorney to ensure the deed meets all legal requirements and accurately reflects your intentions. Once drafted, the deed must be signed, notarized, and recorded in the county where the property is located.

-

Can I change the beneficiaries on a Lady Bird Deed?

Yes, one of the key features of a Lady Bird Deed is the ability to change beneficiaries at any time. The property owner can create a new deed that names different beneficiaries or simply revoke the existing deed altogether. It’s important to follow the proper legal procedures to ensure the changes are valid.

-

What happens if the beneficiary predeceases the owner?

If a beneficiary named in a Lady Bird Deed passes away before the property owner, the interest in the property typically reverts back to the owner’s estate unless alternative beneficiaries are named. It’s wise to regularly review and update your deed to reflect any changes in your family situation.

-

Is a Lady Bird Deed the same as a regular deed?

No, a Lady Bird Deed is distinct from a regular deed. While both transfer property, a regular deed immediately transfers ownership, whereas a Lady Bird Deed allows the owner to retain control during their lifetime. This unique feature makes it a popular choice for estate planning.

-

Do I need an attorney to create a Lady Bird Deed?

While it is possible to create a Lady Bird Deed without an attorney, it is highly recommended to seek legal assistance. An attorney can help ensure the deed is properly drafted, complies with North Carolina laws, and meets your specific needs. This can help prevent future disputes or complications.