Printable North Carolina Durable Power of Attorney Template

Find Other Popular Durable Power of Attorney Templates for Specific States

Poa Financial Form - It’s advisable to consult with a professional to ensure all provisions meet legal requirements and your needs.

Filing the IRS 2553 form is an important step for small businesses looking to elect S corporation status, as it enables them to enjoy the benefits of being taxed as pass-through entities. To ensure accurate submission and to maximize potential tax savings, businesses can refer to resources such as https://smarttemplates.net/fillable-irs-2553 for guidance and assistance in completing this crucial document.

General Power of Attorney Form Pennsylvania - A Durable Power of Attorney simplifies decision-making during challenging health situations.

Misconceptions

Understanding the North Carolina Durable Power of Attorney (DPOA) form is essential for anyone considering this legal document. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- A Durable Power of Attorney is only for the elderly. Many people believe that only seniors need a DPOA, but this document can benefit anyone who wants to ensure their financial and medical decisions are managed according to their wishes, regardless of age.

- A DPOA gives complete control to the agent. While a DPOA does grant authority to the agent, it does not mean they can act without limitations. The principal can specify what powers are granted and can revoke the document at any time, as long as they are mentally competent.

- Once signed, a DPOA cannot be changed. This is not true. The principal can amend or revoke the DPOA at any point, provided they are still of sound mind. Regularly reviewing the document is a good practice to ensure it reflects current wishes.

- A DPOA is the same as a living will. These two documents serve different purposes. A living will outlines medical treatment preferences in case of incapacity, while a DPOA designates someone to make financial and legal decisions on behalf of the principal.

- Only lawyers can create a DPOA. While it is advisable to consult a lawyer for complex situations, individuals can create a DPOA using templates available online. However, it is crucial to ensure that the document meets North Carolina's legal requirements.

- A DPOA becomes effective only when the principal is incapacitated. In North Carolina, a DPOA can be set up to be effective immediately upon signing or to become effective only when the principal is incapacitated. This choice is made by the principal at the time of creation.

Being aware of these misconceptions can help individuals make informed decisions about their legal planning. It is important to approach the Durable Power of Attorney with clarity and understanding to ensure that it meets personal needs and preferences.

Documents used along the form

When creating a Durable Power of Attorney (DPOA) in North Carolina, it is often helpful to consider other related documents that can complement this important legal tool. These documents can provide additional clarity, support, or protection for your financial and medical decisions. Below is a list of several forms and documents commonly used alongside a DPOA.

- Advance Healthcare Directive: This document allows individuals to specify their medical preferences in case they become unable to communicate their wishes. It typically includes a living will and a healthcare power of attorney.

- Living Will: A living will outlines your preferences regarding life-sustaining treatments in situations where you are terminally ill or permanently unconscious. It helps guide healthcare providers and loved ones in difficult decisions.

- Healthcare Power of Attorney: Similar to a DPOA, this document designates someone to make healthcare decisions on your behalf if you are unable to do so. It focuses specifically on medical choices.

- Will: A will is a legal document that outlines how your assets will be distributed after your death. It can also name guardians for minor children and provide instructions for funeral arrangements.

- Trust: A trust is a legal arrangement where one party holds property for the benefit of another. It can help manage your assets during your lifetime and distribute them after your death, often avoiding probate.

- Financial Power of Attorney: This document grants someone the authority to manage your financial affairs, such as paying bills, managing investments, and handling real estate transactions, if you become incapacitated.

- Motor Vehicle Power of Attorney: This document allows a vehicle owner to designate someone else to handle certain matters related to their motor vehicle, providing essential support in transactions during times of absence, illness, or convenience. For more information, visit OnlineLawDocs.com.

- Property Deed: A property deed transfers ownership of real estate from one person to another. It can be important to have clear title to property, especially if you want to include it in a trust or will.

By understanding these documents and how they work together, you can create a comprehensive plan that addresses both your financial and medical needs. This proactive approach can provide peace of mind for you and your loved ones, ensuring that your wishes are respected in times of uncertainty.

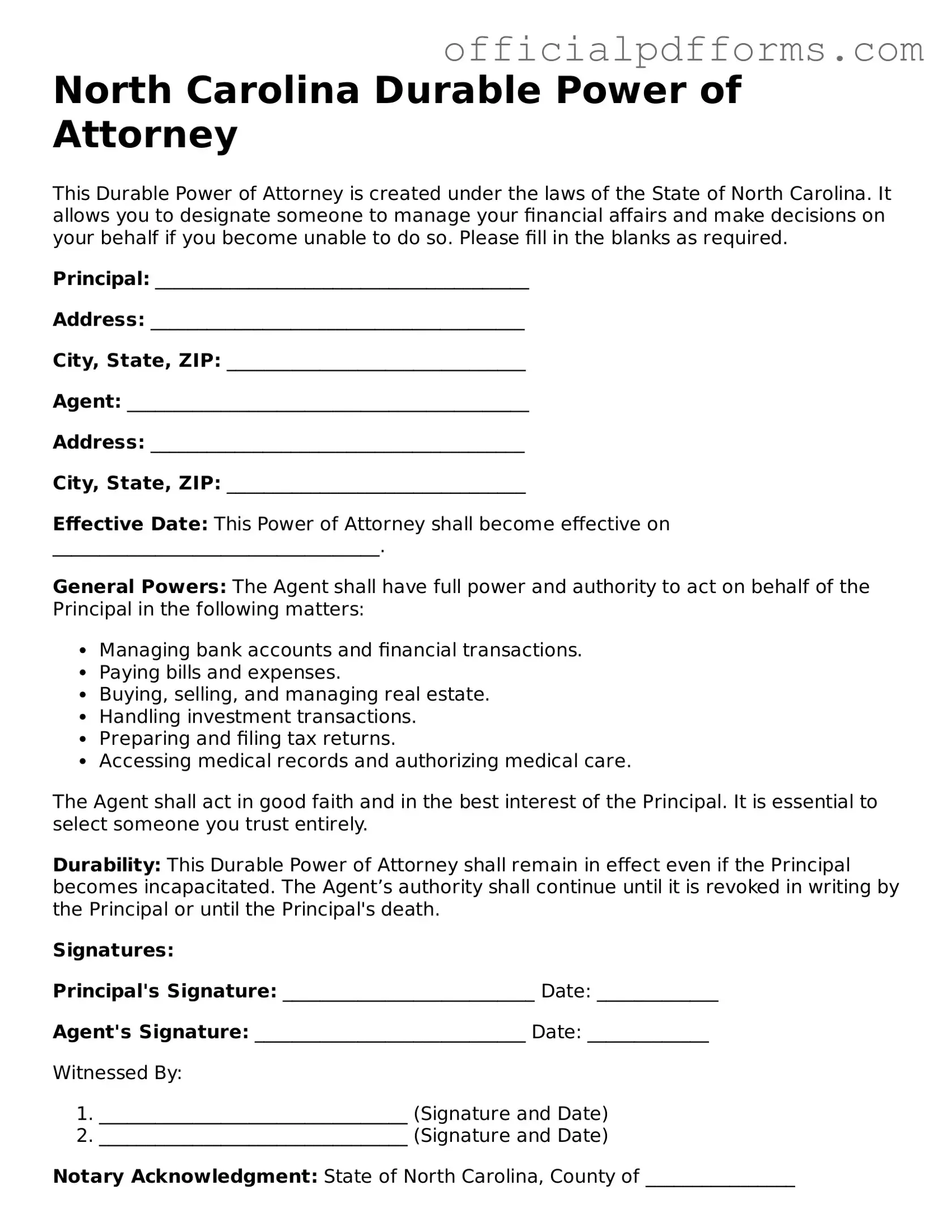

Steps to Filling Out North Carolina Durable Power of Attorney

Filling out the North Carolina Durable Power of Attorney form is a crucial step in ensuring that your financial and legal matters are managed according to your wishes in the event that you become unable to make decisions for yourself. It is important to carefully follow the steps outlined below to ensure that the form is completed correctly and legally binding.

- Obtain the North Carolina Durable Power of Attorney form. You can find this form online or through legal offices.

- Begin by filling in your name and address at the top of the form. Make sure this information is accurate and up-to-date.

- Next, identify the person you are appointing as your agent. This individual will have the authority to act on your behalf. Include their full name and contact information.

- Specify the powers you wish to grant to your agent. You can choose general powers or limit them to specific tasks, such as managing bank accounts or making healthcare decisions.

- Sign and date the form in the designated area. Your signature must match the name you provided at the top of the form.

- Have the form notarized. This step is essential to validate the document and ensure it is recognized legally.

- Provide copies of the completed form to your agent and any relevant financial institutions or healthcare providers.

Once you have completed these steps, your Durable Power of Attorney will be ready for use. Ensure that you keep a copy for your records and communicate your wishes clearly with your appointed agent. This preparation can provide peace of mind for you and your loved ones.

Common mistakes

-

Not naming a specific agent. Individuals often fail to designate a specific person to act on their behalf. This can lead to confusion and disputes among family members.

-

Overlooking successor agents. If the primary agent is unable or unwilling to serve, a successor agent should be named. Many forms do not include this important detail.

-

Failing to specify powers granted. The form should clearly outline the powers the agent will have. Leaving this vague can lead to misunderstandings about the agent's authority.

-

Not signing the document. A common oversight is neglecting to sign the Durable Power of Attorney. Without a signature, the document is not valid.

-

Ignoring witness and notarization requirements. North Carolina law requires that the document be either witnessed or notarized. Skipping this step can invalidate the form.

-

Using outdated forms. Laws change, and using an outdated version of the form can lead to legal issues. Always ensure you are using the most current version.

-

Not reviewing the document regularly. Circumstances change over time. Failing to review and update the document can result in it no longer reflecting your wishes.

-

Assuming the form is only for financial matters. Some people think a Durable Power of Attorney only covers financial decisions. It can also address health care and other personal matters.

-

Failing to communicate with the agent. It is essential to discuss your wishes with the agent. Not doing so can lead to actions that do not align with your desires.

-

Neglecting to keep copies of the document. After completing the form, individuals should keep copies in accessible places. This ensures that the agent can easily access it when needed.

Get Clarifications on North Carolina Durable Power of Attorney

What is a Durable Power of Attorney in North Carolina?

A Durable Power of Attorney is a legal document that allows you to appoint someone to manage your financial and legal affairs if you become unable to do so yourself. This document remains effective even if you become incapacitated. It is important to choose someone you trust, as they will have significant authority over your assets and decisions.

What are the key components of the North Carolina Durable Power of Attorney form?

The key components typically include:

- The name and contact information of the principal (the person granting authority).

- The name and contact information of the agent (the person receiving authority).

- A clear statement of the powers being granted, which can include managing finances, selling property, and making healthcare decisions.

- Signatures of the principal and witnesses, along with a notary acknowledgment.

How does one execute a Durable Power of Attorney in North Carolina?

To execute a Durable Power of Attorney in North Carolina, follow these steps:

- Complete the form with all necessary information.

- Sign the document in the presence of two witnesses.

- Have the document notarized to ensure its validity.

Make sure to keep the original document in a safe place and provide copies to your agent and any relevant financial institutions.

Can I revoke a Durable Power of Attorney in North Carolina?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To do this, you must create a written revocation document and notify your agent. It’s advisable to also inform any institutions that may have relied on the previous Power of Attorney.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, a court may appoint a guardian to manage your affairs. This process can be lengthy and costly. Having a Durable Power of Attorney in place allows you to choose someone you trust to make decisions on your behalf, ensuring your wishes are honored.